Explore Australia leading LNG export companies, including existing infrastructure, project structures, terminals, proposed plants, gas production trends, and current contracts.

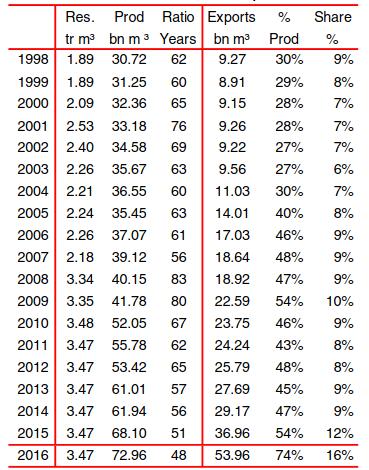

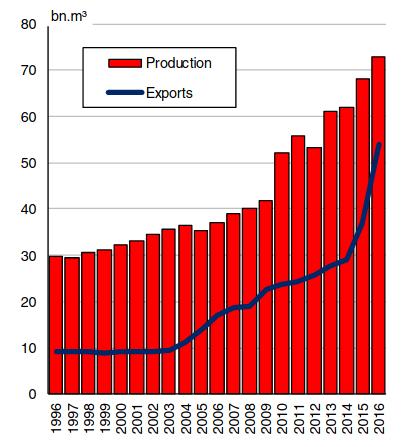

On the back of a swathe of newly opened liquefaction terminals in 2016, Australian LNG exports surged by 46,0 % in 2016 to stand at 94,11 m m3, further cementing Australia’s place as the second largest LNG exporter globally, behind Qatar.

The growth in LNG exports was supported by a ramp-up in activity at the first 3,9 mtpa train of Gladstone LNG facility, which came online towards the end of 2015. Furthermore, a second 3,9 mtpa train at Gladstone LNG commenced operations in mid–2016. Also on the East coast, the Australia Pacific LNG facility, operated by ConocoPhillips, exported its first cargoes in 2016 as both trains started up. On the northwest coast of the country, the first two trains of Gorgon LNG were completed in 2016, adding a further 10,4 mtpa of nameplate liquefaction capacity.

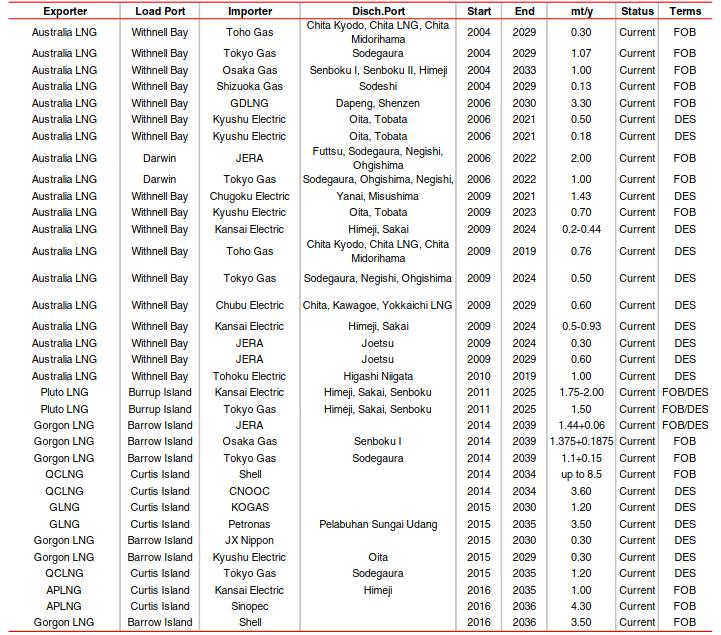

However, shipments from Gorgon have been hampered by a number of unplanned outages, particularly at Train 1. Overall, 23,3 mtpa of nameplate Liquefied Natural Gas Reliquefaction Plantliquefaction capacity came onstream in Australia in 2016. The vast majority of Australian LNG exports in 2016 were destined for Asia, particularly Japan, China and South Korea. This partly reflects the fact that a number of Asian utility companies have long-term agreements to purchase LNG from Australia. Australian exports to China more than doubled y-o-y in 2016 to 27,38 m m3, whilst exports to Japan rose by 10,0 % to 45,71 m m3.

| Existing Infrastructure | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Project Structure | Terminal | ||||||||||

| Plant | Operator | Start Up | Trains | Storage | Name | Berths | LOA, m. | Draft, m. | Vessel Max. m3 | |||

| No. | mt/y | No. | Cap. m3 | |||||||||

| North West Shelf Project | Woodside Petroleum | 1989 | 2 | 5,0 | 5 | 325 000 | Withnell Bay | 1 | 360 | 12,2 | 145 000 | |

| 1992 | 1 | 2,5 | ||||||||||

| 2005 | 1 | 4,6 | ||||||||||

| 2008 | 1 | 4,3 | ||||||||||

| Total Withnell Bay | 5 | 16,4 | 5 | 325 000 | ||||||||

| Darwin LNG | CococoPhillips | 2006 | 1 | 3,4 | 1 | 188 000 | Darwin | 1 | 290 | 11,4 | 147 000 | |

| Total Darwin LNG | 1 | 3,4 | 1 | 188 000 | ||||||||

| Pluto LNG | Woodside Petroleum | 2012 | 1 | 4,3 | 2 | 240 000 | Dampier | 1 | 155 000 | |||

| Total Pluto LNG | 1 | 4,3 | 2 | 240 000 | ||||||||

| Queensland Curtis LNG | Queensland Gas | 2014 | 2 | 8,6 | 4 | 560 000 | Gladstone | 175 000 | ||||

| Total Queensland Curtis LNG | 2 | 8,6 | 4 | 560 000 | ||||||||

| Gladstone LNG | Santos | 2015 | 1 | 3,9 | 1 | 280 000 | Gladstone | 165 000 | ||||

| 2016 | 1 | 3,9 | 1 | 280 000 | ||||||||

| Total Gladstone LNG | 2 | 7,8 | 2 | 560 000 | ||||||||

| Gorgon LNG | Chevron Australia | 2016 | 2 | 10,4 | 2 | Barrow Island | 1 | 165 000 | ||||

| 2017 | 1 | 5,2 | ||||||||||

| Total Gorgon LNG | 3 | 15,6 | 2 | |||||||||

| Australia Pacific LNG | ConocoPhillips | 2016 | 2 | 9,0 | Gladstone | 290 | 11,5 | 165 000 | ||||

| Total Australia Pacific LNG | 2 | 9,0 | ||||||||||

| Australia Total | 16 | 65,1 | 16 | 1 873 000 | ||||||||

Into early 2017, further liquefaction capacity has opened in Australia, namely the third train at the Gorgon LNG facility. In addition to this, a further 17,4 mtpa of liquefaction capacity is scheduled to come online in Australia in 2017.

This would take nameplate capacity to 82,5 mtpa by the end of 2017, which would be the largest of any nation. These projects include the Ichthys LNG project, which has been subject to worker disputes and two 4,5 mtpa capacity trains of the Wheatstone LNG project.

However, Chevron have noted that the start-up of exports from Wheatstone LNG may be delayed slightly, although the project is still reportedly on track to commence operations in 2017. In addition to these projects, the first FLNG to be deployed offshore Australia at the Prelude project is expected to start up in 2018, adding a further 3,6 mtpa of liquefaction capacity.

Beyond these projects which are under construction, several other projects have been mooted. However, given the depressed gas price and the elevated cost of a number of recent liquefaction projects in Australia, FIDs on projects have been limited recently. Some operators are reportedly re-examining the nature of projects, with ExxonMobil rumoured to be considering changing the Scarborough project from a land-based liquefaction terminal to an FLNG solution.

In addition to the challenging project sanctioning environment, there have been gas shortages in some parts of Australia in early 2017, which has placed LNG exporters under significant scrutiny.

Read also: Demand, Supply, and Market Outlook of Liquefied Gas Global Trade

The Australian government has introduced measures, which come into force in July 2017, which allow the state to restrict LNG exports if there is believed to be an insufficient gas supply domestically.

Despite the challenging project environment and political climate, the outlook for Australian LNG is cautiously optimistic. A number of new export terminals are slated to come online which is likely to further drive export growth in the coming years, even with potential limits on exports. In the longer-term, many projects in the FEED and proposed stages seem likely to come online, albeit with some probable delays, as global natural gas demand growth continues driving further demand for LNG.