LNG importation requires import terminals consisting of receiving, storage, and regasification facilities. LNG import terminals can be land-based, as are most of the existing terminals in Europe, Japan, and Korea. Offshore terminals have also been constructed and come either as gravity-based terminals, such as the Italian Adriatic LNG Terminal or as floating storage and regasification units (FSRUs). FSRUs have been developed more recently and offer substantial cost-savings vs land-based LNG regasification terminals.

- Project Development

- Key Considerations for an FSRU

- Project Development

- Import Commercial Structuring

- Choosing a Commercial Structure

- Tolling Commercial Structure

- Merchant Commercial Structure

- Integrated Commercial Structure (“Merchant +”)

- Hybrid Structures

- Driving Factors in Choice of Structure

- Commercial Agreements

- LNG Sale and Purchase Agreement

- Facilities Use Agreement

- Operations and Maintenance Agreement

- Natural Gas Sales Agreement

- Port Use Agreement

- Power Purchase Agreement

- Financing Import Terminals and FSRUs

- FSRU Financing

- Financing LNG-to-Power

The advantage of the FSRU is flexibility since it can be relocated if it is no longer needed. This can also help countries that have gas reserves that will take some time to develop. They can use the FSRUs as a bridge allowing them to import and build the local market until they produce their own gas. FSRUs are quicker to deploy to market, especially if they are converted from LNG – Definition and PronunciationLNG carriers as opposed to being newly built. They are also cheaper than land-based terminals, costing around $250-400 million depending on the regasification capacity and onboard storage. Floating storage units (FSUs) can also be combined with onshore regasification units.

The LNG-to-power sector, where LNG import projects are coupled with power generation facilities, is undergoing a rapid expansion. Many of these are favoring FSRUs. FSRUs could help fuel more than 15 GW of new power generation capacity expected to start up globally over the next five years. If all of these projects go forward, FSRUs could handle up to 27 MTPA of new LNG demand.

Project Development

For importation of LNG to a gas-consuming market, an LNG regasification terminal is required for receiving, storing, regasifying, and delivering the gaseous LNG into a pipeline for delivery to the end-user.

The Project Development consists of the following considerations:

Import Demand Assessment

An assessment is conducted of the prospective supply and demand for the target natural gas market. The portion of the demand that is not satisfied by domestic supply would need to be met by LNG import.

Economic Assessment

It is also important for the customer to perform a comparative economic assessment of the LNG with that of an alternative fuel, if available, to determine the viability of the LNG import. For example, if the power plant’s alternative fuel is an oil product, such as diesel, the delivered LNG price would have to be competitive with the prevailing price of the alternative fuel.

Land Based vs. Floating Infrastructure

In the past, regasification terminals have been exclusively land-based. However, recent developments in marine LNG technology now offer a range of floating regasification facilities which are currently finding favor, especially for small-to-medium scale regas demand. These solutions focus on FSRU technology, but variations including floating storage (FSU) with land-based regas, or a combination of storage, regas and power generation (FSRP) which encompasses a total gas to power solution. These options typically offer lower cost, more flexible financing, and greater optionality. In contrast, a land-based terminal would typically consist of:

- an LNG berth and jetty, with a breakwater if required;

- a regasification facility normally with aerial coolers;

- and LNG storage tanks. Analyses are conducted to determine the size of the terminal and location and future expansion options. Locations are determined based on proximity to end-user markets and pipeline access to such markets.

Key Considerations for an FSRU

Determination of Size

LNG storage and regasification units could have lengths of 100 m – 300 m with storage capacities on the order of 20 000 – 263 000 m3. The gas send-out volumes typically vary from 50 MMscfd to about 750 MMscfd and the associated tariffs usually decrease with increasing send-out volumes. Additional storage could be provided in the form of a floating storage unit (FSU).

Location Selection

The choice of berthing location for the FSRU and the LNG tankers is driven by the location of the targeted market, the meteorological conditions at the port of interest and the availability of local offtake infrastructure including pipelines.

Selection of Type of Facility

Delivered cost of the gas would be affected by the choice of technology employed for the reception and handling of the LNG cargo. FSRUs could be moored close to the port with a jetty and breakwater (if required) or moored in the open sea, typically about 15-20 km offshore, with an associated marine pipeline to bring the regasified LNG to shore.

Tariff

The FSRU in a tolling commercial structure, which is generally built and owned by an independent third party, normally charges a tariff for the regasification service based on contract volume.

Gas Price

Ultimately, the final delivered gas price to the end-user under a tolling commercial structure would be the sum of the LNG price (ex-ship) plus the FSRU tariff plus the cost of transport and handling facilities to the battery limit of the end-user (e. g., a power plant). For example, if the LNG price is $6,00/MMBtu, and the FSRU tariff is $1,50/MMBtu and the transmission tariff is $0,20/MMBtu, then the total delivered gas price is $7,70/MMBtu. For LNG to be competitive, the total delivered price must be less than the alternative fuel price.

Project Development

Independent of the choice of technology (floating or land-based) the following developmental stages will need to be followed:

- Pre-FEED/Project Definition: This phase of the project would typically focus on high-level supply/demand, economic feasibility, and project structuring alternatives, prior to investing significant funds in a more detailed project design proces.

- FEED: A FEED is conducted to define in detail the facilities to be installed, and to develop a FEED package suitable for competitive tendering for the EPC. The FEED phase lasts approximately 12-18 months.

- EPC Bidding: The FEED package provides the basis for a competitive bid for the EPC. The EPC contractor is selected based on technical and financial assessments. The EPC contract is awarded after all regulatory requirements and permits have been approved, the Gas Sales Agreement, LNG Purchase Agreement, and financing arrangements have been executed, and a final investment decision (FID) has been taken.

- EPC Stage: The EPC work for the terminal and the associated pipeline facilities is completed generally within a 2-3 year timeframe and the facilities commissioned.

Sometimes FSRU units can be delivered and commissioned more quickly if a vessel exists for lease, if the customer already has the infrastructure in place, and/or the customer already has a well-developed gas market. Following the project development steps is still important.

Import Commercial Structuring

Project structuring is a critical element of a successful LNG import project. Given the magnitude of the required capital investment and the length of the period of commercial operations, the risks associated with each import project and the functions for the project participants need to be carefully defined and allocated in order to allow debt to be paid off and to generate sufficient returns for investors. Structuring an import project correctly from its inception is important in order to anticipate project risks over time, to avoid misalignments between stakeholders, and other risks to the project’s success.

Source: en.wikipedia.org

The structure chosen for each LNG import project will have ramifications for the allocation of the project’s risks and the roles of the various project participants. It will also have an impact on whether the project is able to attract further equity investors, if needed, and raise debt funding from financiers. The structure can impact project agreement pricing and financing costs because the allocation of risk generally involves a rate-of-return or pricing tradeoff.

Choosing a Commercial Structure

As with LNG export projects, three basic forms of commercial structures have emerged for LNG import projects – tolling, merchant and integrated. There are hybrid variations of these three models and the potential exists for further changes in the future, but these three structures are the basic prevailing structures currently being used for LNG import projects.

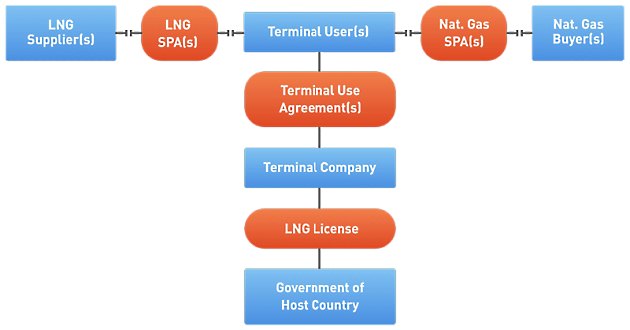

Tolling Commercial Structure

Under the LNG import tolling commercial structure, the user or users of the LNG import terminal are different entities than the owner of the LNG import terminal. The LNG terminal company need not buy LNG or sell natural gas, but rather provides regasification services (without taking title to the natural gas or LNG) under one or more long-term terminal use agreements. The LNG terminal company revenues are derived from tariff payments paid to the LNG terminal company by the terminal users.

The payments typically take the form of a two-part tariff:

- fixed monthly payments cover the LNG terminal company’s debt service, return of and on equity, and fixed operation and maintenance costs;

- and variable regasification service payments are designed to cover the terminal company’s variable operation, maintenance and other costs, such as the terminal’s power costs.

Because the functions of the LNG terminal company generally do not include a commodity merchant function, the LNG terminal company does not bear material commodity merchant risks such as the supply, demand, and cost of LNG and natural gas. The credit of the terminal user or users provides the financial underpinning for the LNG terminal company. Import project tolling structure examples include the Sabine Pass, Freeport, Cameron and Cove Point LNG import projects in the U. S., the UK‘s South Hook LNG import project, and Italy’s Adriatic LNG import project.

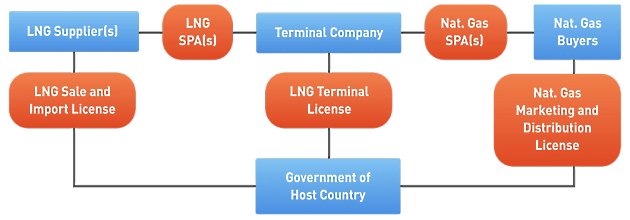

Merchant Commercial Structure

Under the LNG import merchant commercial structure, the LNG supplier and the natural gas marketing or distribution company are different entities than the owner of the LNG import terminal. The LNG import project company purchases LNG from the LNG supplier under a long-term LNG sale and purchase agreement, and sells regasified LNG to the natural gas marketing or distribution company, or directly to a power station, under a long-term natural gas sale and purchase agreement. The LNG import project revenues are derived from the amount by which the revenues from natural gas sales exceed the sum of the cost of regasification (including debt service) and LNG procurement costs.

Read also: LNG Ship-to-Ship Transfer Process

Because the LNG supplier is a different entity than the owner of the LNG import project, there may be more than one supplier of LNG to the LNG import project company, and because the natural gas marketing or distribution company is a different entity than the owner of the LNG import terminal, there may be more than one purchaser of natural gas from the LNG import project company. The credit of both the LNG supplier or suppliers and the natural gas purchaser or purchasers provides the financial underpinning for the LNG import project.

Merchant structure examples include the U. S. Everett Massachusetts LNG import project, India’s Petronet Dahej and Kochi LNG import projects, and Shell’s Hazira LNG import project in India.

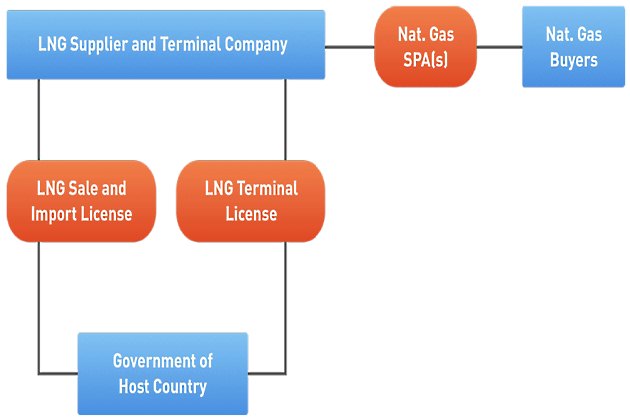

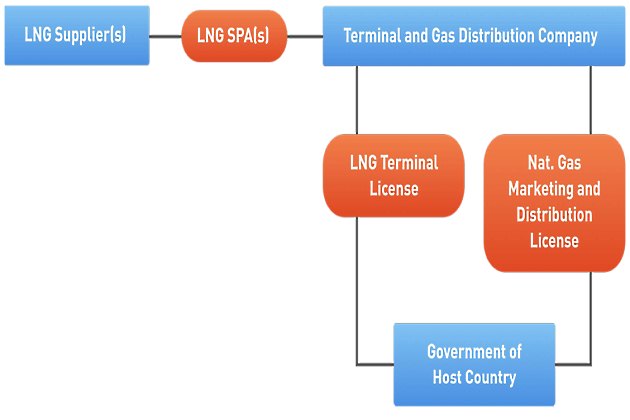

Integrated Commercial Structure (“Merchant +”)

The project development for this structure is the same as under the Merchant Structure, except that the terminal is owned by an entity that undertakes a wider role in the LNG chain; e. g. a power plant (TEPCO) or a gas distribution company (Tokyo Gas) or the LNG export company (e. g. RasGas for the Adriatic LNG Terminal). The ultimate commodity sold may be the product of the company; thus gas, power or steel, as in the case of Tokyo Gas, TEPCO or Pohang Iron and Steel Company (Posco), respectively. As with the development under the Merchant Structure, a FEED package is developed, sent out for bid, and an EPC contract award is made to the successful bidder after all commercial agreements and permits are in place and a FID has been taken. After completion of the terminal by the EPC contractor, the terminal is commissioned and placed in service. Under the LNG import integrated commercial structure, the owner of the LNG import facilities is also either the LNG supplier or the natural gas marketing or distribution company (or perhaps a power producer).

The project revenues for both commercial functions are integrated into one entity such that there is no need for an LNG SPA for delivery at the terminal with respect to integrated structures that combine the LNG supply and import terminal functions. There is no need for a natural gas sale and purchase agreement for delivery at the tailgate of the terminal with respect to integrated structures that combine the import terminal and natural gas marketing or distribution functions (and perhaps the associated power producer function). Because the LNG supplier or the natural gas distribution or marketing company is the same entity as the owner of the LNG import terminal, there is typically no other user of the LNG import terminal. Examples of the integrated commercial structure for LNG import projects are reflected in the diagrams below.

Hybrid Structures

Hybrid structures combining some of the attributes of tolling, merchant, and integrated models may be used to tailor LNG import projects to the characteristics and needs of particular host governments and project participants. For example, hybrid merchant-tolling structures may be used to allow the LNG import project company to take title to the LNG and sell natural gas, but receive fixed monthly reservation charges regardless of whether their customers utilize regasification services and actually import LNG.

| Commercial Structure Checklist | ||

|---|---|---|

| Tolling | Known and commonly used structure familiar with LNG industry participants | equires scheduling alignment of not only the LNG SPA and natural gas SPA but also the tolling agreement |

| No price or market risk for the LNG import project company or its project finance lenders | Need to determine competitiveness of price of the tolling services | |

| Allows ownership in the LNG terminal company to be different from ownership in the LNG supplier or natural gas marketing or distribution company | Unbundling terminal services from commodity/sales services reduces commercial efficiency | |

| Merchant | The terminal user merchant function is aligned with the terminal owner and operator function because they are performed by the same entity | Requires additional project agreements |

| Flexibility to allow non-LNG supplier or natural gas distribution investors in the project company | Requires negotiation of LNG or regas transfer price | |

| Project financing must address risks associated with the commodity merchant function | ||

| Integrated | Commercial parties are perfectly aligned along the value chain | Complex to include other entities |

| No need to determine a transfer price | Project financing must address risks associated with the non-import integrated function | |

| Government Owned | Owner (government) has full control | Government may lack experience in developing, marketing and operating LNG import facilities |

| Government responsible for 100 % of equity and equity risk | ||

Driving Factors in Choice of Structure

There are a number of key driving factors that influence the choice of an LNG import project structure for the host government, the investors, the natural gas buyer(s), the project lenders and the other project stakeholders.

Some of these key driving factors include:

Legal regime and taxes

The host country legal regime and local taxes often have a major impact on project structure. An LNG import project may fall under different legal regimes in the host country, depending on whether it is integrated with LNG supply or gas distribution functions, acts as a merchant, or acts solely as a terminal owner and operator, e. g. general corporate regime, special mid-stream regime or downstream regime. Additionally, the tax rates may differ for LNG importing, terminal operation, and natural gas marketing and distribution.

Governance

The government, local stakeholders, lenders and the LNG buyers may desire to have more of a direct say in the internal governance and decision making in one import function than another import function. This needs to be reflected in the structure selected. A poorly governed structure in any of the LNG supply, terminal ownership and operation, or natural gas distribution components of the LNG import chain can lead to conflicts among the parties and impact the efficiency and reliability of the LNG import project.

Efficient use of project facilities

The LNG import project structure should encourage efficient use of all project facilities and activities by the project owners and by third parties. In determining the optimal project structure for LNG imports, consideration should be given to the costs and benefits of sharing common facilities, open access to third parties for spare capacity, and reduction of unnecessary facilities and their related costs.

Flexibility in Ownership

There may be a desire by the government, other local stakeholders, LNG buyers, or lenders (e. g. IFC) to have a direct ownership interest in all or specified portions of the LNG import chain. Alternately, some of the participants in the commodity chain may not be interested in owning an interest in the LNG terminal company. The choice of a particular structure can enable different levels of ownership in companies performing different components of the LNG import chain.

Desire for Limited Recourse Financing

In general, the cost and complexity of project finance are reduced when the functions and risks of the project company borrower are reduced. Consequently, utilizing an LNG import project tolling structure should facilitate project financing by shifting commodity merchant functions and risks away from the terminal company.

Operational Efficiencies

The integrated structure offers operational efficiencies because only one operator is involved in construction, operating and scheduling activities. The operational inefficiencies of having two operators may be overcome through transparency and coordination between the operators. In addition, separate projects can lead to project-on-project risk i. e. where one project is ready before the other or a default relating to one project jeopardizes another project.

Regulations

The choice of project structure will affect the required regulations.

LNG and Gas transfer prices

The LNG transfer price is the price of LNG sold by the LNG supplier or suppliers to the terminal company in a merchant structure. The natural gas transfer price is the price of natural gas sold by the terminal company to the natural gas buyer or buyers in a merchant structure. These are often contentious commercial points. In addition, each segment of the gas value chain may fall under a different tax regime such that the prices may need to comply with an arm’s length standard to comply with tax transfer pricing laws and regulations.

Commercial Agreements

LNG import projects require different types of contracts at different stages in the LNG import value chain. While a significant number of these contracts are negotiated between private parties, some of the most important ones involve host governments or may be regulated by the host government.

In that context, an understanding of the different types of contracts, their place in the LNG import value chain, and the development of the project, are important. Particular attention should be paid to the technicality and complexity of these contracts. The objective is that governments can prepare effectively for these negotiations, build necessary knowledge to make informed decisions and create dedicated negotiations teams. Contract implementation is an equally important area for host governments to build capacity and dedicate resources.

This section aims at providing an overview of the different types and categories of contracts in order to enable governments to prepare accordingly.

LNG Sale and Purchase Agreement

The LNG Sale and Purchase Agreement (SPA) needed for the LNG feedstock for an LNG import project utilizes the same form of agreement discussed in the chapter entitled LNG Sale and Purchase Agreement. The LNG purchaser will, of course, try to negotiate any project-specific terms and conditions in the SPA.

It will interesting: Public awareness and concerns about LNG

It should be noted that, from the perspective of the project company, an LNG SPA will not be needed in the integrated LNG import commercial structure, which includes the upstream and/or liquefaction developer, or in an integrated tolling LNG import commercial structure.

In these structures, the user of the LNG import project already has title to LNG. In the merchant LNG import commercial structure, or the integrated LNG import commercial structure, which includes the downstream user of the LNG, an LNG SPA is required by the project company.

Facilities Use Agreement

In the tolling LNG import commercial structure, an agreement is needed between the user of the terminal and the terminal project company for the use of the terminal. This agreement, which can go by many names, entails the terms and conditions for the use of and payment for specific services offered by the terminal.

The key terms to focus on are:

- the nature and quantity of services to be used;

- how services can be performed for other customers and what happens in the event of a conflict between customers;

- the terminal fees and charges for the services (explained in the chapter on Import Commercial Structuring);

- fuel and lost or unaccounted-for gas;

- scheduling for LNG receipts;

- term;

- LNG vessel requirements, berthing and unloading details;

- receipt and storage of LNG and redelivery of regasified LNG;

- invoicing and payment;

- liabilities;

- taxes;

- insurance;

- and curtailment of services.

Operations and Maintenance Agreement

Depending on the commercial structure of the LNG import project, the terminal owner may elect to engage a third party to actually operate and maintain the terminal.

The Operations and Maintenance Agreement (O&M) should include:

- the services and scope of the services to be provided;

- the standard of performance;

- the term of the agreement

- the responsibilities and liabilities of the operator and the terminal owner;

- budgets and necessary costs;

- payments and incentives to the operator;

- employees, including local employees, and services, including local services, to be used by operator;

- rights to suspend and terminate early;

- and owner’s rights to monitor and inspect.

Natural Gas Sales Agreement

The Natural Gas Sales Agreement for the sale of natural gas out of an LNG import project utilizes the same form of agreement discussed in the chapter on Domestic Gas Sales Agreements. While many areas of a GSA are important, the key terms to focus on are:

- the commitment of the buyer to purchase natural gas and whether there is a take-or-pay obligation;

- price and payment terms;

- ability of the buyer to withhold payment or dispute invoices;

- what constitutes force majeure for the buyer;

- liability for natural gas that is off-specification;

- and the LNG import project’s liability for delivery shortfalls.

A GSA is not needed in the integrated LNG import commercial structure, which includes the downstream user of the LNG because the LNG import terminal user is using, instead of selling, the natural gas.

Port Use Agreement

LNG import terminals often fall under the jurisdiction of a particular port and are subject to the port’s port use agreement. Where the terminal is considered its own port, the terminal will adopt its own port use agreement. The port use agreement is a set of rules and requirements applicable to all vessels using the port and address a variety of operational and other topics, including responsibility for damages and other liabilities. The LNG import terminal is then responsible for ensuring that each LNG vessel calling at the terminal agrees to comply with the port use agreement.

Power Purchase Agreement

In many situations today, an LNG import project will be bundled with a power generation option. In such situations, the output of the LNG import project may include electricity. In these situations, a Power Purchase Agreement will be required.

Financing Import Terminals and FSRUs

Onshore LNG import terminals can be financed in a similar manner to liquefaction facilities, typically on a project finance basis. The main difference between land-based regasification terminals and liquefaction facilities is one of scale and cost. Liquefaction facilities cost multiples of billions of dollars, while land-based regasification terminals typically cost to the order of $500 million or more, depending on their regasification capacity, the amount of storage included, and the associated infrastructure that is needed. FSRUs are gaining ground over land-based terminals because they cost less to build.

For onshore import terminals, project finance structures are often used and the lenders to the project generally come from the same sectors that appear on liquefaction projects. The project company may raise the financing from international commercial banks, local banks, development banks, and export credit agencies, etc. Given that LNG import facilities will earn money in local currency, they will be more likely to attract domestic bank participation, if they are sufficiently liquid. For example, in April 2015, a group of 11 Indian banks provided 35 287 billion rupees ($560 million) to fund the 5 MTPA Mundra LNG import project in India’s Gujarat state. The project has a total cost of around $730 million and is being sponsored by government-owned Gujarat State Petroleum Corp and Indian conglomerate Adani Enterprises.

Source: unsplash.com

Given the positive socio-economic importance of getting gas to underserved and remote locations, development banks will often fund LNG import projects. They will provide funding to land-based terminals, and may also fund infrastructure associated with FSRU, such as pipelines, jetties, and berthing for LNG carriers. For example, Elengy Terminal in Pakistan, which is a fully-owned subsidiary of domestic company Engro Corp, attracted funding from the IFC and the Asian Development Bank to fund its FSRU-based import operations at Port Qasim. The project cost was $130 million and IFC provided $7,5 million for an equity stake and a loan of $20 million, while ADB provided a loan of $30 million.

For import terminals, funding risk will still be mitigated via the use of long-term contracts, but, in this case, the LNG that comes into the receiving terminal will be sold as gas to power operations and other end-users. Similar due diligence procedures and financing processes will apply. As with liquefaction projects, lenders will look at the features of each project on a case-by-case basis to assess risk (see the article on “LNG Project Financing Financing an LNG Export Project“).

FSRU Financing

For FSRU, different financing considerations apply because they are typically chartered to the importing entity from a shipping company and the shipping company will raise the financing. This has the advantage of reducing upfront project expenditure. The project company will, however, have to take a view on whether the life of the charter would make a fixed import terminal more cost effective.

When the first FSRU started up in 2005, there was a pain barrier to go through as lenders had to assess the technology risk, which was not new, per se, but compressed into a smaller space and floating. But the industry now has a good track record and financiers see FSRUs as secure earners because they are usually on long-term or medium-term charters that allow for debt servicing across long-term repayment profiles.

Read also: The International Trade LNG and LPG

FSRU charters are typically not less than five years and are often renewed after that initial period. This makes it easier to arrange long-term financing. Financiers will sometimes provide financing for FSRU that do not have a charter, but the loans are priced higher due to the greater risk the lender is taking on. But when they finance uncommitted FSRUs, lenders have to be confident that they will secure a creditworthy charterer. So they will only lend to creditworthy shipping companies with a good track record in the FSRU sector. In this way, they are assured that the company will be able to place its unit in the market.

While there are only a small number of companies that offer FSRU units for charter – which currently include Excelerate Energy, Golar LNG, Hoegh LNG, Exmar, BW Gas and MOL (and Gazprom which had one unit on order in 2016), others are looking to break into the sector. The funding methods used by the select group of FSRU providers are diverse. Shipping companies have managed to attract funding from banks in the form of loans, both loans and political/commercial risk insurance cover from export credit agencies (ECAs), and also backing from retail and professional investors who have bought the company’s shares or bonds. Bank and ECA support for FSRUs can be structured as project finance where a special purpose vehicle is created for the FSRU and the revenue is paid back from the proceeds from its charter, or provided directly to the company for the FSRU in a corporate finance transaction.

Some of the shipping companies have master limited partnerships (MLPs), which are a U. S. tax-advantaged structure with partnership units traded on U. S. stock exchanges. Like LNG carriers, FSRUs can be placed into the MLPs. As FSRU are often manufactured in Korea shipyards, Korea export credit agency funding, from KEXIM and K-SURE, is widely utilized. Increasingly, Chinese financiers are providing funding, often through lease or sale and leaseback transactions.

Financing LNG-to-Power

The LNG-to-power sector, where LNG import projects are typically based on FSRUs coupled with power generation facilities, is creating considerable interest.

Independent power projects have a long history of successfully attracting funds using project finance structures. This implies that off-take is guaranteed by the government, a government entity or a creditworthy utility and their steady earnings over long periods – power purchase agreements can span out beyond 20 years – allowing for debt servicing over long payback horizons. This approach can be applied to LNG-to-power, although given the extra components, a number of structures could be used. A single project entity could develop the power and gas operations and raise funding as one entity. Separate project entities could develop the power and gas facilities, and the gas could be bought from the LNG providers and regasified via a tolling contract. Funds could be raised separately or as a single financing with the gas and power entities both taking the borrowers’ role. In a third possibility, gas is sold directly to the power company and the financing is raised by each entity separately.

Source: unsplash.com

One of the main hurdles to overcome is project-on-project risk. If the gas facilities or FSRU are late, the power project will be unable to operate. Or if the FSRU is ready but the power project is delayed, the FSRU will be unemployed. Usually, the risk of delay in completion of the power project is shouldered by an engineering, procurement, and construction contractor via a lump-sum turnkey contract, and by the shipyard for an FSRU, but the two would be unable to assume risk across both components of the project. Typically the power project, not the FSRU, is delayed. This can be dealt with by operating the vessel as an LNG carrier while waiting for the power project to start operating.

Risk can also be minimized by scheduling that allows sufficient time for the power plant to start operating, and possibly by providing flexibility over the initially contracted volumes before any take-or-pay clauses kick in. The power plant may also need backup fuel supply if there are delays in the FSRU’s arrival.

Many shipping companies are participating in different parts of the LNG infrastructure chain, including the conversion of LNG carriers to floating liquefaction/regas vessels. Golar LNG is providing infrastructure further down the LNG chain to the power sector. For its newly created unit Golar Power, the company attracted private equity investment from New York which demonstrates the increasingly dynamic nature of the sector. Oil and gas majors, utility companies and EPC contractors are also looking to invest downstream in power to encourage market development for LNG.