Explore essential yacht purchasing tips, focusing on ownership and the financial aspects. Learn about buying, sharing, or chartering options, shared ownership, time-shares, different charter options, affordability, choosing between new and second-hand yachts, and financing methods.

Perfect for prospective yacht owners evaluating their options.

To buy, share or charter?

We take great pride in owning our own yacht, but is it cost-effective?

If usage is going to be limited, divide the annual cost by the number of times you are likely to use her. Here are the alternatives.

Shared ownership

Some years ago, I gave a talk at the Stafford Coastal Cruising Club, which shares a clubhouse with canal boating enthusiasts, slap in the middle of Britain. There, I met Commodore Paul Harrison, who introduced me to the novel idea of sharing ownership of a yacht with two other families.

Two or more families

“We live almost equidistant from the Welsh and East coasts and with direct motorway access to both the English south coast and Scottish west coast, we are ideally placed to cruise anywhere in Britain.” Each Christmas the three families would meet up for lunch and plan their cruising itinerary for the following season. “One year it was the Scottish islands, another, the south west. We have even based the yacht in Brittany for a season,” he explained.

Each family plan to use the yacht every third week or weekend of the season. When it was their turn, the Harrisons would drive to wherever the yacht was and hand the keys to the departing family to drive their car back to Stafford. When their week was up, they in turn would return home in the car driven up by the succeeding group.

“The system relies on each family having two cars but works very well. It gives us the opportunity to explore new cruising grounds over an extensive area,” Harrison explained.

When they decided to sail around the Brittany coast, the three families shared the yacht delivery from Wales in the same relay method, but once the boat was in French waters, one family elected to keep their second car on the French side as transport to and from the yacht. Each group then returned home in the car driven down to the English ferry terminal by the family taking over from them.

Try before you buy

Many charter companies like Sunsail operate a fleet of cruising catamarans for bare boat and crewed charters in most popular areas in the world.

“By sharing costs and time three ways, we do not become slaves to the boat. Knowing that we have use of it one week in three means we can slot in other interests and never get bored sailing in the same cruising area all the time. Sharing the maintenance costs also helps because, between us all, we can pay to have a lot of the work done professionally.”

Shared within the family

Famed yacht designer and stylist Andrew Winch and his family live in London during the week and escape to a cottage in Bosham on England’s south coast at weekends. There, they share a Southerly 110 swing keel cruising yacht with Andrew’s brother-in-law, a local doctor.

“The arrangement works very well. I have to travel a lot and just don’t have the time to justify owning a yacht on my own,” says Andrew.

Instead, the two families have use of the yacht on alternate weekends and share all the costs between them.

But what happens if there is a family or friendship split? Even the best of friends can fall out, so it makes sense to either draw up a simple contract or letter of understanding, setting out exactly what must happen if one party wants to sell their share.

This is essential if the boat is subject to a joint loan or mortgage. The most equitable way is to call in a marine surveyor to give a market value of the boat. Then the other parties either buy them out or the boat is sold and the proceeds split after all outstanding costs have been met.

Time-share

Yacht partnership programmes operated by big charter companies like Sunsail and The Moorings provide the opportunity to purchase a new yacht at a discount and include her in their charter fleet. You then have use of her, or any other of their yachts, for a period each year.

This allows you to choose a different cruising area each time, taking in popular cruising in the Northern winter grounds like the:

- Carribbean,

- Great Barrier Reef,

- Bay of Islands or Phuket,

and in the summer:

- Mediterranean,

- Aegan and UK.

At the end of the contract, the yacht is sold and you get most of your investment back.

Through Sunsail’s Guaranteed Income option, owners pay the full purchase price of the yacht and place it into the Sunsail charter fleet. You then receive a fixed monthly income to cover the loan repayments. At the end of the programme, the owner is free to take over any further payments owed on the yacht, sell her, or trade-in towards the purchase of a new Sunsail yacht.

Charter

This cuts out all concerns about tying up your capital, and being restricted to set periods for using your yacht. You can charter for a weekend, week or three and everything can be taken care of, including the victualling.

You can even have an experienced skipper onboard to take responsibility for the navigation and running the yacht.

Another option is to pay 65 % of the purchase price, which can offer certain tax advantages. You don’t receive an income return and this scheme is only available with yachts operating in Greece, Croatia or Thailand. The title deeds sit with the charter operator until the end of the contract when they are then signed over to the owner. These yacht partnership programmes are operated by big charter companies like Sunsail and The Moorings.

In addition, you receive the following benefits:

- 4-6 weeks free use of the yacht each year.

- Use of a sister ship at other charter bases worldwide.

- Use of a larger yacht at a preferential rate.

Business partners

Business partners Rob Thompson and Eileen Skinner share a Sunsail 32 – a Jeanneau 32i Sun Odyssey. They have used the scheme to cruise the Greek Islands in their own yacht and had use of another in the British Virgin Islands.

“The scheme works very well because neither of us have a lot of time to go sailing. At the end of each cruise, we simply walk away without having to pay for mooring fees or maintenance costs. Sunsail operate a very comprehensive maintenance and repair service at each of their bases and our boat is well looked after. At the end of the contract, the Company guarantee to put right anything that is not fair wear and tear.”

He also points out that if you are happy to use the yacht out of season you can extend the use of your yacht. “Your “free use” works on a points system weighted to the height of the season. If you are prepared to use her out of season, you can extend the period of use considerably.”

Charter options

If time for sailing is limited to very few weeks during the year, then chartering is often the best option. Not only can you have the pick of the best cruising grounds around the world, but this takes away all the headaches of boat ownership.

You then have the choice of chartering a bare boat or having a skipper onboard to take charge of navigation and berthing at ports of call.

Source: unsplash.com

One to take advantage of this option is Steve Johnson and his family, also members of the far-reaching Stafford Coastal Cruising Club. “We have been chartering yachts for the past 30 years usually to coincide with the Club’s annual Spring cruise. We enjoy sailing in company, and on our last cruise, we chartered a Beneteau 321 from Britannia Sailing to explore the UK East Coast in company with five other families. By sharing the cost between the crew, each berth came to £200, including food, which is very reasonable.”

What can I afford?

The cost of a boat involves much more than just the price tag or mortgage.

| № | Item | Annual cost |

|---|---|---|

| 1 | Monthly repayments × 12 | |

| 2 | Registration and harbour fees | |

| 3 | Insurance | |

| 4 | Mooring fees | |

| 5 | Fuel and oil | |

| 6 | Maintenance/repairs, including lift outs | |

| 7 | Winter storage | |

| Total |

To get a complete picture of how big that hole in the water will be, use this work sheet to bring other costs in to focus.

New versus second-hand

Most yachts have an extraordinary long life. Many of the first fibreglass moulded designs, produced from the mid-1960s and onwards, are still going strong and commanding good prices.

If you want to buy new, that is fine, but the same amount of money could buy you a bigger second-hand yacht. But remember, the running costs will be bigger too.

New yachts

Payment. If you are buying new from stock, then the purchase should be just as straightforward as buying a car. You organise the finance, pay the invoice, and the boat is yours. It only gets complex when ordering a new yacht to be built.

This can take anything up to a year to complete and will involve a series of stage payments. It is essential to safeguard these payments against the possibility of the builder or their agent going bust.

Read also: How to Buy the Best Boat? Essential Tips

Treat your boat purchase as if it were a property. Many yachts cost as much as a house anyway, so give serious consideration to having a lawyer represent your interests. There are just too many sorry tales of customers losing their money during the 2009-11 recession, not to act cautiously.

The builder or their agent will undoubtedly offer you a “standard” contract of purchase.

The important points to include in a contract are:

- The price should be fixed and include any non-standard items.

- Contain a full specification or inventory.

- Delivery: The date should be fixed and if the launch date is important, have a penalty clause inserted to compensate for loss of use if this is delayed.

- Completion should be subject to sea trials.

- Warranties: Insist on having the extent of warranties and “free” after sales service specified.

Safeguarding stage payments

Money held by a solicitor in a “client account” is ring-fenced by the terms and conditions of the licence they operate under, but too often, a “client account” is all too easy to dip into when cash flow runs short. Letters of credit are also only as watertight as the terms and conditions written into them.

The initial deposit. Is this returnable in the event of cancellation, or is it part of the payment plan? The simplest way to secure this is to spread the payments across a number of credit cards. Then, in the event of the agent or builder going out of business, you can make a claim against the card companies.

The purpose of stage payments is to fund the cost of equipment and materials during the construction process. One way to secure these payments is to stipulate within the contract exactly what those assets are:

- the mouldings,

- engine,

- spars,

- sails,

- electronics and furnishings etc,

then ensure that moulding and part numbers are listed as addendums to the contract. Under UK Law, this then gives you clear title of ownership over the items listed.

Source: unsplash.com

Visit the yard as often as possible to photograph progress and ensure your name and hull number are indelibly marked on each item. This way you have proof of what you have title to. Then, should the company go into receivership, you do at least own the unfinished hull and accessories, and the only headache is having it completed.

Elsewhere within the European Union and in many other parts of the world, however, this “clear title of ownership” is far from clear. Then the only safe way to secure stage payments is to take out insurance against the loss. This will add 1-2 % to the cost of the yacht, and in some cases, the builder may be prepared to share half this cost. It is a good point for negotiation.

Insurance. Check that the builder’s insurance adequately covers the yacht during construction (especially if you have title to the hull). If not, then you need to arrange your own insurance.

Certification. All new yachts must be built to comply with European Directives and be CE compliant, and come with EU technical data books. If a yacht is to be used for charter it must comply with the relevant Code of Practice for commercial use. Ensure that these items are covered in the contract.

Value added tax (VAT). If you are a EC resident intending to use the yacht in EU waters, then VAT must be paid. The same applies if you are importing the boat from outside the EU. Ensure that the bill of sale lists the VAT element. You will need to show this whenever you sail to another country and when you sell the boat.

Small Ship Registration (SSR). If finance is being obtained, most lenders will insist upon Part I registration of the yacht in order for the loan company to register their interest. This also provides proof of ownership (as of date of registration) and will assist the process when selling. A new yacht will have to have a tonnage survey, so this needs to be organised with the builder prior to hand-over so that registration can take effect on delivery.

Part III SSR is more informal and has no legal standing, but the certificate is sufficient to show proof of title when sailing abroad.

Second-hand

First rule: Buy quality, not quantity. With yachts that require a lot of restoration, don’t underestimate the cost. It is often cheaper to buy a new yacht than buy new parts.

Agreement. In many countries, a verbal agreement between two parties constitutes a binding contract, but without documentation, any problems that follow can be fraught with difficulties. A friend bought an amateur-built boat from the builder’s widow after her husband had died, thinking that the quick cash deal would save him money and her a lot of anguish. Then came the problem of proving VAT had been paid. Undoubtedly it had been, but without paperwork there was no proof, and the purchaser had to pay it again, in order to resell the yacht.

Then there is the second problem of proving ownership. Does the seller actually have title to the yacht? One scam I came across in the world of classic yachts is multiple selling. Two people thought that they had bought the boat and both had already paid a deposit on the laid up yacht. It just happened that both also shared the same hairdresser, and being an inveterate gossip, he told the second “purchaser” that a previous customer had just bought this “classic boat”. That set alarm bells ringing, and sure enough the seller was trying to double his money and run. The second purchaser never did get his deposit back.

It is sensible to use one of the standard purchase forms available from national sailing authorities like the Royal Yachting Association (RYA). Where the cost of the vessel is substantial, then engage a marine lawyer to ensure that the transaction proceeds without a hitch.

Whether purchasing from the owner or a yacht broker (who like an estate agent acts for the seller), consider the following; the most important things to consider are:

- The condition of the yacht.

- Has VAT has been paid?

- Does the seller actually have the right to sell the boat?

- Is the yacht subject to a mortgage?

Unless you are buying a small value trailer/sailer and are satisfied by its visual condition, it is prudent to make any agreement “subject to survey”. Then, even if a deposit has been paid, any problems picked up by the surveyor not disclosed by the seller, allows you to re-negotiate the price, or terminate the contract and demand your deposit back.

It is also important to ensure that your surveyor has professional insurance just in case they miss something that materialises after the yacht has been bought. Don’t rely on a survey provided by the seller.

Ensure that the seller produces evidence of VAT payment on the yacht before parting with your deposit. The same applies to proof of ownership. If the yacht is registered, then this will name the ultimate owner, but also look for receipts that name the seller.

Title documentation should include:

- Part 1 registration.

- Builder’s Certificate.

- Previous bills of sale.

- Evidence of Recreational Craft Directive (RCD) compliance.

- Evidence of VAT status (if within the EC).

Check to see if the yacht is subject to a mortgage just as you would with the title documents for a property. If the boat is subject to a marine mortgage or a loan, this should be listed on the vessel’s registration documents and recorded in the Small Ships’ Register. Unfortunately, not all loans are recorded this way, and you may still get a visit from a finance company with the right to take the boat you have just bought, to recover the unpaid loan.

A good contract may not prevent this occurring but it does give you the right of action against the seller. If there is a loan, ensure that this is discharged before completion.

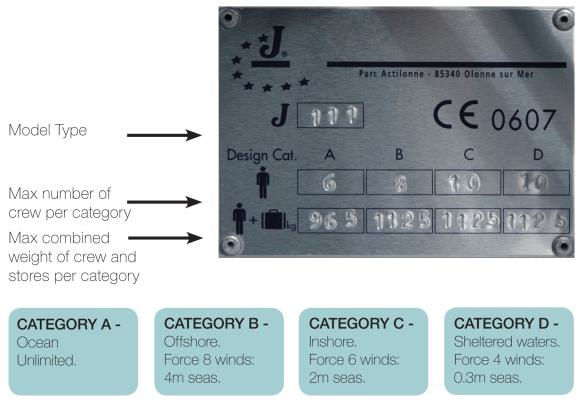

RCD compliance. The Recreational Craft Directive (RCD) is a piece of EU legislation that applies to all recreational craft between 8,2 ft (2,5 m) and 78,7 ft (24 m) brought into or offered for sale within the EU. Boats must comply with specific ISO standards, although equivalent standards can apply.

Evidence of compliance can be found on the yacht’s HIN/CIN (Hull/Craft identification number) on the builder’s plaque. This is a 14-digit number containing the manufacturer’s code, year of build and model year. There should also be a paper document, often found in the back of the owner’s manual. The builder’s invoice and/or certificate may also list the HIN. The CE mark should also be displayed on the plaque.

There are a few exemptions from the RCD. Boats that can show they were in the EU before 16th June 1998 when this legislation came into force, are exempt, as are boats that have been built solely for racing, gondolas and commercial vessels such as fishing and workboats. Yachts used for charter are not included in this category.

Part-finished yachts and those built from scratch by a home builder are also exempt from RCD certification, provided the builder retains ownership of the vessel for at least five years from the date that the vessel was first put into commission. Professionally built hulls supplied for fit-out will have an Annex 3 Declaration, which is the builder’s certification that the hull has been built in accordance with the RCD.

Buying abroad. Boats being brought into use within the EU for the first time must comply with the RCD. On arrival, privately imported boats will be assessed for compliance. Some US boats are built to the RCD and have the required documentation, but check before you buy. If the engine does not meet EU requirements, for instance, this will need to be replaced, so it may not be economic to import the boat. Surveyors are best placed to give professional guidance. VAT will be payable on import.

Boats built in the EU since 1998 will have documentation that they complied with the RCD when first offered for sale, but yachts built within the European Union prior to this date remain exempt unless they have been sold outside the EU and then re-imported. If any of the paperwork is missing then the authorities could well impound the boat the moment you try to move her.

The most common problems stem from outstanding claims for unpaid bills, and vessels that have overstayed their temporary import permit. One solution is to pay a local broker to check all this out. Another is to offer to pay for a crew to deliver the yacht to another port and complete the deal there. Then it is up to the owner to ensure that the paperwork is up to scratch.

Finance

The cheapest method is to pay for it out of savings, but then not too many of us have the luxury of a mega bank balance. What are the alternatives?

Marine mortgage

A marine mortgage is registered in accordance with the UK Merchant Shipping Act 1993 and secured on the new or second-hand boat that it is financing, in a similar way that a house secures a property loan.

Banks will normally lend up to 80 % of the value of the boat over a period of 10 to 15 years. They also offer fixed or variable interest rate options and allow owners to make full or partial early repayments without penalty. Marine mortgages usually start at £100 000.

Secured or unsecured bank loan. This is the simplest way to finance the purchase of a boat valued at less than £100 000. Rates will be cheaper if the amount can be secured against property or other investments. These are often limited to a 5 year term.

Credit Card. The quickest but most expensive way to pay, but OK if you plan to pay off the balance within the interest-free period. If you are not taking possession of the boat immediately, this is also the simplest way to insure against default or failure to deliver which will be covered by the card insurance policy.

Other ways to raise finance. If you have substantial equity in a property, borrow against this. It is likely to be the cheapest form of finance.

Treat the boat as a business asset. To do this, the boat must realise an income from charter, entertaining or as a training boat. You may be taxed for personal use of the boat as a benefit in kind.

Sponsorship. If the boat has a high profile or is used for racing, you may be able to attract commercial sponsorship and receive payment for hospitality and branding on hull and sails.

US tax breaks. In the US, you may be able to claim interest payments back when filing your Federal income tax return, if the boat is equipped with a head and galley, because the asset can be treated for tax purposes as a second home. Don’t forget to save your fuel receipts each time you top up the tanks. A portion of the excise tax on fuel is used by the Government to maintain roads, which some owners reclaim.