This article covers basic info about the state of the global LPG market. Charts will show, how LPG prices rised, what caused LPG production to rise, consumption of LPG and etc.

- High LPG prices (supported by high oil prices) are slowing demand growth in many developing markets.

- Chinese and Indian import levels have stopped growing – at least temporarily.

- High energy prices are stimulating oil & gas projects – which will bring about higher LPG production.

- Middle East LPG production is ramping up – driven by higher crude oil production and new LNG projects.

- The LPG market will be more supply-driven in the future.

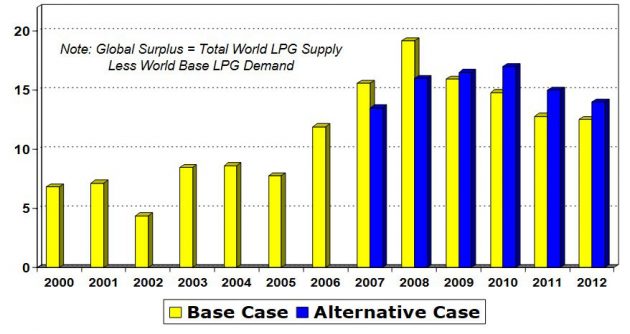

- Global LPG supply surplus is building – However, this has occurred slower than expected in 2007.

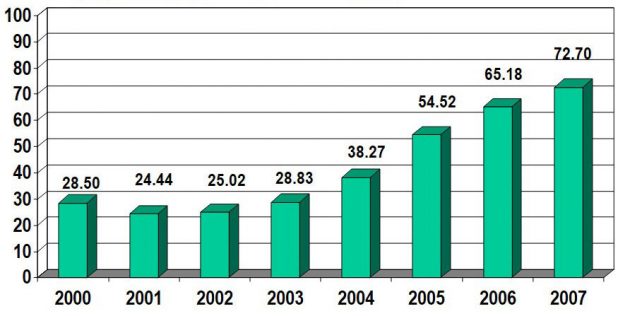

LPG Prices

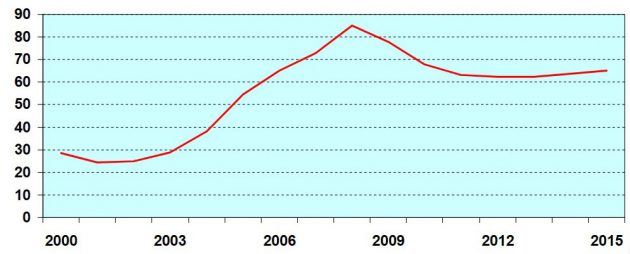

Crude oil prices have reached very high levels – prices have nearly tripled since 2002

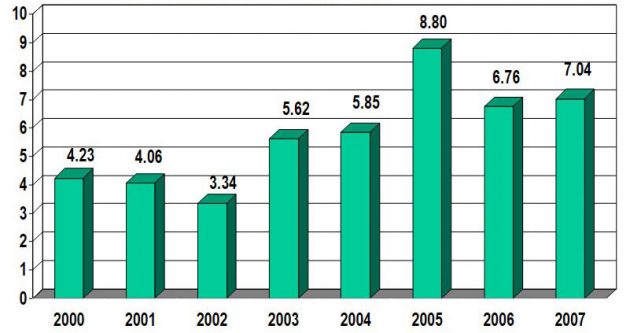

U.S. natural gas prices remain strong vs. history – but are not high relative to crude oil prices

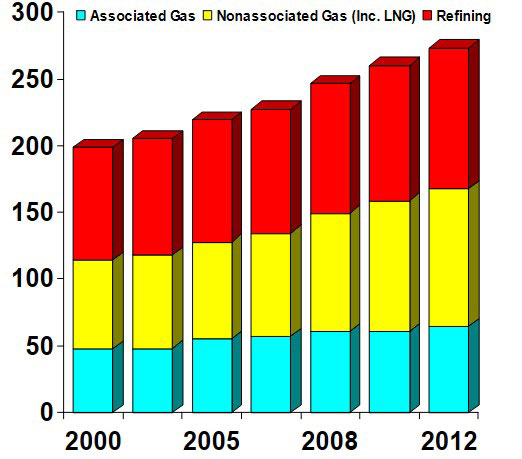

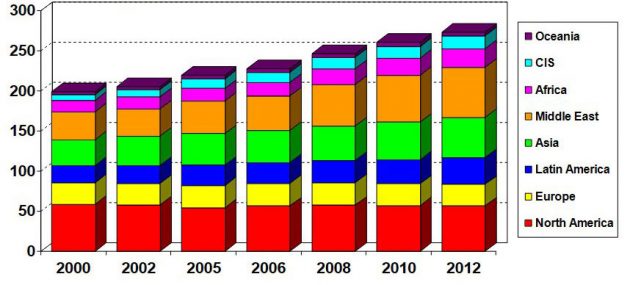

Global LPG supply is expanding rapidly-rising by 46 million tonnes between 2006 & 2012

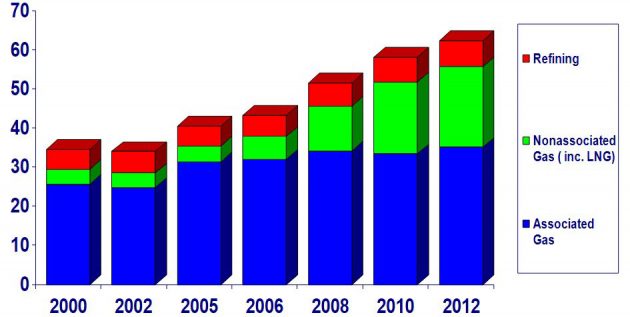

LPG Supply drivers – what causes LPG production to rise?

- LPG is a byproduct – there are no LPG wells!

- LPG is produced as a BYPRODUCT of:

- Oil production (via the processing of associated gas);

- Gas production (via the processing of non-associated gas-including LNG);

- Refining.

- Global LPG production tends to increase rapidly when one or more of the these Industries is significantly expanding.

The rise in LPG production from nonassociated Gas/LNG will lead the supply expansion – accounting for about 55 % of total growth

- The current global LPG supply mix is:

- Assoc. gas 25 %;

- Non-assoc. gas 35 %;

- Refining 40 %.

- LPG from this associated gas will expand by around 8 MM tonnes between 2006 and 2012 (2,2 % p. a.).

- The fastest growth in LPG supplies will occur in the non-associated gas category due to the dramatic expansion in global LNG that is underway.

- LPG supplies from non-associated gas (including LNG) will rise by 25 MM tonnes by 2012 (4,8 % p. a.).

- LPG production from refining is also rising due to strong global demand for light refined products.

- Refinery LPG production will increase by 13 MM tonnes by 2012 (2,2 % p. a.).

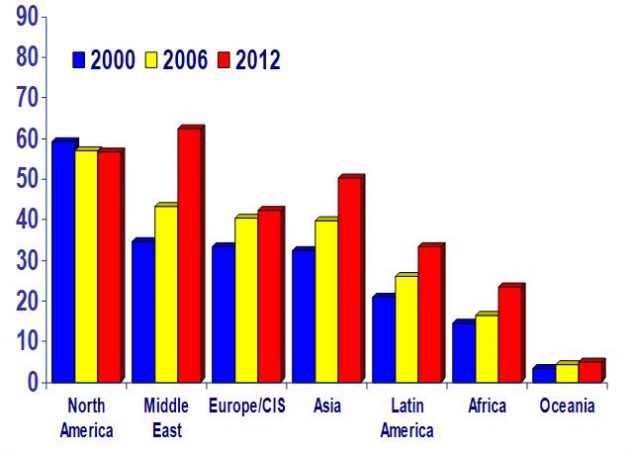

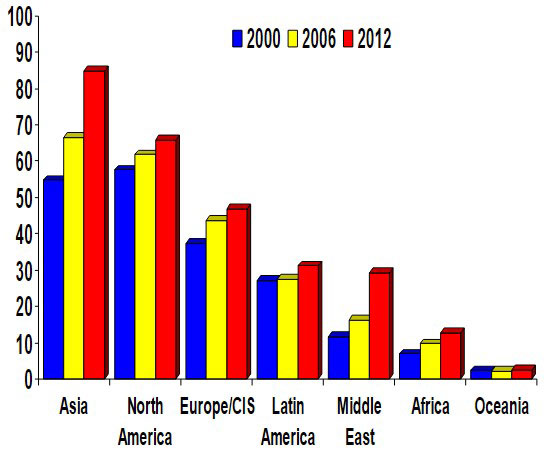

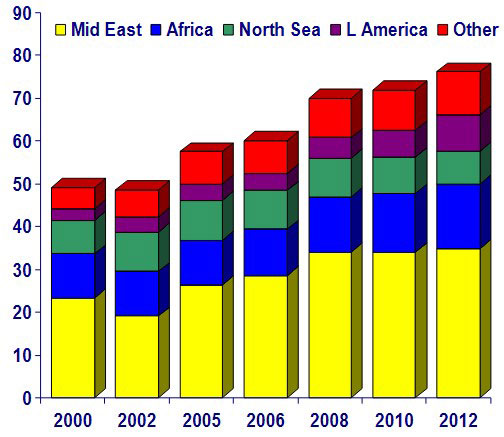

Supply expansion is occurring in most regions outside of North America

- LPG production in North America has peaked since natural gas supplies are no longer expanding.

- The Middle East and Asia are expanding LPG production the fastest.

- Supply growth is occurring in most other regions.

The strongest growth in LPG supply is expected to occur in the Middle East and Asia

- The Middle East will account for over 40 % of global LPG supply growth over this period.

- Asia will also see fairly strong growth in LPG production.

- Other significant contributors to growth in global LPG supply include Africa and Latin America.

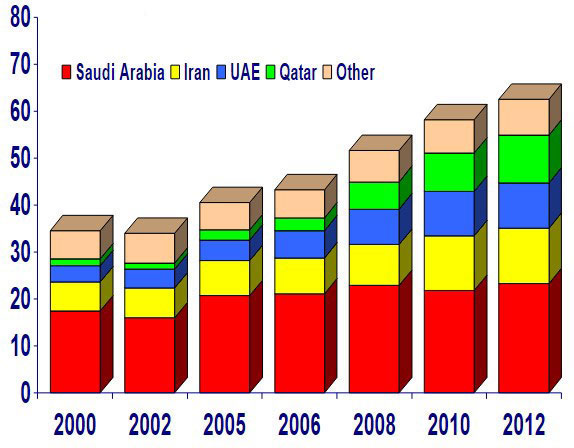

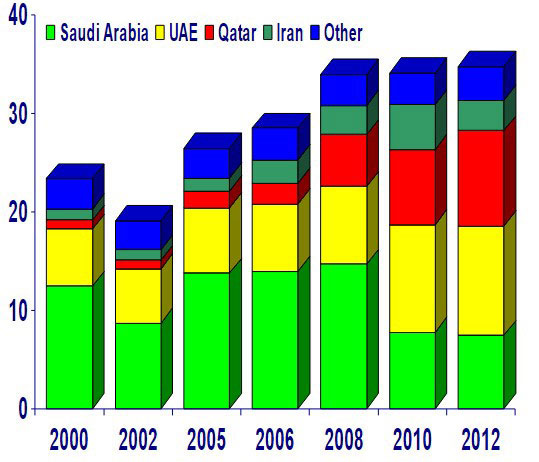

The dramatic expansion of Middle East LNG capacity will lead to a significant rise in regional LPG production

Middle East LPG supply is expected to rise sharply

- LPG production did not rise very fast in the Middle East during the early 2000s.

- Production expanded by 18 % between 2003 and 2006 – increasing by 6,6 MM tonnes p. a.

- Significant growth in LPG supplies are projected for Qatar, UAE and Iran.

- However, there is risk that the timing of part of this expansion could slip.

- Regional production will reach 62 MM tonnes p. a. by 2012 – with supply growth averaging 6,3 % p. a. between 2006 and 2012.

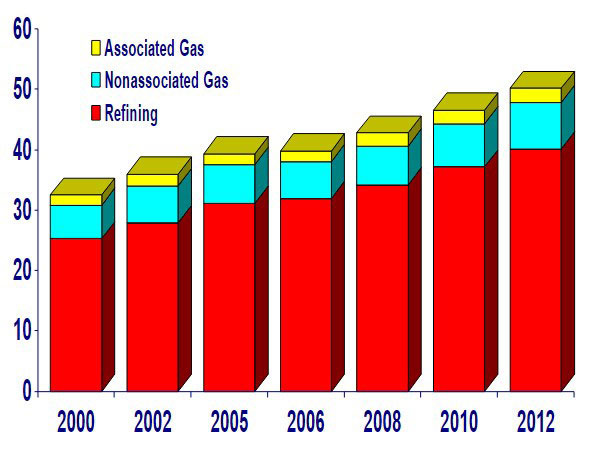

LPG producion in Asia is also rising fairly quickly

- Most (80 %) of the LPG production in Asia is from refining.

- The Asia refining system is being expanded in order to keep pace with rapidly increasing demand for transportation fuels (gasoline, diesel, jet fuel).

- Refinery expansions will increase Asian LPG supplies by over 8 MM tonnes between 2006 and 2012.

- The strongest growth will occur in China and India.

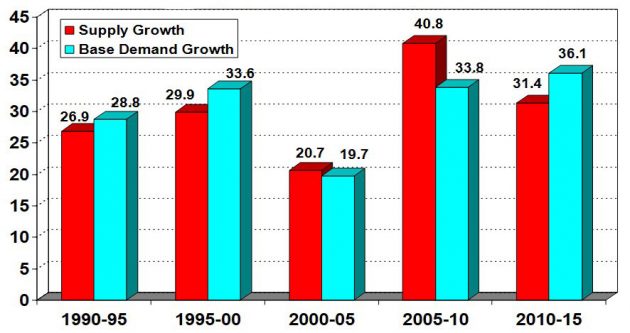

World LPG demand is now growing slower than supply

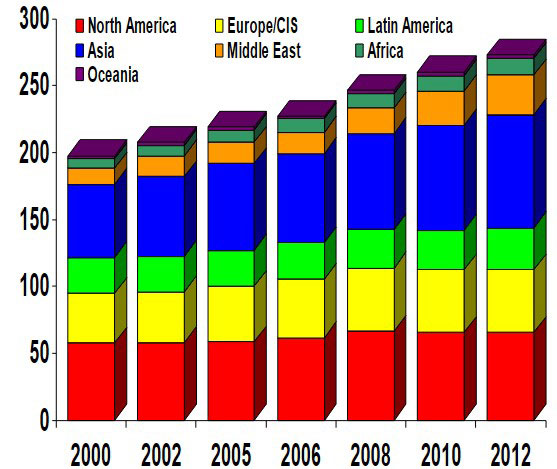

Global LPG consumption

Global LPG consumption continues to rise – however, high prices are slowing growth in developing markets

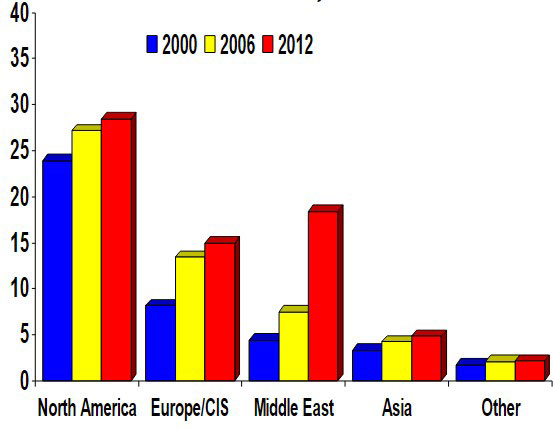

- LPG consumption has increased about 30 MM tonnes p. a. from 2000 to 2006.

- LPG demand growth has been particularly strong in Asia & the Middle East.

- Asia is the largest LPG consumer in the world.

- The Middle East is becoming a more significant LPG demand center-driven by rapid expansion of the petrochemical industry.

- Future growth in North America will be very dependent on the price sensitive petrochemical feedstock market.

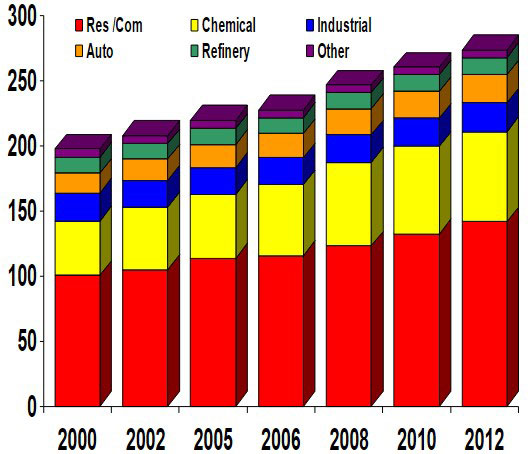

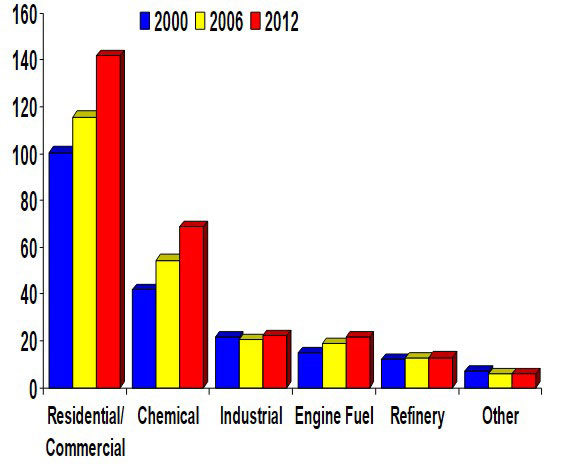

Consumption of LPG in the res/com and chemical sectors continues to dominate the market

- LPG demand in the residential & commercial sector has grown faster than the overall market.

- The res/com and chemical sectors account for about 74 % of total global LPG consumption.

- The auto gas sector is also an important growth market for LPG.

- The industrial and refining sectors have limited growth potential.

Asia is the largest market for LPG – both in terms of size and growth potential

- Asia has become the largest market for LPG-surpassing North America earlier this decade.

- Asia remains a high growth market with very large future potential; however, this growth may be adversely impacted by the high prices in the short term.

- The Middle East is expanding rapidly due to a massive expansion of the petrochemical industry.

Residential/commerical and chemical sectors will continue to dominate global LPG demand

- The res/com sector will remain the largest end-use for LPG.

- Strong growth in the res/com sector has occurred so far this decade.

- However, res/com demand growth could slow significantly if prices remain high for a long time.

- LPG consumption as petrochemical feedstock is expected to continue to expand.

- LPG consumption in the chemical sector could rise even faster if res/com demand slows.

LPG consumption will rise quickly in the chemical sector-particularly in the Middle East

- North America is the largest petrochemical feedstock market for LPG.

- However, the petrochemical industry in North America is not expanding currently.

- The Middle East is undergoing an extensive expansion of its petrochemical industry – consumption of ethane and LPG as feedstock will rise dramatically.

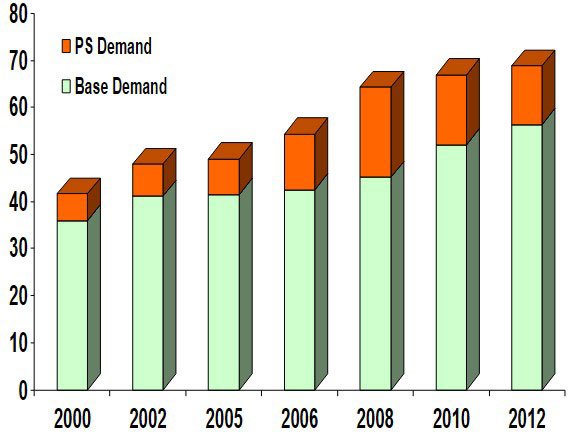

The global LPG supply surplus (base surplus) is expected to continue to rise over the next several years and remain fairly high

Price sensitive chemical demand should rise sharply over the next few years-will probably lead to high seasonal supply surpluses that may weaken regional LPG markets

- Price sensitive LPG consumption was relatively low in first part of the decade.

- With the growing bas LPG surplus, more LPG supplies will be available for the price sensitive market sector.

- The quantity of price sensitive LPG cracking will depend on the timing of some of the new supply projects and the impact of high prices on base demand growth.

LPG Exports

LPG exports will rise significantly by 2012

- Global LPG exports should increase by around 16 MM tonnes per year over 2006 levels by 2012.

- The Middle East will have the biggest impact on world trade in the short to mid term.

- Africa will also contribute to this trend.

Middle East LPG exports are expanding again

- Middle East LPG exports have increased noticeably since the early 2000s.

- Gas developments are spurring major LPG export expansions in Qatar and UAE; however, some delays may occur.

- Expansions in Iran are proceeding fairly slowly.

- Exports from Saudi Arabia are expected to decline as new petrochemical projects are brought on line, increasing local LPG consumption.

Africa LPG exports will significantly rise with new projects in West Africa

- Primary driver for African LPG exports is West Africa projects.

- Nigeria exports may become more significant in regional trade.

- LNG projects in West Africa are key to part of the LPG supply expansion.

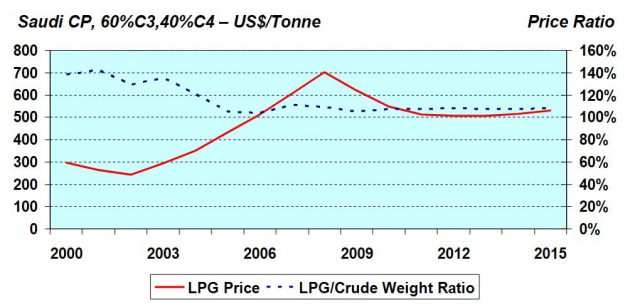

Crude oil prices are expected to stay relativley firm over the next few years

LPG pricing ease slightly from current levels

Summary

- A significant world LPG supply build is in progress.

- The global LNG supply boom is causing a rapid expansion of LPG supply associated with LNG projects.

- High LPG prices are slowing LPG demand growth in developing markets.

- Global LPG supplies are rising considerably faster than base demand:

- This will result in a sharp rise in LPG availabilities (base surplus) for the price sensitive petrochemical feedstock market and/or other incremental markets.

- Most of the prices sensitive feedstock consumption is expected to occur in North America and Europe.

- However, Asia will also increase its consumption of LPG as feedstock.

- Other markets could easily acquire additional LPG supplies if needed.