This article covers information about the State of Liquefied Petroleum Gas Market and shows the diagrams, graphs and tables of LPG trade, macroeconomics, analysis, fleet etc.

Summary

- Macroeconomic overview.

- Trade analysis.

- LPG carrier fleet.

- Market Balances, Rates & Prices.

Macroeconomic overview

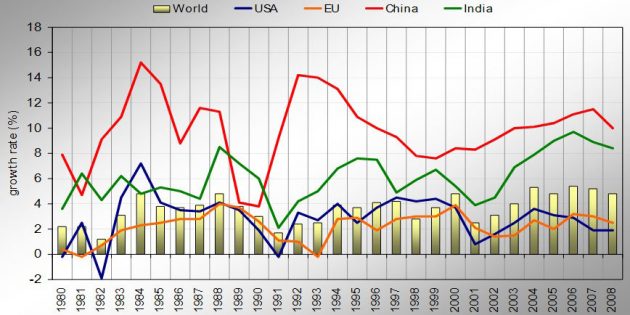

GDP growth

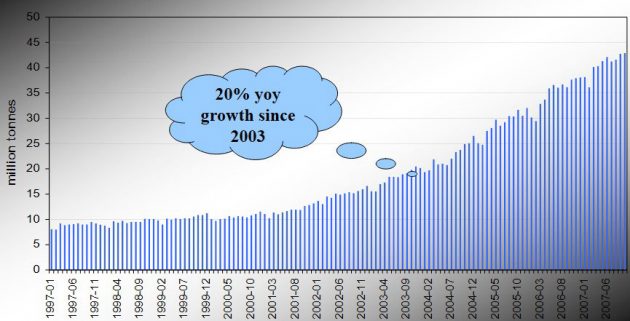

Steel production in China 1997 to 2007 (monthly)

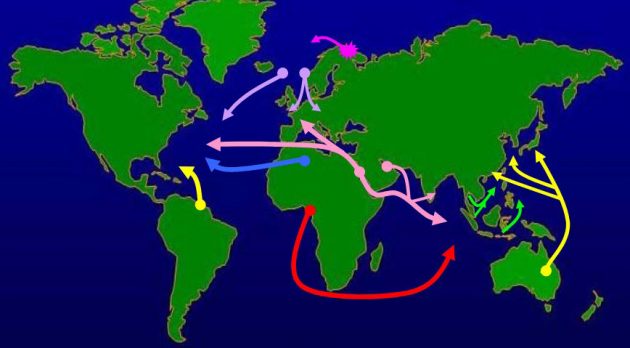

Trade Analysis

LPG…why is it a growing market?

- Seaborne trade forecast to increase at a strong rate => increase in required tonnage / gas capacity i. e. demand for ships.

- High economic growth in US, EU, Japan and China will contribute to LPG demand growth.

- High price of crude oil & natural gas prices encourages LPG consumption.

- LNG associated production (Qatar 2010…10 m tonnes).

- Popular alternative energy source to oil & coal (energy diversification).

- Environmental degradation is a salient issue.

LPG…what are the risks?

- Weak economic growth in US, EU, Japan and China.

- Dampen demand / consumption.

- Exporting countries reduce LPG made available for export in order to service domestic demand.

- Middle East…?

And the fleet…

- Fleet growth exceeds demand growth…causing an erosion in freight earnings.

- A likely scenario.

Industry view

Current situation

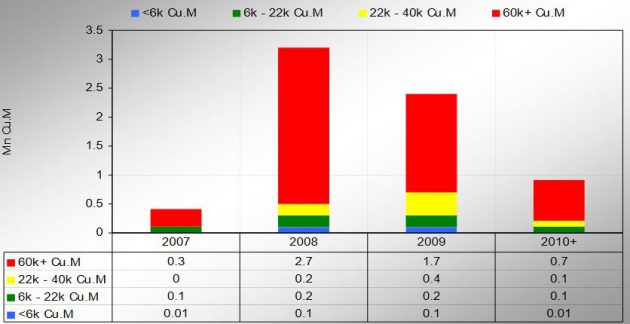

Significant capacity to be added to the LPG carrier fleet through to 2010

- Ocean Shipping Consultants.

- One year TC rates set to fall through to 2011.

- Despite increases in LPG demand and supply the increase in fleet capacity is forecast to have a significant negative impact on freight rates in the near term.

- Harry Vafias.

- Believes that fleet growth will be absorbed by fleet replacement and stable demand.

- MSI data reveals strong demand outlook through to 2010 – CAGR of 7,0% for LPG seaborne trade would indicate a positive trade outlook.

LPG trade to 2010 – million tonnes

LPG Seaborne Trade

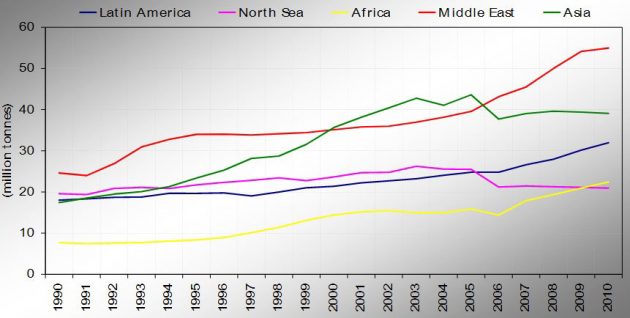

LPG Production

- USA & Saudi Arabia are largest producers…Saudi Arabia #1 Exporter…USA marginal exporter.

- China, India & Russia increasing production substantially – growth rates exceed global growth rate.

| LPG Producer (000 tonnes) | 1995 | 2005 | CAGR |

|---|---|---|---|

| USA | 45,6 | 41,8 | -0,1 % |

| Saudi Arabia | 18,0 | 18,9 | 0,04 % |

| China | 3,6 | 13,7 | 14,3 % |

| Russia | 5,1 | 8,3 | 5,1 % |

| India | 3,3 | 7,6 | 8,7 % |

| Global total | 171,1 | 218,7 | 2,5 % |

LPG Production by Region 1990 to 2010

LPG Consumption

Japan, USA and China are the largest consumers of LPG…42 % of world total.

- Japan huge importer – Seaborne Imports comprise 75 % of LPG consumption.

- USA & China next biggest importers but dependence on imports relative to consumption is less than other countries…China (30 %) & USA (22 %).

| LPG Consumer (000 tonnes) | 1995 | 2005 | CAGR |

|---|---|---|---|

| USA | 48,8 | 50,4 | 0,3 % |

| China | 5,9 | 20,6 | 13,3 % |

| Japan | 19,3 | 18,6 | -0,01 % |

| Russia | 4,2 | 6,6 | 5,0 % |

| India | 3,9 | 9,9 | 9,7 % |

| Global total | 166,1 | 215,2 | 2,6 % |

LPG Carrier Fleet

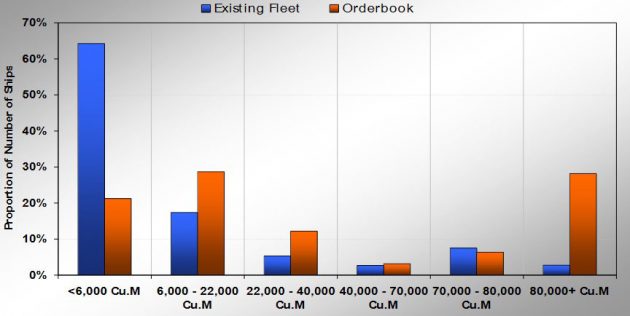

Existing fleet Vs Orderbook

LPG carrier fleet is aged:

- 42 % 20+ years old (no. ships).

- 33 % 20+ years old (GT).

- 33 % 20+ years old (gas capacity).

An abundance of tonnage can be regarded as prospective scrap.

| Existing Fleet | Orderbook | Orderbook/Existing Fleet Ratio | |

|---|---|---|---|

| 1 081 ships | 192 ships | 17,5 % => Number of Ships | |

| 10,4 million GT | 4,4 million GT | 42,3 % => Gross Tonnage | |

| 15,7 million Cu. M | 7,1 million Cu. M | 45,2 % => Gas Capacity |

Fleet Compound Annual Growth Rate (CAGR) of 6,0 % from 2007 to 2010.

| Fleet development…million Cu. M | |||||

|---|---|---|---|---|---|

| Size profile Cu. M | Fleet | Orderbook | Total | Fleet/Orderbook Ratio | % change in fleet |

| <6 k | 1,7 | 0,2 | 1,8 | 12,0 % | 10,9 % |

| 6 k – 22 k | 1,9 | 0,6 | 2,5 | 31,5 % | 33,7 % |

| 22 k – 40 k | 2,1 | 0,7 | 2,8 | 33,3 % | 34,8 % |

| 40 k – 60 k | 1,3 | 0,0 | 1,3 | 0 % | 0 % |

| 60 k | 8,8 | 5,3 | 14,1 | 60,2 % | 60,8 % |

| Total | 15,7 | 6,9 | 22,6 | 43,9 % | 43,6 % |

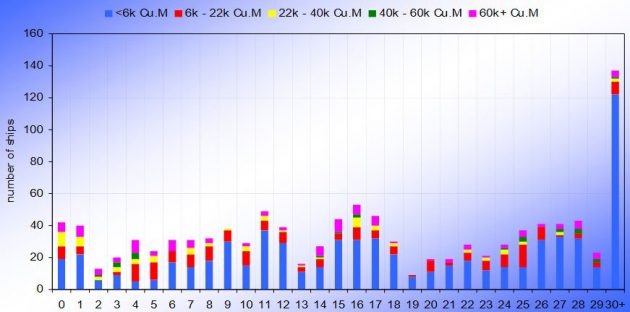

Age Profile – number of ships

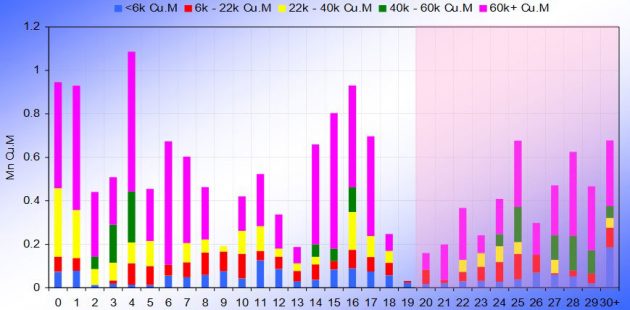

Age Profile – gas capacity

Age Profile – proportion of number of ships

Fleet versus Orderbook – Cu.M

Fleet versus Orderbook – number of ships

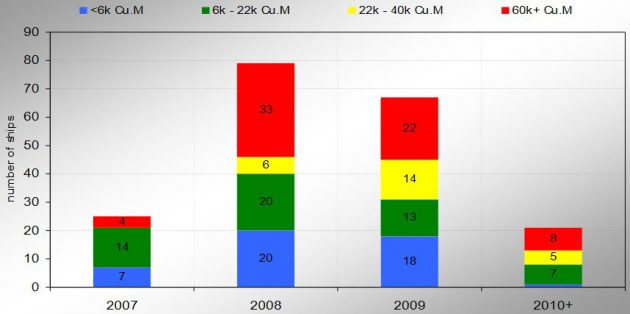

Delivery Schedule – number of ships

Delivery Schedule – Mn Cu.M

Market Balances, Rates & Prices

| Balance of shipping demand and ship supply – ex scrapping | |||||||

|---|---|---|---|---|---|---|---|

| 2006 | 2007 | 2008 | 2009 | 2010 | |||

| Deliveries | number | 41 | 59 | 79 | 67 | 20 | |

| mGT | 0,6 | 0,9 | 1,9 | 1,5 | 0,5 | ||

| Mn Cu. M | 0,9 | 1,4 | 3,1 | 2,4 | 0,8 | ||

| Fleet Development | number | 1 064 | 1 123 | 1 202 | 1 269 | 1 289 | |

| mGT | 10,3 | 11,2 | 13,1 | 14,7 | 15,2 | ||

| Mn Cu. M | 15,6 | 17,0 | 20,1 | 22,5 | 23,3 | ||

| Growth | % Mn Cu. M | 6,0 % | 8,9 % | 18,1 % | 12,1 % | 3,6 % | |

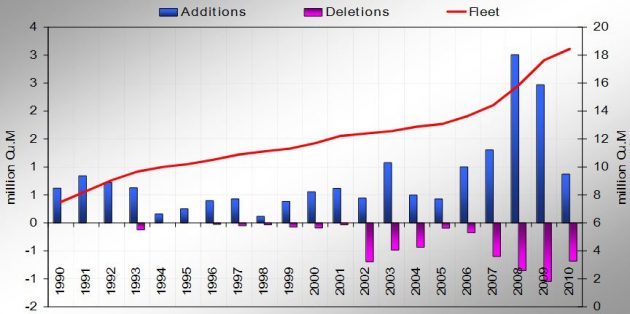

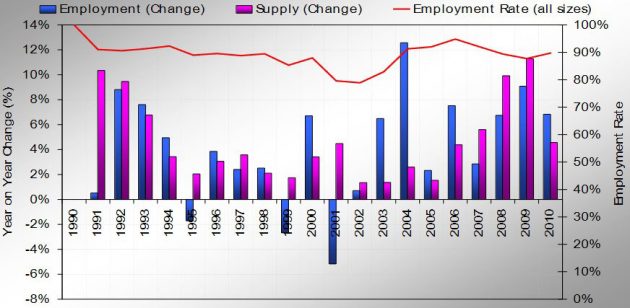

Fleet Development 1990 to 2010…what can we be relatively certain about?

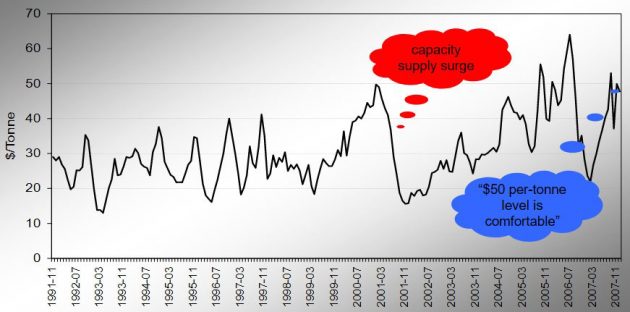

Spot Rates

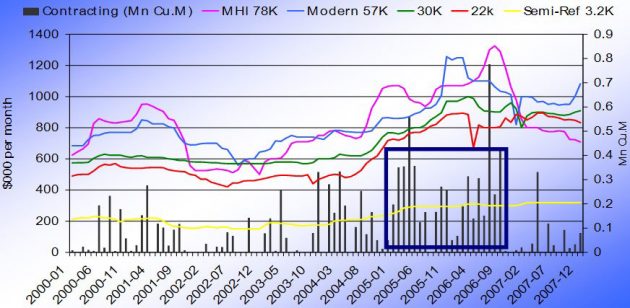

LPG TC Vs Contracting

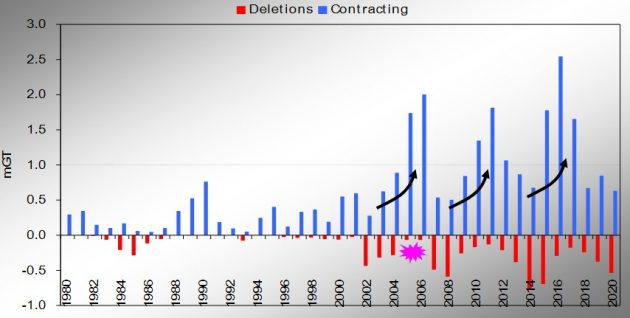

LPG carrier supply responses – contracting & deletions

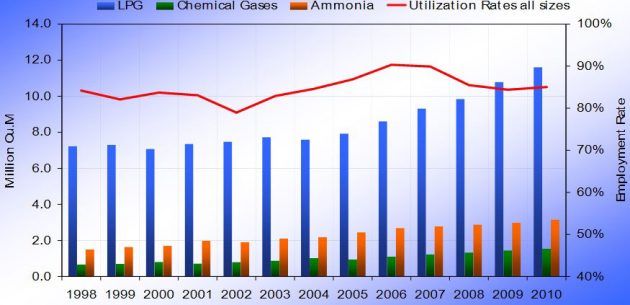

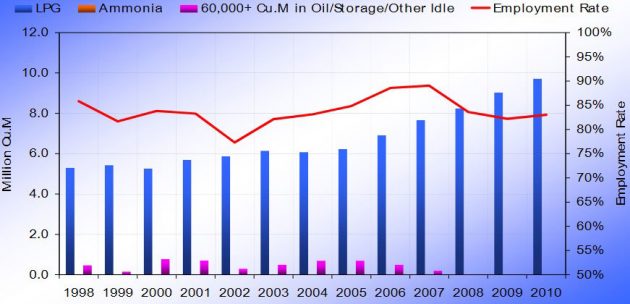

Vessel Employment (Demand by Cargo – All Sizes)

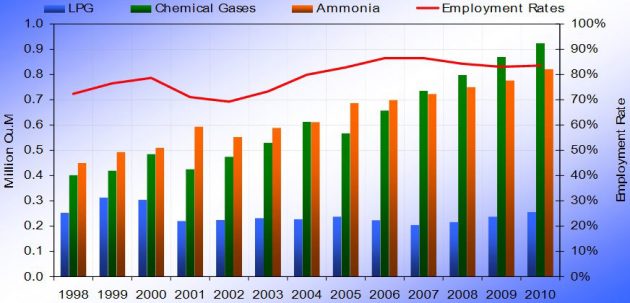

Vessel Employment (6 k – 22 k Cu. M Demand by Cargo)

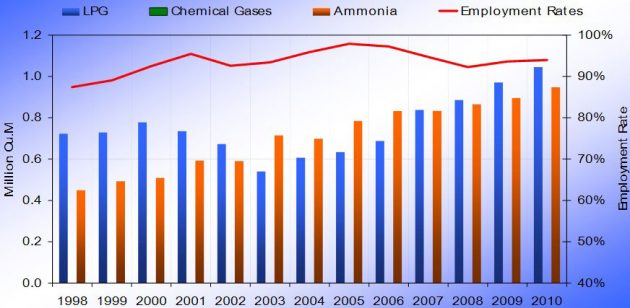

Vessel Employment (22 k – 40 k Cu. M Demand by Cargo)

Vessel Employment (40 k – 60 k Cu. M Demand by Cargo)

Vessel Employment (60+ k Cu. M Demand by Cargo)

LPG Carrier Market Fundamentals

| Vessel Operating Costs 2003 – 2007 (US dollar per day) | ||||||

|---|---|---|---|---|---|---|

| Manning | H&M | P&I | R&M | Others | Total | |

| 2003 | 2 670 | 355 | 215 | 1 875 | 2 385 | 7 500 |

| 2004 | 2 770 | 465 | 265 | 1 960 | 2 480 | 7 490 |

| 2005 | 2 670 | 445 | 290 | 2 250 | 2 625 | 8 280 |

| 2006 | 2 935 | 470 | 300 | 2 195 | 2 960 | 8 860 |

| 2007 | 3 050 | 500 | 315 | 2 095 | 2 995 | 8 995 |

| % increase | 14 % | 41 % | 47 % | 12 % | 26 % | 20 % |