Precious Shipping and Seanergy Maritime Discuss Challenges of Alternative Fuels in Shipping

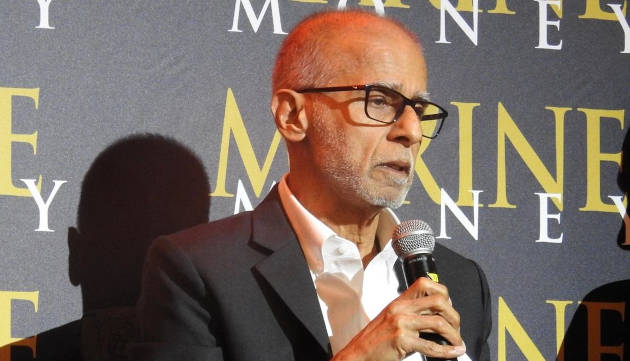

At a recent conference, both Precious Shipping, listed in Thailand, and Seanergy Maritime, listed on Nasdaq, discussed their hesitance to order alternative-fuel vessels. Khalid Hashim, Managing Director of Precious Shipping, shared insights from their research into alternative-fuel newbuildings. He noted that the company inquired about the price difference between a conventional ultramax bulker and an alternative fuel-capable vessel, such as those using ammonia or methanol. The shipyard quoted $33–$35 million for a conventional newbuilding, compared to $45–$47 million for an alternative fuel vessel, which would not be available until 2028–2029, while conventional vessels could be delivered by 2026.

Hashim also highlighted concerns about fuel availability at various ports, as Precious Shipping operates as a tramp operator, meaning their ships go where cargo takes them. He suggested that, despite high secondhand prices, it might be more viable to sell an older vessel and replace it with a secondhand ship that is larger and has lower CO2 emissions.

Source: Marcus Hand

In a separate interview, Stamatis Tsantanis, CEO of Seanergy Maritime Holdings, expressed skepticism about pursuing alternative fuels, stating:

“We never wanted to become the guinea pig of alternative fuels.”

He argued that converting vessels to use ammonia or hydrogen might not be financially sustainable. Instead of transitioning to alternative fuels, Seanergy is focusing on improving the efficiency of its existing vessels through proven technologies, such as Mewis Ducts and silicon coatings, which have resulted in an 8–10 % improvement in fuel consumption. Tsantanis emphasized that it makes more sense to stick with effective existing solutions rather than investing in uncertain and costly alternatives.