With the merger of Conoco and Phillips in 2002 to form ConocoPhillips, a unique opportunity arose to develop large scale LNG projects. This article contains info about how ConocoPhillips Marine is implementing strategy to design and construct LNG tanker both in the near and longer term.

- Summary

- Nomenclature

- Introduction

- The LNG Value Chain

- COPM’s Background

- Approach to Project Development

- LNGC Design

- Approach

- Ship Design

- Next Steps

- LNGC Construction

- Approach

- Selection of Shipbuilders

- Acqusition Strategy

- Selection of Class

- Construction Management

- LNGC Operations

- Approach

- Selection of Ship Operators

- Chartering Strategy

- Operations Management

- Conclusion

Conoco was, and ConocoPhillips is, a significant player in the US and UK natural gas trading business, while Phillips had developed unique technology for LNG manufacture with its proprietary Cascade process. Further, Conoco had maintained a strong marine and shipping business over the years, while Phillips had acquired similar capability in this area through its acquisition of ARCO’s Alaska business.

Summary

With the need for new gas supply to feed the US and UK gas trading businesses, the proprietary LNG technology and the marine and shipping experience and expertise, ConocoPhillips has embarked on development of several large-scale LNG projects within the context of a Global Gas Strategy. ConocoPhillips Marine is the business unit responsible for the development of LNG transportation systems to support this strategy. This article describes how ConocoPhillips Marine is implementing this strategy both in the near and longer term.

Nomenclature

- bcfd – billion cubic feet per day;

- BOG – boil-off gas;

- BTU – British Thermal Unit;

- COP – ConocoPhillips, Inc;

- COPM – ConocoPhillips Marine;

- CPP – controllable-pitch propeller;

- DLA – dynamic load approach analysis;

- FEA – finite element analysis;

- FPP – fixed-pitch propeller;

- HFO – heavy fuel oil;

- IHI – Ishikawajima-Harima Heavy Ind. Co., Ltd;

- LNG – liquefied natural gas;

- LNGC – liquefied natural gas carrier;

- m3 – cubic meters;

- MDO – marine diesel oil;

- mtpa – million tonnes per annum;

- PCU – power control unit;

- PTO – power take-off;

- SFA – spectral fatigue analysis;

- SSDG – ship service diesel engine.

Introduction

The LNG Value Chain

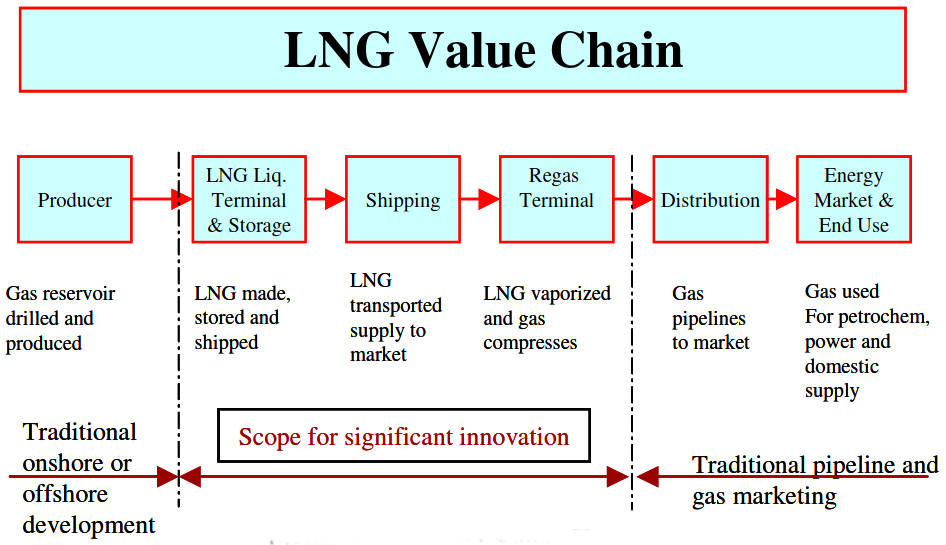

As a major integrated energy company, ConocoPhillips has interests along the whole LNG value chain. There are six major components in the value chain, as shown in Picture 1.

The initial component of producing gas from an established reservoir is usually straightforward. Most of the gas supply for large LNG projects lies in onshore or shallow-water offshore areas, with relatively benign environmental conditions. Similarly the final links in the chain of distribution and energy use (power generation, domestic supply, etc) are also well established in major markets such as the UK and the US.

The area in which there is significant scope for innovation and improvement is in the middle of the value chain, within the LNG production, transportation and regasification components. This article will focus on the transportation systems.

To set the context for describing the development of large-scale, long-haul LNG transportation, it is worth summarizing the parameters associated with a typical large LNG project. Table 1 provides such as summary.

| Table 1. Typical Large LNG Project Parameters (8 000 nautical miles one-way) | |

|---|---|

| Value | Units |

| 10,0 | million tons of LNG per year |

| 1,35 | billion cubic feet of gas per day |

| 1,45 | trillion BTU per day |

| 13,5 | million cubic meters of LNG per year |

| 80 | shiploads per year of LNG @ 225 000 m3 |

| 6,16 | $ million per day @ $ 4,5 per million BTU |

COP is currently engaged in developing large LNG projects in Australasia, the Middle East, North Africa, Russia, South America, Southeast Asia and West Africa. It is to be expected that, as each current project becomes fully operational, one or more new projects will be added to the list. COP intends to be a leader in the LNG industry for a long time to come. The corollary is inescapable: COPM intends to be a leader in the LNG transportation industry for many years.

COPM’s Background

COP‘s defined purpose is to “Use our pioneering spirit to responsibly deliver energy to the world”. With this mission in mind it is clear why COP considers shipping to be a core activity of an integrated energy company. COP owns and operates:

- Crude carriers and LNG carriers in international trade;

- Crude carriers in domestic US trade;

- Towboats and barges in inland trade;

- And North Sea shuttle tankers, drill ships, FPSOs and FSOs engaged in offshore exploration and production.

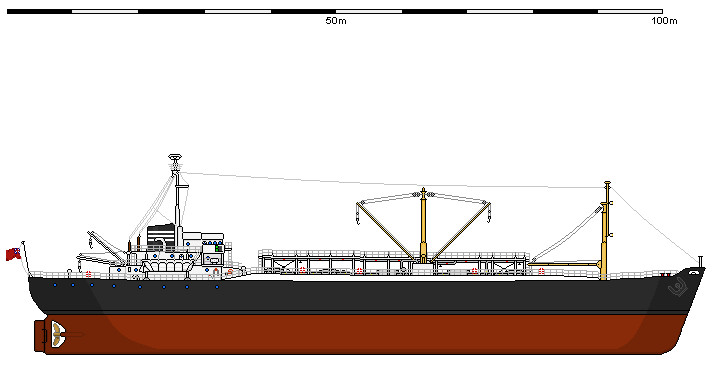

COPM and its various predecessor companies have always been innovators: the first ocean-going LNGC, “Methane Pioneer”, illustrated in Picture 2, was developed in 1958 by a joint venture of the Continental Oil Company and the Chicago Stockyards Company. This vessel sailed from Louisiana in January 1959 to deliver the world’s first ocean cargo to the UK.

Source: shipbucket.com

Today, COP jointly owns “Arctic Sun” and “Polar Eagle”, two distinctive, ice-strengthened 87 000-m3 LNGCs that are the only ships in the LNGC fleet that are fitted with IHI’s SPB containment system. At a time when we are addressing the United States urgent need for huge quantities of imported LNG, it is somewhat ironic that “Arctic Sun” and “Polar Eagle” should be engaged in exporting US – produced LNG, from Alaska to Japan, a trade that has been going on continuously since 1969.

In other marine fields, COP has been the first company to build offshore facilities for the North Sea, the first to build a tension-leg platform (TLP), the first major oil company to have a 100 % double-hull crude carrier fleet, and the first to develop a dynamically positioned drill ship capable of operating in water depths over 10 000 feet.

In summary, it is an integral part of COP’s corporate philosophy that innovation leads to improved performance and COPM practices this philosophy to the fullest. In addition, COPM believes that, to be a technological leader, it is necessary to be a “hands-on” operator.

Approach to Project Development

Before embarking on any detailed work on a project, it is necessary to establish a clearly defined development strategy.

In view of the nature of the contractual agreements between parties Liquefied Natural Gas Projects, calculation of the cost of gas productionin LNG projects, it is clear from the outset that the primary goal of this strategy must be to minimize the cost per unit of gas delivered, in order to maximize the return to the project’s investors.

There are, however, constraints on this goal. First, it cannot be achieved at the expense of creating an unacceptable risk of a disruption in the flow of gas. Second, it cannot be achieved at the expense of the health and safety of the people involved in the project or of the project’s environment.

An additional acquisition guideline is based on COP‘s involvement in multiple LNG projects. Within the constraints of the unique requirements of individual projects, COP seeks as much standardisation of equipment and parts as possible, in the interests of economies in fleet operations.

Finally, it is clear that the ability to assess risk and develop risk mitigation strategies will always be a particularly important element in the development of any project. Innovation would be encouraged in every area of the project’s development but every proposed departure from “standard practice” needs to be the object of risk analysis.

LNGC Design

Approach

Fleet simulation studies are an early and ongoing part of establishing and developing the basis for the design of the transportation system required for any project. A dynamic discrete event simulation tool, is used for all transportation modelling. This tool allows investigators to explore a range of transportation options, varying the number and size of the ships in the fleet, the storage requirements at the loading and discharge terminals, the cargo loading and discharge rates, the bunkering assumptions, and other parameters.

Although commercially available worldwide weather databases include the effects of storm-induced weather events, most models do not include the effects of operational decisions made during storm events, such as rerouting, slowing down, speeding up, etc. As a result, decision logic based on COPM’s experience with the operation of crude carriers in the Gulf of Mexico has been incorporated into the model and the model now appropriately captures shipping delays associated with hurricanes and tropical storms. In addition COPM has conducted a study of the frequency and severity of hurricanes in the Gulf of Mexico, and the results of this study are also incorporated into the transport simulation model.

The economic impact on shipping operations due to geo- political events, such as a potential closure of the Suez Canal, can also be evaluated. In this situation, the ships may be required to sail around the Cape of Good Hope to get to the designated US receiving terminals, adding significant distance and time to the route.

Ship Design

COPM has carried out extensive parametric studies of the design of LNGCs ranging in size from 150 000 m3 to 250 000 m3 and has conducted independent studies to determine the powering requirements for large shallow-draft twin-screw vessels.

These parametric studies were designed to provide engineering data for the following design parameters:

- Vessel sizes: 125 000, 150 000, 175 000, 200 000, 225 000 and 250 000 m3;

- Vessel speeds: 17,0, 19,5 and 21,0 knots;

- Propulsor/steering configurations: Single-screw/single-rudder and twin-screw/twin-rudder;

- Propulsion plants:

- Steam turbine;

- Slow-speed diesel with fixed-pitch propeller and reliqefaction;

- Slow-speed diesel with controllable-pitch propeller, power take-off and reliquefaction;

- Medium-speed diesel with single fuel (HFO) and reliquefaction;

- Medium-speed diesel with dual fuels (BOG and MDO);

- Medium-speed diesel with mechanical drive;

- Medium-speed diesel with electric drive;

- Gas turbine with mechanical-drive, and;

- Gas turbine with electric-drive.

- Cargo containment systems: GTT Mark III, NO96 and CS1; Moss Maritime spherical tanks; IHI SPB prismatic tanks; OceanLNG cylindrical tanks; and Kværner Masa Marine prismatic tanks.

The general findings of these parametric studies were:

- There are no technical obstacles to the construction of LNGCs that will serve satisfactorily for the life of the project.

- There are no technical obstacles to the construction of LNGCs with capacities up to 250 000 m3.

- In general, the technology to design and build the required ships is available, although, in some areas, the data are being extrapolated.

- To reduce the risk associated with the transition from the current designs, which have capacities in the region of 145 000 m3, to designs with capacities in the region of 250 000 m3, great care will be needed to achieve the required performance with acceptable risk.

A Cargo Containment Systems:

Membrane tank systems, specifically the NO96 and Mark III designs, are acceptable. The CS1 design may also be acceptable, but requires more study. Some estimates indicate that the total cost of the CS1 tank system could be 10 to 15% lower than that of the NO96 and Mark III systems, but most shipyards which build membrane LNGCs have already invested heavily in the production facilities required for either the NO96 or the Mk III system and are understandably reluctant to abandon this investment before it has been amortized.

Sloshing is often considered to be a problem with membrane-tank systems, but COPM does not consider that sloshing loads are an issue with long-haul dedicated- trade ships using reliquefaction plants.

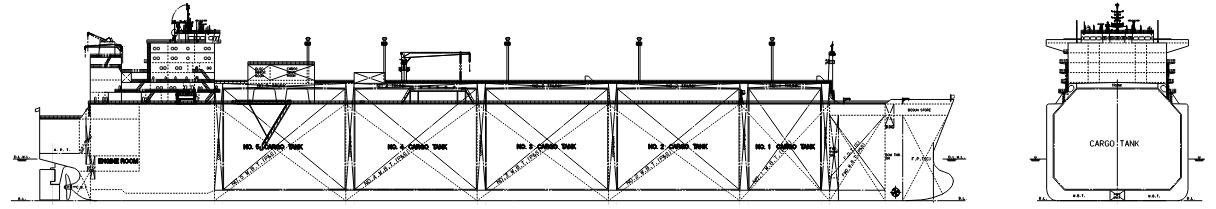

A five-tank configuration for a 225 000 m3 LNGC is technically acceptable. A four-tank configuration needs more study. For optimum hull form, it is desirable that the No. 1 tank be trapezoidal in shape, although some shipyards might want to charge more for the extra work involved in fitting trapezoidal tanks. In addition, any effect on ship’s structure must be considered.

Spherical-tank ships are not considered to be an attractive alternative on routes requiring a transit of the Suez Canal, because the tolls will be significantly higher than for the membrane-tank or SPB systems. Spherical-tank designs also have large openings in the strength deck to accommodate the tanks, which will impose structural issues for larger ship sizes (i. e., ≥ 175 000 m3. Spherical tanks are not, however, eliminated from consideration on other routes.

The IHI SPB tank configuration offers benefits, because of its flush deck and its ability to withstand sloshing loads. At this time, however, the cost to construct a large LNGC using this system appears to be significantly higher than for membrane systems.

B Propulsor/Steering Configurations:

The single-screw/single-rudder configuration is the standard for existing LNGCs. It has a lower construction cost and allows the use of steam propulsion using boil-off gas; studies show that it can be effective for ships < 175 000 m3, but that there are technical issues with larger, higher powered LNGCs.

The twin-screw/twin-rudder configuration is particularly effective for shallow-draft, beamy ships such as LNGCs ≥ 175 000 m3 and allows a fuel saving of 5 % to 6 % over the single-screw/single-rudder configuration. In addition, it provides:

- Improved maneuverability;

- Greater redundancy/reliability;

- Lowered vibration/improved habitability for the crew, and;

- Better stakeholder acceptance.

C Propulsion Systems:

Steam turbines are viable for single-screw/single-rudder ships, although considerably less efficient than diesels (30 % vs. 50 % thermal efficiency). Most current steam- powered vessels are using HFO for 50 % to 75 % of the voyage, with the remaining fuel coming from boil-off gas. Additional problems with steam plants include the shortage of trained personnel for crews and for maintenance; the non-availability of steam plants in the power ranges required for large LNGCs; and the very long lead times for boilers, turbines and gear sets that result from the limited number of suppliers.

Based on COPM‘s studies, slow-speed diesel propulsion with full reliquefaction of the boil-off gas is the preferred choice. These plants are highly efficient and extremely reliable. They provide increased safety, because there is no gas in the engine room. In addition, they result in more cargo being delivered than with steam or dual-fuel medium-speed diesels and require less maintenance. There are potential maintenance issues with reliquefaction that must be resolved and the whole question of reliquefaction must be studied further. The technology is well developed but there are not yet any reliquefaction plants of the required size in marine service.

Read also: History and Future Predictions of the Liquefied Natural Gas Shipping

The dual-fuel diesel-electric system appears to be the next best choice if reliquefaction is not fitted, but there is no service history. Issues to be further studied include fuel flexibility – the ability to burn HFO rather than MDO and to switch without changing injectors. Ships with such systems will deliver less cargo because boil-off is consumed during the voyage; forced boil-off will be needed if LNG is to provide all the ship’s fuel requirements. There may be issues with nitrogen content in the fuel early in the voyage. The sub-alternative of dual-fuel engines with gas injection (300 bar) was eliminated due to safety concerns related to high-pressure gas in the engine room.

Medium Speed Diesel Electric:

- Dual-fuel diesel electrit at sea runs all engines;

- Four engines, two dual-fuel and two HFO, or four dual-fuel? Are HFO generator sets also required? Lots of flexibility;

- Except for dual-fuel the power plant design concept is well proven;

- Better control than fixed pitch slow speed diesel or steam plants;

- Fixed pitch propeller

A slow-speed diesel with four SSDGs is the most common arrangement in large cargo ships. There is no problem finding quality crews; the plant is simple and reliable; an FPP, however, provides less control and manoeuvrability because the engines must be stopped and started when changing directions.

A slow-speed diesel with a PTO, two SSDGs, two transformers and two PCUs is a combination that has been proven on COPM‘s Polar Endeavour Class and on North Sea shuttle tankers. It has a higher first cost than four SSDGs but the potential for reduction in first cost by using sea margin for electric power. A CPP in lieu of an FPP provides better control, as the propeller is always turning. Direction control is by changing pitch; cargo can be pumped with the main engines; and the bow thruster can be run with the main engines.

D Structure:

For the Mark III and NO96 containment systems, the structural arrangements currently applied for standard-size LNGCs are adaptable to larger ships. No major concerns have been identified. As compared to the Mark III, the NO96 requires lower hull girder deflections, resulting in a higher hull steel weight. Structurally, spherical tanks appear to pose issues because of opening sizes and structural discontinuity problems.

E Fatigue Life:

The Fatigue Assessment of Typical Details of Very Large Gas Carriers (LPG)potential of fatigue cracking in these ships, particularly on the inner hull, must receive special attention. Cracks in the inner hull will result in ballast water contamination of membrane tank insulation, and will result in costly repairs. FEA, DLA and SFA capabilities have advanced to the point that that the risk of structural and fatigue cracks can be minimized. Classification society programs, such as SafeHull, Nauticus and ShipRight, can be used to evaluate designs for compliance with rule requirements, but are limited in their design capacity and should not be relied upon for structural and fatigue design.

Shipbuilders are in the business of building ships: few of them also repair ships, and very few track and study fatigue cracking. As a result, shipbuilders should not be relied upon, alone, to provide the FEA, DLA and SFA.

LBP: 321,0 m; Beam: 51,0 m; Depth: 27,5 m; Draft: 12,0 m; Service Speed: 19,7 kts; Cargo: 228 500 m3; Power (NCR): 2 × 21 000 hp; Propulsion: Twin Screw Diesel; Boil Off: Full Reliquefaction; Crew: 28

Thirty-, forty- and fifty-year lives are being studied with consideration for a 40-year or 50-year fatigue life in way of the cargo block, on the basis that the additional steel required will be minimal in comparison to the additional safety margin.

| Table 2. Principal Particulars of the Super-Flex | |

|---|---|

| Characteristic | Value |

| Length Overall | 335,0 m |

| Length BP | 321,0 m |

| Breadth | 51,0 m |

| Depth | 27,5 m |

| Draft (design) | 12,0 m |

| Draft (scantling) | 13,5 m |

| Deadweight (design) | 110 500 mt |

| Cargo Capacity | 228 500 m3 |

| Ballast Capacity | 82 000 mt |

| HFO Capacity | 9 800 mt |

| DO Capacity | 600 mt |

| FW Capacity | 800 mt |

| Cargo System | GTT NO96 or MK III |

| Number of Tanks | 5 |

| Crew | 28 |

| Accommodations for | 38 |

| Service Speed @ 90 % MCR and 20 % margin | 19,7 knots |

| Endurance | 13 000 n. m. + 3 days |

| Main Machinery | 2 × Slow-Speed Diesel |

| Power (NCR) | 43 000 hp |

| Propeller | 5-blade FP |

| Bow Thruster | Yes |

| Reliquefaction | Yes |

Next Steps

Areas of ongoing study include:

- Optimization of the hull design, including tank configuration, LCB location, single-screw/single- rudder vs. twin-screw/twin-rudder, block coefficient, lines development, maneuvering, and sea-keeping.

- Reduction of sea margin, including reduction in hull and propeller resistance; use of larger bore engines or an additional cylinder; electric load (PTO) balancing; interface with system transportation models; and evaluation of use of margin.

- Cargo systems design, including refinement of the required loading/discharge times and rates and discharge head; sizing of the liquid and vapour lines; verification of the pump tower design (i. e., strength, vibration, etc.); confirmation of the tank configuration; and development of tank cooling procedures.

- Redundancy evaluations, especially of the twin-screw/twin-rudder configuration.

- Safety systems design, including evaluation of lifeboat alternatives; engine room firefighting system alternatives; personnel protection systems; and deck fire-fighting systems.

- Mooring/fendering design, including consideration of permissible loading; terminal interfaces; offshore terminals; the use of winches on offshore terminals; winch deck arrangement; and deck fittings.

- Emissions control, including regulations; permit conditions and reduction methodologies.

- Life-cycle cost analysis, including support for financial/budgeting efforts; shipyard periods; and tonnage measurements.

LNGC Construction

Approach

COPM‘s approach to LNGC construction is founded on three premises.

First, given the projected size and scale of the LNG industry, COPM will be in the business of building LNGCs on a continuing basis for decades to come.

Second, given the time required to bring a single large LNG project to full operation, it is inevitable that succeeding projects will overlap: there should be significant value to be had from treating each individual project as a phase in one never-ending mega-project.

Third, given the high value of the product, the biggest risk in LNGC construction will be that of delay: as a result, the single most important element in COPM‘s approach to LNGC construction is effective construction management.

Selection of Shipbuilders

One of the most severe constraints on the successful execution of a series of large LNGC shipbuilding projects is the shortage of qualified shipbuilders and the limited number of available berths.

The universe of active shipbuilders with experience in the Materials of construction LNG and LPG tanksconstruction of LNGCs was defined and those with no recent experience were eliminated. The remaining shipbuilders were then approached to ascertain their interest in building large LNGCs for COPM. On the basis of the responses received, the list was reduced to seven shipbuilders – Samsung Heavy Industries, Daewoo Shipbuilding & Marine Engineering, Hyundai Heavy Industries, Kawasaki Heavy Industries, Mitsubishi Heavy Industries, Mitsui Engineering & Shipbuilding and IZAR Shipbuilding.

Discussions were held with each of these seven shipbuilders to determine their current and potential capability and capacity for large-scale series construction of large LNGCs. At the present time, COPM considers these seven shipbuilders to be pre-qualified to bid for portions of COPM‘s anticipated projects.

COPM realizes that additional shipbuilders are currently seeking to penetrate the LNGC market. COPM welcomes the additional competition. For the time being, however, COPM considers that the risk associated with contracting with an inexperienced shipbuilder outweighs any possible benefit. As a result, COPM intends to limit competition to the seven companies named above until such time as additional shipbuilders have established themselves in the market.

Acqusition Strategy

In order to achieve the optimum level of standardisation and hence of economies of scale, COPM, as charterer and representing the investors in the individual projects, will reserve sufficient shipyard slots to ensure that the needs of all the projects are covered. COPM will then solicit ship construction proposals on a project-by-project basis, evaluate those proposals, and negotiate letters of intent with the shipbuilders.

As in most large LNG projects, independent tanker operators will own and operate the ships, under long- term time charters from the venture management. Each of these independent operators will be responsible for financing his ships. COPM will participate in the selection of these independent operators, as described in the next section.

At the appropriate point in time, each selected operator will negotiate the conversion of one or more letters of intent with the selected shipbuilders into firm ship construction contracts. It is to be hoped that this can be achieved with minimum modifications.

Selection of Class

COPM believes that its multi-project LNGC shipbuilding program is of sufficient size to justify a higher-than- normal level of attention to the service provided by classification services.

Specifically, it is COPM‘s goal to:

- Simplify the plan review and approval process;

- Standardise consturction survey procedures;

- Develop information pooling and analysis;

- Improve process effectiveness, and;

- Add value throughout the life cycle of all the ships.

Because of the scale and intensity of the planned shipbuilding program, COPM plans to engage more than one classification society. Each society may need to be responsible for the classification of ships built by more than one shipbuilder. COPM, as time charter and/or on behalf of each project’s investors, will manage the entire design and construction process, with the assistance of the individual shipowners. The classification societies will, therefore, need to work closely with COPM throughout the program.

By using this innovative approach to classification, COPM expects to:

- Improve the flow of information;

- Capture the economies achievable on a multi-ship, multi-yard program by aligning the organization of class personnel with that of the owners’ construction management teams, and;

- Allow pooling of information and analysis and hence anticipation and elimination of repetitive problem.

The result of these efforts should be to:

- Improve the effectiveness of class (and simultaneously reduce its cost), both during design and construction and throughout the service life of the ships;Improve the shipowners’ oversight of regulatory issues, and;

- Improve the overall efficiency of fleet maintenance.

COPM has reviewed the background and relevant experience of all the members of the International Association of Classification Societies, (IACS), and concluded that four societies are qualified to class large LNG carriers – the American Bureau of Shipping (ABS), Lloyd’s Register of Shipping (LR), Det Norske Veritas (NV) and Bureau Veritas (BV).

The selection of class for a specific contract will, as is customary, be a matter for the individual shipbuilder and the individual shipowner. COPM will, however, use its position as charterer to influence this process in such a way as to avoid any unnecessary inefficiency.

Construction Management

Once COPM’s multi-project LNGC construction program is operating at full throttle, it is to be expected that 20 or more ships could be under contract simultaneously. While it would be desirable for all these ships to be identical, the reality is that the requirements of different projects and the construction practices of different shipbuilders will result in a mixed bag of design and size variations.

If each ship were to be treated as an individual project, there would, inevitably, be considerable duplication of effort, repetition of mistakes, and confusion in communications. Of particular concern is the prospect of a domino effect: a problem arises on one project and is not caught early enough to prevent its recurrence, as a result of which, an additional cost or, worse, a delay, ripples through the entire program. As was seen in Table 1, a single day’s flow of LNG on a single project is worth over $6 million to the project’s investors. Clearly, delay cannot be tolerated. Indeed, delay is so expensive that the customary formula for calculation of liquidated damages becomes irrelevant. It may go against the grain to admit it, but additional cost is less unacceptable than delay.

As a result, COPM intends to act as overall program manager and coordinate all the activities of all the projects, including the plan approval process, the shipowners’ on-site inspection efforts, and the activities of class. A single IT system will be established to provide real-time visibility of all aspects of the design and construction process, and all participants will use the same project planning, control and reporting procedures.

It is hoped that, in this way, the projects will flow as seamlessly as possible. Problems will be identified sooner rather than later, and solved before they can have an impact on either cost or schedule.

In this context, the importance of cooperative relations between the shipbuilders on the one hand and the shipowners, charterers and LNG project teams on the other, cannot be over-emphasized. COPM prides itself on its record of dispute-free contracting with shipyards. Given the high cost of delay and the potential opportunities for an unscrupulous shipbuilder to create problems, it will be critically important to establish and to maintain a spirit of cooperation. To this end, COPM proposes to include incentives for performance, rather than penalties for non-performance, in its standard form of shipbuilding contract.

Finally, the importance of a tightly controlled construction management system leads COPM to envisage a different mix of construction management personnel from that which has become standard practice. First, the long-term – effectively never-ending – nature of the program will allow a higher than usual proportion of construction management personnel to be full-time employees rather than contractors: this should result both in greater continuity from project to project and in improved consistency of procedures. It should also result in several key construction management positions being spread over several projects, with resulting economies.

This innovative approach to construction management is, of course, still untested. To a great extent, in fact, it is still only a concept. The need for some such an approach management is, however, clear. Over the next few months, a project execution plan for the detailed design and construction phase of the program will be developed.

LNGC Operations

Approach

COPM‘s approach to LNGC operation follows much of the same logic that was applied to its approach to LNGC construction.

First, as with construction, COPM expects to be in the business of operating LNGCs for decades to come.

Second, there should be significant value to be had from treating the ships in each individual project’s fleet of LNGCs as entities in one mega-fleet.

Third, given the high value of the product, the biggest risk in LNGC operation will be that of delay: as a result, the single most important element in COPM’s approach to LNGC operation will be effective fleet scheduling.

Selection of Ship Operators

Unlike the LNGC shipbuilding situation, there is no shortage of qualified LNGC owners and operators. There are, in fact, more than are needed, and there are numerous additional operators actively seeking to penetrate the market. The universe of active, independent LNGC owners and operators is easily defined: to this list has been added those additional independent operators that, in COPM‘s judgement, could, if they wanted to, successfully join the ranks of LNGC operators. Four criteria – admittedly somewhat subjective – were used to select the companies on this expanded list:

- Experience in operating a significant fleet of either LPG carriers or crude carriers;

- Financial strength;

- Resources;

- Reputation for quality and reliability.

The result of this effort was a list of about 35 tentatively pre-qualified ship operators. These operators have not yet been approached formally, although informal preliminary meetings have been held with most of them.

Chartering Strategy

If COPM‘s multi-project LNGC program were to grow at the rate of one project a year, if the typical project requires, say, eight large LNGCs, and if the typical project term is 25 years, the total number of LNGCs under common operational control could, hypothetically, grow to as many as 200. In such a scenario, it would clearly be desirable for the fleet to be operated by as few individual operators as possible. As a result, COPM‘s chartering strategy will favour those operators with the financial strength to build three or four ships per project, rather than only one or two.

As discussed earlier, delay is the critical risk in the construction phase: in operation, it is time off-hire. Resources, experience and financial strength will always be valuable attributes in minimising the risk of time off-hire.

In parallel with its LNGC acquisition strategy, COPM will implement a chartering strategy designed to ensure the availability of qualified operators. COPM will develop a pro forma time charter that, like the shipbuilding contract, will be innovative in the extent to which it stimulates above-average performance. Candidate operators will be invited to bid time charter rates on the basis of this pro forma time charter and notional ship prices and deliveries. The selected operators will then execute time charters with the project’s management at the same time as they execute shipbuilding contracts.

Operations Management

COPM‘s approach to management of the operation of the planned LNGC mega-fleet follows the same logic described above. Each ship operator will, of course, operate his own fleet, within the constraints of his time charter, and COPM, as the representative of the time charterer, will coordinate the operations of all the ships chartered or a particular project. In this way, COPM expects to achieve not only economies of scale but also other value-adding synergies deriving from such activities as:

- Sharing of operational information;

- Coordination of scheduled dry-dockings and other off-hire periods;

- Flexibility of assignment of ships to routes.

In addition, with the assent of the various projects, COPM plans to coordinate the activities of the various projects, in order to achieve an additional level of cost reduction and/or value addition.

Conclusion

Although the LNG shipping industry is now 40 years old, it will shortly make a quantum leap in scale, as the first large-scale LNG projects come on line. In the transportation of LNG, as in the transportation of crude oil, iron ore and containers, size matters. In this respect, the unreasoned resistance in the US of local interests to new onshore LNG terminals only helps, encouraging as it does the construction of offshore terminals with no ship size restrictions. COPM expects to see a continuing increase in vessel size as more and more terminals are built which can handle large LNGCs.

This article has described COPM‘s current approach to the concurrent development of multiple large LNGC projects. Much of this strategy is still at the formative stage and it will be necessary to return periodically to provide a progress report.

As should be apparent from the content of the article, COP expects to be in the LNG business on a major scale and for the long term. It is appropriate, therefore, for COPM to take a long-term view of the industry’s marine transportation requirements. This being so, COPM has initiated an LNG Transportation Research & Development Program to explore ways in which LNG transportation can be made more efficient, with improved safety and reliability.

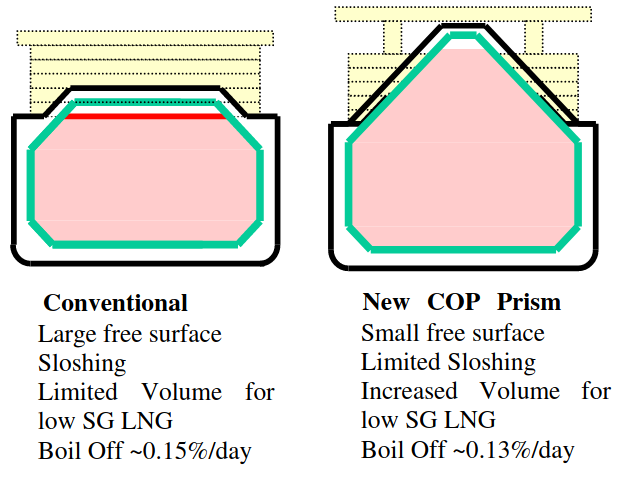

Among the early developments to emerge from this program is the “Prism” or “Pyramid” tank concept, illustrated in Pictures 4 and 5. This concept allows the carriage of large volumes of LNG on shorter ships, with less cargo sloshing than in existing membrane-type designs. Experimental, analytical and engineering studies are currently underway with the expected outcome being a 228 000-cu. m. ship which will be about 20 m less in length than an equivalent conventional vessel.

LBP: 335 m; Beam: 55 m; Depth: 27,6 m; Draft: 12,0 m; Service Speed: 19,5 kts; Cargo: 265 000 m3; Power: 2 × 28 000 hp; Propulsion: Twin Screw; Boil Off: Full Reliquefaction; Crew: 26

COPM also expects to see significant technical developments in the area of cargo containment systems: a less labour-intensive system is urgently needed to reduce construction cost and time. Similarly, the new generation of large ships needs new propulsion systems: the approach preferred by COPM and described in this article may not necessarily prove to be the optimum.

Looking further ahead, it is not unreasonable to visualize a 400 000 m3 ship, with a carbon fibre reinforced ceramic containment system, propelled by gas-turbine driven electric podded drives, using cryogenically cooled super- conducting motors, fuelled with sulphur-free Gas To Liquids produced fuel. Such ships would be in long-haul trans-pacific or trans-atlantic trade trading between large offshore loading and discharge terminals.

These are exciting times for naval architects, using our pioneering spirit to responsibly deliver energy to the world.