Analytics – September 2025: LNG Dominates Alternative Fuel Vessel Orders Amid Market Slowdown

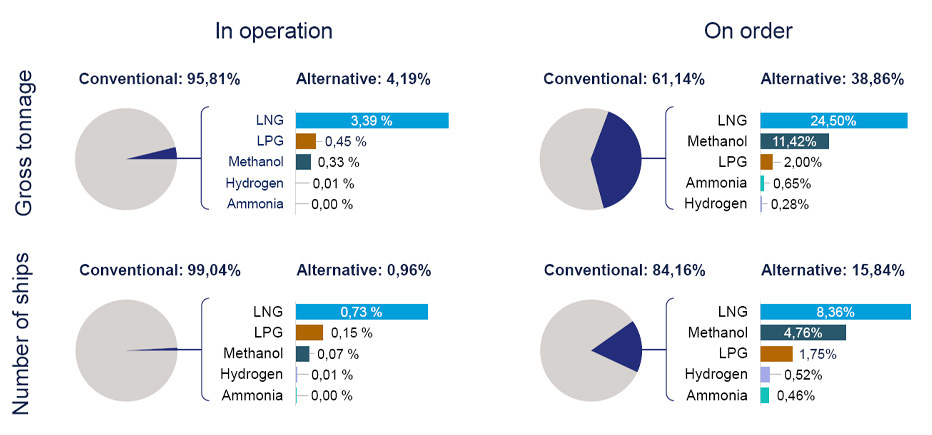

The latest data from DNV’s Alternative Fuels Insight (AFI) platform reveals that liquefied natural gas (LNG)-fueled newbuildings comprised the majority of alternative-fuel orders in September 2025.

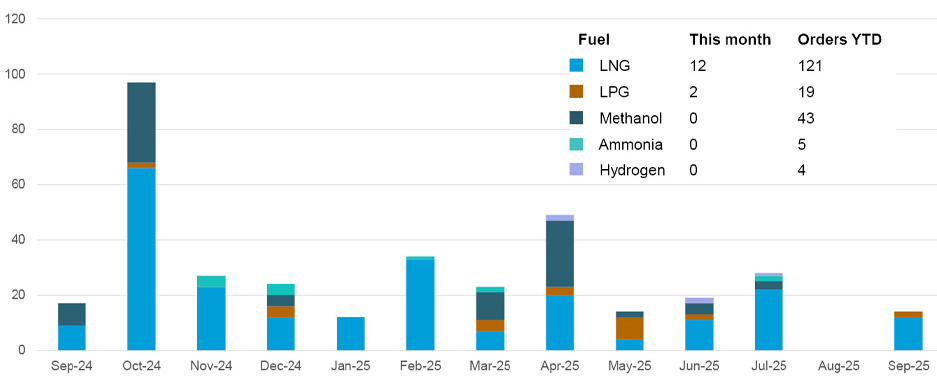

In total, 14 orders for alternative-fueled vessels were recorded in September 2025. Among these, 12 orders were for LNG-fueled vessels: six from the container segment, four from bulk carriers, and two from the cruise segment. The other two orders were for LPG carriers.

Source: DNV

Throughout the first nine months of 2025, there have been 192 new orders for alternative-fueled vessels, representing a 48 % decrease compared to the same timeframe in 2024. LNG-fueled vessels accounted for the bulk of these orders (121), followed by 43 orders for methanol-fueled ships, with the remainder being LPG carriers (19), ammonia-fueled vessels (5), and hydrogen-fueled vessels (4).

Source: DNV

The container segment continues to lead in new orders within the alternative-fueled market, representing 63% of all new orders so far in 2025 (120 vessels).

Jason Stefanatos, Global Decarbonization Director at DNV Maritime, noted:

“After a record-breaking first half of the year, the absence of new orders in August and relatively low activity in September indicate a notable slowdown in the alternative-fuel market during the third quarter. While this trend reflects a weaker overall market for newbuilds and rising contract costs, other elements are also affecting sentiment. Uncertainties surrounding the IMO’s Net-Zero Framework, including lifecycle assessment factors for specific fuels, are causing many owners to take a ‘wait and see’ approach to new orders. Therefore, it is crucial for the industry to attain clearer regulatory guidance in the months ahead.”