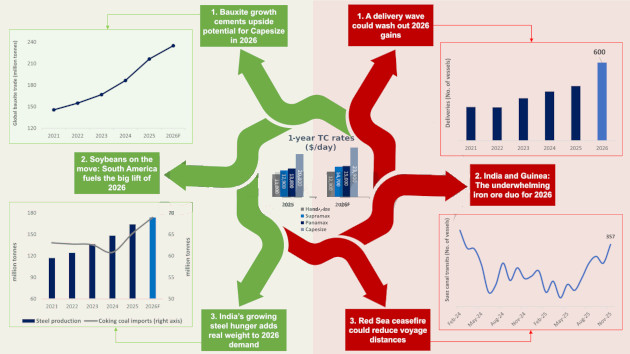

Dry Bulk Forecast 2026: Moderate Market Recovery Expected Amid Strong Bauxite, Soybean, and Indian Coal Demand Despite Fleet and Red Sea Risks

Drewry maintains a moderately optimistic forecast for the dry bulk market in 2026, expecting a significantly calmer and more constructive year after the turbulence of 2025, when geopolitical disruptions and trade policy uncertainty – particularly tariff threats – often overshadowed core supply-demand fundamentals.

Stabilization became evident in the second half of 2025 and has gained further momentum from the recent easing of USTR policy and the early-November US-China tariff truce, which have substantially lowered the risk of abrupt, broad-based trade shocks.

Source: Drewry

The key upside drivers remain firmly in place: global bauxite exports are projected to grow 8,6 %, led by record shipments from Guinea and increased output from Australia (including Rio Tinto’s 57–59 million tonnes in 2025), fueled by strong aluminium demand in China and Europe, green infrastructure projects, and rising Indian imports; Brazil is heading for a record 178 million tonne soybean crop in 2025–26 with early export advantages, complemented by Argentina’s dramatic rebound to around 12,6 million tonnes (mostly to China) after the suspension of export levies; and India’s coking coal imports continue as a reliable pillar, driven by expanding steel production and new blast furnace capacity from Tata Steel, JSPL, and SAIL.

Downside risks, however, are still prominent and could cap the upside: the heaviest wave of new vessel deliveries in over a decade (more than 600 ships, mainly mid-size segments) will significantly expand fleet supply; iron ore contributions from India and Guinea’s Simandou project will remain limited in 2026, with Simandou only in early ramp-up; and the recent Red Sea ceasefire has already led to successful test transits through the Suez Canal in December 2025 (e.g., by Maersk), raising the possibility of route normalization that would unwind tonne-mile gains and exert downward pressure on rates.

In summary, while 2026 is positioned for a fundamentals-led moderate recovery—with strong commodity demand providing the main lift—ongoing fleet expansion and the evolving Red Sea situation are expected to keep gains in check. The Baltic Dry Index, hovering around the 1 950 – 2 000 level as of late December 2025, underscores this ongoing transition toward a more balanced and less volatile market environment.