LNG Shipping Market in 2025: Historic Lows, Winter Rate Spike and 2026 Outlook

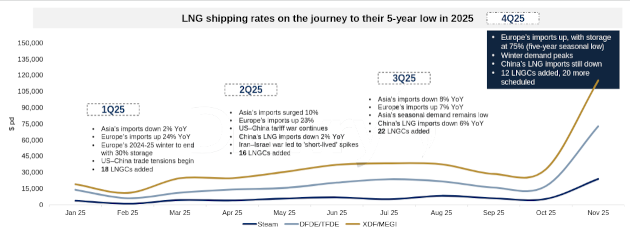

LNG shipping rates in full-year 2025 fell to historic lows despite a sharp and unexpected rally at the end of the year. On an annual average basis, rates for TFDE carriers declined by 48 % year on year, while rates for modern XDF/MEGI vessels were down 35 %. The market narrative briefly changed in October and November, when rates surged above USD 100 000 per day as winter demand emerged. However, this spike was widely viewed as an anomaly driven by seasonal factors in Europe rather than a structural recovery in global LNG shipping demand, particularly in Asia.

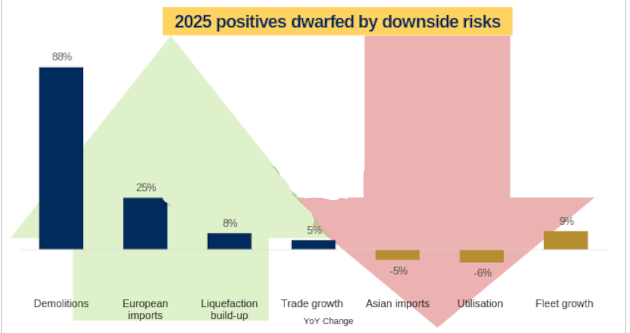

The year began on a weak footing as persistent US–China trade tensions and shifting trade patterns compounded existing challenges in LNG shipping. Ample vessel availability, a 5 % year-on-year decline in Asian LNG demand, mild weather conditions and heightened uncertainty stemming from volatile tariffs and geopolitical risks outweighed positive developments. These included a 25 % year-on-year increase in European LNG imports in 2025, a 6 % rise in global LNG supply and record-high scrapping activity, which surged by 88 % compared with the previous year. Announcements by the USTR, a slow pace of final investment decisions in the first half of 2025 and the rollout of US tariffs prompted shipowners to remain cautious, resulting in sharply reduced newbuilding activity. Only 20 LNG carriers were ordered in 2025 as of 10 December, compared with 76 in 2024.

Source: Drewry

More than 68 LNG carriers had been delivered by the end of November, with over 20 additional vessels scheduled for delivery in the final weeks of the year, including more than 20 modern two-stroke ships. This continued influx of tonnage reinforced structural oversupply and limited any sustained improvement in freight rates. As a result, the number of idled and laid-up LNG carriers nearly doubled during the year, reflecting persistent underutilisation across the fleet.

During the first half of 2025, market conditions were particularly weak. LNG shipping rates for TFDE vessels fell by around 65 % year on year, while XDF/MEGI rates dropped by approximately 55 %. Macroeconomic weakness, fears of recession, unpredictable tariff policies and ongoing trade frictions suppressed demand fundamentals. Geopolitical events, including the Iran–Israel conflict in June, provided only brief and short-lived rate support. Asian LNG demand remained subdued due to slowing industrial output and economic headwinds. Taiwan stood out as an exception, increasing LNG imports as it became fully nuclear-free. European LNG imports, by contrast, surged by 40 % year on year in the first half of the year, led by Spain, Italy, the Netherlands and Belgium. However, this did not translate into higher tonne-mile demand, as Europe increasingly sourced LNG from the US, favouring shorter-haul Atlantic trades.

Source: Drewry

Geopolitics continued to reshape LNG trade flows throughout the year. Prolonged US–China trade tensions resulted in an estimated loss of around 45 billion tonne-miles of LNG shipping demand in 2025. Europe further distanced itself from Russian gas, while China maintained its pause on US LNG imports, accelerating the shift toward intra-basin trade at the expense of long-haul routes such as US–Asia. Early improvements in LNG carrier transits through the Panama Canal were reversed as rising European demand was increasingly met by US supply, offsetting any gains from longer voyages via alternative routes.

In the Far East, increased Western scrutiny of Russian LNG exports contributed to the emergence of a so-called LNG “dark fleet.” Despite ongoing restrictions on Arctic LNG 2, China is estimated to have received more than a dozen cargoes from the project, underscoring continued LNG trade between China and Russia despite Western sanctions. Low freight rates, combined with rising environmental scrutiny, accelerated the scrapping of older steam-powered LNG carriers, with more than 15 vessels scrapped in 2025, compared with eight in the previous year.

The anticipated recovery in rates during the third quarter of 2025 failed to materialise. Seasonally low Asian demand, high vessel availability in both the Atlantic and Pacific basins and higher LNG prices—averaging USD 12.5 per MMBtu in 2025 versus USD 11.0 in 2024—kept buying interest muted, particularly in price-sensitive markets. China’s LNG imports remained subdued amid weak industrial activity, increased pipeline gas inflows and ample domestic supply.

Market conditions shifted sharply toward the end of the year as winter arrived. LNG shipping rates surged to six-digit levels in late October and November, with XDF/MEGI rates exceeding USD 100 000 per day. This rally was driven by strong European LNG demand, tightening vessel availability in the Atlantic, increased US–Europe trade and supply disruptions in regions such as Egypt. Most US LNG exports were directed toward Europe, absorbing available tonnage and supporting short-term rates. In contrast, the Pacific basin saw a much weaker response, as Asian demand remained subdued and US–Asia trade flows stayed limited. As a result, Atlantic rates maintained a premium over Pacific rates, with modern two-stroke vessels increasingly preferred in the West, while four-stroke and steam vessels gravitated toward the Pacific.

Despite volatility in spot and short-term markets, long-term LNG shipping rates remained relatively stable throughout 2025, highlighting confidence in the long-term growth outlook for LNG demand. Around 75 % of LNG carrier orders are tied to long-term charters, with a portion of the orderbook having limited forward coverage or remaining structurally open. The long-term outlook is supported by a wave of final investment decisions in the second half of 2025, with more than 60 mtpa of projects reaching FID, over 90 mtpa of LNG supply deals signed, more than 150 mtpa under construction and around 200 mtpa planned. These developments point to a growing need for LNG carriers over the medium to long term.

Looking ahead, the current rate surge is expected to ease, with 2026 likely to begin on a softer note as additional tonnage enters the fleet. Around 20 modern LNG carriers are scheduled for delivery in December 2025, followed by another 40 vessels in the first quarter of 2026, which should alleviate the vessel tightness seen in the Atlantic. Nevertheless, several factors could provide support to rates in early 2026, including colder-than-expected winter weather in Europe and Asia, a potential rebound in China’s winter LNG buying, shifts in US–China trade policy that could revive LNG trade between the two countries, and any disruptions to Europe’s pipeline gas supplies from Azerbaijan, Norway or Algeria.