Many countries have begun to develop local and regional gas markets, based in some cases on domestic pipelines, and in a few cases on regional pipelines. Markets and infrastructure remain underdeveloped and require large new investments to satisfy the needs of local populations. With well-designed market structures, local and regional gas demand could underpin more development of natural gas resources. Market participants are expressing a preference for indigenous natural gas resources as a primary source of fuel, a feedstock for industries and chemical manufacturing, a target for foreign direct investment, and a source of foreign exchange from exports.

- Domestic Use of Gas

- Natural Gas – Fuel Supply and Demand Economics

- Natural Gas For Power Generation

- Gas to Power Implementation

- Elements of a Gas-to-Power Value Chain

- Gas-to-Power Value Chain Planning

- Gas-to-Power Value Chain Implementation

- Power Generation Investment

- Market Structure

- Elements of a Gas Master Plan

- Examples of Domestic Gas Projects

- Domestic Gas Reservations – Domestic Supply Obligation

- Gas Sector Regulatory Reforms

There is substantial potential gas demand in many countries especially for gas-fired power generation, for fueling industry and natural gas vehicles, and LNG for transportation. A structured, well-regulated, local or regional market can be a deciding factor in how quickly gas can be developed to satisfy that demand. Although there are many challenges involved in using local and regional markets to support large gas development projects; with a suitable market structure, new technology solutions, and innovative contract models, there is likely to be an increasingly attractive range of options.

The chapters that follow review elements that can enable domestic market development and create beneficial spin-offs in terms of replacing competing fuels that can be more expensive. Some examples of local or regional infrastructure serving markets are also provided. A well-developed gas utilization master plan with adequate local participation and buy-in is normally a key component of enabling market development.

In today’s oversupplied global market for LNG, there are opportunities for supporting import projects, but also challenges for developing large-scale projects domestically.

Domestic Use of Gas

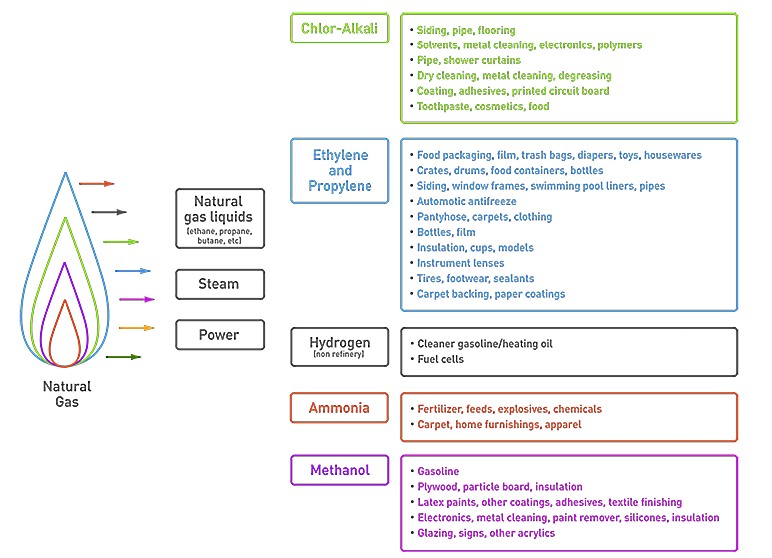

This section provides an overview of the potential domestic uses of natural gas. A major use for domestic natural gas is power generation. Natural gas can also be used as fuel in transportation, industries, commercial buildings or residences. Natural gas can provide fuel substitution for higher cost and more environmentally damaging fuels as well as utilizing a country’s domestic resources. Additionally, natural gas can be used as a feedstock for various other industrial plants, such as fertilizer plants, methanol plants, petrochemical plants and gas-to-liquids plants.

The below diagram shows some of the domestic uses of natural gas.

Natural Gas – Fuel Supply and Demand Economics

The price of natural gas must be balanced between the cost of supply and what is affordable for consumers; otherwise, consumers will not switch to gas, assuming other alternatives are in place and/or available. The price level must be sufficient to demonstrate to the consumer adequate value that overcomes the risks and costs of converting to natural gas from the incumbent fuels (diesel, fuel oil, etc.). The fuel-switching economics must be favorable in the long term, which means, first and foremost, the price difference between the delivered cost of natural gas and the incumbent fuel must be strong over the life of investments by consumers and suppliers.

Local gas prices, particularly for imports, are influenced by global market prices and are also impacted by regulatory policy choices, which impose costs through taxes and mandated technology choices. Taxes, or the lack thereof, can provide incentives or disincentives for fuel choices. Grants, subsidies, and developing economies of scale as the adoption of new technology increases, can offset capital costs. Perhaps the greatest challenge to switching to natural gas has been the recent collapse in crude oil prices and the attendant decline in refined product prices (e. g. of distillates and heavy fuel oil).

Read also: Project Management of the Large-Scale Liquefied Natural Gas Facilities

As mentioned above, an equipment owner (power plant, ship or vehicle) must be convinced that the benefits of switching to natural gas outweigh both the next best alternative and the risks of change. Customers must be convinced that natural gas will be reliably available. Equipment suppliers, maintenance, and infrastructure must be sufficient to provide the comfort of reliability. Understanding the physical infrastructure which will be required to meet demand is necessary to alleviate this critical concern.

Consumers must also be convinced that the benefits outweigh the time and effort required to understand natural gas and its impact on operations and maintenance. Some questions that could arise are: How safe is this fuel? What happens if there is a fire? How will my operations need to change (if necessary) to accommodate this fuel? What are cost and environmental benefits? These are all very real questions that require honest public answers.

Natural Gas For Power Generation

In the past, many large gas development projects have focused on global gas export markets to underpin development, and domestic market opportunities have been secondary. Given the emergence of significant high-quality gas resources in many parts of the worlds, the current weak demand in the global LNG market and the urgent need for new power generation facilities in many parts of the continent, the domestic gas and power value chain is becoming a much more critical feature of natural gas development.

There are challenges involved in connecting gas resource development with power demand, particularly with respect to the small size of domestic gas demand in many countries compared to the magnitude of natural gas resources required to justify a world-scale LNG project. Nevertheless, the ability of power projects to provide the credit necessary to support financing arrangements, and to support the infrastructure required to Weather-related Economics of Natural Gas Transport for Two Propulsion Plant Configurationstransport gas to where the power generation is needed, means that such development remains one of the most promising opportunities to connect gas resources with domestic markets. The use of gas for power generation is, therefore, an important policy goal, especially as power is an enabling factor to stimulate and promote other industrial development and underpin overall economic growth.

The purpose of a gas-to-power strategy is often to encourage the use of domestically produced natural gas and increase power supply to meet domestic needs for power. Imported gas is also an option, assuming either pipeline gas or LNG is available to the country. In either case domestic prices must support the cost of imported or domestically produced gas and the necessary infrastructure. When developing a natural gas power market, the following objectives should be considered at a national level:

- Secure stable, reliable, consistent quality, and cost-effective electric power and fuel supplies to fuel electric generation or industrial operations. Global energy price volatility and geopolitical risks will likely continue. This requires an understanding of in-country risks, regional/local power grid reliability, present and future public power supply availability, local competition for power and fuel resources, public transportation systems, logistic considerations, and insourcing or outsourcing risks and opportunities to operate in an uncertain investment environment.

- Achieve sustainable cost and efficiency improvements. Understand energy-related opportunity costs at a country level. Focus on cost savings, improving domestic manufacturing and trade revenue and achieving predictable operating performance for industries through stable and affordable energy supplies.

- Collaborate internally and engage externally on energy policies and regulations, energy supplies, challenges, and opportunities. Communication, transparency, and collaboration amongst all stakeholders are essential to managing various aspects of the natural gas power generation, transmission, and distribution project development.

- Consider the role of natural gas alongside renewable energy, energy-efficiency strategies and other clean energy technologies to address environmental concerns in addition to the utilization of hydroelectric coal, and/or oil fired base-load power. In recognizing the importance of secure, reliable and economically feasible sources of energy within baseload power generation, natrual gas for base- load power produces lower emissions, is not subject to variable rainfall issues, and provides consistent and reliable power – assuming stable gas supply is available.

- Adapt natural gas fired generation to meet the needs of local communities. Assessing the present and predicted demand and environmental concerns of communities and projects, and designing natural gas power generation or making modifications to existing facilities to meet these needs, is important to reduce emissions and increase energy efficiency. Gas-to-power measures may include power generation for industrial facilities. Gas-fired plants can also be used to run facilities for water storage, desalinization, diversion for mitigation of drought or flooding irrigation, and controlling or containing environmental releases of hazardous materials, process solutions and/or impacted water.

Gas to Power Implementation

Natural gas-fired power generation is based on existing and known technologies with low technology risk, repetitive and standard design, experienced engineering, procurement and construction (EPC) contractors, a global vendor market, a well-established supply chain, and flexible fuel consumption options. The result is a broad selection and training environment for operators, maintenance technicians, and craft workforce.

When combined with natural gas-powered vehicles or industrial, commercial and retail customers, larger scale Exploring Propulsion Systems and Turbo Alternators on Liquefied Gas Carriersnatural gas power generation could serve as an anchor client for developing large-scale capital infrastructure for pipelines, road/rail and supporting infrastructures.

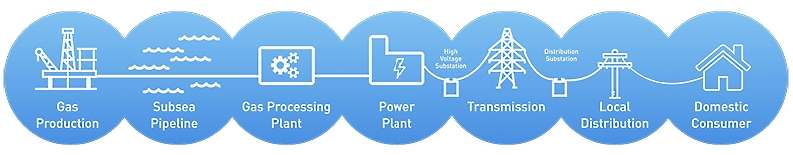

Elements of a Gas-to-Power Value Chain

The below diagram shows a typical gas-to-power value chain in connection with an LNG export project.

This diagram assumes the gas reserves and production are offshore. The gas is piped to the shore for processing/treatment, and is then supplied to an LNG export facility.

Part of the gas, after any required processing/treatment, will be transported to power plants to generate electricity. Some of the constituents of the gas, such as NGL and condensates, may be separately sold to the market. An onshore-value chain schematic would show onshore production and onshore pipeline systems.

Gas-to-Power Value Chain Planning

To ensure the success of a domestic gas-to-power project, proper and careful planning is required. The objective of such planning is to identify the demand centers/end-users and ensure that power can be delivered to the domestic end-users at the lowest cost while meeting reliability, safety, and environmental requirements.

For countries with an integrated electric utility company (usually owned by the government) responsible for the generation, transmission and distribution of power, the utility’s planners will conduct studies to identify the demand centers and locations for future demand growth. These are usually targeted at the main cities and other major populated areas. The electrification plan will need to address how to develop these markets in an optimized manner, and this involves the following alternatives:

- Build power plants close to the demand centers, and pipelines to deliver gas to the power plants.

- Build power plants close to where gas is available, and build transmission lines to connect to the demand centers.

The factors to be considered include:

- Cost: difference between the above alternatives is primarily the difference between the cost of pipeline vs. transmission line.

- Losses: while there are losses associated with transmitting power over long distances, transporting gas over long distances may also require added cost for intermediate compression to maintain pressure.

- Strategic considerations: the development of the initial gas-to-power project under consideration will need to fit in the overall electrification plans for the country.

- Expansion potential: whichever option is selected, the ease of expansion for additional power generation and any associated incremental pipeline/transmission investment will need to be examined.

Gas-to-Power Value Chain Implementation

Successful implementation of LNG and Domestic Gas Value Chainsa gas-to-power value chain depends on the ability of each party to execute the elements for which it is responsible in a timely manner and in coordination with other parties.

Below is a table that shows examples of construction and ownership arrangements:

| Party | Supply Chain Ownership |

| Upstream Investor | Raw gas production / Offshore pipeline / Onshore gas treatment plant |

| Pipeline Investor | Pipeline connecting gas treatment plant to the power plant |

| IPP | Power plant |

| Utility Company | Transmission lines, substations and distribution network |

A successful gas-to-power project typically has each party having the technical, financial and operational capability to undertake its respective investment. The parties must coordinate their plans, including development, construction, and financing plans, in a way that enables timely final investment decisions (FID) and startup of the entire value chain. In cases where the government-owned utility company is responsible for funding and constructing transmission and distribution networks, it must plan for and budget towards the large investments required, and provide confidence to other investors on the availability of government funds and its ability to complete the transmission and distribution networks. Likewise, other investors in the value chain will need to demonstrate the ability to complete their respective segment of the value chain in a timely manner.

Power Generation Investment

Power plants are capital-intensive, long-term investments. Independent power producer (IPP) investors require, among other things, steady revenue from a creditworthy power offtaker (customer) under a power purchase agreement (PPA), reliable fuel gas supply, and a stable legal, regulatory, and taxation environment. To attract IPP investment, host governments will need to provide the necessary legal and regulatory framework in the gas and electricity sector to underpin the PPA which typically has a duration of 20 or more years. Under a conducive investment environment, the IPP will be able to secure project financing as well as payment securitization provided by multilateral agencies such as the World Bank and regional development banks.

Market Structure

The ability of local or regional gas and power markets to partially or wholly underpin a major gas resource development depends largely on the way in which the wholesale and retail gas and power markets are structured.

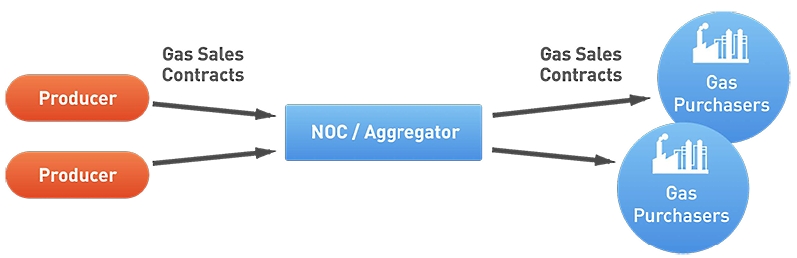

The market segments for natural gas are supply, wholesale, and retail. Each market segment can be structured as exclusive, mixed, or competitive, with prices either regulated or market-based. In the supply segment, the producer sells to an aggregator or directly to an end-user. In the wholesale segment, an entity, such as an aggregator, purchases gas from another entity for resale to other customers. In the retail segment, an end-user purchases gas from an entity for its own use.

An example of an exclusive structure is shown below. A gas aggregator, for example the national oil or gas company, acquires natural gas, provides transportation and compression, if required, and then on-sells the natural gas to wholesale and retail customers.

Of critical importance in any energy market, is a clear and dependable path through which end-users pay for energy received. The flow of energy from the gas developer through to the end-user and the flow of funds in the opposite direction are the key feature of any market and the critical facilitating feature of any project. For domestic and regional markets to provide dependable revenues similar to that which would result from gas or LNG exports to international markets, appropriate planning and execution of market rules, and the nature and level of regulation, are critical factors.

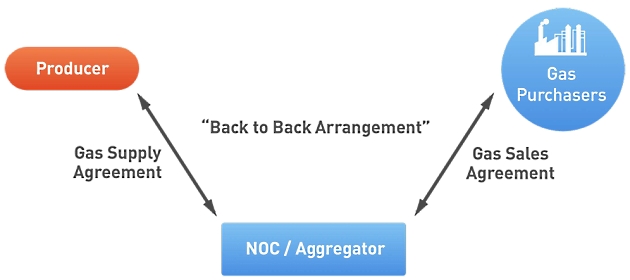

One of the concerns with an aggregator exclusive structure is that the aggregator will stand between the supplier and the customer for contractual and payment purposes. This could lead to a situation where the aggregator is obligated to pay the supplier despite the fact that the gas customer has not paid the aggregator. This concern can be addressed through a mixed structure that includes some sort of payment security from customers or security provided on behalf of the customers.

The diagram below shows an example of a back-to-back structure where the supplier looks to the customers for payment instead of the aggregator:

In a more established market, as shown below, a direct commercial structure where a supplier sells directly to a customer may be used. This structure requires that the supplier or the customer obtains transportation for the gas supply.

In the case of an export sale, the project developers usually rely on a long-term take-or-pay LNG contract, supported by a creditworthy buyer who will sign a binding contract, thereby putting a strong balance sheet behind the purchase obligations. This means that project developers and lenders rarely need to examine what happens to the gas once the take-or-pay buyer has purchased it, so the need to examine market rules downstream of the foundation sale-and-purchase agreement is rarely considered.

For emerging local and regional markets, establishing a creditworthy buyer presents more complex challenges, due to the lack of gas buyers with a pre-existing credit position who are able to support financing requirements.

As a result, lenders and project developers typically have to examine the gas or electricity value chain down to the source of the cash flow, which terminates at the end-user of the gas or power produced. In order to provide a similar level of credit support as a traditional take-or-pay contract, full understanding of the way in which monies flow through the various market participants is integral to ensuring the market is structured to support the project.

Elements of a Gas Master Plan

A starting point for many countries, especially countries that wish to develop gas resources and/or domestic markets for natural gas, is the creation of a Gas Master Plan (GMP). While the contents of a GMP will be unique to each country, there are some helpful general guidelines and principles. In general, a GMP is a holistic framework to identify and evaluate options for natural gas use for domestic supply and/or export. The main goal of the GMP is to provide the foundation to guide policy development for the gas sector of the country. The GMP provides a detailed road map for taking strategic, political and institutional decisions, on the basis of which, investments can be planned and implemented in a coordinated manner.

The role of the government in developing the GMP is to provide a stable, transparent regulatory, fiscal, and financial policy regime to foster the development of the gas sector in a manner which benefits the country as a whole.

While the elements of the GMP vary by the country, there are some broad elements to consider. These elements include:

- Objective of the Gas Master Plan.

- Gas resource evaluation.

- Gas utilization strategy and options consistent with country’s energy policy.

- Domestic supply and demand analysis (power and non-power sector).

- Identification of other domestic “priority” projects.

- Infrastructure development plan/formulation.

- Institutional, regulatory and fiscal framework.

- Development of recommendations about the volumes and revenues from gas finds and future gas production.

- Identification of possible mega or “anchor” projects. For example, a country with a large natural gas find might consider an LNG export project, or other similar industrial-scale plant such as methanol, ammonia production, gas-to-liquids (GTL) projects and dimethyl ether (DME).

- Formulation of a roadmap for implementation of projects.

- Gas sector regulatory reforms.

- Socioeconomic and environmental issues associated with development.

- Gas pricing policy.

An “anchor” project is a large project that provides the economies of scale that may justify the investments in capital-intensive gas infrastructure, which is then available to smaller users. Launching a gas industry from scratch has traditionally required one, or more, large “anchor” customers to undertake to purchase enough gas to justify the significant investments required to build the requisite pipeline infrastructure. Examples of anchor projects include LNG export terminals that may justify offshore gas exploration and production in the first place, power plants, gas-to-liquids plants, methanol or fertilizer plants, which in turn could provide the economic underpinning for pipeline expansions.

With the generally weak global demand for LNG from traditional markets such as Europe or Asia, GMP considerations may have to focus more closely on domestic or regional gas demand to underpin major gas developments, and this may require innovative approaches to gas market development, contractual mechanisms for gas sales, and financing arrangements.

Examples of Domestic Gas Projects

To replace flagging global demand for natural gas, the range of mega or anchor projects might also include a discussion of “priority” gas projects that might be undertaken while plans for any mega projects are being developed. Examples of possible projects include:

- Power projects.

- Gas-to-liquids projects.

- Fertilizer plans.

- Petrochemicals.

- Methanol projects.

- Gas transmission and distribution pipelines.

- Fuel for industry such as iron, steel and cement projects.

Domestic Gas Reservations – Domestic Supply Obligation

Assurance of gas supply is critical to delivering the policy objectives of the GMP. This includes recognition that gas-based industries, such as methanol, fertilizer, or power industries, need a certainty of gas supply before large investments are made. At the same time, many governments face the issue of ensuring that gas is available for critical domestic gas utilization projects which will advance the domestic economic growth agenda.

To balance these often competing objectives, many gas-producing nations have some form of gas reservation policy or domestic supply obligation, aimed at ensuring that local industry and local consumers are not disadvantaged by gas exports.

International examples of domestic supply obligations (DSO) include:

- Nigeria requires all oil and gas operators to set aside a pre-determined minimum amount of gas for use in the domestic market. This is a regulatory obligation with the initial obligation level determined based on a review of the base-case demand scenario for gas in the domestic market. The domestic gas obligation provides a base load of gas that must be processed through the gas-gathering and processing facilities. Since the obligation to supply the domestic market is the responsibility of the gas supplier, title to gas-processed remains with the gas suppliers.

- Israel, Indonesia, and Egypt have laws mandating that a percentage of gas extracted must stay within their domestic markets. Israel reserves 60 % of its offshore natural gas. Egypt has legislated that 30 % of gas production must be directed to domestic consumers. Indonesian reservation is applied on a case-by-case basis to new projects, but reservations of up to 40 % have been agreed to in recent years.

- In the United States, the Department of Energy’s (DOE) authority to regulate US natural gas exports arises from the Natural Gas Act (NGA) of 1938. By law, applications to export US natural gas to countries with which the United States has Free Trade Agreements (FTAs) are deemed to be consistent with the public interest and the Secretary of Energy must grant authorizations without modification or delay. The NGA directs DOE to evaluate applications to export US natural gas to non-FTA countries. Under the NGA, DOE is required to grant applications for authorizations to export US natural gas to non-FTA countries, unless the Department finds that the proposed exports will not be consistent with the public interest, or where trade is explicitly prohibited by law or policy. Canada also has similar public interest laws regarding the export of its gas.

- Norway, Qatar, Russia, Algeria, and Malaysia control domestic supply from their gas reserves by having state-owned companies taking the role of dominant producer.

- Western Australia is the only state in Australia with a gas reservation policy. Under Western Australia law, 15 % of all the gas produced in that state must remain in the state. Western Australia’s gas reservation scheme has been able to guarantee domestic supply at attractive prices, while still allowing investment in the LNG industry and a healthy level of exports.

Gas Sector Regulatory Reforms

Depending on the level of development in the country, various regulatory reforms may be needed to promote the development of the gas sector. Legislation and regulations for licensing the construction, operations, and pricing of natural gas transmission and distribution pipelines might be needed. There should be standard, publicly available terms and conditions for licensing developers of infrastructure that define service obligations, operating rules, and tariffs.

The licensing, operations and tariffs of gas transmission and distribution pipelines should be overseen by an independent regulator.

It will be interesting: Fundamentals of Liquefied Natural Gas

Many governments are considering unbundling value chains for regulatory purposes. Unbundling refers to the separation of segments in the gas value chain to reduce the potential for monopoly, and to increase transparency and the ease of regulating smaller projects. Consumers should see the gas price separately from the cost of transporting and distributing it for transparency. Unbundling can facilitate third-party access to pipelines.