Liquefied Natural Gas project require considerable capital investment and involve multiple project participants. As a result, the projects typically need to have long, productive lives and enduring partnerships. Risk needs to be allocated and functions for the project participants defined in order to allow debt to be paid off and to generate sufficient returns for investors.

Each project would be expected to produce LNG over a period which could span 20-40 years, so it is important to structure the project correctly from its inception to anticipate project risks over time and to avoid misalignments between stakeholders and other risks to the project’s success.

As a result of their high costs, LNG projects are typically executed by joint venture entities with more than one sponsor and with multiple project participants. An appropriate structure will enable entities, often with different aims, such as governments or state-owned entities and private sector companies to comfortably participate in the project. Private sector companies could be energy companies, utilities, and, as is increasingly the case, investors from the financial community. A well-structured project will afford participants sufficient protection in their endeavors. A robust and well-thought-out structure can make provisions for changes to ownership and the future addition of facilities. Overview, Process and Technology of Natural Gas Liquefaction (NLG)Liquefaction projects are often expanded via the addition of new LNG trains.

The structure of liquefaction projects will have ramifications for the allocation of risk. The structure can determine whether the sponsors are able to successfully sign sales or tolling contracts with buyers or tolling counterparties. It will also have an impact on whether the project is able to attract further equity investors, if needed, and raise debt funding from financiers. If a project’s structure is weak or overly complicated, the sponsors may struggle to attract buyers for their product as buyers will be evaluating project risk when deciding whether to enter into a sales contract.

The structure can impact the financing to the extent that the sponsors may be charged a higher price for any debt that is raised or it may even prevent the project sponsors from attracting funding. These structures may be applied to liquefaction projects utilizing floating liquefaction technology.

LNG import facilities, both land-based and FSRU, will cost less to implement than liquefaction projects, but similar considerations apply. They will often operate over a long timeframe and involve multiple partners.

Choosing a Project Structure

Three basic forms of commercial structures have emerged for LNG export projects – integrated, merchant, and tolling. There are hybrid variations of these three models and the potential exists for further changes in the future. But these three structures are reviewed herein because they are the prevailing structures being used in the LNG industry. There is another option for the host government to fully develop the LNG plant, but this option has had limited application since governments generally do not have the experience or access to the necessary capital.

Read also: Basics of safety on gas carriers

The selection of a particular commercial structure is a matter of sometimes heated debate and negotiations among the investors in the project and the host government, and the outcome is influenced heavily by the driving factors discussed below. The choice of a commercial structure has a significant impact on the success of the project both in the short-term and over the life of the project. With the wrong structure in place, local investors may not be able to participate in an LNG project and the expansion of the LNG project may be prevented or impeded. Since, ultimately, the government must approve the development under most PSAs/PSCs or licenses, the investor must give consideration to government preferences and should engage closely and collaboratively with the government when making key decisions on project structure.

Integrated Commercial Structure

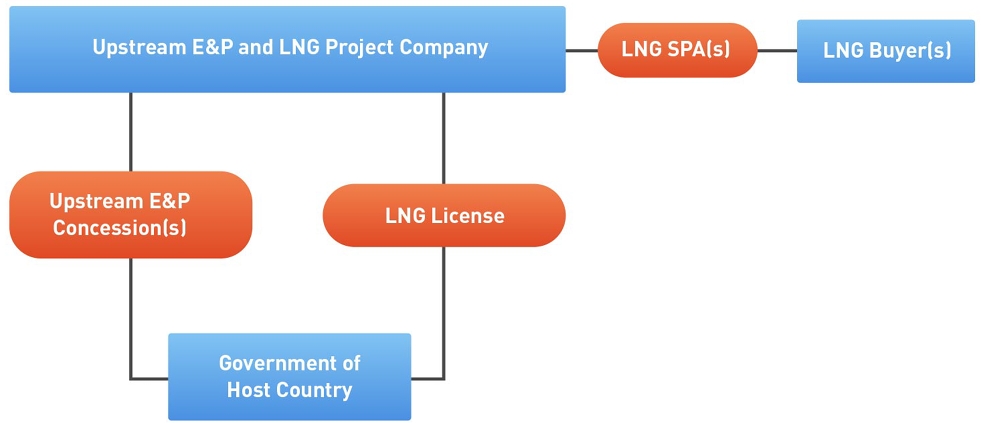

Under the integrated commercial structure, Everything about Natural Gas in Modern Industrythe producer of natural gas is the owner of the LNG export facilities as well as the upstream. The exploration and production project is fully integrated with the LNG liquefaction and export project. The project revenues for both projects are derived from the sale of LNG under one or more LNG sale and purchase agreements (SPAs) entered into by the individual upstream participants or the integrated project company, if one exists. Because the owner of the upstream exploration and production project is the same entity as the owner of the LNG liquefaction and export project, there is typically no other user of the LNG liquefaction and export project. The credit of the LNG buyer or buyers provides the financial underpinning for both the upstream exploration and production project and the LNG liquefaction and export project.

Examples of integrated project structures include Qatar’s Qatargas and RasGas projects, Russia’s Sakhalin Island, Norway’s Snohvit, Australia’s Northwest Shelf and Darwin LNG, and Indonesia’s Tangguh.

The above diagram describes the integrated commercial structure for LNG liquefaction and export projects.

Merchant Structure

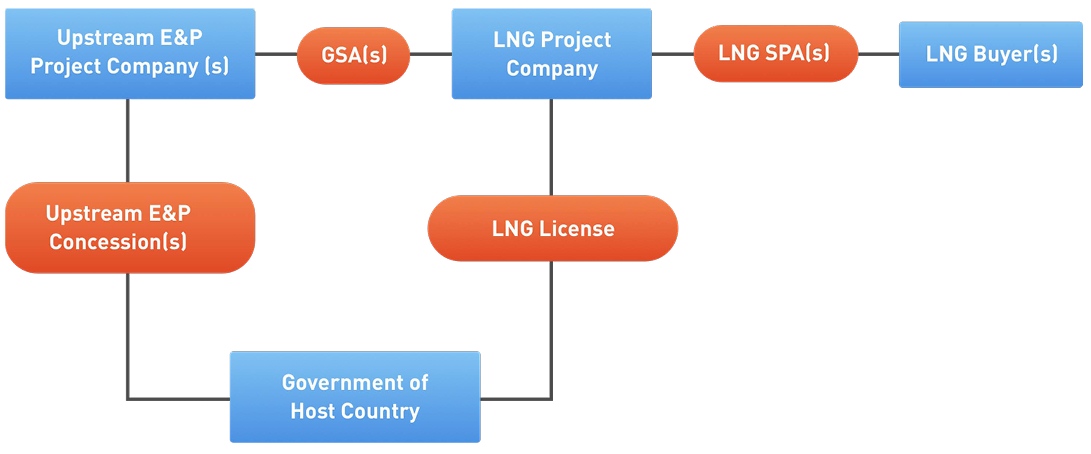

Under the merchant commercial structure, the producer of natural gas is a different entity than the owner of the LNG export facilities, and the LNG liquefaction project company purchases natural gas from the upstream exploration and production project company under a long-term natural gas sale and purchase agreement. The upstream exploration and production project revenues are derived from LNG and Domestic Gas Value Chainsthe sale of natural gas to the LNG liquefaction project company. The LNG liquefaction project profits, in turn, are derived from the amount by which the revenues from LNG sales exceed the sum of the cost of liquefaction (including debt service) and natural gas procurement costs. Because the owner of the upstream exploration and production project is a different entity than the owner of the LNG liquefaction and export project, there may be more than one supplier of natural gas to the LNG liquefaction project company. The credit of both the LNG buyer or buyers and the natural gas producer or producers provides the financial underpinning for the LNG liquefaction and export project.

The merchant commercial structure for LNG liquefaction and export projects is illustrated in the diagram below.

Merchant structure examples include:

- Trinidad trains 1, 2, and 3;

- Angola;

- Nigeria;

- Equatorial Guinea;

- and Malaysia.

Tolling Structure

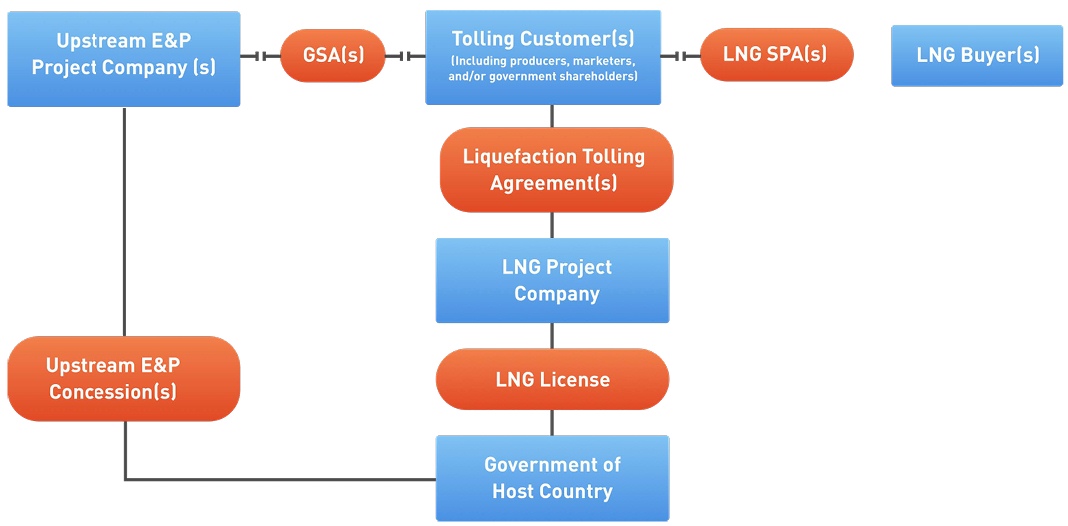

Under the tolling commercial structure – the owner of natural gas, whether a producer, aggregator or buyer of natural gas – is a different entity than the owner of the LNG export facilities. The LNG liquefaction project company provides liquefaction services (without taking title to the natural gas or LNG) under one or more long term liquefaction tolling agreements. The LNG liquefaction project revenues are derived from tariff payments paid by the terminal’s customers. The payments typically take the form of a two-part tariff. Fixed monthly payments cover the project company’s fixed operation and maintenance costs, debt servicing, and return on equity.

Cargo payments are designed to cover the project company’s variable costs, such as power. Because the functions of the LNG liquefaction project company do not include a commodity merchant function, the LNG liquefaction project company does not bear commodity merchant risks such as the supply, demand, and cost of natural gas and LNG. The credit of the tolling customer or customers provides the financial underpinning for the LNG liquefaction and export project.

Tolling structure examples include Trinidad’s train 4, Egypt’s Damietta, Indonesia’s Bontang, and the US‘ Freeport LNG, Cameron LNG, and Cove Point facilities.

The tolling commercial structure as applied to LNG liquefaction and export projects may be illustrated as follows:

Hybrid Structures

Hybrid structures combining some of the attributes of integrated, merchant, and tolling models may be used to tailor LNG liquefaction and export projects to the characteristics and needs of particular host governments and project participants. For example, hybrid merchant-tolling structures have been used in the US by Cheniere’s Sabine Pass and Corpus Christi projects. Here, the project companies provide a marketing service to acquire natural gas and actually take title to the natural gas and sell the LNG to the customer, but also receive fixed monthly reservation charges regardless of whether their customers take LNG.

The below table lists some advantages and disadvantages of the different commercial structures.

| Advantages and disadvantages of commercial structures an LNG Project | ||

|---|---|---|

| Commercial Structure | Advantages | Disadvantages |

| Integrated | Commercial parties are aligned between the upstream and LNG liquefaction project | Does not allow for different upstream projects with different ownership to come together in one LNG project |

| Does not allow for other entities, including the host government, to also have ownership in the plant | ||

| No need to determine a transfer price | Complex to expand for non-concession production | |

| Merchant | Known and commonly used structure familiar with buyers and lenders | Requires additional project agreements with government |

| Potentially different fiscal and tax regime | ||

| Flexibility to allow non- concession investors in the LNG plant | Requires negotiation of gas transfer price | |

| Tolling | Known and commonly used structure familiar with buyers and lenders | Requires additional project agreements with government |

| No price or market risk for the LNG project investor | Potentially different fiscal and tax regime | |

| Government Owned | Owner (government) has full control | Government may lack experience in developing, marketing and operating LNG |

Driving Factors on Choice of Structure

There are a number of key driving factors that influence the choice of an LNG project structure for the host government, the investors, the LNG buyer(s), the project lenders and the other project stakeholders. Some of these key driving factors include:

- Legal Regime and Taxes: The host country’s legal regime and local taxes often have a major impact on project structure. An LNG project may not be considered as a part of the upstream legal regime in the host country and therefore will need to comply with another legal regime, e. g. general corporate regime, special mid-stream regime or downstream regime. Additionally, the tax rate for the upstream regime may be different (higher or lower) than the legal regime for the LNG project. Both of these factors are considered in selecting a structure.

- Governance: The typical upstream venture is an unincorporated joint venture with the external oversight provided by the host country regulator and internal ‘governance‘ provided through an operating committee to the operator, who is generally one of the upstream parties. Day-to-day governance and oversight tend to be less rigid and controlled when compared to an incorporated venture. The government, local stakeholders, lenders and the LNG buyers may desire to have a more direct say in internal project governance and decision making. This needs to be reflected in the structure selected. A poorly governed structure can lead to conflicts among the parties and impact the efficiency and reliability of the LNG Project.

- Efficient Use of Project Facilities: The LNG project structure should encourage efficient use of all project facilities, by the project owners and by third parties. The structure should encourage sharing of common facilities, open access to third parties for spare capacity and reduction of unnecessary facilities and their related costs, thereby making the project more profitable for all stakeholders.

- Flexibility in Ownership: There may be a desire by the government, other local stakeholders, LNG buyers or lenders (e. g. the International Finance Corporation) to have a direct ownership interest in all or specified portions of the LNG project. Alternately, some of the upstream investors may not be interested in owning the liquefaction portion of the LNG project. The choice of a particular structure can enable different levels of ownership in the different components of the LNG project.

- Flexibility for Expansion: A chosen structure may discourage or enable maximum use of common facilities and future expansion trains. For example, an integrated project structure is more difficult to expand if new production comes from third party gas resources than would be the case with a merchant project or a tolling project. If at some point the upstream does not have enough gas, it may be more difficult to integrate another player with a different gas production model or a different IOC into an integrated project.

- Desire for Limited Recourse Financing: If the LNG project is going to try to attract limited recourse project financing, a special purpose corporate entity must generally be set up as the finance partner. It is harder to get this sort of project financing with an unincorporated joint venture structure. Consequently, an LNG project looking for financing will typically have a separate corporate structure for the full LNG project or at least for the financing aspect of the LNG project.

- Operational Efficiencies: The integrated structure offers operational efficiencies because only one operator is involved in construction activities. The operational inefficiencies of having two operators can be overcome through transparency and coordination between the operators. Separate projects can lead to project-on-project risk i.e. where one project is ready before the other.

- Marketing Arrangements: The marketer of the produced LNG can be different from the producer, depending on the LNG project structure. The issue is whether there is individual marketing by an investor of its share of LNG production or whether LNG is marketed by a separate corporate entity.

- Regulations: The choice of project structure will affect the required regulations.

- Gas Transfer Price: The gas transfer price is the price of gas being sold by the upstream gas producer to the LNG plant in a merchant structure. This is often a contentious issue, since the major sponsors of the LNG project need to negotiate benefit sharing Domestic market for relationships on LNG saleswith the upstream gas producer. In many cases, each segment of the gas value chain may fall under a different fiscal regime. The overall profit of the sponsor may then be maximized by selectively determining where the economic value is to be harvested. When the gas is moved from the upstream (production) to the downstream (e. g. LNG) sector, an “arm’s length” price may be difficult to negotiate. For example, the natural gas production phase of the project may be subject to an upstream fiscal regime which in many countries includes a high tax rate (Petroleum Profit Tax or equivalent). The transportation segment, such as a gas pipeline or conversion of the natural gas to other products such as methanol, usually does not fall under the high tax regime.

Import Project Structures

LNG import projects typically follow the same major project structures utilized with LNG export projects, namely integrated, merchant and tolling. In this context, it should be noted that the LNG import terminal itself, whether land-based or floating, can be owned by the LNG import project or leased, often through a tolling mechanism.

- Integrated Structure: the integrated import structure entails the upstream and liquefaction owners extending their reach into the gas market by including a regas terminal. This allows the upstream owners who produce the gas to sell their regasified LNG as gas in a distant market. Examples include the UK‘s South Hook LNG receiving terminal, Italy’s Adriatic receiving terminal and a number of Japanese and Korean receiving terminals.

- Tolling Structure: in the tolling structure the import terminal provides services, including offloading, storage, and regasification, and charges a fee for such services. Examples include the US and Canadian import terminals, and Belgium’s Zeebrugge import terminal.

- Merchant Structure: here the owner of the import project buys LNG and sells natural gas, earning a profit on the difference between the price of the LNG and the costs of the import terminal. This structure is exemplified by the various Japanese terminals serving the Japanese utilities.

These structures are discussed in more detail in the chapter on LNG Import Projects.