Uncover the future of mobility with our in-depth analysis of satellite-based applications for maritime and terrestrial services. Explore key players like Inmarsat, ViaSat, and Intelsat, and learn about innovative solutions such as Comms-on-the-Move and HTS/Ka-Band transportable systems that are transforming connectivity in remote and dynamic environments.

This article Services, service options, and service providers change over time (new ones are added and existing ones may drop out as time goes by); as such, any service, service option, or service provider referred to in this chapter is mentioned strictly as illustrative examples of possible examples of emerging technologies, trends, or approaches. As such, the mention is intended to provide pedagogical value. No recommendations are implicitly or explicitly implied by the mention of any vendor or any product (or lack thereof).x assesses emerging maritime and terrestrial mobility applications and services that can be provided with satellite-based systems.

Maritime broadband satellite services have seen growth over the past 10 years with the market being served by lower bandwidth L-band solutions (Inmarsat, Iridium) and regular C-and Ku-band Very Small Aperture Terminal (VSAT) services. While the coverage of these services is now practically global, these systems have limitations in terms of available bandwidth per vessel, particularly in high-traffic shipping routes in the Northern Atlantic as well as in the Pacific Ocean. As connectivity requirements in the maritime industry are increasing and as vessels are implementing a larger number of higher bandwidth applications such as video conferencing, real-time monitoring, route planning, cloud-computing applications, and crew connectivity, satellite operators have responded by including high-traffic maritime routes in the coverage areas of their upcoming High Throughput Satellite (HTS) systems. A growing inventory of HTS capacity along the most highly travelled maritime routes from operators such as Inmarsat (GX), Telenor (Thor 7), Intelsat (EPIC) and O3b was becoming available at press time In particular, operators that already provide regular capacity to maritime markets (Intelsat, Telesat, Telenor) are planning to overlay new HTS beams to enhance capacity within their “regular” satellite footprints.

Table 1 depicts the most active maritime routes and Table 2 identifies some key operators and services; notice that some of these services were in the process of being rolled-out at press time as several HTS systems with oceans coverage were being launched (Inmarsat GX, O3b, Intelsat EPIC, among others).

| Table 1. Routes with Major Concentration of Shipping Traffic | |||

|---|---|---|---|

| Market ID | From | To (and Vice Versa) | Maritime Traffic |

| 1 | North America | North America | H |

| 2 | North America | South America | L |

| 3 | Pacific Ocean entry/exit to Panama | Atlantic Ocean entry/exit to Panama | H |

| 4 | Caribbean | Caribbean | H |

| 5 | North America | Europe | VH |

| 6 | South America | Europe | M |

| 7 | Europe | Africa | L |

| 8 | Europe/Mediterranean | Indian Ocean (via Suez) | H |

| 9 | East Asia | Far East Asia | M |

| 10 | Far East Asia (north–south) | Far East Asia (north–south) | H |

| 11 | Far East Asia | Australia & Islands | M |

| 12 | Far East Asia | North America | H |

| Low = low; M = medium; H = high; VH = very high | |||

The expectation is that the lower cost of HTS capacity in conjunction with more extensive geographic coverage as new HTS spacecraft is launched and will accommodate the increasing demand for (affordable) service.

| Table 2. Key Maritime Satellite Services Operators (as of press time) | ||||

|---|---|---|---|---|

| Provider | HTS Infrastructure | Band | Geography Focus | Application Focus |

| Inmarsat | Global Xpress | Ka | Worldwide | Merchant ships, cruises, offshore, oil/gas platforms/exploration |

| Intelsat | Epic | Ku, Ka | Northern hemisphere | Merchant ships, cruises, offshore, oil/gas platforms/exploration |

| O3b | 8 spacecraft constellation | Ka | Worldwide (but within 45 L north and 45 L south) | Cruise ships |

| Telenor | Thor 7 | Ka | Europe area | Merchant ships, cruises, offshore, oil/gas platforms/exploration |

| Telesat | Vantage | Ku | Caribbean and Europe area | Merchant ships, cruises, offshore, oil/gas platforms/exploration |

Traditionally the maritime industry has made significant use of machine-to-machine (M2M) services on MSS bands, as described in M2M Developments and Satellite Applications“Exploring Innovations and Applications of M2M Technology”. M2M services operate at lower speeds and support basic functions such as geo-location information, machine surveillance, surveillance of various conditions (e. g., temperature and speed), Supervisory Control and Data Acquisition (SCADA), and ship identification services used for Automatic Identification System (AIS) or Long-Range Identification and tracking (LRIT). LRIT was established as an international system in May 2006 by the International Maritime Organization (IMO). AIS is a collision-avoidance navigational aid system also mandated by the IMO that originally operated in the VHF radio band (see Exploring the Future of Satellites“Trends, Technologies and Applications of Modern Satellites”); while it was originally designed for short-range operation, it is now possible to receive such data by satellite in many (but not all) parts of the world.

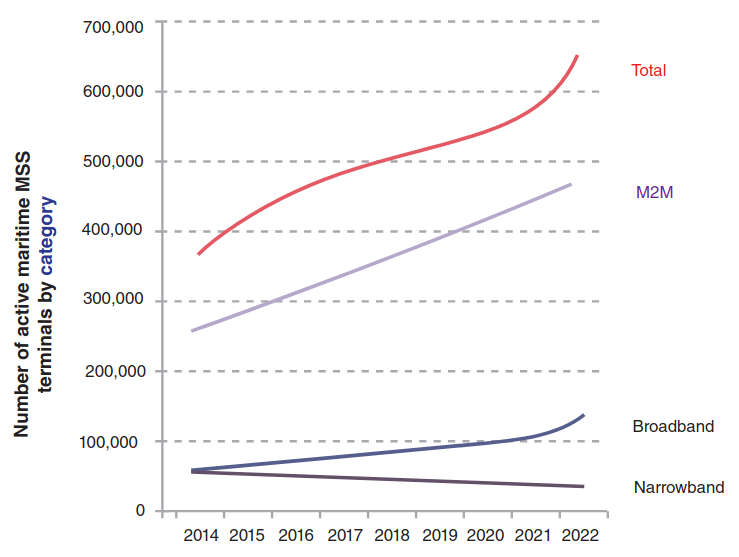

Around 375 000 satellite communication terminals were in operation in the maritime market in 2014. The market is comprised of narrowband (less than 128 kbps) terminals, M2M terminals, and broadband terminals. At press time:

- About 71 % of the maritime terminals were used for M2M and for safety communications (e. g., Inmarsat-C);

- 13 % were narrowband terminals (e. g., Inmarsat-B, FleetPhone, Thuraya Seagull), and;

- 16 % were broadband terminals (e. g., FleetBroadband, Iridium OpenPort, Iridium Pilot).

With a projected (combined) CAGR of around 7 % over the next few years, the number of maritime terminals is estimated to reach 650 000 by 2022-MSS terminals are still expected to account for the large majority (95 %) of terminal deployment over the next few years, and the population should grow from around 375 000 terminals in 2014 to around 619 000 terminals by 2022 (with VSATs growing from 12 500 to 31 000). Over the same period the CAGR of broadband VSAT terminals is expected to be 13 %, for M2M terminals 8 %, and for narrowband terminals -7 %. The VSAT deployment (which is a subset of the broadband pool) will grow at a more significant rate, especially with the deployment of Ka HTS: the VSAT terminals should grow from around 9 000 terminals in 2011 to around 30 100 terminals in 2022, with a CAGR over the 10-year period of 12 %.

Figure 1 shows terminal and revenue projections synthetized from industry sources.

Table 3 also depicts other forecast data.

| Table 3. Maritime Terminal and Revenue Forecasts | |||||

|---|---|---|---|---|---|

| 2014 | Details | 2022 | Details | Notes | |

| MSS terminals Non-VSAT | 362 500 | See Note 1 | 619 000 | See Note 2 | Note 1: 260 000 M2M terminals 52 500 broadband 50 000 narrowband |

| Note 2: 480 000 M2M terminals 130 000 broadband 40 000 narrowband | |||||

| VSAT terminals | 12 500 | 31 000 | |||

| Ka | 500 | 13 000 | |||

| Ku | 9 000 | 15 000 | |||

| C | 3 000 | 3 000 | |||

| Total | 375 000 | 650 000 | |||

| (a) VSAT revenue | $320M | $700M | |||

| Ka | $10M | $100M | |||

| Ku | $260M | $525M | |||

| C | $50M | $75M | |||

| (b) MSS Revenue | $430M | $500M | |||

| (c) Wholesale bandwidth revenue | $450M | See Note 3 | $525M | See Note 4 | Note 3: $200M broadband $70M M2M $180M narrowband |

| Note 4: $360M broadband $95M M2M $70M narrowband | |||||

| Total (a) + (b) | $750M | See Note 5 | $1 200M | See Note 6 | Note 5: 65 % merchant ships Each 7 % for government, O&G, leisure boats, passenger ships, fishing ships |

| Note 6: 50 % merchant ships Each 10 % for government, O&G, leisure boats, passenger ships, fishing ships | |||||

| Total (a) + (b) + (c) | $1 200M | $1 750M | |||

It should be noted that most of the deep sea-ships have multiple communication solutions for different shipboard functions. We saw in earlier chapters that Ka terminal are less expensive (as an initial first cost) compared with traditional VSAT equipment, typically costing between $30 000 and $70 000 per vessel. Traditionally service providers have had to purchase the terminal equipment and then lease it to end-users because of the high cost. The reduced Ka costs, due to the smaller size of the equipment, may fuel more wide-scale uptake of connectivity to vessels of all sizes in the next 5 years, to the end of the decade. According to market research forecasts for Euroconsult, the number of Ka HTS maritime VSAT terminals is expected to grow from a nascent market today, to about 13 000 terminals by 2022 (up from about 1 000 in 2015). Net additions of HTS terminals are expected to ramp up in 2016, averaging nearly 1 750 units/year until 2022, this being about 2,5 times the net VSAT terminal additions for regular C-band and Ku-band combined. Total maritime service revenues are projected to be around $1,7 billion in 2022.

The Atlantic Ocean represents about 50 % of the total maritime market (in terms of terminals and traffic), owning to the concentration of shipping routes in the North Atlantic, the cruise ship business in the Caribbean, and Oil & Gas (O&G) installations in the Gulf of Mexico. The second largest region is the Pacific Ocean owning to the import business from China. Maritime VSAT service providers (including but not limited to MTN, KVH, Astrium Services/Airbus Group, and Harris Caprock) are expected to integrate HTS capacity into their current service plans, allowing them to offer higher throughput at current price levels or offer the current bandwidth packages at a reduced cost per bit in the future. Inmarsat, with an existing maritime business in L-band now reportedly plans to be offering worldwide coverage through a tessellation of high-power Ka-band spot beams, addressing global shipping companies with dispersed fleets and routes.

DVB-S2 Modulation Extensions and Other Advances

Traditional providers may encourage their client bases to switch from legacy Ku-band satellites to their HTS Ka-band systems by offering appealing deals on the new services. O3b also has a maritime non-GSO offering that focuses on the high-end of the market (large cruise ships, e. g., Royal Caribbean and off-shore O&G), which has large bandwidth requirements and an economic incentive to deploy the relatively large on-board equipment; the system architecture of the O3b constellation and ground terminal cost, however, makes it less suitable for smaller vessels.

Key Players

The M2M focus of the maritime market is discussed in greater details in M2M Developments and Satellite Applications“Exploring Innovations and Applications of M2M Technology”. Here we provide a more general overview.

Inmarsat

Inmarsat offers high-availability VSAT services through a combination of both GX (Ka-band) and FleetBroadband. Inmarsat has served the market for over 30 years. Their network is global, thus facilitating the delivery of higher performance consistently – with a downlink up to 50 Mbps and an uplink to 5 Mbps. The all-IP network enables point-and-click capability with a consistent user experience worldwide: Inmarsat: A Guide to Satellite CommunicationInmarsat GX will enable seamless, real-time operations between vessels and land offices, in addition to enhanced communications and entertainment for the crew.

Inmarsat GX is much simpler and quicker to install than existing Ku-band systems, minimizing downtime in the dock for vessels. There is the option to use a 60-cm terminal that does not require a crane for installation. GX terminals will be lower cost than those currently available for Ku-band, and services will be available for a fixed monthly fee.

ViaSat/KVH

ViaSat, in partnership with KVH Industries, provides reliable, high-speed Internet access to seagoing vessels over the vast majority of the busiest maritime corridors. Applications include cruise, commercial business, and offshore O&G exploration. Operating on the ViaSat Yonder® network, the mini-VSAT Broadband service offers cable modem-like speeds so customers can connect to a virtual private network, send and receive email with attachments, make VoIP phone calls, browse the Internet, and transfer files, just as they would from a land-based business office.

The following KVH mini-VSAT Broadband service options are available:

- TracPhone V7 – The first FCC-approved 24-inch VSAT antenna. With over 1 000 V7 systems shipped in the last three years, it is the fastest growing maritime VSAT broadband system.

- TracPhone V3 – The world’s smallest and most affordable maritime VSAT System. The 14-inch antenna weighs just 25 pounds and is perfect for use on tuna towers.

- TracPhone V11-IP: Dual-mode C-/Ku-band antenna for global VSAT connectivity and a complete IT&C solution from a 1,1 meter (42,5-inch) antenna.

- TracPhone V7-IP: Enterprise-grade solution for broadband connectivity and onboard network management, from a 60 cm (24-inch) antenna with Ku-band service.

- TracPhone V3-IP: The world’s smallest maritime VSAT, with fast data speeds and low airtime costs, from a 37 cm (14,5-inch) antenna with Ku-band service.

- IP-MobileCast: A fast, affordable content delivery service that utilizes multicasting technology to deliver entertainment and operations content to vessels at sea over the mini-VSAT Broadband network.

Intelsat

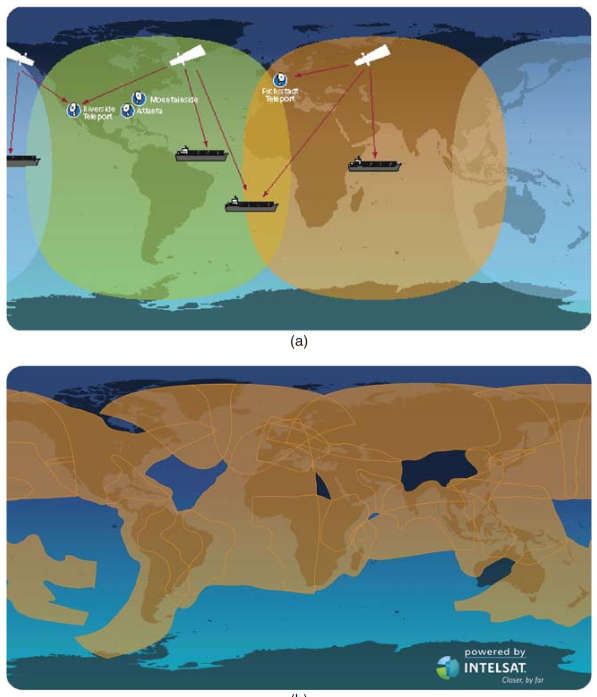

Intelsat offers the Global Mobility Network to provide broadband solutions for maintaining communications for vessels, crews and passengers across the commercial shipping, oil and gas, and cruise and yacht industries. Utilizing a hybrid satellite and fiber infrastructure, the firm is able to provide constant, high-speed IP access for converged voice, data, and Internet applications – all on one convenient global platform.

Intelsat’s support of a range of shipboard antenna sizes and modem solutions provides true flexibility in designing a mobility solution. Proven global C-band coverage, combined with global Ku-band mobility beams over the world’s major shipping routes, ensures that maritime operators stay connected anywhere they are.

Figure 2 depicts the global coverage of Intelsat’s mobility services.

(a) C-band. (b) Ku-band

O3b

O3b, as a non-GSO operator, is targeting the maritime market (among other markets). O3b satellite beams will follow ship tracks on ship’s normal route (the cruise operator provides O3b with normal ship course). The service will provide 350 Mbps Committed Information Rate (CIR) to each ship. The service entails beam tracking updates in real-time if the ship has to change course. O3b will maintain ship within beam center, but the ship needs to provide latitude/longitude updates on 2-h intervals via in-band or out-of-band channel (see Figure 3).

O3b states that the following advantages accrue from the use of their service:

- Improve customer satisfaction;

- Attract new and more affluent passengers who need better connectivity;

- Add new services to the passenger experience;

- Enable additional revenue streams from bandwidth services by selling daily and weekly Internet access packages to passengers;

- Better leverage social networking as an advertising channel;

- Attract and retain quality staff through improved crew welfare.

O3b also targets the scientific and military maritime segments. For example, O3b offers the ability to provision between 300–500 Mbps to a vessel or group of vessels as they maneuver. The options to either track vessels or to move beams based upon predetermined courses or route are available.

Key to the service is the terminal technology. O3b has partnered to offer a maritime terminal with the following features:

- OrBand™300 is the evolution of Orbit’s OrBand portfolio into Ka-band;

- Compact maritime VSAT system that offers industry-standard RF performance equivalent to a 2,4 m/95′′ dish in just a 2,7 m/106′′ footprint;

- Takes up 40 % less deck space than industry-standard 2,4 m/95′′ and 3,8 m/150′′ systems, and is more than 30 % lighter than competitive solutions;

- Enables the most demanding maritime vessels and platforms to enjoy fiber-like broadband communication for high-speed internet services;

- Small enough to be shipped as a single, fully assembled and tested unit in a standard 20-foot container, the OrBand300 is designed for quick and simple single-day installation;

- OrBand300 can be installed while ships are on routine port calls, substantially driving down operational costs and eliminating the need for vessels to await dry dock.

Comms-on-the-Move Applications

Military and government missions typically require to be able to sustain communications while on the move, such communication is known as Comms-On-The-Move. These capabilities enable vehicles and other assets to achieve high-throughput, reliable, and secure communications. While somewhat-mundane communications can be achieved by the military (staff, vehicles) with 4G cellular services (where such services are available), even with VPN-based access to government networks, there are situations where satellite communication is required either because of a particular military-based application that entails satellite-oriented connectivity, or because 3G/4G cellular connectivity is not available (say in rural areas, battleground theaters, and so on). Applications also include nonterrestrial situations, for example, airborne missions for Intelligence, Surveillance, and Reconnaissance (ISR), Command & Control, and en-route connectivity for the delivery of data-rich content to warfighters in the theater and commanders around the world.

Advanced antenna design techniques have resulted in highly transportable antenna systems, including backpack terminals employed in DOD and military applications and highly mobile antennas used in Comms-On-The-Move applications. Phased array antennas have come into some use; for example, a new meta-materials flat panel Ka-band antenna has been tested and is nearing introduction into the marketplace by Kymeta, as mentioned in High Throughput Satellites (HTS) and KA/KU Spot Beam Technologies“Applications and Design Considerations of HTS Satellites”.

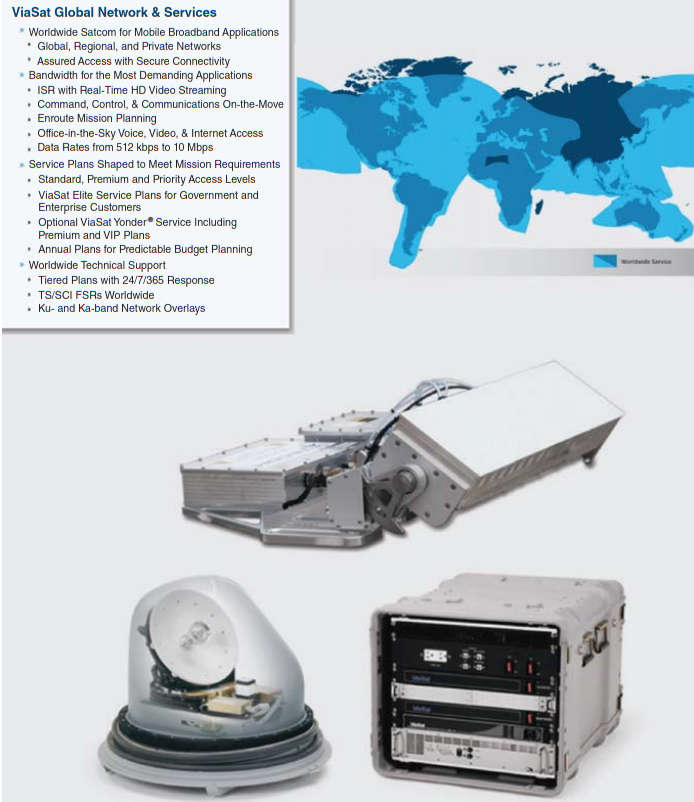

One illustrative example This material is based on company information.x of an approach to Comms-On-The-Move is ViaSat’s systems. ViaSat’s airborne satellite communications services offer worldwide access and offer a range of service levels providing connectivity and performance options tailored to meet a variety of needs. Network performance is optimized for reliable, secure two-way mobile broadband, so that airborne operators have the capability to send full-motion video, make secure phone calls, conduct video conferences, access classified networks, and perform mission-critical communications while in flight. For airborne ISR missions, ViaSat private managed networks deliver critical intelligence such as High Definition (HD) full-motion video into theater, while military and political leaders stationed beyond the horizon can monitor a mission’s progression throughout execution. ViaSat’s private managed airborne networks are proven to support multiple simultaneous aircraft in-flight (termed simultaneous operations – SIMOPS). Dozens of compatible airborne satcom terminals, hubs and ground infrastructure – some located in DISA teleports – can access US Department of Defense and coalition data entry points around the world. Figure 4 depicts an example of the technology.

HTS/Ka-Band Transportable Systems

Transportable systems have been available for years for military, news gathering, and sporting events. The “new angle” is to use an IP service over a Ka HTS satellite to stream content via an Internet-based VPN to the intranet of the content aggregator (e. g., a TV station). At Ka frequencies, antenna pointing to a specific supporting spacecraft can be somewhat difficult; hence, more sophisticated systems enable quick setup using built-in antenna pointing aid for rapid satellite acquisition.

According to some market research firms, the use of HTS Ka-band capacity for Satellite News Gathering (SNG) traffic represents a growth opportunity for operators; the assertion is that the multiplication of HTS systems in coming years will unlock growth opportunities in the SNG market, as HTS capacity becomes increasingly available, and coverage footprints are expanded globally. Usage of Ka-band will be driven by the cost of satellite distribution; such cost is expected to be up to 50 % cheaper than Ku/C capacity. Ka-band is still new in the SNG market and offers opportunities to develop services: the share of HTS Ka-band in total SNG revenues is expected to grow from less than 0,5 % in 2013 to a forecasted 18 % in 2023. Avanti, Eutelsat, and ViaSat were the first operators to launch HTS Ka-band SNG services.

Advantages of Ka-band for SNG services include:

- The lower chance of adjacent satellite interference and;

- The smaller risk of uplink mispointing to other spacecraft considering the plethora of existing Ku/C spacecraft now on station.

One illustrative example of Ka-band HTS-based transportable systems, especially for SNG applications is Exede® Enterprise service from ViaSat; the satellite-based service delivers live HD video from the field – no matter where the story happens. Exede helps news organizations get the story whether it is in a metropolitan area or in a natural disaster situation with no electricity, cell connection, or even vehicle access.

With the “internet-on-the-go” organizations can get affordable HD video benefits by the following:

- Augmenting your existing Electronics News Gathering (ENG) and SNG vehicles.

- Replacing them with more affordable Exede SNG vans, trucks, and crew cars.

- Using our portable terminal – it fits in an airline-checkable suitcase.

The ViaSat SurfBeam 2 Pro Portable Terminal is designed for users requiring high throughput connectivity in a compact and portable package. Field reporters, remote medical and peace workers, and emergency responders benefit from high-speed Internet with the convenience of “near-instant” connectivity even in locations where no other communications infrastructure is available. The form factor is ruggedized to support operation in harsh conditions and supports multiple configuration options to suit user needs. The complete system, including the satellite terminal and antenna, can be packed into a single case for transit and is lightweight enough to be carried by a single user. The unit enables fast web browsing and supports video streaming, file transfers, VPN connections, and bandwidth-intensive Internet applications.

It is capable of delivering downstream rates up to 40 Mbps and upstream rates up to 20 Mbps, and provisioning tools enable the network operator to create different classes of service with configurable downstream and upstream rates. The modem has an embedded acceleration client that works with acceleration servers in the gateway to provide a faster, more responsive user experience. With four standard Ethernet connections, the terminal natively supports up to four IP devices, such as PCs, cameras, and routers as well as other user equipment. The antenna includes a collapsible satellite reflector and feeds, transmits, and receives electronics. The modem can be deployed attached to or located separately from the antenna. The compact SurfBeam 2 Pro Portable Terminal is designed for a quick and reliable user installation in less than 10 min by personnel with minimal satellite training (see Figure 5).