This material presents a series of discussions and criticism of important aspects of liquefied natural gas (LNG) system, which are essentially components of existing and proposed projects described in article «Description of LNG technology and import systemLNG technologies».

The aspects addressed were identified by OTA after consideration of public concerns and analysis of both near-term and longer term effects of deploying this technology in many locations around the country. Considering the present status and trends of developing projects and LNG technology, the nine subjects covered here were judged to be deserving of attention at the Federal Government level based on either public concerns, the possibility of significant problems developing, or both.

- LNG tanker design and construction

- LNG tanker regulations and operations

- Tanker traffic

- Tanker inspections

- Crew training

- Regulation of terminal operations

- Standards for terminals

- Inspection of LNG facilities

- Decisionmaking process in certification of LNG projects

- Lack of clear policy and jurisdiction

- Time required for approval

- Financial diffiulties

- Information and opportunities for participation

- Safety research on LNG facilities

- Scenarios

- Vapor cloud research

- Estimating the risk to the public

- Value of further research

- LNG facility siting

- Who should establish siting criteria?

- What criteria should be considered?

- What is remote?

- Liability for LNG accidents

- Maritime law

- State versus Federal jurisdiction

- Land-based liability

- Staff working paper № 1

- Reliability of LNG supply

- Reliability of suppliers

- Impacts of an interruption in supply

- LNG pricing policy

Since some LNG projects are already operating or approved and a significant amount of technology is already in place or developed, Federal attention seems to be desirable in two separate time frames:

- attention to near-term problem areas of technology, regulation, decisionmaking, or research which could affect many projects already operating or nearly so and;

- attention to longer term policies which may be more important as the technology develops and becomes more dominant on the national scene.

Each subject in this chapter is presented as a critical review of the present system with key problems highlighted. Some analyses of future trends and effects are also included.

The first five papers are principally subjects for near-term attention and could be used as basis for congressional review of regulatory agencies or general investigation of the safety issue in the context of existing projects and facilities. These papers are:

- Tanker Design and Construction.

- Tanker Regulations and Operations.

- Regulation of Terminal Operations.

- Decisionmaking Process in Certification of Import Projects.

- Safety Research on LNG.

The remaining four papers are principally subjects which may require longer term attention following determination of policy in the national interest. There may be need for specific legislation to influence projects if major policy changes are determined. Some of the subjects require further study or investigation and these are noted in the discussions. The subjects are:

6 LNG Facility Siting.

7 Liability for LNG Accidents.

8 Reliability of Supply.

9 Pricing Policy.

LNG tanker design and construction

The Coast Guard specifies and enforces design standards for US flag ships and for foreign flag ships calling at US ports. Standards for foreign ships were worked out in cooperation with the Intergovernmental Maritime Consultative Organization (IMCO), and a draft code is under consideration. In addition, the Coast Guard published proposed standards for self-propelled vessels carrying bulk liquefied gases on October 1, 1976. The proposed standards for US flag ships differ only slightly from the IMCO code and the effective date for both sets of standards is the same. The new standard is intended to replace both the Letter of Compliance program for foreign vessels and existing 46 CFR, rules described in the article «Description of LNG technology and import system» regulations for domestic vessels.

As of September 1976, the existing fleet and scheduled deliveries of LNG ships totaled 79 vessels. All of these vessels and any additional ones contracted for prior to October 31, 1976, or delivered or converted prior to June 30, 1980, will not be subject to the new design and construction standards. These vessels will comprise a significant portion of the fleet until the end of the century that will not be subject to the new regulations, although some of these vessels may still meet the new standards.

However, LNG ship technology has developed over the past 20 years and is currently in use in worldwide trade with only minor technical problems. Modern LNG ships have been in use for the past 5 years in Boston and 8 years in Alaska. No serious accidents have occurred and it appears that existing US Coast Guard standards of design and construction are probably adequate to assure equally low risks of ship failures in the future.

There is, however, concern about the risks of a major collision that would penetrate an LNG cargo tank. These concerns are not related to design and construction of the LNG tankers, but rather to the possibility that increased numbers of tankers and other ships will be operating in more and more congested harbors and coastal areas. This is an operational and regulatory problem which is discussed in the next section.

The two oldest LNG ships in operation appear to be typical of the quality of design and construction. The ships, the Methane Princess and the Methane Progress, are 27 000 cubic meters each, which are about the size of a single tank on 1977 LNG carriers, and have been transporting LNG from Algeria to England since 1964. No major accidents have occurred on these ships with over one million voyage miles each. A study done in 1973 presented an analysis of technical problems of these ships and the 71 000 cubic meter ships, Arctic Tokyo and Polar Alaska, which have been in service from Alaska to Japan since 1969.

The Methane ships Gas Freeing of Cargo Tanks on Liquefied Natural Gas Carrierscargo tanks were an early freestanding prismatic tank design of aluminum construction. The Alaska ships had a later version of a membrane tank design with stainless steel interior lining. The Methane ships experienced minor problems with the insulation system, as the cargo tanks caused cold spots on the inner hull and some cracking in the mild steel hull. The problems were either repaired while in service or postponed until the next shipyard period. The average number of days out-of-service for repairs has been 25 per year for each of the Methane ships. This is only slightly higher than the 20 days per year usually planned for regular repairs to large, complex ships.

The Alaska ships experienced much higher out-of-service rates (about 50 days per year) and several more operational problems in their first 4 years of service. Some factors that may have influenced this include:

- the ships were much larger than previous designs;

- the voyage from Alaska to Japan is much longer than previous LNG routes;

- the extreme temperatures and weather in Alaska.

The problems experienced by the Alaska ships include damage to membrane and insulation due to tank-sloshing loads, damage to membrane due to a cable tray failure, overpressurizing of barrier spaces around tanks, and various machinery failures. Some redesign and overhaul was necessary to correct the containment problems but none caused any serious personnel safety hazard.

In fact, there have been no serious accidents or serious safety problems involving any of the 32 ships now in the worldwide LNG fleet.

However, the new LNG tankers now entering the trade are larger and do employ some new systems. Although they have been carefully designed and constructed some concern is merited due to the increase in scale and new containment systems employed.

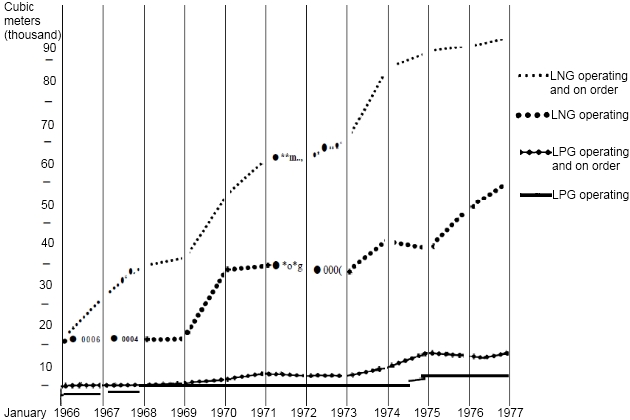

Most of the LNG ships now under construction, built, or designed for the major US import projects are of the 125 000 to 130 000 cubic meter size. Forty-seven of this size and none of any other size were under construction as of March 1977 (figure 1).

Plans have been made for 165 000 cubic meter ships for the proposed North Slope Alaska to California project by El Paso but this project is not approved and no ship contract has been let. Some consideration has also been given to LNG ships as large as 300 000 cubic meters to serve offshore terminals, but no firm plans have been made. The major concern about the development of much larger ships is that an accident will have more serious consequences. Before designs are firm it would be prudent to consider the need for limits on either tank sizes or total ship sizes. Some correlation between siting of facilities, ship or tank size, and research into LNG spill behavior may also be useful.

An interesting example of difficulties which may occur in getting a major new technical system in operation is provided by a recent accounts of the 125 000 cubic meter LNG tanker Hilli. Unloading of the tanker was halted in a Japanese harbor when a metal bolt was found in the cargo lines. The ship has been taken out of service and, along with two sister ships scheduled to enter service soon, is undergoing intensive inspections until the source of the bolt is found. It is estimated that the activity may take 2 months and could cost millions of dollars.

However, such problems with new ships, carefully built, operated, and monitored in early stages of projects, appear to have a negligible effect on public safety. However, as the present fleet grows older, risks of failures could increase. Future concerns for projects now in the design and construction stages include:

- How well each ship will be maintained and kept in adequate condition.

- How well various new containment systems will perform over time.

- How well inspection and monitoring of ship and machinery condition and operation will be performed.

- How well foreign flag operation will continue to adhere to US standards and whether countries such as Liberia will perform adequate surveys and inspections.

- How well shipyard repairs and surveys can be performed on these complex vessels with tight operating schedules.

During the public participation program which OTA conducted as a part of this assessment, it was learned that there appeared to be little concern about the design and construction of LNG tankers, but considerable concern about the operation.

Those participants who did discuss construction of LNG tankers spoke favorably about the jobs created in US shipyards by contracts for LNG tankers.

In this study, OTA looked only at LNG tankers. However, the study indicated that it is logical that liquefied bulk gas carriers should be treated together for purposes of future controls on design, construction, and maintenance. Liquefied petroleum gas (LPG) carriers and other gas tankers have been in service for longer periods and in much more varied shipping circumstances than LNG carriers. Some of these other gas carriers have had more serious accidents. In addition, many more US ports are regularly receiving or shipping LPG and other gas cargoes.

The Coast Guard and international agencies have considered all liquefied gas carriers together in the past, and the Coast Guard’s mandate for setting design and construction standards for LNG and LPG tankers stems from the same legislation. Recently, however, public concern about LNG has forced the Coast Guard to give disproportionate attention to LNG tankers. In all design, construction, and maintenance controls, LNG and all other hazardous cargo tankers should be considered together.

LNG tanker regulations and operations

Regardless of the design safeguards required for LNG tankers, the possibility and consequences of a major spill on water due to a ship accident are the most serious concerns. The gas industry, Government officials, and those who joined in OTA’s public participation program during this assessment all agree on that fact.

As marine traffic in such hazardous cargoes as LNG and LPG increases in the future, much more attention will be needed in the whole area of vessel traffic monitoring and control, especially since the movements of other marine traffic in the vicinity of liquefied gas tankers may not be as predictable as the movement of the LNG ships.

Tanker traffic

The Coast Guard has authority to grant the Captain of the Port the power to control any vessel within the territorial sea and to prescribe conditions and restrictions for the operation of waterfront facilities.

The only US ports where LNG tankers are currently operating are Boston, Mass., and Kenai, Alaska. The Captain of the Port in Boston has prepared an operations/emergency plan specifically for LNG. The Captain of the Port in Kenai has not. He relies instead on a voluntary operations plan drawn up by the four industrial users of the port.

The Boston plan requires that all LNG vessels bound for the Everett, Mass., terminal meet a Coast Guard cutter 4 miles out for an inspection of cargo systems prior to entering port. The officer-in-charge will then make a determination of whether the ship should be allowed to enter the harbor. From that point on, if permission to enter port is given, the Coast Guard cutter will escort the tanker to the terminal, remain berthed nearby during the unloading operation, and finally escort the tanker back out to the open sea. During the transit to and from the terminal, the Coast Guard broadcasts warnings to keep the harbor clear of all other traffic. Simultaneous unloading of LPG tankers in an adjacent berth is prohibited.

Due to the unique traffic problems with each LNG terminal site, local planning will always be required. However, the present method of operation – especially closing down long sections of Boston waterways during an LNG tanker transit-may be very costly and unworkable as increased numbers of LNG tankers enter service. Effective long-range planning to handle traffic problems is required now.

With tanker deliveries once every 20 to 30 days into the relatively uncrowded Boston Harbor, the inconveniences and costs to other shipping activity are modest. However, when deliveries are made more regularly or into very busy harbors, pressures will exist for the Coast Guard to be less rigorous in their controls.

For example, LNG tanker deliveries to the new terminal at Cove Point, Md., are expected every 2 to 3 days. At the same time, more than 4 000 major ships per year pass Cove Point on their way to and from the Port of Baltimore, one of the 10 largest ports in the United States. By comparison:

- Boston Harbor handles only 1 500 ships per year;

- the Delaware River, 5 000;

- New York Harbor, 10 000.

In addition, LNG ships bound for Cove Point will have to mix with other ship traffic in the Chesapeake Bay at Hampton Roads.

Probably the greatest single safety measure that could be taken to develop and to maintain safe LNG shipping and safer shipping in general would be the adoption of positive traffic control over vessels within harbors, rather than simply allowing ships to follow rules of the road.

Historically, oil tanker casualty data have indicated a need for improved marine traffic safety in US ports and waterways.

The Ports and Waterways Safety Act of 1972 authorizes the Coast Guard to establish, operate, and maintain vessel traffic services (VTS) in congested waterways, require installation of electronics for implementation of traffic safety systems, and control vessel traffic where conditions require it through routing schemes and speed limits. While this is not a positive control system in the same sense that air traffic controllers exercise authroity over flight, it does give the Coast Guard the statutory authority to deal with hazardous cargo traffic in a concrete way.

The Coast Guard completed a detailed analysis of ports and waterways traffic in 1973. VTS systems for San Francisco, Puget Sound, and the Houston Ship Channel are now operational, and systems for New Orleans and Valdez are expected to be operational late in 1977. A system is being developed for New York Harbor and its approaches.

Priorities for ports to be outfitted with VTS have been set by the Coast Guard based on historic information reflecting the level of traffic, the opportunity for accident, and the costs and benefits of installing the system. It now appears that the Coast Guard should also study harbors and waterways and possibly consider new VTS locations based on at least three additional factors related to the cargoes:

- the percentage of ship traffic in hazardous cargoes in relationship to all traffic in the port;

- the potential for increased traffic in hazardous cargoes;

- the impacts of various types of ship accidents which might occur in each harbor.

Admittedly, VTS are complex and costly systems. However, the complexity and cost of current practices – such as halting traffic around LNG tankers and providing individual Coast Guard cutter escorts for each LNG tanker – will become more unmanageable and less feasible as traffic increases.

Safety of all vessels around and including, hazardous cargo ships depends on implementation of some level of VTS system by the Coast Guard to reduce the probability of ship collisions.

In testimony before a Coast Guard hearing considering the need for VTS in the Chesapeake Bay, a representative of the firm which will operate the LNG tankers into Cove Point noted that working VHF radios and radar are not now required on ships entering the Bay. He indicated faith in the LNG tankers, which are so equipped, but added, «We are concerned, however, about the basis for entry and transit (of other vessels) and who will pass our berthed vessels at Cove Point».

Citizens who joined in OTA’s public participation program expressed considerable concern about the operation of LNG tankers in crowded harbors and the problems of tying up other ship traffic. One participant suggested that in order to minimize the possibility of collision and to provide a large area of empty water in which an LNG spill might dissipate, LNG tankers be restricted to routes away from normal shipping lanes and terminals be restricted to isolated coastal points away from other shipping ventures.

Tanker inspections

The Coast Guard assures the compliance of foreign LNG tankers to established standards by boarding the ships for an inspection when they enter US ports.

Inspections are required at least every 2 years and may be carried out, as they are in Boston, on each arrival in a US port.

These inspections are limited to cargo-handling systems, deck machinery and compartments, and fire and gas detectors for the cargo system. The general condition of the ship and the capability of the crew are not included in these inspections. Thus the inspection does not reduce the risk of failure of propulsion, navigation, and steering systems, or even verify the crew’s training and experience.

One very specific criticism of the Coast Guard’s inspection procedures is that it relies totally on shipboard instrumentation during the inspection. While most systems can be checked by actuation of controls and by builtin self-test features, there is one very obvious oversight. The ability of the ship’s gas detection system will be limited to sensor location in hazardous areas only.

The major questions to be raised about the inspection procedures are:

- Is the Coast Guard determining and using the best means of detecting gas in void spaces?

- Is the Coast Guard developing inspection procedures which will allow them to adequately inspect the growing fleet of vessels which will soon include ships of several different designs, with different foreign flags and crews of different nationalities?

- Are the Coast Guard inspectors available in sufficient numbers with adequate training in hazardous materials?

To date, Coast Guard inspectors have had little specific training in LNG or other liquefied gases. However, a 3-week course in hazardous materials, including LNG, is being developed and is scheduled to begin this fall. The course is designed to train more than 100 Coast Guard personnel each year in inspection techniques for hazardous material carriers. However, the course is a voluntary one, and it is not clear that all personnel involved in regulation and inspection of LNG carriers will actually receive training.

A detailed course outline had not been completed when this report was written, but it appeared from preliminary materials that appropriate subjects would be offered.

Crew training

The Coast Guard has already proposed regulations setting out minimum standards for persons employed on US flag LNG tankers. But there appears to be disagreement over whether the Coast Guard has a mandate to propose similar standards for personnel on foreign flag ships entering US harbors. To date, the Coast Guard has preferred to work internationally to develop those standards and is participating in Intergovernmental Maritime Consultative Organization (IMCO) sessions on the subject. It is open to question whether this approach ensures an adequate level of training and competence among foreign crews.

This situation could be changed significantly by S. B. 682, the Tanker Safety Act of 1977. If passed, the act would mandate crew standards on all tankers entering US ports, regardless of flag.

Several training programs, funded by shipping companies and unions, are in existence, but training at these schools is not required currently by any Federal agency.

One particular area of concern is training in the use of fire protection equipment. Experience has shown that serious accidents which involve tankers with flammable cargo almost always result in a fire. As the Ad-Hoc Maritime Committee of the AFL-CIO states, hands-on type fire prevention, detection, extinguishment, and containment training presently available to professional seamen, is lacking in magnitude, depth and scope. Repetitive retraining, at various Maritime Administration sponsored field schools, … is, at best, presently capable of exposing personnel only to historically employed evolutions that require no prethinking, equipment selection or command decision capability. In fact, fire or explosion currently accounts for 90 percent of the deaths and injuries in all tanker collisions. The tanker casualty rate did not show a decrease between the years 1970 and 1975. The actual number of collisions increased with the increase in traffic. Analysis of 825 fires aboard US Navy ships shows a similar trend.

Thus, minimum requirements for crew training in the use of fire prevention and protection equipment should be a cornerstone of the Coast Guard safety efforts.

Regulation of terminal operations

Standards for terminals

The existing industry standard for production, storage, and handling of LNG in landbased terminals is the National Fire Protection Association (NFPA) 59 A. These standards have been adopted by many State agencies as well as by OPSO, making them part of the Federal regulations for LNG terminals.

To date, many portions of baseload LNG import terminals appear to have been designed to much more stringent requirements than the minimum specifications set forth in 59 A. Still, a strong case can be made for more stringent requirements in many areas, particularly those relating to public safety. Industry is opposed to promulgation of tougher standards unless the need is clearly demonstrated. This opposition is at least partly because of the fear that such standards would be retroactively applied to existing peak shaving and import facilities which would be difficult and costly to modify. On the other hand, some members of the public interest groups which cooperated in OTA’s public participation program are calling for retroactive application of new standards with a gradual phasing out of any facilities which do not meet these standards.

The prospect for retroactive application of new requirements does now exist with the proposed standards recently published by OPSO.

There are several areas in which the proposed standards are considerably more comprehensive than the NFPA 59 A standard. These include definition of a thermal exclusion zone, vapor dispersion zone, and seismic design criteria. In may other respects, however, the proposed standards are less definitive than the existing specification. These areas include specifications for concrete materials, equipment spacing within the facility:

- valves,

- piping,

- electrical equipment.

Industry representatives have criticized the regulations as being overly stringent in defining thermal and vapor dispersion exclusion zones, specifying inappropriate estimating techniques for determining these exclusion zones.

There is also concern that the proposed regulations do not allow for the development and use of several alternative means of controlling vapor cloud generation in the event of a spill. The proposed regulations stipulate the use of a buffer zone (which could be as large as 3 to 7 miles depending on the size of the diked area around storage tanks) or provisions for automatic ignition of a vapor cloud.

The use of automatic ignition during an LNG release may have an effect opposite of that desired in a fire protection system; it could result in cascading equipment failures and much greater damage than would be the case with other methods of control.

Ideally, the regulations should provide for developing technology which both protects the plant and enhances public safety. Some typical alternatives which have been proposed and large-scale tested are the use of high-expansion foam systems for direct control of impounded LNG spill fires, the use of high-expansion foam systems for reductions in the downwind travel of vapors from LNG on land, the use of fixed dry chemical systems for impounded spill fire extinguishment, and the use of certain types of fireproofing coatings for cryogenic and thermal protection of structural steels.

In general, LNG spill and fire research has resulted in the improvement of and application for commercial fire protection and damage control systems in LNG facilities. While it is generally conceded that these type facilities have excellent safety records and accident-free histories, they can still be improved. It was also generally agreed during the December 1976 ERDA LNG Workshop, that adequate fire protection equipment performance and design requirements have been experimentally established for definition of the hazard-control systems for typical operating and impounded LNG spill conditions. However, one expert estimates that only 30 percent of the existing peak shaving facilities have adequately designed and installed fire protection systems capable of controlling a major LNG spill condition. Thus, attention to these issues and recognition of the hazard reduction capabilities of experimentally proven fire protection and safety systems both in the development of regulations and in allocations for research and development programs would be well justified.

Concern about firefighting ability extends beyond that of the LNG facility. There has been considerable public discussion of whether local fire departments near an LNG facility have the expertise and financial resources to prepare themselves for dealing with a possible LNG emergency.

Those who contributed to the public participation program had few suggestions for specific changes in terminal regulations. They did, however, desire that regulations be clearly defined and strictly enforced. Many suggested that regulations include requirements for training of personnel employed at the terminals and the preparation of evacuation plans for the areas near an LNG facility in the event of a major accident.

Inspection of LNG facilities

Once standards for construction and operation of LNG facilities are clarified, there will still remain the necessity to inspect facilities for compliance with regulations.

It appears that there are gaps in current inspection procedures which could cause problems in the future.

The Office of Pipeline Safety Operations (OPSO) has the responsibility for inspection of all pipelines and other facilities used in transportation or sale of natural gas in interstate commerce. However, the small size of the OPSO staff limits its ability to inspect facilities. In fact, OPSO has been described by industry managers as «almost invisible in the field». A The small staff also impairs OPSO’s ability to participate in FPC hearings although compliance with OPSO regulations is one subject of the hearings.

The Secretary of Transportation is therefore authorized to enter into agreements with State agencies to take over inspection duties. These agreements require that:

- the State must adopt at least minimum Federal safety standards;

- the State must submit an annual certification that it has adopted such standards and is complying with a number of other more technical conditions.

The Office of Pipeline Safety Operations does not have these agreements with all States and the inspection mechanisms vary in the States which do participate. This could result in uneven enforcement of regulations concerning LNG facilities. For this reason, it appears that guidelines for inspection and enforcement should be included in OPSO regulations along with standards for construction and operation of the facilities.

Guidelines for training of inspectors, methods of inspection, and how often facilities should be inspected could raise public confidence, enhance safety of LNG plants, and ensure equitable enforcement practices. There also appears to be a problem of inspecting facilities for compliance with stipulations which may be imposed by FPC when it issues a certificate of public convenience and necessity. In some recent FPC rulings, these stipulations have been quite complex and technical. At the present time, however, there is no mechanism for enforcing these orders. The FPC staff is insufficient for performing followup inspections on a routine basis. Inspections are performed only when, and if, the applicant applies for modifications to an existing facility. Thus, the conditions of certification are considered more as good faith agreements with the company than a regulatory order.

In addition, the FPC can and does require occasionally higher standards than those contained in existing OPSO regulations. However, OPSO does not verify compliance with these higher requirements during its inspection of LNG facilities.

It appears that inspection of facilities for compliance with all similar requirements – regardless of the source of the requirement – should be fixed with a single agency. Since most of the duty already falls to OPSO or its delegated State authority, it appears logical OPSO should be charged with this expanded task.

Decisionmaking process in certification of LNG projects

The Federal Power Commission (FPC) is the lead agency in determining whether or not each individual LNG import project is in the public interest and, therefore, will be allowed.

However, both the LNG industry and concerned members of the public have found the agency unresponsive to their needs. Most criticism leveled against the agency can be collected into four areas:

- lack of clearly enunciated Federal policy and jurisdiction on import matters;

- length of time required for approval process;

- financial difficulties inherent in the approval process;

- lack of adequate information and opportunity for intelligent participation in the decisionmaking process.

Lack of clear policy and jurisdiction

Historically, the FPC’s role has been to regulate the entry of suppliers into the interstate Environmental Impact of Liquefied Natural Gasnatural gas market and to ensure that interstate sales take place at prices which are «just and reasonable». Early on in the import of LNG, that caused a problem of jurisdiction which has not yet been completely resolved. For an import facility where the gas is to be sold interstate, there is little difficulty since FPC approval is required for both the importation and the construction/operation of facilities to handle the gas. However, where the imported gas is to be sold intrastate, there has been confusion as to whether the FPC could require that facilities meet Federal standards.

In 1974, a US Court of Appeals ruled that the FPC could require certain standards of the intrastate facilities if the Commission first made an affirmative finding that such standards were necessary to protect the public interest. As a result of the court decision, the Distrigas terminal outside of Boston came under FPC jurisdiction. It now appears likely that such jurisdiction will include any other terminals which may sell imported gas only to an intrastate market.

Jurisdiction is also clouded in another area where there is a lack of guidelines for the division of responsibility among the FPC, OPSO, and the US Coast Guard in promulgation and enforcement of safety and siting standards which an applicant must meet. Since the Coast Guard’s role has been mostly to review applications and advise the FPC in areas of Coast Guard expertise, the more serious present conflict is with OPSO. There are two major questions involved in the conflict:

- To what extent can the FPC require higher standards than those contained in OPSO regulations? The two agencies clashed directly on this point in the past. In a controversy involving the Chattanooga Gas Company, the FPC temporarily closed down an LNG peak shaving facility which OPSO had inspected and approved. This led to an effort between the two agencies to develop a memorandum of understanding delineating responsibilities; however, so far this effort has not been successful.

- Which agency – if either – shall establish siting criteria for the location of import terminals? OPSO has proposed new safety standards for LNG terminals which bear heavily on the selection of specific sites. The effort has surfaced two problems:

a) there appears to be a statutory prohibition against OPSO standards prescribing the location of LNG facilities;

b) the FPC has expressed concern that it has exclusive jurisdiction over site selection. The FPC has received a request by the attorneys general of several east coast States to begin rulemaking on uniform siting criteria and has asked for comments on this request; however, the outcome of this issue is far from certain.

Until these jurisdictional problems are decisively resolved, it is difficult, if not impossible, to plan facilities which can be approved.

The LNG industry has been particularly critical of the FPC in the realm of decisionmaking. One representative told OTA that the recurrent theme of industry’s relationship with the FPC was «we can’t follow the rules because we don’t know what the rules are or will be».

One of the underlying problems which frustrates the FPC’s decisionmaking duties and processes is the fact that it is a regulatory agency, not a policymaking body. The questions of import levels, pricing mechanisms, and siting criteria which the FPC must regularly consider are all pieces of basic energy and environmental policy issues which should be determined before individual project decisions are made. There are currently no national policies for LNG which could be used as a basis for consistent FPC decisions on these subjects. However, the policy void in which the FPC now operates may be filled by the new Department of Energy.

Under the Department of Energy Organization Act, the FPC will be absorbed by a new five member Federal Energy Regulatory Commission, which will be a semiautonomous body in the Department of Energy.

In general, the change is an effort to strike a balance between maintaining independent regulation of energy and fitting such regulation into a policy framework which is responsive to the President. In part, the Act sets out the following:

- the Commission has jurisdiction over natural gas prices and the granting of certificates of public convenience and necessity;

- the Secretary of Energy has responsibility for regulating imports and exports of natural gas and for issuing certificates of public convenience and necessity for imports and exports;

- the Secretary has the authority to establish natural gas curtailment priorities, which are then implemented and enforced by the Commission;

- the Secretary may act as an intervener in the Commission’s proceedings and may set reasonable time limits for the completion by the Commission of its rulemaking proceedings.

Currently, the relationship between the Secretary’s import approval and the Commission’s certification function is unclear and needs to be clarified. On the positive side, however, the Secretary’s authority over imports provides at least the institutional possibility that LNG decisions will be made in the framework of conscious policy choices concerning the role of LNG in the Nation’s energy mix, the acceptable level of imports, the preferred supplier countries, and tradeofls between LNG and alternative domestic and imported fuels.

This policy framework has been lacking in the present structure and is sorely needed.

Meanwhile, the FPC practice of making case-by-case decisions on such matters makes planning difficult for the LNG industry or by opponents of any particular project. There is another troublesome policy question: In recent decisions, the FPC has issued its approval contingent upon receipt of all State and local approvals. These decisions raised concern among some industry representatives that the FPC was abdicating its authority to local politicians.

The issue here is one of Federal preemption. What if the FPC authorized a particular project and State authorities refuse to allow it? The Natural Gas Act provides for condemnation of land for pipelines, but does not specifically mention terminal facilities. Case law on the subject is limited and the question has never been decided directly by the courts (see tabl.).

| Statutes and executive orders | |

|---|---|

| Administrative Procedures Act, 5 US C. § 551 et seq (1970) | Establishes the minimum procedures which agencies of the executive branch must follow in establishing rules and regulations. |

| Admiralty Extension Act of 1948, 46 US C. § 740 (1970) | Provides that admiralty jurisdiction is to extend to all injuries caused by a vessel even if such damage or injury is «done or consummated» on land. |

| Coastal Zone Management Act of 1972, 16 U. S. C. § 1 451 et seq (Supp. 1972) | Authorizes the Secretary of Commerce to make annual grants to any coastal State to assist in developing a management program for land and water resources of its coastal zone. Such grants are contingent on approval by the secretary of the State’s program, i. e. that it meets certain criteria specified in the Act. After approval of a State’s program, no Federal permit or license for an activity affecting that State’s coastal zone unless that activity has been certified as consistent with the State’s program. |

| Dangerous Cargo Act, 46 U. S. C. § 170 (1970) | Directs the Coast Guard to identify all dangerous cargoes, prescribe regulations establishing standards for containers and handling of explosives and other dangerous cargoes and for inspection to ensure compliance with these regulations. |

| Department of Energy Organization Act of 1977, P. L. 95-91 | Creates a new Department of Energy consolidating many of the energy organizations of Government. Of particular interest to LNG is the creation of semiautonomous Federal Energy Regulatory Commission, which will absorb many of the functions of the Federal Power Commission as they relate to LNG. The major exception is that the Secretary of Energy will have authority to approve or disapprove import applications. |

| Executive Order 10173-Regulations relating to the safeguarding of vessels, harbors, ports, and waterfront facilities of the United States. | Authorizes the Coast Guard to «supervise and control» the transportation, loading and unloading of dangerous cargoes. Also allows the Coast Guard to require owners and operators to obtain a Coast Guard permit for the waterfront facilities used in the handling of such cargo. (The Coast Guard does not currently require such a permit). |

| Federal Water Pollution Control Act, Amendments of 1972, 33 U. S. C. § 1 251 et seq (Supp. 1972) | A comprehensive act aimed at cleaning up the Nation’s waters. Discharges of pollutants require permits administered by EPA and the Army Corps of Engineers. In certain cases, this permit authority may be delegated to the States. |

| National Environmental Policy Act of 1969 (NEPA) 42 U. S. C. § 4 321 et seq (1970) | Provides that each «major Federal action significantly affecting the quality of the human environment» must be preceded by an analysis of that action’s environmental impact. |

| Natural Gas Act of 1938, 15 U. S. C. § 717a et seq (1970) | Gives the Federal Power Commission broad powers to regulate imports, exports, and the interstate transportation and sale of natural gas. Under Section 3, no imports or exports may proceed without an order from the Commission. Under Section F, no facilities for interstate transportation or sale may be constructed without a certificate of public convenience and necessity from the Commission. The Commission’s authority over interstate sales of natural gas includes setting the prices at which the gas is sold. |

| Natural Gas Pipeline Safety Act of 1968, 49 U. S. C. § 1 671 et seq (1970) | Authorizes the Secretary of Transportation to set minimum Federal safety standards for pipelines, establishes a cooperative State-Federal enforcement program, and provides for Federal aid to States to bring State standards up to the level of Federal standards. |

| Outer Continental Shelf Act, 43 U. S. C. § 1 331 et seq (1970) | Declares US. jurisdiction over the subsoil and seabed of the Outer Continental Shelf and establishes the system for Federal leasing of these lands for resource development. |

| Ports and Waterways Safety Act of 1972, 33 U. S. C. § 1 221 et seq (Supp. 1972) | Title I provides that the Secretary of the Department in which the Coast Guard is operating may prescribe standards and regulations to promote the safety of vessels and structures in or adjacent to the navigable waters of the United States and $0 protect such waters and their resources from environmental harm due to vessel damage or loss. Title II provides that the Secretary shall prescribe minimum design, construction, and operation standards for vessels carrying certain cargoes in bulk (e. g. oil). |

| Shipowners Limitation of Liability Act 46 U. S. C. § 181 et seq (1970) | Provides that shipowners may limit their liability after an accident involving their vessels to the value of the vessel and its cargo after the accident. An exception is made for loss of life or bodily injury, in which case liability is limited to $60 per ton of the vessel. |

| Submerged Lands Act 43 U. S. C. § 1 311 et seq (1970) | Provides for State resource management of the seabed out to a distance of 3 miles from shore (3 marine leagues in the case of the States bordering the Gulf of Mexico). The Federal Government retains control over the waters over such lands for purposes of commerce, navigation, national security, and international affairs. |

| Cases and FPC opinions | |

| Distrigas Corporation v. Federal Power Commission, 495 F. 2d 1057 (D. C. Cir. 1974). | Decided that the FPC may, under the Natural Gas Act, impose the equivalent of Section F certification requirements for LNG imports even if the gas is to be sold intrastate. This authority is discretionary, and must be preceded by the Commission’s finding such requirements to be necessary to protect the public interest. |

| Federal Power Commission, Opinion No. 795, Trunkline LNG Company and Trunkline Gas Company, Docket Nos. CP74-138, 139, 140, issued April 29, 1977 | |

| Opinion No. 796-A, Issued June 30, 1977 | The first Trunkline opinion ordered incremental pricing and conditioned the certification upon Trunkline compliance with all other Federal, State, and local laws and regulations. In the second opinion, the FPC reversed itself as to pricing (allowing rolled-in pricing) but kept its condition of compliance with other laws and regulations. |

| Washington Department of Game v. Federal Power Commission 207 F. 2d 391 (9th Cir. 1953); Federal Power Commission v. Oregon, 349 US. 435 (1955); City of Tacoma v. Taxpayers of Tacoma, 357 US. 320 (1957) | The above cases conclusively determined that, in the permitting of hydroelectric facilities, the jurisdiction of the Federal Power Commission preempts that of any State commission or body. |

| Transcontinental Gas Pipe Line Corp. v. Hackensack Meadowlands Development Commission, 464 F. 2d 1358 (3d Cir. 1972), cert. denied, 409 US. 1118 (1973) | Action by natural gas company to enjoin regional development commission from interfering with an LNG peak shaving facility. Subsequent to the construction of the facility, New Jersey passed a law establishing the Hackensack Meadowlands Development Commission. The gas company, wishing to construct an additional storage tank at the facility, secured a certificate of public convenience and necessity from the FPC. The Hackensack Meadowlands Development Commission, however, refused to issue a permit for the addition. The Federal courts enjoined the State commission from interfering, finding its refusal to grant a permit an unreasonable restraint on interstate commerce. |

There is, however, a close analogy in the FPC’s jurisdiction over hydroelectric facilities. There, the courts have expressly held that Federal jurisdiction preempts that of State authorities. The Commission’s jurisdiction over hydroelectric facilities comes from a different statute than the Natural Gas Act, but there is probably an equally strong or stronger argument to be made in favor of Federal preemption in natural gas. The balance between State and Federal powers in one LNG peak shaving plant has been described by a US Court of Appeals in the Hackensack Meadowlands case – «Although the States are not precluded from imposing reasonable restraints and restrictions on interstate commerce, and although the authority to enact zoning ordinances under the State’s police power is clear…, it is equally settled that a State may not exercise that police power where the necessary effect would be to place a substantial burden on interstate commerce». However, the FPC’s recent action in the Trunkline case clouds the matter considerably.

Another area of uncertainty is the question whether provisions of the Coastal Zone Management Act apply to the various permits which the Federal Government grants in connection with LNG. Under the Act, applicants for any Federal license or permit for an activity in the coastal zone of any State with an approved coastal zone program are required to certify that their proposed project is consistent with the State’s program. The Federal Government is prohibited from issuing the license or permit until the State concurs or fails to act within 60 days or the Secretary of Commerce makes a finding that the proposed project is consistent with the overall objectives of the Coastal Zone Management Act.

There are two problems in this procedure as it relates to LNG: First, it is not entirely clear what kinds of authorizations are covered by the terms «license or permit» and, therefore, it is unclear if FPC certificates of public convenience and necessity would be included. Second, another provision of the Coastal Zone Management Act states that the Act is not to modify laws applicable to Federal agencies.

The FPC has announced its intention of conducting a rulemaking on the Act, but has not yet taken a position on what procedure it will adopt.

Time required for approval

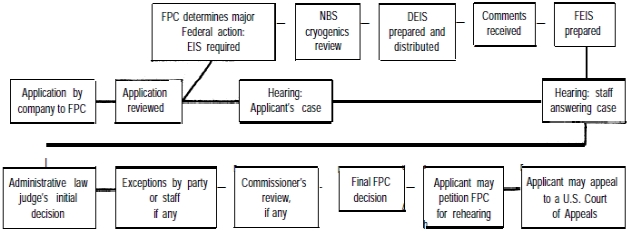

To date, the first LNG import project approved, the El Paso I project at Cove Point, Md., required 49 months to gain final FPC certification. The recent Trunkline decision took 43 months; the Pacific-Indonesia decision, which is still subject to review, has taken 44 months. However, the FPC has adopted an accelerated schedule for the El Paso II project and anticipates that the procedures will require only 9 months. Meanwhile, the long process coupled with the uncertainties such as what type of pricing scheme will be imposed as a condition of the final certificate, make it difficult for US firms to compete successfully with foreign countries which are capable of making faster decisions (figure 2).

The problem, however, lies not only with the FPC, but in the fact that the decisionmaking process in private industry in which long-range commitments are made early on is not compatible with the lengthy, sometimes unpredictable, Government process.

For example, before an LNG company makes application for Federal permits, commitments have been made for an LNG supply from abroad, for acquisition of the land, and for construction of the tankers which will carry LNG to the United States. It is not difficult to understand that such early commitments may not always be approved or be compatible with plans which are approved.

Much of the time used up by FPC is exhausted dealing with generic policy issues which could, and should, be decided in advance so that individual applications could move through a well-defined series of decision points. As noted earlier, there is the potential for considerable improvement in the time schedule for decisionmaking under the new Department of Energy.

Some citizens who joined in the OTA public participation program expressed concern that the United States could lose needed supplies of foreign gas if Government processes are not coordinated and expedited. However, others expressed concern that any attempt to streamline procedures may result in fewer opportunities for the public to be involved. There was strong support in all segments – the gas industry and related businesses, State and local governments, and public interest groups – for increased effort to make LNG approval procedures more open to those who are concerned.

Financial diffiulties

The financial problems caused by the cumbersome approval procedure are on two levels: first, the lengthy process allows considerable cost escalation to occur resulting in a higher cost to the ultimate consumer; second, both the applicant and interveners who may oppose the applicant must invest considerable sums of money in the project prior to approval or rejection by the FPC.

The cost escalation which most routinely occurs is in the contract price paid to the supplier of the LNG. For example, in the case of the recently abandoned Eascogas project, contract price of the LNG rose form 44,75 cents per thousand cubic feet to $1,32 per thousand cubic feet as it was necessary to renegotiate the contracts during the 5 years in which the application was pending.

In addition, industry claims a $5 million to $8 million investment in paperwork is necessary to get an import project moving through the approvals process. These early costs are, of course, ultimately borne by the consumer.

The process is equally as expensive for members of the public who may wish to participate in the FPC process. In theory, the right to participate as an intervener at FPC proceedings is one of the most direct and effective public participation mechanisms in the executive branch. It is a formal opportunity for all interested parties to participate in the decisionmaking process. In actual practice, however, participation is limited to groups with sufficient finances and expertise to closely and continuously monitor FPC proceedings. This generally means that gas companies and State utility commissions are able to participate effectively, but other groups which are affected by FPC decisions, such as environmental and consumer groups, have not been able to participate extensively.

One of the major expenses facing groups which wish to participate as interveners is legal fees. Although representation by an attorney is not strictly required by Commission rules, the complexities of the quasi-judicial proceedings make a lawyer a practical necessity. Even at the reduced rates offered by public interest law firms, legal services for an average 20-day hearing would be approximately $25 000.

Information and opportunities for participation

Adequate information about applications and FPC proceedings are necessary for effective participation in the decisionmaking process. However, the specialized nature of the subject and the quasi-judicial practices of FPC are a major deterrent to public involvement. Moreover, FPC, like most other Government agencies, relies on the Federal Register as its means of providing notice of applications and proceedings to the public. There is little, if any, effort to encourage participation from a broad range of groups which maybe interested in the proceedings or affected by the project.

In practice, the public input into OPSO and Coast Guard regulations appears to be less limited, and both agencies mail announcements to a list of interested parties in addition to publishing such announcements in the Federal Register. These actions are taken under the Administrative Procedure Act, and regulations which provide an opportunity for public hearings if the agencies deem them to be necessary. Both OPSO and the Coast Guard also have technical advisory committees, although membership in these groups is generally limited to people with backgrounds in appropriate gas-related fields. Except for a subtask force of the Natural Gas Survey, the FPC has no advisory committee directly related to LNG.

Safety research on LNG facilities

Research to determine whether LNG facilities are safe for the public involves:

- postulating a «worst case» scenario;

- estimating the extent of a vapor cloud, which is a central key event of any LNG disaster scenario;

- estimating the probability of other events occurring and their consequences (through fault tree and risk analysis).

Making sense of the Safety, Risks and Security Aspects in Liquefied Natural Gas IndustryLNG facility safety question requires examination of each of these subissues.

Scenarios

Postulating an LNG disaster scenario is clearly an almost limitless task. There are countless combinations of events which could lead to an accident. Of necessity, then, LNG safety researchers have simplified the task. It must be questioned, however, whether in the process of simplifying, important possibilities for faults have been overlooked, thereby leading to overly optimistic or pessimistic results. Since there has been little worldwide experience with shipping LNG, compared to the shipping of other cargoes, the historical record is scant and statistical evidence is limited. The creation of LNG disaster scenarios is, therefore, a somewhat subjective undertaking which is vulnerable to the biases of individual analysts.

The use of disaster scenarios to search for possible faults in a system is a useful analytical approach. But to infer, as most LNG safety reports do, however inadvertently, that all the important possibilities have been «covered» may be shortsighted. A review of the investigation of past disasters of other types shows how «failure paths» can be overlooked or summarily dismissed. This was true of NASA catastrophes, such as the death of three astronauts in the Apollo program, and of public works projects, such as the failure of the Teton Dam in Idaho.

Vapor cloud research

Researchers differ in their findings about the behavior of a LNG vapor cloud as it disperses into the atmosphere after a spill on water. From a safety perspective, the key issue is how far and how broadly a vapor cloud travels. Estimated distances vary from less than 1 mile to more than 50 miles. Some have argued that these differences indicate the need for more investigation and more research.

However, combined past research is inconclusive because researchers use different initial assumptions about a spill, have different concepts about how the vapor cloud would behave, and different interpretations of data which is available. Further research could resolve only some of these differences.

Different assumptions. – One of the reasons research results differ is that different weather conditions are assumed for the time of the spill. To some extent the meteorological research community has tried to standardize assumptions about weather conditions by using commonly accepted classifications of weather states. There are, however, several classification schemes in use.

Furthermore, some researchers use «worst case» (stable) weather conditions while others argue that such assumptions are pointless because an LNG tanker would not enter a harbor under these conditions because they only occur at night.

Further research will not resolve these types of differences in initial assumptions.

Concepts. – Further research could however, minimize the differences in conceptual approaches used in LNG models.

For example, some researchers assume LNG is vaporizing from a single spot; others assume that the source is a line or an area. Some researchers visualize a vapor cloud as a continuous plume; others see it as a series of puffs. All of these different visualizations lead to different mathematical representations in the models and to different equations and results.

Interpretation of data. – Further experiments could also develop data which would help resolve differences in interpretation of raw data that is now available. For example, it has been shown that an LNG cloud is flammable only when the concentration of natural gas is between 5 and 15 percent.

Therefore, because there is a lack of data on large spills, researchers must make an educated guess about the maximum distance downwind a vapor cloud could still contain pockets of gas sufficiently concentrated to be flammable. This question bears directly on the issue of how far a plume must travel before it is unignitible. More data from further experiments could possibly answer this question with greater certainty than presently exists.

Most LNG researchers would like to see further experiments undertaken. But until there can be some agreement in the assumptions to be used in such experiments, and until there is some faith that the assumption are realistic, such investigations cannot be useful for public policymaking.

Estimating the risk to the public

Fault-tree analysis and risk analysis have been applied successfully to equipment systems which have been in use over an extended period of time and for which there exists a firm data base of failure and repair records. In these situations, the techniques enable the risk analyst to determine with some confidence the probability that specific components will fail. In innovative situations, however, risk is less amendable to this kind of analysis.

One reliability/safety analyst with 11 years experience in the aerospace industry described in testimony before the FPC how, in the late 1950’s, the aerospace industry was quite optimistic about risk-assessment methodology.

But he points out:

This optimism was soon dispelled by hundreds of cases of unexpected test and operational failures and thousands of system malfunctions. Many of the failures and malfunctions modes had either been previously analyzed and seemed to be noncredible events or had come as a complete surprise which previous analyses had not identified at all. By the early 1960’s, it had become apparent that the traditional method of identifying potential failure events and assigning historical probabilities of occurrence to these events, as was done in the Little and Homer reports (Little was consultant to an LNG applicant before the FPC, Homer was a consultant to FPC) had consistently led to overly optimistic conclusions. Consequently, the failure rates were consistently underestimated.

The risk assessment issue is also one of contention between the Department of Transportation agencies (US Coast Guard and OPSO) and the FPC.

In his initial decision on the application by Pac Indonesia LNG Company and Western LNG Terminal Associates to import LNG to Oxnard, Calif., FPC Administrative Law Judge Samuel Gordon supported his opinion on LNG safety by citing the risk-assessment statistics of the applicants’ consultant.

The analysis shows that under the worst case, the highest fatality probability is one chance in 6,7 million per person per year within fiveeighths of a mile of the site, decreasing to probabilities of one chance in 10 million per person per year or less within 1 mile of the site and to one chance in 1 billion to 10 billion per person per year or less beyond 3 miles of the site. The probability of one occurrence is 113 000 with a probability of one chance in 710 septendecillion (710 followed by 54 zeros) per years.

In contrast, a DOT study on LNG took an opposite position regarding the applicability risk analysis:

Several approaches may be taken in the analysis of potential system failures and the consequent risk. A statistical estimate of risk can be made if enough years of experience with the system are available. Unfortunately, the total operating experience of the LNG industry is not sufficient to demonstrate that risk levels are acceptably low on a purely statistical basis. For example, to assure that the risk of any fatality from an LNG facility is at a level of less than 10-5/year (equivalent to the risks associated with machinery) would require a statistical data base of about 500 000 plant-years of operation without major accident causing a fatality beyond the plant boundaries. Even with major growth in the LNG industry, experience accumulated through the next decade will be about two orders of magnitude below that required to assure a risk level of 1-5 fatality/year by statistical data. Therefore, a statistical approach is not sufficient to quantify LNG facility risks.

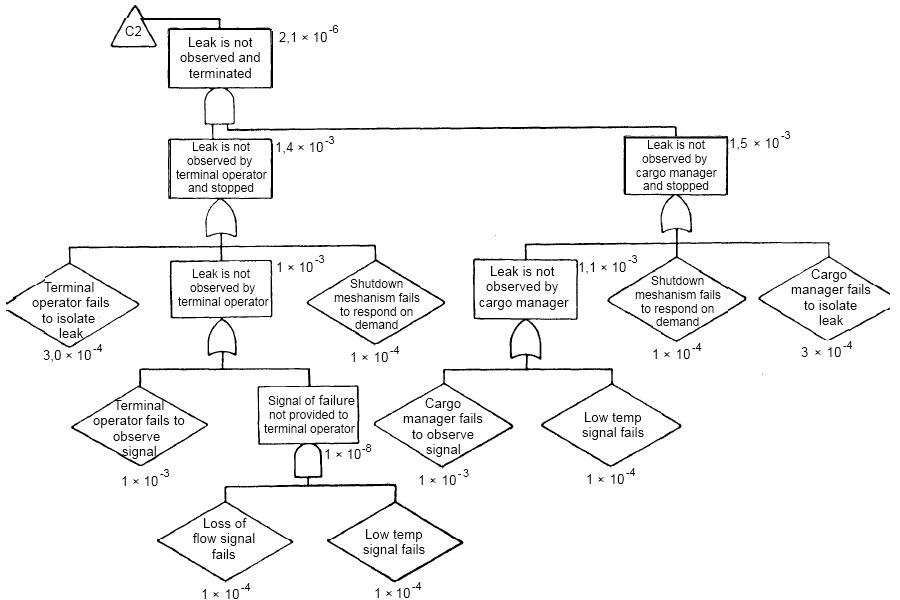

Accordingly, OPSO and the Coast Guard do not use risk analysis in consideration of LNG operations. It appears that fault-tree analysis and risk analysis are useful management techniques to identify «trouble spots» in a complex system so that preventive measures can be taken (figure 3).

It is also useful for comparing one kind of a risk against another where a choice is to be made between types of equipment or procedures. Even in these applications however, a reliable data base and historical record of performance are important. As presently applied by the FPC, the use of faulttree analysis and risk analysis to determine whether LNG facilities are safe is most questionable; worst of all such inappropriate use of the research techniques leads to a false sense of knowledge about the possible risks.

Value of further research

Research on the behavior of LNG spills and the possible consequences of spill accidents has been conducted over the past 10 years by various Federal agencies and private industry groups. Recent Federal efforts have been primarily sponsored by the Coast Guard who have an annual budget of about $1 million designated for LNG safety researches. These efforts have included experiments and analyses on many of the same subjects that are now being suggested by ERDA for much expanded research programs, i. e.:

- LNG vapor generation and dispersion;

- fire prediction and control;

- explosive characteristics.

The most recent spill tests have been conducted at the Naval Weapons Center at China Lake, Calif., and have been jointly sponsored by the American Gas Association (AGA). These have included:

- vapor-cloud ignition tests;

- pool-ignition tests;

- explosion tests.

The vapor and pool ignition tests have resulted in data on evaporation rates, downwind vapor concentration, flame propagation, and radiation characteristics. The explosion tests have been exploring the applicability of such theories as dynamic self-mixing, which has been applied to recent weapons development and has been used to explain large variations in the energy yield from volcanic explosions. If such theories do apply, it is considered possible that an unconfined LNG vapor cloud could be detonated. However, in all tests to date, no detonation of LNG clouds has been accomplished and efforts to detonate using explosive riggers have resulted in ignition and burning of the cloud but not explosion.

Some researchers believe that further tests are necessary to demonstrate that an unconfined LNG cloud will not detonate.

Read also: Hazards of LNG and Relevant Gases

At the present time, the Energy Research and Development Administration is tentatively planning to conduct and study over a period of more than 5 years several major spills of LNG. The project is expected to cost about $50 million, making it the largest LNG research program ever undertaken. The research design is still in the formative stages and it has not yet been determined how many experiments will be conducted, how large they will be, and whether they will be on land or water.

There are three critical questions about this proposed research and any large-scale, longrange research which may be considered:

- Feasibility: Is it possible to economically and safely transport large quantities of LNG to a test site, to set up reliable monitoring equipment, and generally to set off a large LNG fire which is both measurable and safe?

- Validity: How valid will the results be from just one experiment or a small series of experiments? Unless a large enough number of spills are conducted, the arguments resulting from interpretation of a data base which is inadequate will continue.

- Timeliness: How timely will the results of this research be 5 or more years from now? How many significant LNG policy decisions will still remain to be resolved?

Past research has produced conflicting results and predictions, and it is unlikely that the United States can afford the time and money to conduct enough research to resolve the differences and come to firm decisions about the safety and behavior of LNG. For this reason, decisions about LNG systems should be made on the basis of nonquan – titative approaches which result in prudent siting criteria and strict design, construction and operation standards. Existing research techniques should be used to identify potentially dangerous elements in the overall system so that specific research can be undertaken to find ways of improving the safety of those elements.

Many of these specific types of research were called for by those who joined the OTA public participation program during the LNG assessment. These suggestions included:

- site planning research to develop a nationwide siting plan and establish specific siting criteria;

- an independent detailed analysis of the LNG system to specifically identify the safety issues involved;

- further investigation to determine the most efficient methods of handling LNG fires, to assess the possible impacts of such fires, and to establish procedures for coordinating and mobilizing local firefighting efforts and evacuating neighboring areas;

- a study of the capabilities and equipment of agencies responsible for inspection of LNG tankers and facilities;

- an analysis of the decisionmaking process for LNG project applications so that better procedures can be established to guarantee that the public will be able to express its concerns about the safety of facilities.

LNG facility siting

One of the most controversial aspects related to LNG is the location of major import terminals, storage facilities, and regasification plants.

Siting is closely related to safety or to the public’s perception of the safety of facilities. Environmental, land-use, and aesthetic considerations are also important.

There is currently no operating experience with major baseload import terminals in the United States and only limited experience in LNG shipping throughout the world. Researchers, therefore, do not have sufficient data on which to predict with any degree of accuracy the likelihood that a major LNG spill will occur, how the spilled liquid and resulting vapors will behave, and what would be the impacts of a spill. Since little is known, some citizens are fighting LNG facilities and have urged that the facilities, if needed at all, be located at the sites which are remote from dense population centers.

The principal questions of the siting controversy are:

- Who should establish siting criteria?

- What criteria should be considered in approving an LNG site?

- What is a «remote site»?

Who should establish siting criteria?

Site selection is currently undertaken solely by the company or consortium proposing an LNG import project for approval. The considerations which lead to a final selection are technical and economic ones. The Federal Government’s role is strictly reactive, in that it can approve or disapprove sites proposed by industry but does not tell industry in advance where it may or may not locate.

In addition, the Federal process is not designed to encourage local participation in consideration of industry’s proposed site. The lack of such participation has been identified as a serious concern of most of the public interest groups contacted during this study.

The lack of any standards, which proposed sites must meet, has led many groups to suggest that specific siting criteria be established. It seems possible either that a standard site screening process could be established by the Federal Government or that a set of uniform siting criteria could be developed.

There are differing views on the advisability of establishing such criteria on a Federal level: The American Gas Association has stated that each site is unique and must be treated on its own merits, while some representatives of public interest groups have stated that a national LNG siting policy is needed to address safety and siting concerns.

During OTA’s public participation program, the one concern most often voiced about siting criteria was that the public should be involved to the maximum extent possible in establishing such criteria. Groups also said they felt more public participation would be necessary in permit processes or decisionmaking procedures set in place by adoption of siting criteria.

Currently, three Federal agencies have some bearing on site selection: FPC, OPSO, and the Coast Guard.

- The FPC, which ultimately approves or disapproves a site, was asked by a group of Eastern States in May 1976, to establish siting criteria, but so far has taken no such action.

- The Office of Pipeline Safety Operations, which is responsible for the safety of facilities and pipelines involved in interstate transportation of natural gas, has proposed regulations which will impact on site selection primarily by mandating the size of a buffer zone to protect surrounding areas from the heat of a fire at the storage tanks and from the vapor cloud which might form as a, result of a tank rupture.

Since the LNG terminal operator would have little control over property utilization outside his own property line, the result of the OPSO proposals is to require that the terminal and storage tanks be located on a large piece of property owned by the LNG company. Under the proposed regulations, a thermal exclusion zone would require that storage tank dikes be about one-half mile away from humans in any public area. In addition, there is a requirement for a vapor dispersion zone, which is the area necessary for vapor from an instantaneous spill of an Prevention rollover in LNG TanksLNG tank to dissipate to the point where gas concentration in the cloud is less than 2 percent. Depending on the size of the LNG tanks and the design of the dikes surrounding them, that area could range from 1 000 to 12 000 acres under the proposed regulations. The alternative offered in the proposed regulations is a redundant automatic ignition system, which would set a spill afire and contain the heat in the one-half mile thermal exclusion zone.

The Coast Guard has an indirect influence on site selection by exercising its:

a) responsibility to determine if ships will be permitted access to a proposed site;

b) its responsibility to advise all concerned parties of operational constraints and safety criteria which would be applied to the marine portions of the project if it is approved.

The Coast Guard assessment of marine transportation and safety aspects of a proposed project is made informally, either at the request of an applicant before FPC proceedings begin or in response to the environmental impact statement prepared by the FPC. The analysis considers such things as the depth and width of the channels to be used by LNG ships, the necessity of dredging, the adequacy of surveys and charts, and the density and location of other waterborne activity. However, the Coast Guard has no specific criteria to use in evaluating each of these areas or specific standards which proposed sites must meet.

Obviously, if there are to be Federal siting criteria, the expertise of these three Federal agencies should be combined and a single set of regulations formulated. However, it is not clear that these criteria should, in fact, be set at the Federal level. The selection of acceptable sites for LNG facilities will involve many tradeoffs between environmental preservation, economics, and safety which can possibly best be made at the State and local level.

One possible mechanism for combining local preferences with the national interest is already in place. That is the Coastal Zone Management Act. The Act charges coastal States with formulating land-use and siting plans for coastal areas in exchange for Federal funds for planning, implementation, and impact compensation. It requires that facilities which require Federal licenses and permits comply with the State plan unless specifically exempted by the Secretary of Commerce.

While the Act itself is still the center of some controversy and has yet to prove itself as a management tool, the Act could provide a framework in which to consider sites for LNG terminals and other energy facilities.

What criteria should be considered?

Distance and population density should not be the only criteria for siting LNG facilities. Many other factors also affect the safety and acceptability of a site, and it is possible that in some aspects, such as availability of firefighting equipment, nearness to distribution lines, and ease of access, remote siting may be a drawback.

One list of such factors is included in an alternative site study conducted for the FPC during preparation of the environmental impact statement for the Tenneco Atlantic Pipeline Company (TAPCO) application to build a 495-mile pipeline to New York from an LNG terminal in New Brunswick. In this study, a large section of the northeast coast was screened for oceanographic, bathymetric, navigational, and land-use conditions which would identify potential LNG terminal sites. The potential sites were then evaluated in relation to other land uses, other shipping activities, safety, the consequences of accidents, the possibility of system outages, environmental impact, and economic cost.

If the Federal Government were to establish siting criteria, an approach in three parts would probably be desirable. The first would cover very minimum standards that every site of a certain capacity would have to meet, the second would involve national strategic planning, and the third would be specific site evaluation based on established guidelines.

Minimum standards could cover:

- property dimension and distance from storage tanks or ship terminals to property lines;

- conditions of harbor entrances, shipping channels, turning basins, anchorages, and tanker berths;

- relations to other marine and land-use activities in the region, including impacts on natural resource values;

- presence of unusual hazards or related hazardous operations in the region.

The Federal Government could prepare national plans for future LNG import projects based on:

- the existing gas pipeline networks and projected demand;

- the projected domestic supply of gas to these pipelines;

- the possible foreign countries with excess gas to export.

In this way an accurate number of future projects could be forecasted. The American Gas Association has stated that less than 10 additional LNG import terminals will be required, but logical locations and relative needs for these terminals have not been established. Following a national plan, evaluation of various possible sites or projects could be established utilizing guidelines covering such items as:

- Location of sites relative to dense population centers and other land-use conflicts with terminal activities and consideration of specific safety hazards.

- Location of terminal relative to other ship traffic and existence of special traffic control.

- Local benefits of the specific industry base and possible satellite development.

- Possible degradation of natural areas or residential areas due to establishing added industrial activities.

- Location of populated areas exposed to specific accident scenario at a terminal.

- Presence of specific external factors which may lead to accidents such as severe weather, active seismic zones, nearby airports, etc.

- Availability of equipment and methods to control effects of accidents, such as firefighting equipment and emergency contingency planning.

- Use of accident-prevention measures such as monitoring and inspection of facilities or operation, training of personnel, and control of shipping traffic.

A number of citizen groups say that offshore LNG terminals may be preferable from the standpoint of safety and land-use issues.