LNG Project Development plays a vital role in the global energy landscape. It encompasses several phases, starting with capacity building and technology transfer, which are essential for enhancing operational efficiency. Transparency and openness throughout the process bolster stakeholder trust and facilitate smoother project execution.

Accurate resource reserve estimates and well-defined project phases, including FEED and EPC contractor selection, are critical to making informed final investment decisions (FID). Furthermore, mastering LNG technology and adhering to a robust construction schedule are key to ensuring successful project outcomes. By focusing on these factors, projects can achieve their objectives while minimizing risks and maximizing returns.

Introduction

Countries with new natural gas resource discoveries, or those looking to start or increase the use of natural gas, may not have the requisite technical and commercial capacity required to develop their resources or capture and preserve the benefits of resource development.

Furthermore, these countries may have existing laws that govern development but may not have the capacity that will be needed to successfully develop a large natural gas resource or form a viable domestic natural gas industry. Capacity building is intended to bridge that gap and to build the capabilities and knowledge of government officials to negotiate with confidence and on an equal footing with project developers. Capacity building also helps local people make informed decisions concerning the country’s resources and how to develop them to benefit their citizens and improve the economic situation in the country – not only for the short term but for generations to come. Another goal of capacity building is to create a ready pool of educated, trained and informed personnel to feed into the labor force for future projects.

Training

For local content participation to be effective and sustainable, there needs to be a deliberate policy that requires building the capacity at various levels within the country, such as national and local government officials, and the private sector including small-to-medium enterprises (SMEs). Training for national and local government officials should be targeted primarily at a better understanding of the project to facilitate regulatory and environmental permitting processes. Private sector training should include strategies for project development including effective contract negotiations as well as overall project management to provide the needed trades, professional services, and goods.

Specific skills need to be identified as early as possible in the planning of a project to allow training to be organized and provided to meet project schedules. The capacity building effort should galvanize support from other stakeholders such as government, academia, and subject matter experts. It is important that the qualification of the intended service providers and the quality of the goods supplied are consistent with the requirements of the project with appropriate evaluation and monitoring protocols in place.

The training could be delivered through a combination of formal instruction, (both locally and abroad), and supervised on-the-job-training (OJT). It can be provided or facilitated through various means and may require a partnership of academia, government, foreign donors and subject-matter experts. The training should be considered along the entire value chain with emphasis on the appropriate delivery for the needed goods and services. For LNG export and import projects, training should be considered in the initial assessment of the project’s economics and viability, through to the engineering, procurement, construction and project commissioning phases. It is important that trained personnel are gradually absorbed in the appropriate phases of the project to provide them the opportunity to bridge theory and practice. However, any on-the-job-training should have minimum disruption of the project workflow.

Transparency and Openness

Achieving successful development of Domestic Gas Infrastructure – Unlocking the Potential of LNG and Gas Value Chainsdomestic gas infrastructure and LNG plants is a complex process that requires communication, transparency, and ongoing dialog between host governments, local governments and stakeholders, and industry. Conflicts are naturally going to arise at various times during development and operations due to unstated or unfulfilled expectations or failures to meet projected schedules or goals. It is important to create open formal and informal lines of communication to jointly address problems at an early stage as they arise. This builds trust between parties that will enable them to work through more difficult problems later. These dialogs can prevent roadblocks which could lead to costly delays in development and other potential legal remedies.

It is important to recognize that the host government and project developers are not adversaries, rather they are partners dually responsible for natural gas development. Neither can accomplish the end result without the other’s help. Capacity building creates common understanding which is the foundation of any partnership.

Technology Transfer

Technology transfer is a deliberate policy by a host country to ensure that there is a process in place for the sharing of skills, knowledge, expertise and technologies in the oil and gas sector between expatriate and foreign oil companies, government officials and the local workforce. This is mostly for areas of expertise that are new to the country’s workforce. Technology transfer is closely related to knowledge transfer, but not in totality. Technology transfer is a vehicle for bridging the gap in knowledge and expertise from LNG investor expatriate staff to the local workforce. Often,technology transfer can take the form of on-the-job training or learning through doing.

In a specialized industry like LNG, the host country workforce often does not have the requisite knowledge, know-how or technical skills to participate in the project. In order to achieve human technology transfer, the host country often signs a technology transfer agreement with the LNG investor. The agreement provides that technology transfer will occur within a specified time frame for local workforce knowledge and expertise development. A government agency (or agencies) are assigned responsibility for ensuring compliance by the LNG investor with the technology transfer agreement commitments. Technology transfer is measurable and time-bound as specified in the agreement. Technology transfer is developed through conscious and sustained efforts by both LNG investors and government.

The transfer of technology can be measured by answering the following questions:

- To what extent are increasing technological capabilities of the host country workforce reflected in terms of expertise in the LNG/gas plant technology?

- To what extent has technological learning and technical expertise influenced the performance and know–how of the local workforce?

Reasons for Technology Transfer in LNG industry.

- The drive to bring awareness and develop necessary capabilities to the local workforce by the host government.

- The need to put a deliberate strategy in place for succession planning from expatriates to the local workforce of the host country.

- The need for human capacity development for the host country through an LNG project development.

LNG Development

Introduction

An important policy objective of developing The role of the government in ensuring the development of the gas sector, key factors and principles gas resources in Africa is to promote domestic access to energy resources while growing the electricity and industrial sectors. In many cases, because the investment associated with developing the resources is very significant, LNG export appears as the reasonable option for securing the necessary financial resources underpinned by long-term LNG offtake contracts. Typically a portion of the gas will be allocated to the domestic market, the rest to the liquefaction plant.

Resource Reserve Estimate

Before embarking on a project, it is essential to formulate a comprehensive reserve estimate for the resource. After the exploration and development (E&P) company (or consortium) obtains the lease, they will likely complete 3D seismic surveys, which allows a geological and geophysical understanding of the oil and gas resource potential. The E&P company will proceed with one or more exploration wells. If the results of the exploration well(s), evaluated in well logs, are promising, then flow tests may be performed. Additional appraisal wells may then be drilled to delineate the extent and quality of the reservoir before a discovery may be announced.

The resource can be appraised at any point in time, based on the information available at that time. As more information becomes available through additional wells or production tests, the resource will be evaluated using engineering methods. Resources can then be classified as reserves after more certainty exists that they can be technically recovered. Production probabilities of proven, probable and possible reserves are estimated. Reserve estimates continue to be refined throughout the development of the field(s). After the initial reserve estimate is completed, the field flow rates will be estimated based on best engineering practices. Then, economic analysis is typically performed to determine the economic recoverability of the reserves.

As the field development moves progressively from the initial phases into the final phases, the reserves are increasingly defined with more certainty as well as the upstream investment requirements to produce them and achieve the desired deliverability for the LNG plant and any domestic gas requirements. At least 20 years of plateau production from dedicated proven reserves is highly desirable to proceed with an LNG project and begin LNG marketing and financing efforts.

Before the sales and purchase agreements are finalized, reserves must be certified by an independent petroleum engineering reserve certification firm. The lenders will also require the certification of the reserves dedicated to the project before providing financing.

LNG Project Development Phases

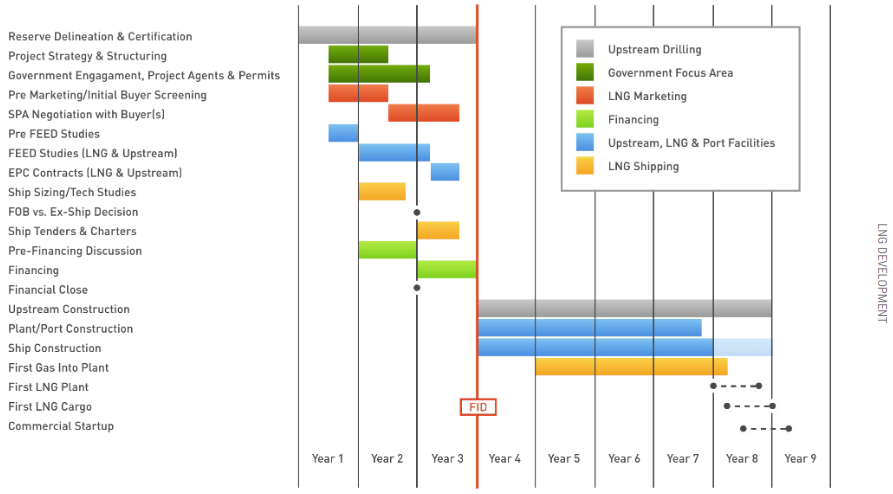

Progressing an LNG project from inception to final investment decision (FID) requires three main work streams that run in parallel:

- commercial;

- technical;

- and financial.

The commercial work stream consists of securing the necessary project agreements and LNG offtake contracts. The financial team will rely on the technical and commercial feasibility of the project to structure and secure the necessary capital investments to finance the project. The technical work stream ensures that the technical aspects of the project are sufficiently defined and a contractor is selected to undertake engineering, procurement and construction (EPC) works. Details of the technical work stream are described in this section; commercial and financial work streams are addressed separately in this handbook.

An LNG export project typically comprises the following developmental phases:

- Screening and Evaluation.

- Pre-Front End Engineering Design («Pre-FEED»).

- Front End Engineering Design (FEED).

- Engineering, Procurement and Construction (EPC) bidding, evaluation, and selection of contractor.

- EPC Phase – performing final engineering designs and drawings, procurement of materials and equipment, and construction of the project.

As project development progresses from the screening evaluation phase through EPC, the project developer will be spending increasingly larger amounts to complete the work deliverables under each phase. Each phase prior to the EPC (which occurs after FID) acts as a decision point where the project developer may exit the project if the analysis does not support proceeding to the next phase.

In each phase below, the project developer will work to provide increasing definition in the description and cost of the facilities, and the execution schedule with a goal of achieving a high definition of costs (+/- 10-15 %) by the time of awarding the EPC contract. Project economics, calculated for each phase based on the latest cost estimates, schedule, and the LNG pricing outlook, would be a key factor in determining whether the project is economically viable to move on to the next phase.

- Discovery of a gas field has resulted in a preliminary reserve estimate that may be sufficient to support an LNG project.

- Screening and evaluation – based on the initial estimation of the size and deliverability from identified gas reserves, an initial description is developed of a potential LNG project, including the size of the LNG trains and their initial and ultimate number. Several potential LNG plant sites are evaluated, based on their suitability for berthing for year-round shipping via LNG carriers (water depth, weather conditions, etc.). Possible pipeline routes to the potential plant sites are assessed as well as pipeline sizing. Initial cost estimates are made based on benchmark cost data. LNG market opportunities are assessed and LNG price forecasts are secured. Screening economics over a range of scenarios are developed to help in optimization and assessment of the attractiveness of the potential project and whether the potential project has sufficient merits to warrant proceeding, e. g. if the reserves could support a 15-20 year plateau gas sale at a minimum 3-5 MTPA which is the minimum economic size of a single LNG train. Economies of scale can improve the financial decisions with a larger size train and multiple trains if the market exists. The reserve requirements for a 5 MTPA plateau sale of 20 years is approximately 8 TCF. The duration of this screening work can vary from 6 months to more than a year depending on what information is already available from existing reserve studies and previous drilling and reservoir assessments. Staffing is increased and a rough cost of this phase could be around 500 000 to 1 million US dollars.

- Pre-Front End Engineering Design («Pre-FEED») – initial or preliminary designs for the intended project. This results in a better estimation of project and costs and can take an estimated six months. Costs can be on the order of 2 to 5 million US dollars typically.

- Front End Engineering Design – information necessary to prepare bidding documents for selection of an EPC constructor. This phase can take 1 to 1,5 years. This can typically cost in the range from 40 to 80 million US dollars.

- Engineering, Procurement and Construction (EPC) Bidding, Evaluation and Selection of Contractor (See separate section) – 6-8 months duration. It is often necessary to pay several million dollars to each of the unsuccessful bidders for their work (See separate discussion).

- EPC Phase – after a final investment decision, the EPC contractor will produce final engineering designs and drawings, arrange the procurement of materials and equipment, and oversee construction of the LNG plant and export facilities. Costs should be more accurate at this phase and completion of the project could cost US $ 1 500 – 2 500 per tonne of capacity or perhaps more depending on local and market conditions.

FEED

After the in-house screening and evaluation and contractor led Pre-FEED which covers optimization of various plant equipment and configuration options, the basic scheme is selected for the FEED in order to provide better scope definition to the EPC contract bidders. The FEED process takes approximately 12-18 months to complete with a resulting FEED package.

Two of the key outputs from the Pre-FEED are cost estimate and schedule projection. Estimated FEED cost for an LNG plant can range from US $ 40-80 million depending on size and complexity. Company personnel required for the FEED are in the order of 20-30 full-time persons.

The better the definition of the project at the Pre-FEED stage, the better the definition for project cost and schedule. LNG project cost estimates after the pre-FEED stage generally have a contingency (uncertainty in the estimate) in the order of 30-40 %. After the FEED, the contingency level is reduced to about 15-25 %. The EPC contract will generally have a contingency of about 10-15 % as you gather more information and do progressively more design work.

EPC Contractor Bidding and Selection

Failure to implement a proper bidding process is likely to result in significant problems with project completion. Performance guarantees are required (legal agreements that require agreed specifications be completed). EPC contract bidding for a greenfield project is almost always done on a competitive basis. The number of contractors experienced and qualified to carry out an LNG project is limited, on the order of 6-7. The number of qualified bidders is often further reduced by the practice of forming consortiums for bidding on the EPC work, which can reduce the number of separate bidding companies or groups to only 3 or 4. Usually, one company acts as the lead for the consortium. Competitive bidding is highly important for obtaining a competitively-priced proposal.

One method employed to increase the competitive intensity is to utilize a competitive FEED approach, whereby two well-qualified bidding consortiums are selected to conduct separate FEEDs, with a commitment from each to submit lump sum bids as the price of admission to such a limited competitive bidding slate. Prior experience indicates that this bidding strategy can potentially save 10-20 % on the price of the EPC bid.

An additional approach occasionally employed that may be used by companies without significant LNG experience to reduce requirements for internal company expertise is the so-called Open-Book FEED/EPC approach. Under this approach, a chosen EPC contractor provides a price at the end of FEED with an option for the company to continue forward under a given pricing approach utilizing open disclosure of adjustments based on actual equipment bid costs. This method has not been as commonly used.

The following discussion is based on selection processes based on competitive bids from multiple bidders or bidding consortiums (i. e., two or more) whether under a competitive FEED approach, or a process where multiple EPC contractors are provided with a single FEED for their bidding.

The FEED package is provided to the EPC contractor-bidders as the basis for their bid submittal. As part of their bid submittal, they are requested to provide a Resource Reserve Estimate in LNG Project Development PhasesDesign Endorsement Certificate (or equivalent) stating that they are in accord with the FEED and endorse the FEED design. This is essential in order to prevent future Change Order legal claims that might result from a defective LNG FEED package, which can be very costly. If a bidder cannot endorse the FEED, then they must propose any required changes necessary to achieve the specified LNG capacity, obtain the LNG company’s concurrence, and then base a bid and guarantees on an approved revised FEED package. In addition, included in a company’s bid instructions, an opportunity is provided to each LNG EPC bidder to provide in the bid submittal a higher LNG capacity performance by up to a specified limit (e. g. 5 %).

The bidders are typically provided a period of around 4-6 months to prepare and submit their bids after receipt of the company’s FEED package. The EPC bidders submit their bids in 2 packages.

The first EPC bid submittal is the unpriced proposal or technical proposal, that describes in detail all important technical and project execution aspects of the bid, including major equipment specifications and performance sheets (e. g., for refrigerant gas turbines, refrigerant compressors, main cryogenic heat exchanger or cold boxes, fired heaters, waste heat recovery units, LNG storage tanks, LNG jetty and berth including LNG vapor recovery facilities at the berth). The unpriced proposal bid also includes a complete detailed project execution plan, including a detailed EPC Schedule. The execution plan will address:

- the early site work;

- the plan for the temporary facilities (construction camp, roads, construction material offloading facility (MOF), site preparation);

- the plan for site mobilization of construction personnel and the arrival of concrete batch plants), and the delivery schedule of the major equipment to the site and its installation.

The company evaluation of the unpriced proposal requires about 2 months. As part of the unpriced proposal, each bidder is required to provide a schedule guarantee and performance guarantees for LNG capacity and fuel consumption.

Proper evaluation of contractor capability is highly important for assuring the successful completion of an LNG project. This capability is generally assessed by evaluating the engineering, procurement, and construction capabilities from each contractor’s technical submittal, including key personnel they propose for their project team, as well as assessments in the three areas of quality, project control, and project management. Safety performance is also critical, and their performance on past LNG projects is critical. Safety is a component of each of the six area mentioned earlier and goes into the evaluation score for each of the areas.

Adjustments are made for any non-conformities or differences in guaranteed plant performance (LNG capacity, fuel consumption, assessed downtime) and are priced as adjustments to the proposal. Each bid submittal is judged as to whether it is acceptable or non-acceptable, and the results of the evaluations are reviewed with management for approval of the non-conformity price adjustments and final approval of the bid slates. Approved EPC bidders are then requested to submit the priced proposals. These submittals include a lump sum price and an EPC completion schedule guarantee. Plant performance guarantees and the schedule completion guarantee are each backed by a schedule of liquidated damages (escalating penalties) in the event of non-performance. Plant LNG capacity is measured by a plant performance test conducted within a specified time after startup (typically on the order of 6 months). The Priced Proposals are evaluated and the price adjustments from the unpriced proposal evaluations are applied. The overall evaluation is then assessed, and a recommendation prepared for EPC contract award. This process may require going back to the EPC contractors for some final clarifications, but generally, this priced evaluation can be accomplished within 1 to 2 months.

The EPC award to the successful EPC contractor is not made until the other necessary conditions for the final investment decision (FID) have been achieved and the FID decision taken. These other conditions include:

- government approvals, including passage of any enabling legislation;

- execution of sales and purchasing agreements (or alternately, binding heads of agreements);

- financing agreements.

The lack of any of these other necessary agreements can hold up the final investment decision and the subsequent EPC award.

Final Investment Decision (FID)

The final investment decision (FID) is the decision to make a final commitment to the project, including the financial commitment to award the EPC contract and the satisfaction of conditions precedent in the LNG SPAs. This decision by the project partners requires:

- the prior completion of all necessary government agreements, including complete fiscal terms and passage into law of all required enabling legislation and land allocation and access;

- financing commitments provided to the project by the lenders, including export credit agencies, multilateral development banks, commercial banks, and other lenders.

EPC Stage

The EPC contractor is required to provide a project execution plan (PEP) which shall include:

- the detailed engineering specifications, the procurement plan;

- the construction plan;

- health, safety, and environment (HSE) plan;

- as well as quality assurance, project management, and project control aspects.

Engineering

The EPC contractor uses the FEED work as the starting point to carry out detailed engineering and design needed for construction, utilizing appropriate design specifications, material specifications, and construction specifications. In addition, detailed engineering requires the application of a safety-in-design process, a safety-in-review process (HAZID), and a hazardous operations plan (HAZOP).

EPC contractors generally have fairly complete databases detailing cost and deliveries for major equipment that they have compiled prior to submitting their bids. During periods of high industry activity, there can be shortages even of common equipment, such as normal valves (Australian Gorgon experience) and price spikes for such materials as copper or specialized alloy cryogenic materials, such as the nickel-chrome alloy used in the LNG storage tanks.

Considerations should be given to ordering materials and equipment in advance, where warranted to maintain or improve schedules. Some major equipment, such as the refrigerant turbines, can generally be ordered with a schedule of cancellation costs. The costs are generally low during the first 6 to 9 months since they only represent engineering costs and therefore have only limited exposure for the company if cancellation is required during that time frame. Engineering work and procurement work should be done in the same office to ensure proper coordination.

Construction

This part of the EPC phase typically takes 4 to 6 years. It is performed at the plant site, except for those plants that are modularized, (i. e., have their main equipment placed inside modules that are fabricated in offsite fabrication yards such as those in Korea or China).

During the first 16 months, EPC contractor focus is on Engineering and Procurement in the contractor’s home office. Meanwhile, initial mobilization on the plant site is focusing on site clearance and road construction.

After 16 to 20 months, the majority of project activities shift from home office to the site. Approximately 5 000 to 8 000 workers may be required. Initial activities include:

- Building the large construction camps.

- Arrival of concrete batch plants on site.

- Construction of foundations.

- Construction of pipe racks (supports).

With the availability of the construction camps, the mobilization of large numbers of workers can occur. Equipment delivery on site occurs between the 30th to 45th months. Then installation of equipment and running piping on pipe racks can begin.

Commissioning of plant equipment can begin between the 12th and 18th months before start-up. The first major equipment to be commissioned and started up is the power generation system.

After the plant is mechanically complete, and after equipment commissioning is completed, the plant is ready for the introduction of the natural gas feedstock. Start-up can range from two to as long as six months or more if there are problems. Typically it takes about six months for the plant to ramp up to its full capacity.

After the plant is operating at full capacity and operations are stable, the plant performance and acceptance tests are conducted by the company jointly with the contractor. Any deficiencies found that are covered under the guarantee provided by the contractor, must be corrected by the contractor before the company accepts the plant as complete and final payment is released.

LNG Technology

The production of LNG from natural gas is based on three main processes:

- gas treating;

- dehydration;

- and liquefaction.

Treating results in the removal of impurities from the raw gas and these comprise entrained particulate matter, mercury, and acid gases such as H2S and CO2. The chilling or liquefaction process is the conversion of the treated and dehydrated gas into liquid by refrigeration of the gas down to a temperature of about -162 °C (-240 °F). There are two main commercially available processes for liquefaction, the Cascade process and the Air Products (APCI) C3MR process which employs a combination of propane and mixed component refrigeration (C3MR process). Most of the LNG trains in operation employ the Energy consumption Optimization and Improvements in the Natural Gas Liquefaction ProcessAPCI technology rather than the Cascade process (about 80/20), due to the number of trains built pre-1995 employing only the APCI process. Since then, the ratio of APCI trains to Cascade process trains has changed to about 65:35, based on capacity. There is not a large advantage to either major technology.

The most common liquefaction process currently used for land-based LNG plants is the APCI–C3MR. The feed natural gas stream is essentially pre-cooled with a propane refrigerant and the liquefaction is completed with a mixed refrigerant of Nitrogen (N2), Methane (C2), and Propane (C3). The C3MR technology is well-known and has high efficiency, ease of operation and reliability, with the use of readily available refrigerant streams. However, the use of propane as a key refrigerant requires some risk mitigation due to flammability concerns, especially at low points, and this is reflected in the plant design by locating the refrigerant storage tankage at some distance from the main process.

The Cascade process typically employs three pure refrigerants, such as methane, ethylene, and propane. The feed stream is first is cooled to about -35 °C in the propane cycle, then it is cooled to about -90 °C in the ethylene cycle, then finally it is liquefied to -155 °C in the methane cycle.

LNG Technology has generally followed an evolutionary path rather than one of radical, rapid changes. Over the last 30 years, the size of LNG plants has grown from 2 MTPA to as much as 7,8 MTPA (size of the large Qatar trains), with attendant economies of scale – though required specialized equipment and materials and large required gas reserves for the 7,8 MTPA size make facilities of this size difficult to replicate. The current standard size is about 5 MTPA. The size increase has resulted from the availability of large size gas turbines for refrigerant service.

The evolutionary approach has served the industry well. The well-established LNG technology has given LNG EPC bidders the confidence to bid on a lump sum turnkey basis, increasing the execution certainty of the companies developing LNG plant projects.

Innovative technology continues to appear on this evolutionary track; the recent use of aero-derivative turbines in LNG plants is an example. Use of aero-derivative turbines reduces plant fuel consumption by about 10 % and improves plant up-time by about 2 % through avoidance of the long downtime maintenance cycles associated with the frame industrial turbines. The first use of aero-derivative turbines was in the Conoco LNG plant at Darwin, Australia. The second use was in the ExxonMobil LNG plant in Papua New Guinea which started up in 2015.

A company’s project manager charged with executing an LNG Plant project on budget and on schedule generally prefers that there be only limited use of new technology and that it has first been utilized at other sites; i. e., only limited or no use of «Serial No. 1 technology».

Read also: Project Management of the Large-Scale Liquefied Natural Gas Facilities

Modularized LNG plants have been utilized in selective locations in recent years at locations such as Gorgon LNG and Pluto LNG with mixed results. They require earlier and more complete engineering during the EPC phase for the use of the fabrication yard in the module fabrication. Any delays in the engineering and procurement work can be very disruptive to the module fabrication work, so some additional execution risk is introduced. Large modules can also be difficult to offload and transport.

Schedule Estimate

With the gas resources already defined, the estimated time for execution of an LNG export project could range from 6-10 years, assuming no interruptions. As expected, many unforeseen developments can occur during project implementation which can impact the schedule, so contingencies are normally factored into the indicated schedule range. Schedule discipline should be maintained throughout the project. Schedule recovery options should be identified to mitigate delays. Change management must also be employed to minimize changes since any changes will impact the schedule and almost always add cost. It is important to optimize the engineering, procurement and construction schedules to minimize the number of critical path items for the project. Delays in the overall project schedule result in liquidated damages for the contractor (giving the contractor incentive to complete the project on time). It is a requirement for the EPC contractor to develop a level 4 project schedule (Primavera) as a guide throughout the project.

Key Success Factors

Some important factors contributing to the success of the LNG project include:

- Government support, timely issuance of permits and authorizations, timely access to the plant construction site.

- A complete set of geotechnical data from an adequate number of bore holes on the plant site to determine soil conditions and allow proper foundation planning or soil remediation if required. Seismic information to evaluate potential earthquake problems is also necessary.

- A well-qualified and experienced LNG EPC contractor. Key EPC personnel assigned to the project must be capable and experienced in the LNG area.

- EPC contract should be lump sum turnkey to increase project certainty:

- Ensures contractor has ‘skin in the game’ and is aligned with the company in being highly motivated to keep costs under control and project on schedule.

- Needs to be turnkey to provide contractor the latitude he needs to perform in order for him to take on the obligation of a lump sum contract.

- Company and EPC contractor relationship needs to be collaborative.

- EPC contractor needs to evaluate and formally endorse the company’s FEED design (Design Endorsement Certificate). If he finds an issue with the FEED, he is to propose and agree with the company on a proposed remedy to the FEED, and then provide the formal endorsement. This is important so as to avoid future costly change orders due to later design changes.

- Minimize change orders in the EPC no matter how attractive they may appear.

- Maintain focus on safety in all aspects of the LNG project. Maintain a strong, proactive, involved safety program in collaboration with the contractor.

- In the EPC contract, secure strong guarantees on:

- LNG plant production capacity.

- Fuel consumption.

- LNG product quality meeting all specifications.

- Plant completion schedule.

- All other products or emissions must meet specifications.

- Completion guarantees.

- LNG partners need to be fully aligned throughout the project development phase.

- Take measures, where available, to increase project execution certainty.

- Embrace new technology but on a measured basis. Avoid «Serial No. 1» unproven applications which almost always result in delays and increased costs.

- Implement an effective training program to facilitate utilization of local labor in the construction and operation of the LNG plant.

- Persistence and patience are critical – LNG plants are challenging and complex and take some time to implement.

- Keep the project as simple as possible.

- Recognize other associated investment opportunities that may be available with the LNG project, such as natural gas liquids extraction, helium recovery if it exists in the feed gas (the LNG process increase the concentration of helium 10-fold, and can make its recovery economic, as was the case in Qatar), potential for domestic gas deliveries for power generation, and so on.