LNGC Longevity is a crucial aspect of the shipping industry, particularly as it navigates the evolving landscape of energy transportation. Advances in technology have significantly improved the durability and efficiency of LNGC kits, allowing them to withstand varying operational demands. As the US shale revolution reshapes the market, the need for resilient LPG carriers is more pressing than ever.

Furthermore, the rise of ethane gas carriers highlights the industry’s adaptability to new fuel demands and regulations. By focusing on LNGC longevity, stakeholders can ensure safer and more sustainable operations in the long term. This emphasis on durability not only benefits operators but also supports broader environmental goals within the energy sector.

Long shelf life for original LNGC kit

The durability of the cargo-handling equipment on the early LNG carriers highlights the sound engineering principles on which the suppliers based their designs.

In discussions on the various early LNG carrier designs, the emphasis has always been on the relative merits of the rival cargo containment systems. Engineering components like:

- cargo pumps;

- compressors;

- valves;

- gauges and control systems;

so vital to the safe and effective operation of the vessels, rarely get a mention.

Many of the essential pieces of cargo-handling equipment developed for the early LNG carriers enjoyed universal applicability, irrespective of the ship’s chosen containment system. And many of these pioneering equipment items are still around today, albeit in scaled-up versions. Their longevity bears testimony to the sound engineering principles and innovative technology on which the design of the original equipment was based.

One good example is the submerged electric motor pump (SEMP). Without these sophisticated cargo pumps, with the ability of their motors to operate within the liquid cargo, the progress from original experimental LNG vessels to the modern ships of the 266 000 m3 Q-max size would not have been possible.

The original JC Carter cryogenic centrifugal pump was developed in 1947 in support of the US government’s early rocket programmes. The pumps were used to feed liquefied gas fuel to the rocket engines. James Coolidge Carter conceived the idea for a SEMP for liquefied gas service at his factory in Costa Mesa, California in 1958.

SEMPs have a major safety advantage over their external motor counterparts in that there is no need for a shaft to penetrate the tank, thus eliminating mechanical seals. Another advantage of integrating the pump and motor into a single unit with a common shaft is that coupling and alignment issues are removed. As hydrocarbons are dielectric fluids, electrical cables and the motor itself can be safely surrounded by LNG.

Deepwell pumps had been fitted on Methane Pioneer for its historic trial voyages in 1959 but such units proved not to be ideal in LNG service as the temperature differential between the tank and the external atmosphere had a tendency to cause the shaft to bind.

The first shipboard JC Carter SEMPs were installed in one of the three Best Practices for Gas Tank Installation and Cargo Tank Insulationcargo tanks on the experimental 640 m3 LNG vessel Beauvais, the conversion of which was completed in February 1962. The tests proved to be satisfactory and a shipset of nine JC Carter SEMPs was ordered for both Methane Princess and Methane Progress. Each cargo tank on the vessels was fitted with a single pump with a capacity of 205 m3/hour. A secondary gas lift pumping system was itted on the deck. Mr Carter himself was amongst the distinguished guests present at Canvey Island in October 1964 to welcome the arrival of Methane Princess from Algeria with the first commercial LNG cargo.

Early on in the evolution of LNGC design it was decided that two cargo pumps per tank offered the optimum arrangement for timely and efficient cargo discharges. JC Carter was to become the market leader for SEMPs for LNG carriers over the next two decades.

Honeywell was another US supplier of equipment to Methane Princess and Methane Progress. A Honeywell 320 point data logger was installed in each vessel’s main cargo control room for recording temperatures from the cargo tank surfaces, the insulation and the hull structure. The data recorded was transferred to a strip printout sheet for onboard use and a punched tape for computer analysis ashore.

Foster Wheeler provided two of its ESD II main boilers for each of the steam turbine-driven Methane Princess and Methane Progress. The units were the first to utilise cargo boil-off gas (BOG) on an LNG carrier, and the combustion system was designed to burn fuel oil, methane BOG or a combination of both. Foster Wheeler was responsible for the boiler design and the engineering of the firing equipment, automatic controls and the boiler instrument panel.

The Scottish engineering firm Munro & Miller of Edinburgh was another supplier. Five years earlier the company had provided 150 mm and 200 mm diameter expansion joints for the cargo piping systems on Methane Pioneer. The success of that vessel’s trial shipment programme prompted Conch Methane Services to order a total of 190 Munro & Miller expansion joints for Methane Princess and Methane Progress. The equipment accommodated the thermal expansion and contraction of the vessels’ fixed piping systems.

The company’s success in the LNGC field continued when it was contracted to supply 555 expansion joints of between 50 and 400 mm in diameter for the cargo piping systems on the four 41 000 m3 Esso Brega-series ships built in Italy and Spain later in the 1960s.

The most common liquid level float gauge on the early LNG carriers was from Whessoe Systems and Controls of Darlington in the north of England. The Whessoe float gauges that had been widely used on pressurised LPG carriers required some changes to component materials to ensure suitability for the new LNG application. LNG carriers must also have in place a secondary means of top level measurement and on the early vessels this was achieved through the provision of a toughened glass sight gauge in the cargo tank dome with a measuring scale visible below inside the tank.

The distinctive shape of the Luceat pilot-operated safety relief valves (SRVs) arranged in pairs on LNG carrier cargo tank domes was first seen on Jules Verne. The pioneering French ship was fitted with 14 such SRVs, two per cargo tank and each 6 inches in diameter. The relatively low maximum design pressure employed for fully refrigerated LNG carrier cargo tanks requires accurate and delicate pressure control. With the Luceat valve the tank pressure was determined by a pilot diaphragm with a large surface area to amplify any small variation in the tank pressure. The valve was of rugged construction, the delicate pilot diaphragm being fully integrated into the valve housing head. Most of the early LNG carriers built in Europe were fitted with Luceat pilot-operated SRVs.

French engineering components were encouraged and commonplace on Jules Verne. The vessel was fitted with two 450 m3/hour stainless steel Guinard SEMPs in each of its seven cargo tanks. Having been successfully tested on Beauvais, Hibon Pompes Roots blowers were installed on Jules Verne to supply boil-off vapour to the boilers and for gas-freeing cargo tanks. Hibon supplied a wide range of Roots blowers to many of the early European-built LNG carriers with the French membrane cargo containment systems.

Another two companies whose names were to become familiar in LNG circles were associated with the construction of the independent, prismatic-shape cargo tanks for the four ships in the Esso Brega series. Chicago Bridge & Iron (CB&I) built the four double-walled cargo tanks required for each ship in Italy, using aluminium supplied by Kaiser. Air Liquide contributed a 22 000-litre nitrogen tank for each of the quartet, for purging and inerting the cargo tanks’ inner barrier spaces, hold void spaces and cargo compressors.

Two centrifugal compressors manufactured by Paul Airco Cryogenic of California were fitted in a deckhouse room within the cargo area on each of the four Esso Brega series ships. Driven by a coupled steam turbine, the compressors were used to deliver cargo BOG to the main boilers. The Airco package for each vessel included two cargo heaters, a control panel and associated equipment. MSA of Pittsburgh supplied a fixed Guide for LNG Maintenance and Operation – Standards, Systems, and Safetygas detection system in the cargo control room on each of the Esso ships.

The breakthrough order for Gaz Transport, when it was contracted to supply its membrane containment system for the 71 500 m3 Polar Alaska and Arctic Tokyo building at Kockums in Sweden, brought the manufacturers of non-traditional shipbuilding materials into the LNG arena for the first time. The key components of the ships’ Gaz Transport system were the invar primary and secondary barrier material and the plywood boxes filled with perlite used as insulation.

The 36 percent nickel steel alloy invar had been developed in the 1920s by the Imphy Division of Société des Forges et Ateliers du Creusot (SFAC) as a material with a very low coefficient of thermal expansion. The only manufacturer of invar, the Imphy steelworks had to step up production to deliver the required sheets for Polar Alaska and Arctic Tokyo.

Kockums contracted the Finnish company Kaukas to supply the containment system’s perlite-filled plywood boxes. The loose perlite was not the easiest material to handle and protective masks and gloves were needed. The factory workers called this irritating material French snow. Kaukas was to become a key supplier of plywood boxes to Gaztransport and Technigaz (GTT) in later years.

Although LNG carrier construction has now switched from Europe and the US to Asia, many of the original component manufacturers are still supplying their specialist equipment to the sector. While some may be operating under different names, they continue to promote the same proven technologies that have stood the industry in good stead over many years, sometimes as many as 50!

25 YEAs of LNG EXPORT. As the largest carrier of LNG from Australia, the North West Shelf Shipping Service Company has safely and reliably delivered more than 4 000 LNG cargoes to the North West Shelf Projects’ Asian customers since 1989.

Today’s LPG and ethylene carriers stem from many starting points. The genesis of today’s LPG and ethylene carriers was peopled by as many pioneers as the LNG carrier sector, and often their paths would intersect to mutual benefit.

Because of the simplicity of the design and the range of worldwide trading opportunities, more fully pressurised (FP) LPG carriers have been built than any other type of gas carrier. The FP fleet is engaged in the distribution of liquefied gases to virtually every country with a coastline. FP ships are amongst the smallest of the gas carriers and tend to serve regional trades.

The design parameters for pressurised cargo tanks remain as they were in 1934, when the first riveted types were installed on board the pioneering Shell tanker Agnita. Because the tanks are essentially pressure vessels for carrying cargoes under pressure at or near ambient temperature, mild steel is used as the tank material and no tank/piping insulation or reliquefaction plant is required. Tanks are designed typically based on a minimum cargo temperature of –5 °C and maximum design pressures between 17 and 18 barg (1 800 and 1 900 kPa).

Trade routes in the 1950s and 1960s – the real formative years of LPG transport – fell into two categories and influenced ship design. First the oil majors, anxious to make use of the LPG produced by their oil refineries, looked at ways of moving all the products of the refining process to market. This resulted in the development of combined oil/LPG carriers and oil tankers with additional deck pressure vessels for LPG. The second basic ship type was the small dedicated LPG carrier specifically built to supply remote coastal and island communities with gas for use as a fuel.

A key early ship in the annals of LPG transport history was the 6 050 m3 Natalie O Warren. This vessel, a former CA-I type cargo ship named Cape Diamond, was converted at the Bethlehem Steel yard at Beaumont, Texas in 1947 for Warren Petroleum, a subsidiary of Gulf Oil. Natalie O Warren was provided with 68 vertical, cylindrical cargo tanks. Elsewhere in the US in 1947 and 1948 Esso modified its oil tankers:

- Esso Sao Paulo;

- Esso El Salvador and Esso Brazil;

by installing pressurised tanks formative LPG in part of the oil cargo spaces below the main deck.

A number of European companies also entered into LPG transport by sea in the years immediately after World War II. Norsk Hydro took delivery of the 1 454 m3 anhydrous ammonia carrier Hydro in 1950. This conversion, by the Marinens shipyard in Norway, had 20 cylindrical cargo tanks and traded between Hydro’s plants.

In Denmark the Tholstrup family LPG business had started in 1941 based on the import of LPG from Poland and Germany using railway tank wagons. In 1951 Tholstrup contracted the Svendborg shipyard to convert the small coaster Morild to the 129 m3 Kosangas by installing a single horizontal cargo tank.

Italy introduced LPG distribution in the Mediterranean. In 1953, to enable the carriage of LPG from the mainland to Sicily and Sardinia, a small coaster was converted to the 540 m3 Flavia Bonfiraro, A year later another conversion, the 315 m3 Cornelia, entered service; she was provided with onboard bottle-filling equipment as there was no shore storage.

In 1954 the 817 m3 Cap Carbon, built by the Dutch shipyard Foxhol and fitted with 14 vertical cylindrical tanks, opened a new trading route from a facility near Marseilles in southern France to Arzew in Algeria.

In 1955 two European oil majors took delivery of their first purpose-built LPG vessels. The French yard La Ciotat built the 1 390 m3 Butagas, with 36 cylindrical cargo tanks, for Maritime Shell while in Germany the Ottensener yard constructed Neviges and Langenburg, a pair of 2 580 m3 sisterships, each with nine cargo tanks, for British Petroleum.

The Dutch Bijkers yard made two contributions to the early fleet of LPG carriers with the 2 006 m3 Marion P Billups in 1956 and the 3 178 m3 Fred H Billups in 1960. Both ships were for Marine Caribbean Lines, a subsidiary of New York-based Marine Transport Lines, and were fitted with 19 vertical cylindrical tanks.

The conversion of the cargo ship Haut-Brion to the 1 012 m3 LPG carrier Loex by the INMA La Spezia yard in Italy on behalf of Gazocéan in 1958 represented a significant design change in terms of cargo tank orientation. The nine cylindrical pressure vessel cargo tanks on this ship were horizontally mounted.

Japan was in the vanguard in introducing LPG transport to Asia. In 1960 L P Maru No 1, with 13 vertical cylindrical tanks, was delivered to Nippon Ekika Gas Yuso by the Harima shipyard in Aioi. This 990 m3 ship also had a horizontally mounted tank on the main deck forward which was used to discharge each of the other tanks using two compressors and an electric cargo pump.

The combined oil/LPG carrier Esso Puerto Rico, built in 1958 by Cantieri Riuniti dell’Adriatico in Italy, was able to carry 12 788 m3 of LPG and was the largest ship ever built with fully pressurised LPG tanks. The ship configured with the typical «three island» oil tanker profile of the time, had a forecastle, a bridge deckhouse over the cargo tanks and a poop. Esso Puerto Rico could carry 33 600 m3 of oil in the lower wing tanks, while 40 of the ship’s 58 pressure vessel tanks were positioned vertically in the centre tanks and 18 horizontally in the upper wing tanks.

How do modern FP LPGCs differ from the pioneering vessels of this type? The main difference is that now two or three horizontally mounted tanks are the preferred arrangement rather than the multiple numbers of vertical tanks. Also tank thicknesses have increased, enabling considerably larger individual tank capacities as a result. Another significant change is that most modern carriers have deepwell pumps to discharge the cargo rather than using compressors and booster pumps.

Looking to the future there is every indication that in coming years there will still remain more fully pressurised LPG carriers in service than any other type of gas carrier due to not only their versatility and simplicity of design but also the nature of market demand.

In terms of cargo-handling characteristics the semi-pressurised/fully refrigerated (semi-ref) LPG carrier is a more technically challenging gas ship to operate than the simple FP LPGC.

From the mid-1950s to the mid-1960s a great deal of research was carried out in Europe on onboard refrigeration in order to enable the carriage of larger volumes of LPG in lighter weight tanks. The experiment that was to lead to the successful refrigeration of LPG carrier cargoes was carried out in France in 1958 when a 40 m3 pressurised cargo tank on board the fully pressured 1 390 m3 Butagaz, the first ship to be built at La Ciotat, was specially insulated. Then, through the use of a gas compressor, the cargo in this tank was cooled. The tank in question was one of 36 vertically mounted, pressurised cylindrical tanks on board the ship.

As a follow-up an order was placed at La Ciotat by Gazocéan for the 920 m3 Descartes. All the tanks on the ship were modelled on the Butagaz experimental tank. Descartes was to be the first semiref LPG carrier.

In the years immediately following the French breakthrough other European shipyards converted or built relatively small LPG carriers with a cargo refrigeration capability, each one experimental in its own way. Tank pressures varied in the range 5–9 barg (600-1 000 kPa) and, depending on the products carried, different minimum design temperatures were specified for these early refrigerated ships, including:

- 0 °C;

- –10 °C;

- –25 °C;

- –30 °C;

- and –34 °C.

A major decision was made by the classification societies in 1966 when they specified that, subject to strict requirements for the gas-handling and storage arrangements, a semi-pressurised LPG carrier could carry fully refrigerated cargoes without a secondary containment system barrier.

This ruling cleared the way for a busy few years, beginning in 1967 when the first semi-ref LPG carriers were delivered. The tanks on these ships were designed for the carriage of liquefied propane at its atmospheric-pressure boiling point of –48 ˚C.

A considerable change of direction occurred in 1976. The publication of the then IMCO Code for the Construction and Equipment of Ships Carrying Liquefied Gases in Bulk required a rethink on design as ships with large, above-deck tanks could not satisfy the damage stability requirements of the Code. Transversely mounted, below-deck, cylindrical tanks and longitudinally mounted, below-deck, bilobe tanks were two of the solutions used to improve ship stability.

Some noteworthy series designs were completed in Europe. Moss Værft delivered the 12 060 m3 Inge Maersk to A P Møller in 1972 as the first of nine-ship series. The Jos L Meyer shipyard was rebuilt to enable it to win an order for six 12 000 m3 semi-ref LPG carriers from Latvian Shipping. The first, Yurmala, was delivered in 1975 and all were fitted with three bilobe cargo tanks. In 1981 the Danish yard of Odense at Lindo completed the 15 070 m3 Sally Maersk as the first of six semi-ref LPG carriers for its A P Møller parent company.

The first South Korean yard to enter this niche market was Hyundai Heavy Industries (HHI) when its Ulsan yard delivered the 4 415 m3 Greta Kosan in 1990, one of a pair for Kosan Tankers of Denmark. China took its first step down the semi-ref path in 1996 when the Shanghai Edward yard built the 3 200 m3 Coral Obelia for Anthony Veder.

«The apple does not fall far from the tree», is an old adage that springs to mind when considering the small-scale LNG/ethylene/LPG carriers which are currently joining the LNG fleet in increasing numbers. This multi-gas carrier concept was exactly the approach taken in the early 1960s when designers were competing to find the best way to transport LNG by sea safely and economically.

The initial ethylene trade routes were established around the coasts of Europe, Mexico and Japan. In addition to the cargoes carried by a semi-ref LPG carrier, a typical liquefied ethylene gas carrier (LEGC) could also trade with ethane, ethene and ethylene, ensuring the longest cargo list of all the gas carriers.

Ethylene ships have incorporated a grand variety of cargo tank shapes over the years, including spherical, prismatic and membrane versions and longitudinally and transversely mounted cylindrical and bilobe types. Cargo tank materials compatible with the -104 °C boiling point carriage temperature of ethylene have included aluminium alloys and 5, 9 and 36 percent nickel steels.

In May 1964 Pythagore, a 630 m3 experimental LNG/ethylene/LPG carrier, was delivered to Gazocéan by Ateliers et Chantiers du Havre in France. The first ethylene carrier built in Japan was the appropriately named Ethylene Maru № 1, which was delivered to Ishikawajima Ship and Chemical Company in Tokyo in 1965.

Also in the mid-1960s the Scottish shipowner George Gibson received a contract to ship ethylene for Imperial Chemical Industries (ICI) from Teesside in the UK to Rozenburg, near Rotterdam. This deal resulted in the delivery, in July 1966, of the 833 m3 Teviot and, later in the same year, the 824 m3 Traquair from the Burntisland shipyard in Scotland. This pair of fully refrigerated ships each had a single prismatic aluminium-magnesium alloy cargo tank extending in a sloped fashion above the main deck.

In September 1966, on the other side of the North Sea at Bremen, AG Weser delivered the 824 m3 Lincoln Ellsworth to Oslo shipowner Einar Bakkevig. Like Teviot, Lincoln Ellsworth was fitted with a single, fully refrigerated cargo tank.

During the 1967-70 period Japanese shipyards flexed their muscles with eight LEGC deliveries. The Sumitomo yards built the experimental 785 m3 Ethylene Daystar in 1968 and the 1 188 m3 Ethylene Dayspring in 1969 for Daiichi. Each ship had two aluminium membrane cargo tanks developed by Bridgestone, utilising 3 mm thick plate, and the cargo tank area was protected by a double hull.

European shipbuilders introduced more LEGC variations at the start of the 1970s. The Hebburn shipyard of Swan Hunter in the UK delivered the fully refrigerated 3 344 m3 Emiliano Zapata to Petroleos Mexicanos in 1970. Another Technigaz prototype for Gazocéan, the 4 073 m3 LNG/ethylene/LPG carrier Euclides, built at Le Havre in 1971, was the first LNG carrier with spherical cargo tanks and the first without a secondary barrier. German shipbuilder Heinrich Brand in Oldenburg delivered the 2 741 m3 Melrose with aluminium bilobe cargo tanks in 1971. The ship was the first in a series of five LNG/ethylene/LPG carriers for George Gibson and Bernhard Schulte from Brand but none of the quintet ever carried LNG.

Moss Verft in Norway introduced what was to be the first in a long line of successful LEGC designs in 1971, through the delivery of the 4 100 m3 Roald Amundsen for Einar Bakkevig. To round off 1971, a remarkably varied 12 months for LEGC newbuildings, the Yokohama yard of Mitsubishi delivered the 1 120 m3 Shinryo Ethylene Maru, a ship with two Technigaz membrane tanks, to Shinwa Chemicals.

In 1972 Italy completed its first ethylene carrier, the 1 100 m3 Capo Verde. In 1974 Hitachi’s Innoshima yard delivered the 1 106 m3 Sankyo Ethylene Maru, a unique experimental LNG carrier embodying two different cargo tank systems. The forward aluminium spherical tank was based on a Chicago Bridge & Iron design, and the aft 9 percent nickel steel prismatic tank had a part-Exxon pedigree.

The Spanish built a prototype LNG/ethylene/LPG carrier, the 4 936 m3 Sant Jordi, to a design by Sener at the Tomas Ruiz de Velasco yard in Bilbao in 1976. Constructed with four spherical, 9 percent nickel steel cargo tanks, the ship was used in the transport of ethylene and LPG as no employment could be found for it in the LNG trades.

By the mid-1970s the experimenting in LEGC construction had stopped and an ever-increasing number of shipyards, particularly in Germany and Italy, successfully built semi-ref ethylene carriers with independent cargo tanks of similar design. The capacity of these ships has risen steadily, culminating in the 22 000 m3 Navigator Mars and her four sisters delivered by the Jiangnan yard in China, beginning in the late 1990s.

The series production lines and full orderbooks for fully refrigerated LPG carriers (FRLPGCs) in China, Korea and Japan are in stark contrast to the one-off, pioneering designs of such ships developed in Europe and Japan four to five decades ago.

What progress, in terms of ship design, has been made in the intervening years? All FRLPGC carriers completed in the last 25 years, be they sized at 22 500, 35 000, 60 000, 78 000 or 84 000 m3, are built to virtually the same design concept. Looking at a cross-section of a modern FRLPGC in way of the independent prismatic cargo tanks will reveal a double bottom and upper and lower side water ballast tanks. The IMO Type A cargo tank is constructed with low temperature steel suitable for a minimum temperature of –48 °C and a maximum pressure of about 0,25 bar (25 kPa). Insulation is fitted externally on the cargo tank.

In order to provide a secondary barrier within the ship’s overall cargo containment system, the transverse bulkheads between the cargo tanks, the inner bottom, the side ballast tank boundaries, the side hull and the main deck at centre are constructed with the same low temperature steel as the cargo tank. The cargo tanks are held in place with a system of chocks and supports to prevent movement when the ship is underway.

This basic approach to FRLPGC cargo containment has been around for a long time. The first LPG carrier utilising the side hull as the secondary barrier was the 29 540 m3 Antilla Cape, built in 1968 at AG Weser yard in Germany.

French engineers had earlier made the breakthrough in refrigeration technology needed to enable the carriage of LPG in ships in a fully refrigerated state. In 1961 the product tanker Iridina was converted at the La Ciotat yard and the resultant ship was able to carry up to 10 800 m3 of refrigerated butadiene or butane at near atmospheric pressure.

The first purpose-built FRLPGC was the 28 837 m3 Bridgestone Maru, delivered from the Yokohama yard of Mitsubishi Heavy Industries (MHI) in 1962. The shipowner and yard adopted a conservative approach for most aspects of the ship’s design.

Cargo tanks with above deck trunks were a distinctive, early feature of European designs. Kockums in Sweden delivered the 25 100 m3 Paul Endacott in 1964 based on a design by Marine Service GmbH of Hamburg, while Norway’s Moss Verft completed its first FRLPG, the 11 070 m3 Havgas, in 1965. Hawthorn Leslie in the UK delivered the 11 750 m3 Clerk-Maxwell to Nile Steamship in 1966 and Spanish builders Euskalduna delivered the 11 200 m3 Alexander Hamilton to A L Burbank in 1968. Also in 1968 the Kiel yard of HDW completed the 18 300 m3 Roland, another FRLPGC constructed to the trunk deck design.

Elsewhere certain designers were beginning to question whether the trunk deck feature was all that advantageous. The cargo tanks on trunk deck-type LPG carriers, with their many radius tank corners, were difficult to build. In order to cut costs the now «standard design», with the side hull as the secondary barrier, was introduced and quickly gained in popularity.

French engineers had one or two ideas of their own. The La Ciotat yard decided that surrounding the cargo tanks with loose perlite insulation was a good design feature and delivered the 14 300 m3 Capella, the first FRLPGC with this type of insulation, to a company affiliated with Gazocéan in 1967.

FRLPGC innovation was also taking place in Japan during the early days of LPG transport. In 1969 Bridgestone Liquefied Gas cooperated with Kawasaki Heavy Industries in the design and construction of the 72 300 m3 Bridgestone Maru № 5, the first ship built with the award-winning KASMET IMO Gas Code – Detailed Overview of the Gas Tank Rulessemi-membrane cargo tank system.

Six semi-membrane tanks for propane were arranged in pairs over the ship’s parallel midbody while ship-shape, integral tanks for butane were arranged forward and aft of the propane tanks. Bridgestone Maru № 5 had a double bottom and double side hull. The ship’s semi-membrane tanks were cubeshaped, with all the edges rounded, and anchored at the top under the cargo dome. Eight FRLPGCs were built with KASMET semi-membrane tanks.

During the 1970s Norwegian, Finnish, French and Polish shipyards constructed 24 000, 52 000 and 75 000 m3 FRLPGCs to designs developed by Kverner Moss. At about the same time in Japan Mitsubishi and Shell pioneered an internal insulation system. This was installed on three ships built at MHI’s Yokohama yard, beginning with the 77 400 m3 Pioneer Louise in 1976, but the concept did not prove successful.

MHI transferred the construction of FRLPGCs to its Nagasaki yard in the early 1980s. In 1989 the yard delivered Nichiyuh Maru, the first ship built to Mitsubishi’s standard 78 000 m3 V-Series, to Yuyo Steamship.

Over the past 45 years fully refrigerated LPG carriers have been built at a myriad of shipyards in Europe and Asia. Today, however, such vessels are only built in Asia at eight yards – two in Japan (MHI and KSC), two in Korea (HHI and DSME), three in China (Jiangsu, China Shipbuilding and Jiangnan) and one in the Philippines (Hanjin).

US shale revolution sweeps up LPG carrier fleet

The surging output of US shale oil and gas is proving to be a game changer for not only LNG ships but also all types and sizes of LPG and chemical gas carrier.

Shipowners poised to benefit from the US shale gas revolution are not limited to those in the LNG sector. Because shale gas, and shale oil, are rich in natural gas liquids (NGLs) and because the volumes being produced are rising rapidly, US exports of the principal NGL fractions propane and ethane are set to climb.

These products are also providing US petrochemical manufacturers with cheap feedstocks and boosting their competitiveness in the world marketplace. There are currently 11 major projects underway in the US to either expand existing chemical plants or build new ones to run on ethane feedstock. These developments, in turn, will support resurgent US chemical exports, including of chemical gases such as ethylene.

As a result, the US shale boom is going to reverberate throughout all the gas shipping sectors, not just LNG. In fact LPG carriers are already accruing benefits. Whereas the first US exports of LNG derived from shale gas are not due to begin flowing until late 2015, LPG loadings for overseas customers are already on the rise.

After a decade in which LPG import outweighed exports, the US became a net exporter of LPG once again in 2011 and seaborne shipments are forecast to grow strongly in the years ahead. The US exported 9 million tonnes (mt) of LPG in 2013, about 75 percent ahead of the level recorded in 2011.

Propane accounts for 90 percent of this traffic and butane 10 percent. With propane in Houston now costing about 60 percent of that in Japan and the US market for propane currently oversupplied, it is not difficult to appreciate the overseas interest in US product. US exports are driving the demand for new very large gas carriers (VLGCs) and supporting the healthy freight rates commanded by the ships in the existing fleet.

Falling in the 75-85 000 m3 size range, VLGCs are the largest LPG carriers afloat and the gas shipping industry’s workhorses when it comes to transporting large volumes of propane and butane over long distances. The 156-vessel VLGC fleet transports LPG as fully refrigerated cargoes. The current VLGC orderbook stands at a massive 82 such vessels.

Approximately 90 percent of the US LPG export cargoes are shipped from Gulf Coast terminals. Existing Gulf LPG terminals are being expanded and new facilities are under construction to cope with the growing export volumes. The terminal expansion projects will help US LPG exports reach an estimated 13,5 mt in 2014 and rise to a possible 21 mt in 2017.

At the moment, most of the US exports are shipped to customers in Latin America and Europe. However, given the relatively low price of US LPG and rising local demand, it is hardly surprising that Asian buyers are becoming increasingly interested in the VLGCs cargoes loading on the Gulf Coast.

The opening of the enlarged Panama Canal in 2015 will help trim the shipping costs associated with these long-distance deliveries. In terms of Panama Canal transits VLGCs are currently a borderline case. Only the smallest ships in the class, or about 20 percent of the fleet, are able to utilise the Canal as it stands. The enlarged waterway will be able to accommodate the entire VLGC fleet.

Chinese plastics producers are lining up to become major buyers of US LPG. There is a major shortage of propylene in China due to the growing demand for its use in the manufacture of high-quality plastics for consumer goods. The construction of propylene dehydrogenation (PDH) plants in China that will use US propane as feedstock has been identified as the optimum solution. Chinese firms have plans for nine such plants and it is estimated that the country will need 6 mta of propane feedstock from US suppliers by 2017. When all the plants are completed in 2016, China will account for 40 percent of global PDH capacity.

Although the Middle East region remains the leading exporter of LPG by a considerable margin, increasing volumes of its gas output are being used as feedstock for its own expanding petrochemical production. The timely rise in US LPG exports is helping to compensate for declining Middle East shipments and to offset any potential market disruption. It is also generating more tonne-miles in delivering cargoes to customers, thus keeping VLGCs busy and shipowners happy.

Healthy VLGC freight earnings are expected to be sustained for the next two years, at the very least, due to close alignment between the newbuilding delivery schedule and the steady rise in the industry’s tonne-mile demand. Assuming an average vessel lifespan of 28 years, there will also be a number of older vessels taken out of service for recycling over the next three years.

Another type of gas carrier fleet for which demand is expected to remain strong is the semi-pressurised/fully refrigerated (semi-ref) gas ship. Their high technical specification provides them with the ability to carry a wide range of cargoes and to switch between grades according to market fluctuations.

Until recently, those semi-ref ships able to carry ethylene at its boiling point of –104 ˚C represented the apogee of what was possible with semi-ref vessels. There are approximately 140 such gas carriers in service. In recent years, however, «multigas» ships able to carry LNG as well as ethylene and LPG have been introduced. The flexibility of their cargo-handling systems enables them to move between coastal LNG distribution and international ethylene trading duties according to market demand.

The future of the multigas ships appears assured, due not least to the current expansion of the global LNG industry and, in tandem, the small-scale end of the LNG supply chain. The regional distribution of LNG is poised for rapid growth in the years ahead. One key driver is the increasing use of LNG as marine fuel and the need to supply local bunkering stations. Another is the desire of customers in remote locations to replace their expensive oil fuels with more competitively priced, clean-burning natural gas.

LPG carriers that fall in the 12 000-23 000 m3 size range are identified as the handysize fleet. There are currently 135 such vessels in service and 35 on order. Although this fleet does include some fully refrigerated ships, the vast majority are semi-ref vessels. Furthermore most of the handysize gas carriers in the semi-ref segment are ethylene-capable. Some of the newbuildings will be dedicated to the carriage of ethane itself. Ethane carriers are the focus of the following article in this publication.

Ethylene is a basic petrochemical building block and the volume transported by sea represents only 5 percent of global production. It is nevertheless an important cargo for gas carriers and even a small rise in ethylene output worldwide, as is happening on a continuous basis at the moment, can have a significant impact on the demand for semi-ref ships.

Another factor affecting the requirement for longhaul ethylene shipments is regional production imbalances. As an example, until recently China produced only 50 percent of its ethylene requirement domestically. Although the construction of new chemical plants is helping the country become more self-sufficient, China’s buoyant economy continues to grow at such a rate that it is likely to remain a significant importer of ethylene for some time.

The small-ship segment of the LPG carrier fleet comprises 350 fully pressurised ships and 220 semi-ref vessels. Small gas ships have not enjoyed such a buoyant freight market as VLGCs and handysize ethylene carriers in recent years, due primarily to the effects of the global economic recession, but the trades have still been lucrative. The relatively restrained orderbook of only 30 small gas carriers also bodes well for a continuation of the good balance between ship supply and demand.

The small-ship segment also expects strengthening demand for its vessels in the years ahead due to the trickle-down effects of the US shale gas boom. A significant percentage of the new shipments of LPG and chemical gases moving in larger vessels on international routes will require onward distribution to local and regional customers when they arrive at their main discharge port.

Today investments in LPG carriers of all types make more sense than they have done for many years. Bold ship and terminal newbuilding decisions are being encouraged by healthy revenue streams, strong demand and the promise of rising freight volumes for several years to come. Supporting all these developments is the bandwagon that is the US shale revolution.

Enter the ethane gas carrier

Ethane carriers are a new type of gas ship, configured to deliver the burgeoning output of this US shale byproduct to meet the feedstock needs of chemical producers worldwide.

The scene is set for the emergence of ethane as a notable liquefied gas carrier cargo on deepsea routes. The product is a key component of the natural gas liquids (NGLs) in which the new US shale oil and gas volumes coming onto the market are rich. It is also a major petrochemical industry feedstock offering many advantages over the alternatives.

As a reflection of this new dawn for a liquefied gas that has figured only marginally in the annals of gas shipping to date, orders have been placed for several comparatively large ethane carriers in recent months. The contracts are backed by long-term charters with European chemical manufacturers seeking to gain advantage from imports of competitively priced US ethane feedstock.

Ethane is at the «light» end of the NGL mix and the most prolific of its five components. The other constituents are propane, normal butane, isobutane and natural gasoline. In most NGL flows ethane accounts for almost 50 percent of the total volume. Gas fractionators are used to process NGLs into their pure, component parts.

Ethane has traditionally not traded in global markets and is used primarily in facilities adjacent to where it is processed. This is because it is relatively difficult to liquefy and transport in bulk. Ethane has a vapour pressure of 3,85 MPa at 21,1 ˚C and a boiling point of –88,5 ˚C. It has a specific gravity of 0,54, as opposed to 0,45 for LNG. These properties mean that ethane must be either refrigerated to a very low temperature, compressed to a high pressure or have both temperature and pressure controlled to keep it in a liquid state and enable its transport by sea in bulk.

In gas carrier terms ethane can be carried fully refrigerated in liquefied ethylene gas carriers (LEGCs), because ethylene has a boiling point of –104 ˚C, or at –45 ˚C and a pressure of 5 bar (500 kPa). Some ethane, processed from North Sea gas, is moved around locally in the North and Baltic Seas region in small semi-pressurised/fully refrigerated (semi-ref) gas carriers provided with extra compressor power.

The biggest production centre is at Kårstø in Norway, where some 900 000 tonnes per annum of ethane are separated out from the North Sea dry gas arriving at the terminal by pipeline. Aside from these European shipments, which have been underway for a couple of decades, the movement of ethane has been limited to transmission through pipelines in gaseous form.

Read also: Safety, Risks and Security Aspects in Liquefied Natural Gas Industry

The new ethane carriers that have been ordered recently are being built with US ethane exports in mind. The newbuilds comprise a series of six 27 500 m3 vessels and four of 35 000 m3. These new ethane carriers are being built as semi-ref vessels with IMO Type C, bilobe, pressure vessel cargo tanks. All are bigger than the largest LEGC yet built.

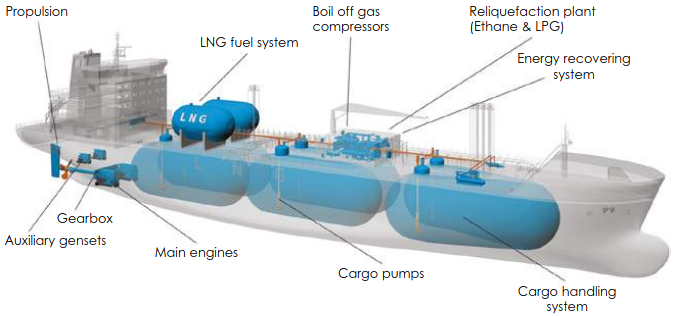

The 27 500 m3 ships are under construction at the Sinopacific Offshore & Engineering (SOE) yard in China for Copenhagen-based Evergas. Termed the Dragon series by the shipowner, they will also be able to transport LNG, LPG and petrochemical gases, including ethylene, and are being provided with Wärtsilä cargo-handling and dual-fuel propulsion systems.

The propulsion system on each ship comprises two Wärtsilä 50DF dual-fuel main engines, two Wärtsilä 20DF auxiliary gensets, a gearbox and a controllable pitch propeller. The cargo-handling package features a reliquefaction plant for ethane and LPG cargoes and an integrated LNG fuel supply system. The ships are reported to be priced at US $ 64 million each.

All six Evergas ships have been taken on 15-year charters by the chemical major Ineos for the transport of US ethane to Europe for use as feedstock. Most of the cargoes will be loaded at Marcus Hook in Pennsylvania and carried across the Atlantic to the gas company’s ethylene crackers in Rafnes, Norway and Grangemeouth, Scotland.

The Marcus Hook ethane will be processed from the huge Marcellus shale gas play in the northeastern US. The new Marcus Hook loading terminal near Philadelphia will be operated by Sunoco Logistics. Ineos has also secured capacity at the ethane export facility that Enterprise Products plans to build on the Texas Gulf Coast to capitalise on that region’s important shale gas deposits. Due for completion in mid-2016, this will be a large facility capable of producing 240 000 barrels per day of ethane. That is more than enough feedstock to run two worldscale ethylene crackers.

The Evergas sextet, which are due for delivery in 2015, represent the final component in what Ineos calls Mariner East, the first-ever US ethane export project. New ethane receiving terminals are being built at Rafnes and Grangemouth, for completion in mid-2015 and 2016, respectively.

Ordered by Navigator Gas at the Jiangnan yard in China, the four 35 000 m3 vessels are designed as ethane/ethylene/LPG carriers and each will be powered by a low-speed MAN ME-GI dual-fuel engine. Each ship is priced at US $ 78,4 million and the first in the series is due for delivery in April 2016. TGE Marine Gas Engineering has been contracted to design and supply the cargo handling and high-pressure fuel gas systems, including the cargo and LNG fuel tanks.

Each vessel will have three bilobe tanks, the two largest of which will have capacities in excess of 12 000 m3. TGE Marine points out that the Navigator Gas ships will be the world’s largest Type C tank-based Features of cargo delivery LNG/LPG carriersgas carriers and that it is developing conceptual designs for even larger ethane carriers.

In August 2014 Navigator Gas signed a 10-year charter for the first of its 35 000 m3 vessels with the chemical company Borealis. Under the agreement, which is scheduled to commence in late 2016, the ship will transport ethane from the Marcus Hook terminal to Borealis’ cracker at Stenungsund in Sweden.

Another attraction of exports from Marcus Hook is the fact that there is no sizeable petrochemical industry in the northeastern US able to absorb the volumes of ethane that Marcellus is starting to produce. Transatlantic shipments will assist in revitalising parts of Europe’s ageing petrochemical industry. It is estimated that, even including shipping costs, the Marcellus ethane arriving in Europe will be 50 percent cheaper than local product processed from North Sea gas.

Interestingly, all the new deep-sea ethane carriers contracted to date have been specified with dual-fuel propulsion systems that include an LNG-burning capability. Shale gas production in the US is spurring the construction of numerous natural gas liquefaction plants while the LNG bunkering concept is spreading in Europe. It appears likely that there will be adequate sources of LNG bunker fuel for the ships serving on transatlantic routes.

Another option is to use boil-off gas from ethane cargoes as a propulsion system fuel. MAN is developing its ME-GI dual-fuel engine range to run on a variety of fuels, and ethane is one under consideration. Ethane would require the introduction of the gas to an ME-GI engine at an even higher pressure than is the case with methane, so the current LNG engine would have to be modified with respect to fuel valves, control block, piping and material.

For the future the industry is considering ethane carriers larger than those ordered to date, most notably fully refrigerated very large ethane carriers (VLECs) of up to 90 000 m3 in capacity. Class societies have been investigating designs for such vessels, including suitable containment systems. All the LNG systems, or variations thereof, are deemed to be viable. Due to the nature of the cargo a VLEC will have to be a much more robust and sophisticated vessel than an LPG-carrying very large gas carrier (VLGC) of similar size.

Compared to the recently ordered ships, VLECs will realise further transport economy-of-scale benefits, especially on long-haul routes to India and to China via a widened Panama Canal. However, appropriate infrastructure would need to be in place at each end of the supply chain.

Reliance Industries is an Indian chemical producer interested in the benefits that VLECs and imports of US ethane might realise for their operations and recently ordered six 84 000 m3 membrane tank VLECs at Samsung in Korea. The ethane will be used as feedstock at the new ethylene cracker it is building at its Jamnagar refining and petrochemical complex on the northwestern coast of India.

Ethane holds the potential to develop further as a deepsea gas carrier cargo in the years ahead as shale oil and gas plays in other parts of the world are developed. However, for the moment, all eyes are on the US and the ethane carrier newbuildings that will take to the seas over the next two years.