The era of rapid change in the maritime industry is upon us, and its primary driver is the Decarbonization of maritime transport. From stringent IMO and EU regulations on emissions (CO2, SOx, NOx) and the adoption of new fuels (LNG) to the revolution in ship classification (Digital Classification, E-certificates) – the sector is undergoing a massive transformation.

- Towards Zero Emissions: Environmental Outlook

- CO2 data collection in the EU and at the IMO

- SOx regulations

- NOx regulations

- Ballast water management

- Emerging issues

- The path to Digigtal Classification

- Simply efficient

- Learning application

- E-certificates in demand

- The Link that is no Longer Missing

- Safety first with the UTS solution

- Flex LNG Counts on Technology for the Future

- Moving up at a rapid pace

- Good and getting better

- Future fuel

- LNG Green Sharing the Way

- Open to improvement

- Sharing the benefits

This article offers a comprehensive look at the environmental challenges, digital innovations, and practical steps industry leaders are taking to navigate the path toward zero emissions.

Towards Zero Emissions: Environmental Outlook

While the world is struggling to live up to its commitment to limit climate emissions, new data indicate that climate change may be more severe and occur more rapidly than anticipated earlier. The IMO is looking for ways to make shipping climate-neutral over the next decades. DNV GL gives an overview of the status of the discussion and potential future measures.

When the Paris Agreement was adopted in 2015 in response to the increasing signs of global climate change, shipping and aviation were not included. Instead, the IMO and ICAO were asked to come up with greenhouse gas (GHG) emission reduction schemes of their own. At MEPC 72 the IMO has now adopted a strategy to reduce emissions from shipping. This aims to reduce total emissions from shipping by at least 50 per cent by 2050, and to reduce the average carbon intensity by at least 40 per cent by 2030 while aiming for 70 per cent in 2050, all figures compared to 2008. The ultimate vision of the IMO is to phase out greenhouse gas emissions entirely at the earliest time possible within this century. This initial strategy will be reviewed in 2023 based on information gathered from the IMO Data Collection System (DCS) as well as a fourth IMO GHG study to be undertaken in 2019.

This ambitious strategy forms the cornerstone of the global effort toward the Decarbonization of maritime transport, setting clear benchmarks for carbon intensity and total emission reductions. As it must be assumed that the global shipping activity will continue to grow towards 2050, the 50 per cent emission reduction target is quite ambitious and will most likely require widespread uptake of zero-carbon fuels in addition to other energy efficiency measures. However, there are no zero-carbon fuels available today. A concerted research and development effort is needed not only to develop such fuels but also to make them available in the required volumes.

Source: AI generated image

To implement its ambitious strategy the IMO must develop new policy measures and regulations. The strategy contains a long list of options, such as strengthening the EEDI, applying operational indicators, reducing speeds, rolling out market-based measures, or developing zero-carbon fuels. Work on an action plan to kick-start the development of appropriate measures will start this fall.

While limited immediate impact on ships is to be expected, the efforts required to reach the long-term goals will have to build over the coming years, with a real impact starting to materialize in the 2020s. In a long-term perspective, DNV GL expects this strategy to fundamentally change the way ships are designed and operated.

CO2 data collection in the EU and at the IMO

In the EU, regulations for monitoring, reporting and verification (MRV) of CO2 emissions have entered into force, requiring all ships above 5 000 GT sailing to or from European ports to report CO2 emissions, cargo data and average energy efficiency. 2018 is the first year of reporting, with data being published annually by the EU as of mid-2019.

One purpose behind the EU MRV regulations was to encourage the IMO to work on a similar mechanism with global coverage. The EU regulation itself contains a provision for a review aimed at alignment with a future international system, if in place.

It is therefore significant that the IMO has adopted a global mechanism for mandatory monitoring, reporting and verification of fuel consumption data for all ships 5 000 GT and above. The scheme, known as the IMO Data Collection System (DCS) on Global gas market and history of LNG/LPG consumptionfuel consumption, will have 2019 as its first year of operation.

Read also: The business of LNG and historical involvement in maritime transportation of gas

The IMO DCS differs from the EU MRV in several important aspects, including the confidentiality of data, the calculation of efficiency metrics, and the requirements for data verification. While these are all issues where the EU has a strong preference for the requirements of its own system, the European Commission has nevertheless initiated a formal review process aimed at aligning the EU MRV with the IMO DCS. There are encouraging signs of a legislative proposal to be published in May 2018, though it is expected to be challenging and likely time-consuming for the commission, the parliament and the council to come to an agreement. DNV GL believes that full alignment is unlikely, and that the industry may have to cater to both reporting regimes for the foreseeable future (see article “Flex LNG Counts on Technology for the Future”).

SOx regulations

IMO has agreed that the 0,5 % global sulphur cap will be implemented from 1 January 2020. The decision is final and will not be subject to renegotiation, which gives certainty to the maritime and bunker industries. There were intense discussions on both the practicalities of implementation and on how to ensure robust enforcement and a level playing field. IMO is continuing to discuss implementation and supporting measures on a priority basis and is holding an intersessional meeting dedicated to the topic in July. The meeting is expected to provide robust guidelines for industry and authorities; these will be finalized at MEPC 73 in October and then circulated.

Ship operators will have to choose their preferred compliance strategy, a decision with far-reaching operational and financial implications. There is no one-size-fits-all solution on the table; scrubbers, LNG, and “hybrid” fuels are all realistic options, but most vessels are expected to default to using 0,5 % marine gas oil (MGO) and blends, at least initially. Local availability issues and price volatility are expected to result from the dramatic change of the fuel demand situation as of 1 January 2020, and the number of non-compliance cases, especially because of insufficient tank cleaning at Developing LNG Bunkering Facilities in Ports: Governance and Good Practicebunker facilities and on board ships, is likely to be rather high during a transitional period.

Enforcement remains a critical concern, especially on the high seas. Contrary to emission control areas (ECAs), where enforcement is up to the respective port state, monitoring of operations on the high seas is the responsibility of the flag state. Legitimate questions are being asked about the readiness of all flag states to provide uniform and robust enforcement to ensure a level playing field around the globe. To alleviate the enforcement issue to some extent, the IMO at MEPC 72 agreed to establish a ban on carriage of non-compliant fuels for all ships without scrubbers. This ban is likely to be adopted at MEPC 73 and will then take effect in March 2020. Ships without scrubbers will still be allowed to carry non-compliant Use of Cargo as Fuel on Gas Tankersfuel as cargo.

Moving to regional and domestic matters, it should be noted that in the EU the Water Framework Directive is imposing restrictions on the discharge of scrubber water. Belgium and Germany have prohibited the discharge of scrubber water in most areas, thereby limiting the operability of open-loop scrubbers. Similar restrictions apply in some US coastal waters, e. g. off Connecticut.

In Asia China’s regulations for domestic SECA-like requirements are being rolled out in the sea areas outside Hong Kong/Guangzhou and Shanghai as well as in the Bohai Sea. China is taking a staged approach, initially requiring a 0,5 % maximum sulphur content in fuel burned in key ports in these areas, gradually expanding the coverage to finally apply fully to all fuels used in these sea areas from 2019 onwards. Conceivably the allowable sulphur content will be tightened to 0,1 % by 2020, and China may eventually submit a formal ECA application to the IMO. In our view there is a real possibility of these zones being extended to include further Chinese sea areas.

NOx regulations

The NOx tier III requirements have entered into force in the North American ECAs for ships constructed on or after 1 January 2016. Anyone constructing a ship today needs to consider whether operation in the North American ECAs will be part of the operational pattern, whether upon delivery or at any time in the future. If so, NOx control technology will be required on board. When choosing an NOx control technology operators should consider how they intend to ensure compliance with the 2020 sulphur cap to avoid system integration issues.

With respect to upcoming regulations, IMO has agreed to apply NOx Tier III requirements to ships constructed on or after 1 January 2021 when operating in the North Sea and Baltic Sea ECAs. There are presently no indications of plans for additional NOx Tier III areas.

Ballast water management

The Ballast Water Management (BWM) Convention entered into force on 8 September 2017, more than 27 years after the start of negotiations, and 13 years after its adoption in 2004. The implementation schedules was revised at MEPC 71 in July 2017.

Briefly put, every ship in international trade will be obliged to comply at some point between 8 September 2017 and 8 September 2024. For ships from 400 GT upwards, the compliance date is linked to the renewal of the International Oil Pollution Prevention certificate, while ships below 400 GT must comply by 8 September 2024. By that date the entire world fleet must be in compliance.

It will be interesting: Basic Info about Liquefied Petroleum Gas Transportation on the LPG tankers

In the US, the domestic ballast water management regulations entered into force in 2013. New ships must comply upon delivery, while existing ships must comply by the first scheduled dry-docking after 1 January 2014 or 2016, depending on ballast water capacity. USCG type approval is required for ballast water treatment systems; six such approvals have been granted so far, with eleven more in the approval pipeline. The USCG’s previously liberal extension policy granting deferred installation dates to more than 12 500 ships due to the unavailability of approved systems has changed since the first type approvals were issued.

Presently the USCG is very restrictive on granting extensions and this policy is likely to tighten further. In practical terms, operators should now plan their installation dates based on the compliance dates in the regulation and not gamble on receiving an extension.

Emerging issues

There are a number of new environmental regulations under consideration at the IMO as well as in various countries. They cover a broad range of topics, such as plastic pollution from ships, the impact of noise on cetaceans, particle emissions, hull biofouling, and a ban on heavy fuel oil in the Arctic. The discussions are at various stages; New Zealand, for example, has introduced biofouling regulations in May this year. The noise issue is primarily a concern of a few isolated stakeholders, while plastics and an Arctic HFO ban are under consideration at the IMO. Nevertheless, most if not all of these topics are likely to be the subject of further domestic or international regulations sooner or later during the next decade.

To successfully meet these environmental mandates, the entire sector must embrace innovation. The next major phase of the Decarbonization of maritime transport relies heavily on digital classification, e-certificates, and data-driven efficiency.

The path to Digigtal Classification

After a fast start, DNV GL continues to pick up the pace in the digital transformation of its classification services. “We started looking into machine learning as a tool for modernizing classification in 2016”, says Morten Østby, Senior Principal Consultant at DNV GL. “When the team realized how important this could be, it was implemented in April 2017. By the autumn it was in production”.

Such a fast-track realization is fairly typical of the digital transformation sweeping DNV GL’s classification business. “The aim is to move the customers over to a digital interface”, says Østby, “where clients and vessels can stay up to date, receive notifications, and take advantage of digital storage capabilities – and that’s just the beginning”. Østby’s ally in the push to modernize class, Senior Principal Engineer Arun Sethumadhavan, emphasizes the main focus of the digital initiative: “Ease of access and comprehension are important for customers. Today that means mobile access and expanded functionality”. The jumping-off point for the journey through DNV GL’s modern class universe is a personalized online portal that provides customized and secure access to all digital services and support resources. As of November 2017 they are embedded in DNV GL’s Veracity platform.

Simply efficient

“Smart survey booking is a major move in streamlining a previously tedious and often inefficient manual task”, says Østby. Smart Survey Booking is a DNV GL service enabling clients to keep their vessels in operational condition in the most efficient manner possible. The service minimizes the on-board impact from surveys and audits and reduces on-shore and on-board administration work, among other advantages.

The smart survey booking solution automatically finds the optimal window for a ship’s periodical surveys, allowing for as many survey and audit requirements and requests as possible to be covered in one survey, to avoid multiple inspections. “Based on this time window and a list of possible ports entered by the operator, the system also looks for the closest geographical location, accounting for the scope and duration of the survey and surveyor availability, and issues a recommendation”, says Østby. “This minimizes both the time involved in booking the survey and the inconvenience for the vessel, while keeping the costs down by helping reduce surveyor travel times”. An enhanced version of the application is expected to be available before 2019, Østby informs: “When the customer requests a survey, the system will estimate port call options based on the Veracity ETA Predictor, and benchmark these ports to help identify where full scope can be completed where also travel and overtime cost is favourable”. A link to all DNV GL-approved service suppliers in the respective country has also been added to the benchmarking feature with the aim of improving efficiency and keeping survey costs down.

Learning application

Many improvements are made possible by introducing machine learning, or ML, into the survey booking process. “ML is used to calculate the time required for each survey”, says Østby. “When the scope and other parameters are set, the system outputs a time estimate based on historical data”.

DNV GL has also incorporated ML into its DATE (Direct Access to Technical Experts) service where a customer’s problem description transmitted by e-mail can make it challenging to assign the case to the correct category and expert or section for fast processing. “A discrepancy between the description and interpretation may cause the inquiry to be routed to the wrong expert”, says Sethumadhavan. “Now DATE uses ML to vet cases based on historical data and quickly directs them to the proper expert. This cuts down on manual vetting and reduces time wasted on re-routing and finding another expert. We are already seeing that ML-assisted vetting is more than 80 per cent accurate, and it gets better every day”. Each ML-vetted routing receives a confidence rating before being enacted. Any inquiry that has not received a very high confidence rating is returned for manual vetting. “ML is chosen for category assignment only when the confidence level is very high”, explains Sethumadhavan. “By using continuous learning logic, the ML system is constantly refining its selection criteria and improving its hit rates quickly”.

But there are other human factors that complicate the advisory process. “While we all use English only, there are different language patterns and rules in different parts of the world”, Østby says. “We have had to teach the machines to accept compound words and different spellings. We can even teach them to vet incorrect language”.

DIGITAL SERVICES – THE GAINS, THE CHALLENGES, THE POTENTIAL

Anastasios Papagiannopoulos, President of the Baltic and International Maritime Council BIMCO, shares some thoughts about the importance of digitalization in shipping.

What needs and challenges shipowners are facing can be fulfilled or overcome by adopting digital services?

Papagiannopoulos: Digital services can bring efficiencies in operation and reduce administrative burden on board as well as on shore. At BIMCO we have been engaged in projects to reap benefits from structured and automatic exchange of information between ships and ports to facilitate port formalities. We see great potential in this area and work is now underway to facilitate agreement on the data elements for such communication.

What should shipowners consider now to realize the full potential of digital services for their fleets?

Digital services can be deployed to ships today. They do however require effective communication channels to the Internet. Careful consideration of the connectivity for ships is an important parameter. At the same time, careful consideration of the security of on-board cybersystems is equally important. While harvesting the upsides of a digital transformation, covering the downsides is a necessity. The industry guidelines for cyber-security on board ships are an important reference.

What has been the most valuable digital trend launched in the maritime sector recently and why?

Remember how we looked at the Internet back in the early 90 s. It had some potential, but most of us had no idea about the revolution it would bring about. What I am trying to say is that cheap connectivity is an enabler in itself. We have yet to see what we can make out of it in terms of common platforms and services across the fleet.

What future services that have not been launched yet would have big potential to succeed?

For many years we have been talking about the concept of a “maritime single window” for exchanging port formalities. So far it is merely a vision. We at BIMCO are confident about the potential of the concept and are working actively to facilitate its implementation. Thousands of man-hours are spent every year on tedious repetitive tasks to satisfy the individual requirements of each and every port in the world. We look forward to allowing our crews on board to do more meaningful work instead.

Ship inspection often poses a conundrum: The object may be a fairly straightforward structure or piece of equipment on board, but human eyes are still required to verify its state. Traditionally that means the human doing the verification has to be on board. But that is not necessarily true anymore.

Remote technology is enabling eyes to see the object of inspection from virtually anywhere in the world. Equipped with something as simple as a smartphone app, personnel on board can connect to the surveyor on land, and the survey is underway. “The surveyor steers the input and evaluates the quality of the data”, says DNV GL‘s Senior Principal Consultant Morten Østby. In other words, the “cameraman” on board takes instructions from the surveyor on land who acts as the “director“. One key prerequisite: the surveyor must have actual on-board experience. “You have to have been there to be able to know what you are seeing”, Østby confirms. “But the customer must be willing to cooperate”, he adds. “Proof of repair or remediation must be provided”. For the time being the technology will be used on occasional surveys, not for certification, and possibly for selected follow-up items when the surveyor has left the ship.

Remote inspection could also be used for certification of materials and components. “The first steps have been taken. Many more will follow”, Østby assures.

E-certificates in demand

DNV GL has been running pilots on electronic certificates for several years, achieving IMO compliance and winning the endorsement of many flag states, 53 as of 1 April 2018. “This shows just how fast the technology can be taken into use once it has proved viable”, says Østby. “Within seven months after the rollout in mid-October 2017, more than 100 000 electronic certificates have been issued on more than 9 800 vessels in operation, including many class entries and newbuilds, and the number is growing rapidly every day”. Customers benefit significantly, says Østby, by being able to share certificates globally immediately upon issue. “Ports, vetting organizations, flag states, charterers, buyers, insurers – everyone wants to see the certificates”, he says. “Before, owners and captains had to keep track of the original while sending multiple copies to land. Manual updates were an over-whelming task, and the system was by no means secure. Now the digitally signed original is secure but easily accessible in the Cloud”.

Using an e-mail subscription function, each update of an e-certificate or issuance of a new one triggers a notification to all involved parties, with the verified document attached. Documents are accessible through the DNV GL interface, i. e. the fleet status portal. In addition, provisions to carry out authentication/validation checks and access can also be granted via a secure public website, using a unique tracking number (UTN) on the certificate or by sharing temporary access codes generated from the fleet status portal. “All transactions are in keeping with IMO guidelines”, says Østby.

Read also: The New Generation of Liquefied Natural Gas Carriers – Basic Design Philosophy

The overall response from Flag States to the electronic certificate regime has been positive. “So far more than 85 per cent of the DNV GL fleet is covered by flag acceptance for issuance of statutory certificates on their behalf”, Østby confirms. Embracing the new digital reality involves a behavioural change for the stakeholders, he notes, and DNV GL is willing to help those unfamiliar or uncomfortable with digital transactions to familiarize themselves with new methods and learn to trust the system.

Many owners have requested e-certification for all their ships as soon as possible. “Owners see the benefits. Endorsements are verified and completed automatically, complex processes such as frequent certificate updates are automated, and there is no human handling of documents”, Østby sums up. “That reduces the quality assurance work to verify certificates, and once they are in the system, they can never be lost”. DNV GL is proud to be leading the fast march toward modernizing classification, bringing efficiency, accuracy, and security to certification and survey booking processes that had remained virtually unchanged for decades, if not centuries.

The Link that is no Longer Missing

The natural gas industry is looking at a new era in LNG distribution: the Madrid-based global energy company Gas Natural Fenosa and the Norwegian engineering firm Connect LNG have jointly made the world’s first floating ship-to-shore LNG transfer system a reality.

LNG is rapidly conquering coastal countries around the world, making clean energy available to ports large and small. A new floating system developed jointly by Gas Natural Fenosa and Connect LNG now offers a convenient, safe and uncomplicated means to transfer LNG from ships to onshore terminals.

During the successful sea launch of the first full-scale and market-ready universal transfer system (UTS) on 7 October 2017, Gas Natural Fenosa and Connect LNG carried out a complete LNG transfer operation from Skangas’ LNG carrier Coral Energy to the onshore LNG terminal at Herøya, located in one of the largest industrial parks in Norway. The time from finalization of the detailed design to successful hook-up of the terminal was less than six months. The solution was installed at the Herøya terminal the day after its arrival from the dockyard, and in full operation the next day, exemplifying the rapid deployment capability of the solution.

The patented UTS is a floating solution that replaces the need for cost-intensive and environmentally challenging shoreside and jetty structures. Promising to be a true game-changer, it could rapidly expand the LNG value chain at locations where LNG transfer was previously not possible due to environmental and economic constraints. The UTS is a plug-and-play solution requiring no modifications to LNG carriers.

Safety first with the UTS solution

The UTS seamlessly integrates with safety systems on both the LNG carrier and the onshore terminal. Whether the port is building new capacity or seeking to expand its existing infrastructure, the UTS will work with all cargo handling and safety systems as well as operating philosophies. The platform supports safety systems, including ESD valves, monitoring equipment, ERS, and control systems of any kind, enabling safe connection, transfer and disconnection. In an emergency the UTS can be disconnected and separated immediately without compromising the integrity of any system components.

Separation between the terminal and the LNG carrier reduces collision risks and increases the safety distance from other activities. The system is designed to comply with all relevant rules and regulations and has undergone full offshore classification by DNV GL.

“With their UTS, Gas Natural Fenosa and Connect LNG have launched a system on the market that provides cheaper access to a low-emission energy source”, states Johan-Petter Tutturen, DNV GL Business Director Gas Carriers. The UTS is the direct link that will help meet the rapidly increasing global demand for natural gas, especially for power generation in emerging markets.

“We started an innovation journey and here we are today with a game-changing solution that is revolutionary for the LNG industry”, says the spokesperson for Gas Natural Fenosa. “From now on there is a market-ready system available that opens a world of possibilities in the small-scale LNG business”. “With Connect LNG’s disruptive technology and agile company culture, combined with Gas Natural Fenosa’s long track record in the energy market, there was an obvious foundation for collaboration. Leveraging both companies’ strengths, the UTS provides access to natural gas where it has not been economically viable in the past”, declares Morten Angset Christophersen, Managing Director at Connect LNG.

As a pioneer in gas and electricity integration, Gas Natural Fenosa is a multinational group providing energy to nearly 22 million customers in more than 30 countries. The company’s operations cover the entire natural gas value chain, from pipelines and liquefaction to storage and regasification through to a fleet of LNG carriers of its own. Backed by this comprehensive expertise, the company is well positioned to play a leading role in addressing the world’s future energy needs. Connect LNG was established on the belief that cleaner and cheaper energy should be accessible worldwide. Based on decades of Norwegian experience with LNG and maritime technology, Connect LNG develops solutions to make this mission a reality.

Flex LNG Counts on Technology for the Future

For its growing LNG carrier fleet, Flex LNG is heavily investing in the adoption of new technologies. DNV GL has partnered with Flex LNG to facilitate safe implementation and operation.

“Technology is the key differentiator for Flex LNG“, confirms CEO Øystein M. Kalleklev. “We started from scratch, with no legacy issues to consider. This allowed us to invest fully in the technology that can set us apart from the competition”. Kalleklev is referring to the major advances in LNG carriers that give newer vessels efficiency and environmental advantages over older tonnage. This focus on advanced propulsion systems and lower boil-off rates demonstrates a practical, commercial pathway for the Decarbonization of maritime transport through superior vessel design and operational efficiency.

It will be interesting: FAQ about Basic Facts, Safety and Security Clarifications of Liquefied Natural Gas

Long out of service in other trades, steam turbines have remained in favour as power plants for LNG carriers due to the ample supply of boil-off fuel from their cargo. But as insulation technologies improve, boil-off has been reduced and more efficient engines are needed to cover the same distances using less fuel. “When boil-off was as high as 0,2 per cent, you did not really need a highly efficient Types of propulsion systems on ships carrying LNGpropulsion system. The move from steam turbines to four-stroke diesel electric came in around 2006, and that was a great improvement. But now boil-off is down to around 0,07 per cent, and even less with reliquifaction plants, so we are employing the most efficient, modern slow-speed two-stroke engines”.

Moving up at a rapid pace

This adoption of new technology reverses a long-standing trend in shipping, where LNG carriers have risen to the top of the shipping industry in efficiency advances. “Not only do the new engines burn less fuel, they are smaller than the old technology, which means there is more room for cargo”, Kalleklev explains. All this adds up to newer ships being more attractive on the charter market, a large part of the reason Kalleklev says Flex LNG is bullish on the segment.

Flex LNG has taken delivery of four new vessels as of autumn 2018, with two additional MEGI vessels set for delivery from DMSE in mid-2019, and two X-DF vessels due from HSHI in 2020. In addition, the main shareholder in Flex LNG, the John Fredriksen family, ordered five more LNG carriers through their private company Seatankers in 2018, scheduled for delivery in 2020/21. This brings the Group’s tally of modern LNG vessels to 13, if the eight Flex LNG vessels are included.

All the ships are equipped with slow-speed two-stroke propulsion (MEGI or X-DF), giving about 30 per cent lower fuel consumption than trior dual-fuel diesel electric vessels. The X-DF new-buildings will be fitted with Selective Catalytic Reduction (SCR) to comply with IMO Tier III regulations both in gas and liquid mode, giving them high trading flexibility.

The X-DF vessels will be classed with DNV GL. “Flex LNG and our affiliated companies Frontline, Golden Ocean, Ship Finance and Seatankers use many different class societies in order to learn best practices and benchmark performance. As we have good experience partnering with DNV GL, we are pleased to have them on board for the four X-DF carriers under construction”. Johan Petter Tutturen, Business Segment Director Gas Carrier at DNV GL, comments: “For DNV GL, energy optimization and efficiency have always been among our main focus areas. Charterers are looking for the most energy efficient LNGC, since they are the ones who will pay for the fuel. By investing in new and innovative technology to reduce fuel consumption and make assets even more environmentally friendly, owners give themselves an advantage in the market. With our vast experience in this field, DNV GL is able to support and assist the owner and builder in achieving this goal”.

Good and getting better

“The four vessels we have in operation now have performed well”, Kalleklev reports. “We are now in the early phase of the recovery cycle for LNG shipping following four challenging years from 2014 to 2017. After the Fukushima reactor incident, the market for LNG transport experienced a boom, which resulted in excess transport capacity. A lot of ship owners had good access to capital and they placed too many orders”. He goes on to explain that the down cycle in shipping rates was also due to delays in bringing new LNG capacity on-stream, in particular the Australian trains. Despite these factors, Kalleklev believes that the fundamental prospects for LNG shipping remain very strong, meaning that markets have balanced out relatively quickly despite limited attrition of older tonnage. “Even though older steam vessels have high retirement age, many in layup will not come back”, Kalleklev says. “The last generation of vessels will be around for a while for short-term contracts and short voyages. But for longer hauls you need more efficient vessels”. Then there is the benefit of LNG becoming a global commodity. “LNG is not a liner business anymore. Owners can sell where demand is highest, and that increases the need for transport”. LNG traders have also established themselves in the industry, giving new life to the LNG market. “This is the future trend. We have about 300 million tonnes of LNG a year being produced globally right now. In just a couple of years, that will increase by 100 million tonnes“. Demand is growing to match supply as well, largely due to the lower emissions footprint of LNG and its lower price compared to other energy sources. “The trend favours a switch from coal and oil to gas, and LNG is the best way to transport gas over greater distances”, says Kalleklev.

Future fuel

“In the marine market, everybody is talking about scrubbers for compliance with upcoming emissions regulations, but I think that LNG as a maritime fuel will become more attractive after 2020″. He points to the general uncertainty surrounding regulations, emissions and availability of both heavy fuel oil and marine gas oil – not to mention price. “LNG is cheaper than gas oil, and large, high-speed vessels like container ships are coming on with LNG capabilities. They consume more fuel, and they will need to comply with ECA sulfur restrictions, so it also needs to be clean. This is part of the reason we believe there will be a need for more LNG at bunkering stations”. With all these signs pointing to a stronger market Øystein M.

Kalleklev has good reason to be optimistic about LNG, both as a commodity and as a fuel. Combined with their investment in cleaner, more efficient technology, Flex LNG would also seem well positioned to serve the growing market. “There is always risk involved in choosing new technology”, he sums up. “Rather than avoid it, we like to talk about technology risk as a differentiator”.

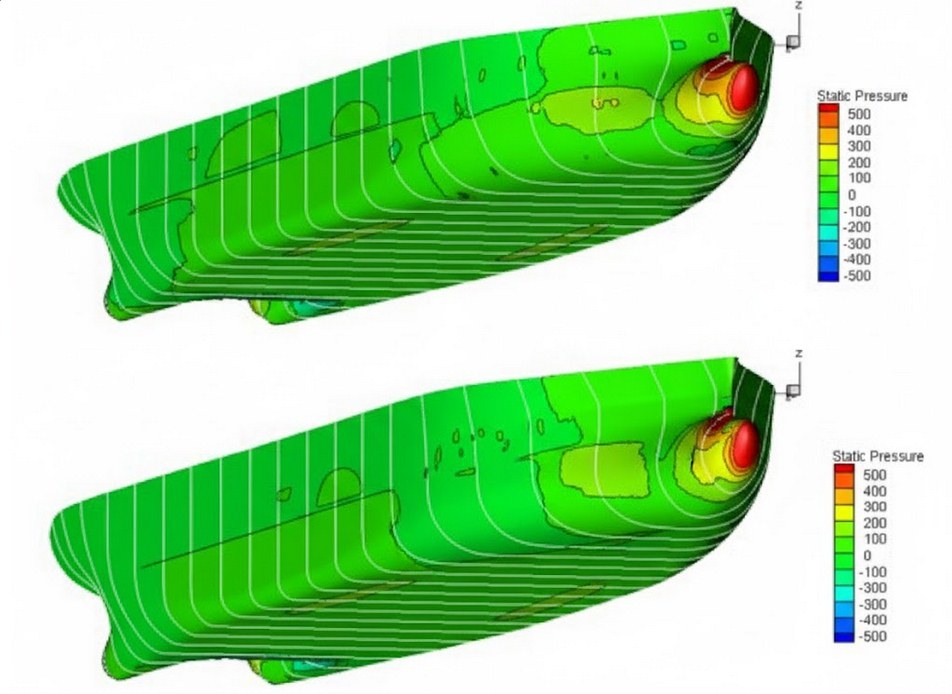

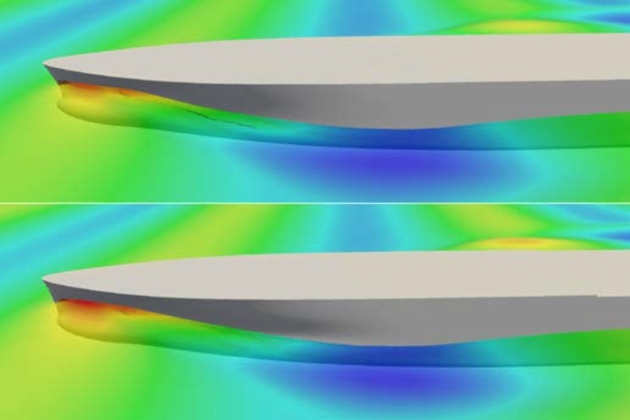

Project partners DNV GL, Hyundai Heavy Industries (HHI), Gaz-transport & Technigaz (GTT) and shipowner GasLog achieved significant improvements in LNG carrier design and efficiency in Phase I, focusing on hull hydrodynamics, cargo volume, reduced boil-off, and overall machinery and system efficiency. Compared to the base case, studies proved that an overall energy consumption improvement of approximately eight per cent depending on operating condition could be achieved.

Phase II was dedicated to further enhancing optimization potential and verifying results, including an increase of 25 per cent in operational efficiency from partial re-liquefaction, and a validation of the findings from LNGreen I for technologies such as dual-fuel auxiliary engines with economizers. “Joint development projects (JDPs) are where we try out new ideas”, says Phase II Project Manager Daniel Nordås, Hydrodynamic Engineer at DNV GL Maritime Advisory. “Phase I delivered a lot of innovation, and we used Phase II to validate and refine these concepts, but also to encourage further investigation of potential uncovered in LNGreen“.

LNG Green Sharing the Way

Established to develop tomorrow’s LNG carrier through innovative use of today’s technology, the LNGreen joint development project is now drawing to a close.

Open to improvement

The project focus was to combine accessible technology and existing knowledge in new ways, and that in itself required an innovative approach to sharing. “This particular way of working together required a different mindset”, says Nordås. “Compared to a typical JDP, there was more open discussion and sharing of knowledge. Each potential innovation was discussed freely”.

One notable example was the sharing of data and methodology. “Partners typically do not want to disclose the specifics of how they work, as this is their competitive advantage”, Nordås says. But in LNGreen, GasLog sent operational data to HHI and engaged with the yard in the design process, and DNV GL cooperated with HHI on advanced analyses such as added resistance in waves, in order to provide a more robust platform for design discussions and innovations. “DNV GL’s primary role was to assure smooth cooperation between the partners, with a focus on finding new ways to use existing technology”, Nordås relates.

“We provided design verification services and acted as a sparring partner, discussing both practical and technical matters, and potential class and regulatory issues”. Representing tank design and manufacturing in the project, GTT has their own takeaway: “It is always a plus to have cooperated closely with leading industry partners, but in LNGreen we also gained valuable insight into shipowners’ requirements and priorities”, says GTT CEO Philippe Berterottière. “This further strengthens our credibility in future dealings with both yards and owners”. GasLog’s motivation for participating in LNGreen was to discover and explore improved and innovative design solutions for the future LNG vessels, says a GasLog representative. “HHI was very accommodating in exploring new options to satisfy the project’s needs. HHI and GTT worked very closely together, and DNV GL contributed by validating technology and assuring compliance with class rules. All these efforts helped move the discussion forward”.

| LNGREEN RESULTS | ||

|---|---|---|

| Maximize Hydrodynamic Performance | Maximize Cargo Volume and Minimize Boil-off | Increase Overall Machinery and System Efficiency |

| 2,5 per cent hull resistance improvement | 5 per cent increase in cargo volume (182 800 m3 vs 174 000 m3) | 6 per cent increase in efficiency compared to DFDE base case |

| Hull form optimized for reduction of added resistance in design waves | Boil-off rate reduced to 0,085 per cent per day without change of insulation type (vs 0,09 per cent/day) | Validation of the two-stroke option as most efficient |

| Twisted rudder, rudder bulb, positive indication of efficiency improvement with high-efficiency propeller | Consideration of mechanical energy saving devices (ME and AE economizers, shaft generators, dual-fuelled auxiliary engines) | |

| Application of reliquefication unit | ||

Sharing the benefits

Hyundai Heavy Industries also confirms their satisfaction with the overall results: “HHI is pleased with the good cooperation established between all partners in the LNGreen project. The partners have shared knowledge in new ways and achieved innovation that will benefit LNG shipbuilding and transport for many years to come”, says Project Manager Bumwoo Han from HHI.

These investigations are essential for hull efficiency improvements

Johan Petter Tutturen, DNV GL Business Director Gas Carriers, sums up: “LNGreen provided innovative insight into gas carrier design and operations, but the project also laid the foundation for increased trust and sharing between the partners. Now we look forward to sharing the benefits of all our efforts with the gas carrier industry”.