Future of the LNG Industry is increasingly promising, driven by innovations in coastal LNG carriers (LNGCs) and the escalating demand for LNG bunkering. As environmental regulations tighten, the LNG bunkering market is positioned to grow significantly, offering cleaner energy alternatives for maritime operations. Projects like the Arctic Pilot Project serve as essential precursors to major developments such as Yamal LNG, highlighting the strategic importance of natural gas in evolving energy markets.

By 2029, the industry is expected to witness further advancements in technology and infrastructure, enhancing efficiency and sustainability. Stakeholders must remain agile, adapting to market dynamics and regulatory changes to capitalize on emerging opportunities in this vital sector. As we look ahead, collaboration and investment will be critical in shaping a resilient and innovative LNG landscape.

Five FLNG vessel projects are underway and developers of upwards of 20 further such schemes are working towards final investment decisions.

It is ironic that the first LNG to be liquefied for transportation by sea was produced on a floating barge in the Louisiana bayous some 55 years ago. The industry has had to wait for over half a century since that historic moment but the first production of commercial quantities of LNG on a floating vessel is now only a matter of months away. The five projects currently underway – comprising four newbuilding vessels and an LNG carrier conversion – bring the LNG industry full circle and launch it into a new era.

The FLNG conversion project is a late starter, having only been announced in summer 2014. Which of the four floating LNG production (FLNG) newbuilding vessels under construction will be the first to enter service has been the subject of some speculation. Shell contracted the first LNG «floater» in May 2011, the 488 m-long Prelude vessel which Samsung Heavy Industries (SHI) is building for positioning off Australia’s northwestern coast.

Prelude embraces many groundbreaking technologies and will be the world’s largest floating, man-made structure upon completion. However, such is the scale of the project that it will not be ready to enter into service until early 2017.

A more modest newbuilding is the 300 m-long FLNG vessel that Petronas ordered at Daewoo Shipbuilding and Marine Engineering (DSME) in early 2012 for what it terms its PFLNG 1 project. The scheme calls for the vessel to be positioned in shallow water about 180 km off the coast of Bintulu in the Malaysian state of Sarawak in order to liquefy gas from the Kanowit field. In contrast to the Prelude LNG production capacity of 3,6 mta, PFLNG 1 will be able to liquefy 1,2 mta. The Malaysian unit is scheduled to commence LNG production in late 2015.

In February 2014 Petronas sanctioned a second floating LNG project for Malaysian waters. The PFLNG2 vessel will be built at SHI and have a capacity to produce 1,5 mta. It is due to go into service in 2018 off the coast of Sabah, where it will process gas from the Rotan field.

The smallest of the four FLNG vessels under construction is that being developed by Exmar for a 15-year charter with Pacific Rubiales and positioning at Tolú on Colombia’s Caribbean coast. The non-propelled vessel, named FLNG Caribbean and termed a floating liquefaction regasification and storage unit (FLRSU), was ordered at the Wison yard in China in June 2012 and is scheduled to be providing LNG, at a rate of 0,5 mta, by the second quarter of 2015.

The recently announced conversion project involves the fitting of four modular liquefaction trains on Golar LNG’s 1975-built, 125 000 m3, spherical tank LNG carrier Hilli. The work, which will be carried out at Keppel Shipyard in Singapore, will provide the vessel with a liquefaction capacity of 2,2–2,8 mta. Black & Veatch’s proprietary Prico liquefaction technology will be utilised and the conversion project is due for completion in the first quarter of 2017.

Golar holds options with Keppel covering similar conversions on two other of its older LNG carriers. The shipowner has not yet finalised a charter deal for Hilli in its new role but is in negotiations with several potential customers.

On paper it looks like the Exmar FLRSU will be the first past the finishing line. However, the contenders will not be claiming a place in the history books until the first cargo from their floater is transshipped. Experience has shown that it is best not to take anything for granted when new technologies are being applied.

The five committed FLNG projects look set to be the first batch of many similar initiatives. Floating production is poised to follow in the footsteps established by the LNG industry’s adoption of the floating storage and regasification unit (FSRU) concept over the past decade. Having said that, the technologies involved in Innovations in LNG Import/Export StreamliningLNG regasification are much less complex than those involved in its liquefaction, so FLNG will never match the extent and the pace of the FSRU take-up.

Nevertheless the welcome given by the LNG industry to floating regasification shows how quickly innovative technologies can be adopted and accepted in the modern era. Just as importantly, floating regasification has been quick to prove that major cost savings can accrue from offshore solutions. When the regasification cost element of delivered gas via an FSRU comes in at one-third that of gas processed at a shore-based import terminal, the benefits are not difficult to appreciate.

The US has eight and Australia seven FLNG schemes on the drawing board. The developers of the majority of these projects are currently engaged in preliminary engineering work with a view to commissioning full front-end engineering and design (FEED) studies. A successful outcome, along with the necessary permits and gas sales agreements in place, would enable a final investment decision (FID) to be taken in 2015–16 and their projects to transship the first LNG to delivery tankers in 2018–2019.

Most of the US and Australian initiatives are based on floaters with relatively large, single train liquefaction capacities, of 3–4 mta, to enable the export of sizeable quantities of gas. The US projects, for example, are competing with numerous shore-based terminal schemes to export the same shale gas resources.

In Australia the offshore fields targeted by the FLNG community hold significant reserves, and floating production offers a lower cost, fast-track alternative to the construction of a shore-based export terminal and an associated, long-distance, subsea gas pipeline.

Sometimes, however, even an FLNG proposal in Australia is found not to be commercially justified. In summer 2014 GDF Suez and Santos decided to shelve their planned Bonaparte FLNG scheme rather than press on to the FEED stage, citing the questionable economics of the project.

Shell is a partner in a number of Australia’s prospective FLNG developments, and in these cases the energy major’s Prelude technology has been chosen as the route to project realisation. The concept is based on solid foundations, Shell having researched its FLNG options for 15 years and devoted 1,6 million man-hours to work on the engineering challenges before deciding on the Prelude design and equipment.

Prelude will be moored using the world’s largest turret yoke arrangement 200 km from the nearest land off Australia’s northwest coast, an area prone to seasonal cyclones. The Prelude FLNG vessel is being designed for not only an uninterrupted service life of 20 years at this location but also a further 20 years at another potential offshore gas field development.

Making the Prelude concept more widely available will be facilitated by the fact that Shell has entered into a master service agreement with Technip and Samsung covering the design, construction and installation of multiple FLNG facilities over a period of up to 15 years.

Smaller scale units are also well represented amongst the FLNG schemes under development. It is estimated that there are over 650 remote offshore fields with between 0,5 and 5 trillion cubic feet (tcf) of stranded gas that would be ripe for development with small-scale, barge-mounted liquefaction plants.

The combination of liquefaction plants of modular construction and simple barge-shaped hulls, especially when the facility is moored in nearshore waters, helps ensure that the investment cost per tonne of LNG produced is much below the equivalents for both a large-scale FLNG project and a shore-based export terminal. Exmar’s small FLRSU, for example, is expected to cost US $ 300 million, complete with topsides. The Exmar FLRSU, which is due to be positioned at a dedicated jetty located 3 km off Colombia’s Caribbean coast, is illustrative of the effect such a vessel can have on a region’s LNG supply chain.

The FLRSU will work in tandem with a floating storage unit (FSU) also moored at the jetty, transferring LNG to the FSU as it is liquefied.

It is likely that initially the terminal will export full LNGC cargoes of 140 000–160 000 m3, depending on the sizes of the FSUs and the delivery tanker, to the international spot market once every six weeks. Eventually, once the region’s customers have their LNG receiving infrastructure in place, the FLRSU will supply the small-scale power generation markets of Central America and the Caribbean using coastal LNG carriers.

Exmar has established a strategic alliance with Black & Veatch, the supplier of the FLRSU’s liquefaction plant technology, and Wison, the builder of the vessel, to explore further opportunities for the small-scale FLNG technology the partnership has developed.

One of the principal advantages of the FLNG approach to bringing LNG to market is that the entire vessel can be built under controlled conditions by experienced and skilled workers at a dedicated yard. In doing so the cost overruns, construction problems and inclement weather conditions often encountered at shore terminal building sites can be avoided.

Yard construction of an FLNG vessel also enables the building schedule to be accelerated through replication and efficiency shortcuts, again to the benefit of the overall budget. Financing arrangements are usually facilitated by yard construction, and the overall project will benefit from the lessons learned from previous projects of a similar nature.

The FLNG projects involving the vessels under construction are based on the side-by-side method of offloading LNG to the LNG shuttle carrier. The next frontier, for projects in more inhospitable waters, will be the adoption of the tandem offloading method. For the moment, however, the homework has been done, the foundation FLNG vessels are currently under construction and a raft of investment decisions on new projects is imminent. The FLNG era has begun.

Coastal LNGCs come into their own

Only a decade old, coastal LNG carriers are poised to help a major extension of the LNG supply chain at the small-scale end of the spectrum.

The delivery of the 6 500 m3 Coral Anthelia to Anthony Veder and the 2 500 m3 Kakayu Maru to Tsurumi in 2013 raised the complement of coastal LNG carriers worldwide to 16 vessels. Another four such ships are on order, all building in China and earmarked for gas distribution duties along the country’s long coastline. Three of the vessels are in the 28-30 000 m3 size range and, on delivery in 2015, will be the largest coastal Propulsion Trends in LNG Carriers: The Shift from Steam to Dual-Fuel Diesel and Electric SystemsLNG carriers yet built.

This fleet of small-scale LNG carriers is only a decade old. It has emerged to facilitate the extension of the LNG supply chain and to bring the benefits of this clean-burning, competitively priced fuel to a much wider range of customers. The main market drivers for small-scale LNG are the growing use of gas as marine fuel and the need to supply remote residential communities, power stations and commercial ventures not connected to the pipeline grid.

Predicting the size of the coastal LNG carrier fleet 10 years hence and the pace at which it will grow pose challenges but it is safe to say that the influence being exerted by the current market drivers will continue to strengthen. New delivery routes, terminal facilities, bunker depots and fuelling stations are being developed and naval architects’ drawing boards around the world are filling up with coastal LNGC design concepts. A number of newbuilding projects have been mooted and several are poised to materialise.

All the coastal LNG carriers built to date have IMO Type C insulated, pressure vessel cargo tanks fitted horizontally in the vessel. The Type C tanks are either cylindrical or bilobe in shape and stainless steel and aluminium have been used as tank materials. With Type C tanks there is no need for the cargo containment system to have a secondary barrier. Ship designs with alternative containment systems, including GTT membrane tanks, have been developed but as yet only Type C tanks have been specified.

Various types of propulsion system have been utilised on small-scale LNG carriers, including dual-fuel arrangements which enable the use of cargo boil-off gas as vessel fuel. When dual-fuel plant is specified, back-up arrangements, such as a reliquefaction plant or gas combustion unit, must be in place either to handle excess boil-off gas or for emergencies when there are problems with the propulsion system.

While the new reality of an extended LNG supply chain is getting closer, there are still parts of the existing coastal LNG carrier fleet that are not fully employed in the trade. Eight of the ships are designed as multipurpose gas carriers, with the ability to carry ethylene and LPG as well as LNG. This flexibility has helped the operators achieve high utilisation rates for the vessels until that time they are needed for LNG distribution duties. The current strength of the ethylene trades has been a boon in this respect.

The largest of the coastal LNG carriers currently in service, the 15 600 m3 Coral Energy, is fully dedicated to the trade. The vessel was built by Neptun Werft of Rostock in Germany, part of the Meyer Group, for Anthony Veder, and Skangass, the vessel’s long-term charterer, worked closely with the principals in the design of the vessel. The ability to load LNG at large terminals and deliver cargoes to all sizes of terminals by means of a dual manifold arrangement was a key design consideration.

Anthony Veder describes Coral Energy as the world’s first direct-drive, dual-fuel, ice-class 1A LNG carrier. The ship’s Wärtsilä dual-fuel engine is linked directly to the propeller, thus avoiding the power losses that can arise with diesel-electric drive systems. The 1A ice class rating means that the vessel will be able to function in the Baltic Sea throughout the winter months.

Coral Energy has been delivering cargoes loaded at the Skangass liquefaction plant in Stavanger’s Risavika harbour to receiving terminals at Fredrikstad in Norway and Nynäshamn in Sweden. Until the European LNG distribution and bunkering markets get up to speed the Risavika plant has spare capacity, and Coral Energy has also been facilitating product sales by transporting LNG offered by Skangass on the spot market.

IM Skaugen operates four LNG carriers of 10 000 m3 and two of 12 000 m3 as part of its Norgas fleet. All six ships are able to carry ethylene and LPG as well as LNG and have been primarily employed in the petrochemical gas trades since their delivery from Chinese shipyards over the 2009-11 period. The vessels have conventional propulsion systems and are fitted with a new type of reliquefaction plant developed to handle LNG boil-off gas.

One of the Skaugen vessels, the 10 000 m3 Norgas Innovation, had a taste of things to come when it delivered a domestic Chinese LNG cargo recently. The shipment was transported from the Dalian import terminal in northern China to the Jovo Group’s new LNG terminal in the southern port of Dongguan in Guangdong province.

The Jovo terminal, which features two 80 000 m3 storage tanks, is China’s second coastal LNG receiving terminal. A third small-scale terminal is under construction and proposals have been tabled for an additional eight such facilities in China. Both Jovo and the operator of the Dalian terminal are affiliates of China National Petroleum Corp (CNPC).

IM Skaugen is reported to be considering contracting up to four additional LNG/ethylene/LPG carriers in China. A 17 000 m3 cargo-carrying capacity has been mooted for the new vessels, as has been the ability to run the ships on LNG cargo boil-off gas.

Bijlsma, a member of the Veka Group in the Netherlands, built the 1 100 m3 Pioneer Knutsen, the smallest coastal LNG carrier, in 2004. That vessel, which is fitted with a dual-fuel propulsion system, has performed non-stop LNG distribution services along the Norwegian coast on charter to Gasnor over the past 10 years.

Veka has devoted time to developing its LNG vessel design portfolio in recent years and is now marketing its concepts for an inland waterway LNG carrier, a coastal LNG carrier and a seagoing LNG bunkering vessel also able to transport oil fuel bunkers. The coastal LNG carrier design features two Type C cargo tanks of 2 000 m3 each.

TGE Marine of Bonn in Germany is another company which has developed a portfolio of LNG distribution vessel designs based on the use of Type C tanks. TGE Marine is supplying the bilobe cargo tanks and cargo-handling plant for the three 28-30 000 m3 coastal LNG carriers building in China. The TGE package comes complete with tank supports that have been redesigned in order to accommodate cargo tank expansion and shrinkage due to temperature variations.

Japan has five 2 500 m3 coastal LNG carriers in service, all built by Kawasaki Heavy Industries (KHI) and all engaged in loading cargoes at certain of the country’s import terminals for distribution to the smaller regional terminals in locations where the demand for gas is more limited. Two of the vessels are engaged in transporting LNG in the Seto Inland Sea area in southern Japan while the remaining three load cargoes supplied by Tokyo Gas at the Sodegaura terminal in Tokyo Bay for the 850 km run up the country’s northeastern coast to Hachinohe and Hakodate.

All the ships are fitted with a pair of aluminium Type C tanks covered with 330 mm of Kawasaki Panel insulation and are powered by conventional diesel engines. The containment system design accommodates pressure build-up during the course of the short voyages. The tanks have a design pressure of 3 barg (3 100 kPa) and are able to contain all the cargo boil-off gas that is generated. Voyages to Hakodate take around 48 hours, which is well within the tanks’ seven-day design allowance before venting is required.

Japan is now looking beyond this fleet to its future small-scale needs and is considering larger capacity vessels for «milk run» distribution operations as well as LNG bunker vessels. As the builder of all the country’s small-scale LNG tankers to date, KHI is leading the design review and amongst the options under consideration is the use of LNG-fuelled vessels.

Capacities up to 10 000 m3 are being considered for the milk run LNG carriers while a design for a 6 000 m3 LNG bunker vessel has also been developed by the shipbuilder. The milk run distribution tanker would be engaged on somewhat longer voyages, so the pressure build-up would be greater than that on the existing ships. KHI reports that a 6 000 m3 Type C aluminium cargo tank with a design pressure of 8 barg (8 100 kPa) is feasible as an alternative.

The option of going for tanks with a lower design pressure and burning boil-off gas in the ship’s propulsion system comes with the challenges of finding the necessary skilled engineering officers to man the ships and designing a scaled-down gas combustion unit for any excess boil-off gas that might be generated on the ship.

The gas shipping sector has been able to utilise the expertise gained in the design and construction of ethylene carriers in the initial designs for coastal LNG carriers. Indeed one-half of the small-scale LNG carriers are multipurpose vessels with the ability to also carry ethylene. The industry has also tackled the challenges associated with the design of larger cargo tanks and the handling of boil-off gas in relation to the fuel needs of the propulsion system. The scene is set for a flourishing of small-scale LNG shipping.

LNG bunkering market beckons

The use of LNG as marine fuel is poised to become an important new market. The extent of the breakthrough is dependent on many variables.

As of 1 May 2014 there were 52 gas-fuelled vessels that are not LNG carriers in service and 57 such vessels on order. The majority of this 102-ship fleet are either currently sailing in emission control areas (ECAs) or will be upon delivery.

The allowable sulphur content of fuel used by ships sailing in ECAs will be reduced from 1 to 0,1 percent as of 1 January 2015. Not surprisingly this restriction is creating considerable interest in the use of LNG as marine fuel in the North and Baltic Seas and North American coastal waters – the three regions which are currently designated ECA zones.

LNG is one of three options available to shipowners seeking to ensure compliance with the increasingly strict requirements governing ship atmospheric pollution. Alternatively ships can be either switched to running on low-sulphur marine diesel oil (MDO) fuel or fitted with an exhaust gas scrubber to enable the continued use of heavy fuel oil.

All the options have advantages and disadvantages but it is acknowledged that the use of LNG entails higher upfront costs in providing the necessary systems for a newbuilding than those associated with the two alternatives. On the other hand burning LNG ensures compliance with all existing and likely clean air regulations and holds the promise of lower lifecycle costs, due not least to reduced maintenance costs. That potential increases with any widening of the gap between oil and gas prices that may occur.

Most of the existing LNG-fuelled ships are Norwegian-flag vessels sailing in Norwegian coastal waters. The country’s government incentivised shipowners to opt for LNG as marine fuel through benefits deriving from a nitrogen oxide (NOx) emissions fund that was established a decade ago. The inducements were backed by the ready availability of North Sea gas and a rapidly developed LNG bunkering infrastructure that is supplied by coastal LNG carriers and a fleet of cryogenic road tankers.

LNG World Shipping published a list showing all the ships in the in-service and on-order fleets as of 1 May 2014. The catalogue of ships on order highlights the extent to which the use of LNG as marine fuel is spreading out from Norway. It is not only going global but also encompassing many more ship types than the cross-fjord ferries and Offshore terminal for transshipment of liquefied gasoffshore supply vessels (OSVs) that feature prominently in the current Norwegian fleet. As well as car/passenger ferries and OSVs, the on-order listing also includes:

- container ships;

- roll-on/roll-off cargo vessels;

- gas carriers;

- product/chemical tankers;

- car carriers;

- tugs;

- a bulk carrier and an icebreaker.

Norway has provided the ideal springboard for the breakout of LNG bunkering into other parts of Scandinavia and Northern Europe. Sweden, Finland and Denmark are pressing ahead with small-scale terminal and fuelling station projects while the Fluxys LNG import terminal in the Belgian port of Zeebrugge and the Gate facility at Rotterdam in the Netherlands are engaged in the provision of dedicated jetties to enable the loading of small LNG carriers and bunker vessels. Both ports, along with Antwerp, are likely to host their own LNG bunker vessel operation within the next two years. Several other European ports are embarking on similar initiatives.

Progress with the provision of LNG bunkering arrangements in the region are being reinforced by the European Union’s commitment to the use of LNG as marine fuel. This commitment takes the form of both the strict environmental legislation it promulgates and the subsidies on offer to initiatives that support its Trans-European Network-Transport (TEN-T) programme. Measures have also been introduced to promote the use of LNG to propel vessels sailing on the Rhine-Main-Danube inland waterway system.

Shell is playing an important role in the advances being made in Europe. The energy major has acquired Gasnor, the Norwegian LNG distribution company, and is building upon the network already in place. Shell will be the foundation customer of the new breakbulk LNG facility being built at the Gate import terminal in Rotterdam and is chartering two LNG-powered inland waterway tankers currently sailing on the Rhine.

Another notable feature of the LNG-powered ship orderbook is the progress now being made in North America. The region’s operators have contracted 19 LNG-fuelled vessels, comprising 16 for service in the US and three for Canada. The availability of plentiful supplies of competitively priced gas in the two countries and their ECA status will spur further orders in the region in the years ahead.

The US orderbook includes 10 large container ships – both newbuildings and conversions – that are taking LNG fuelling into new realms in terms of installed horsepower, gas consumption and bunkering arrangements.

One country that is currently only marginally represented on the list of LNG-fuelled vessels in service and on order is China. However, that situation is poised to change dramatically. The government is supporting the use of LNG as a transportation fuel in an effort to tackle the air pollution that beleaguers the country.

The current tally shows that China has two Chinese-built, LNG-powered tugs in service and two similar vessels on order. However, the country has in place a wide-ranging and growing LNG distribution infrastructure which includes a larger number of cryogenic road tankers, tank containers and vehicle fuel tanks than any other nation.

Modified versions of these vehicle LNG fuel tanks have been fitted to a number of fishing and inland waterway vessels in China as part of a trial programme to assess the viability of dual-fuel running. Numerous local companies are reportedly on the verge of constructing fuelling stations for the Yangtze and other rivers as well as LNG-fuelled river vessels that will utilise these depots. In addition domestic shipyards are currently building three coastal LNG carriers of 30 000 m3 each for use in carrying LNG to small shoreside distribution terminals and riverside fuelling stations planned for the country.

The current, fast-changing situation for LNG-powered vessels worldwide begs the question as to how big this fleet will be five or 10 years from now. However much research is carried out to underpin a forecast, any estimate has to be qualified by the plethora of variables that come into play. Will any new ECAs will be created? Will the reduced global sulphur cap for heavy fuel oil be implemented in 2020 or 2025? How will the prices of competing fuels evolve and what impact will refinery technologies have on their ability to increase the production of middle distillate fuels? When will individual sectors of the world shipping fleet fall due for rejuvenation?

In DNV GL’s own analysis of the global potential for LNG fuel, the class society concludes, in its median case scenario, there will be 1 800 LNG-powered vessels in service by 2020, comprising 1 100 newbuildings and 700 conversions. MAN Diesel & Turbo believes there could be as many as 2 000 gas-powered vessels consuming 15 million tonnes of LNG by 2020. In this, the «most likely» of the MAN outcomes, LNG would displace approximately 8 percent of the global shipping fleet’s current consumption of liquid oil fuel.

In March 2014 Lloyd’s Register (LR) issued the results of its own investigation into the worldwide potential for LNG as bunker fuel. Entitled Global Marine Fuel Trends 2030, the study encompassed three major global economic scenarios and concluded that, in its «status quo» scenario, LNG will account for about 11 percent of the world bunker market in 2030. Heavy fuel oil will remain the dominant driver of ship engines, commanding a market share of about 66 percent.

LR points out that the use of LNG would be greater but for the comparatively young age of much of the world fleet. One sector that is ageing and has not experienced any notable infusions of newbuilding tonnage of late is that comprising chemical and small product tankers. LR states that LNG could be powering over 30 percent of small tankers by 2030.

It is vital that this nascent LNG-fuelled vessel fleet is provided with an internationally agreed set of rules governing LNG bunkering, including aspects such as ship design and equipment, transfer arrangements and operational safety. Harmonised requirements will give shipowners the level playing field they need to underpin their investments and provide users of LNG-fuelled ships with a base upon which they can build a safety performance record every bit as exemplary as that established by the LNG carrier sector.

A unified regulatory regime will also assist maritime authorities in dealing with the extremely diverse industry that is beginning to emerge. Administrations are being requested to review an ever-increasing number of LNG-fuelled vessel concept designs that span a full range of vessel types and encompass different types of gas-burning engines, gas treatment equipment and bunker tank design and location. Port and coastal state authorities charged with verifying the safety of a ship’s LNG bunkering arrangement and its ability to perform as required also have a vested interest in the availability of a single, common regime against which they can test compliance.

The maritime industry is working hard on the development of such an instrument – in the form of IMO’s International Code for Ships using Gas or other Low Flash-Point Fuels (IGF Code). Efforts to finalise the IGF Code have been prioritised and a spring 2015 adoption date has been targeted. This would allow the new regime to become mandatory some time in the first half 2017. Once the work on the use of LNG, methanol and low flash point diesel fuels is complete, other fuels such as LPG and hydrogen will be addressed.

The causes of global harmony, sound design and reliable operations will be greatly facilitated by the Society for Gas as a Marine Fuel. SGMF is a new non-governmental organisation (NGO) established to promote safety and industry best practice in the use of LNG as a marine fuel.

Arctic Pilot Project – an early precursor to Yamal LNG

Although stillborn, Canada’s Arctic Pilot Project of 35 years ago set a precedent that is now being followed up with the first icebreaking LNGCs.

The Arctic Pilot Project (APP) was launched to determine if there was a technically and economically feasible way of delivering gas from the Canadian Arctic islands by ship. The shipping component of the scheme was to comprise two 140 000 m3 icebreaking LNG carriers, operating year round. Loading was to take place at a terminal on Melville Island’s Bridport Inlet while the delivery voyage would be across Lancaster Sound and between Baffin Island and Greenland across Baffin Bay and the Davis Strait out into the North Atlantic.

Panarctic Oils of Calgary had discovered the Drake field, with its 110 billion m3 of gas, in the Melville Island region in the late 1960s. Although Melville is not considered to be in the High Arctic, it does fall within what the Canadian Arctic Shipping Pollution Prevention (ASPP) regulations specify as Zone 6. Vessels navigating in this zone are required to be able to move unaided through ice 2-2,5 m thick during the winter months.

APP was initiated by Petro Canada, as the overall project operator and manager, in early 1977. Melville Shipping Ltd, a consortium of three shipping companies, joined the venture to provide technical resources and expertise for the shipping segment. The shipowners were Federal Commerce and Navigation of Montreal, Upper Lakes Shipping of Toronto and Canada Steamship Lines of Montreal.

The APP project itself had a precedent. In 1969 Exxon had converted its crude oil tanker Manhattan into an icebreaking vessel to prove the viability of North West Passage transits. More specifically the oil major had sought to evaluate the potential for Arctic tanker operations as a means of exploiting Alaska’s North Slope oil field. In the event, although the tanker successfully navigated the route, carrying a single, token barrel of oil on the return voyage, it was an expensive exercise and a pipeline across Alaska was deemed to be more economically feasible.

The challenge of discovering a sea route along the North West Passage through the Canadian Arctic has excited entrepreneurs and explorers alike for centuries. The challenge was just as real for the interests behind APP, bearing in mind the need for a year-round solution for large, sophisticated ships.

Shipbuilders, consultants, ice specialists and equipment manufacturers with experience in LNG ship construction flocked to Canada to promote their capabilities. This frenzied competition prompted a range of research programmes worldwide in the search for the optimum icebreaking LNG carrier design.

Because there were no class or regulatory rules in place governing the design and construction of LNG carriers for operations in such a hostile environment, designers were left to formulate their own specifications. No LNG ship of the proposed size had yet been built and the cargo sloshing phenomenon was not understood to anything like the extent it is today.

An additional challenge was the choice of material and thickness for the low-temperature steels to be used for the hull ice belts. Another design consideration was the fact that the vessels would spend 70 percent of their time in open water en route to and from the proposed Canadian east coast receiving terminal.

Not surprisingly under the circumstances, the tendency is to err on the side of caution and a conservative approach to the design of the vessels was taken. It was decided to build the ships as Arctic Class 7 icebreaking LNG carriers according to the ASPP classification. This specifies the steel grades required for hull ice belts. For the ships in question there would be six ice belt areas, covering the stern and bow, the mid-body, the upper and lower transition and the lower bow.

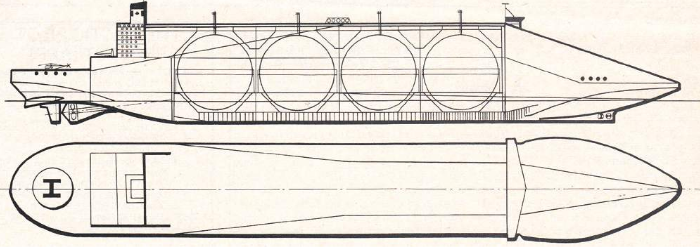

The naval architects proposed a hull shape which featured a propulsion-efficient aft-end, a mid-body with tapered lower sides and an icebreaking fore-end. Hull resistance in open water and in ice, including first year ridge ice, was studied, as was vessel manoeuvrability in ice. Model tests were carried out at the Wärtsilä Arctic Design and Marketing (WADAM) ice basin, the Hamburg Ship Model Basin (HSVA) and in Canada at Arctec and the National Research Centre’s hydrodynamic laboratories.

After a thorough review of all the options, the designers narrowed down the vessels’ cargo containment system to a choice between spherical and membrane tanks. The propulsion system favoured by the APP team was particularly adventurous for the time. Gas turbines burning cargo boil-off gas, with electrical transmission of power to three fixed-pitch propellers, got the vote. The arrangement featured an 8,0 m diameter centreline propeller and two 7,5 m diameter wing propellers.

The design team believed an electric transmission system would provide a superior performance in ice-covered waters due to the high torques available at low propeller/shaft speeds and the excellent response times. Also it was appreciated that gas turbines offered improved performance in a low-temperature environment.

In the event, despite the steep learning curve, APP did not proceed. A combination of falling oil prices, poor market demand, an economic recession and a lack of political confidence ensured that the curtain was drawn on the initiative in 1982. Quite simply APP was a project ahead of its time. But some seeds were sown.

Today the LNG industry is focused on the northern Russian port of Sabetta, where Yamal LNG is poised to become the world’s first Arctic LNG project. Blessed with rich gas deposits nearby, Sabetta is located at the mouth of the Ob River and is icebound for nine months of the year. The US $ 27 billion scheme, which has been given the go-ahead, will require a fleet of 16 icebreaking LNG carriers of 172 000 m3 each to ensure the delivery of gas along the Northern Sea Route on a year-round basis to customers in Asia and Europe. The ships will be delivered over the 2016-18 period, and when Yamal is operating at full capacity a laden LNGC will depart Sabetta every 38 hours.

The Arc 7 ice class ships will be able to proceed through sea ice up to 2,1 m thick and to operate in temperatures as low as –50 ˚C. The intention is for the ships to sail eastbound to Asia during summer period, independent of any icebreaker escort, and to sail westbound to a transshipment point in Europe for the rest of the year. At this location LNG will be loaded onto conventional LNG carriers for the final leg of the delivery voyage.

This Yamal LNG icebreaking fleet, which will be shared amongst three shipowning consortia, will be built by Daewoo Shipbuilding and Marine Engineering (DSME) in Korea. Each ship will cost approximately US $ 310 million to construct and will be provided with a reinforced Gaztransport and Technigaz (GTT) № 96 membrane tank Liquefied Natural Gas and Liquefied Petroleum Gas Cargo Containment Systemcargo containment system. A dual-fuel diesel-electric (DFDE) propulsion system has been chosen and at the end of the power train on each ship will be three Azipod propulsors.

The design of the Yamal LNGCs is based on Aker Arctic’s «double-acting» technology. The combination of the azimuthing propulsion pods and the icebreaking bow means that the vessels can break ice in both directions. However, they will be most effective as icebreakers when moving stern first, as the omnidirectional Azipods can be used not only to provide propulsive power but also to keep broken ice clear of the hull due to their wash effects.

Back in Canada the riches of the Drake field are still in position in the icy surrounds of Melville Island. Now, 32 years on since APP faltered, should our sights be once again focusing on this remote part of northern Canada? So much progress has been made with LNG carrier design in the intervening years that the task would be much easier this time around.

Where will the industry be in 2029?

LNG Shipping at 50 had the opportunity to ask a panel of experts to predict the state of play in 2029, on the occasion of SIGTTO’s 50th anniversary.

LNG Shipping at 50: The global trade in LNG is currently around the 240 million tonnes per annum (mta) mark. What do you think the trade level will be in 2029 (approximately) and why?

Andrew Clifton: It will probably be around double that, if not more. Demand is rising and is likely to continue to do so for environmental, cost and security of supply reasons. The two countries with the largest reserves of natural gas, Russia and Iran, currently have just one export terminal between them. Once these vast reserves come onstream, along with the export projects planned for the:

- US;

- British Columbia;

- East Africa;

- the eastern Mediterranean;

- the Arctic and Australia,

the world’s LNG production profile will look very different to that of today. Of course, not all proposed projects will be built but those that go ahead will mean a significant boost to world output.

Jean-Yves Robin: Global trade could be in the 400–425 mta range. This figure is arrived at because export plants traditionally work at an 85 percent utilisation rate while liquefaction capacity worldwide could reach the 450–500 mta level.

Bill Wayne: My guess would be about 400 mta. The drivers are an increasing awareness that gas will have a key role to play in a world of low CO2 emissions and the possibility that significant quantities in the form of LNG could be utilised as marine fuel. It is worth noting that the global market for marine bunker fuel oil stands at 300 mta. Just a 15 percent swing, which seems a fairly conservative estimate, would require an extra 40 mta of LNG production. Moderating influences on this gas demand are the traditional issues of high capital cost requirements and perceived risks in doing business in some countries with access to undeveloped reserves.

Ed Carr: I don’t have a figure in mind, but it is logical to think that natural gas will continue to be the fossil fuel of choice into the foreseeable future, primarily for power generation but also for domestic use such as heating and cooking, particularly in emerging markets. The use of gas as a petrochemical feedstock is also driving demand. Indonesia and South America are good examples of LNG markets that did not exist 10 years ago. Furthermore the threat of geopolitical disruptions to pipeline deliveries will prompt decision makers to put in place LNG import infrastructure as a hedge against supply interruptions.

Chris Clucas: Extrapolation of statistics from the past 10 years suggests a level of around 425 mta, or about 80 percent ahead of the current trade volume. The positive factors include world population and economic growth, environmental concerns and plentiful supplies of gas. On the other side of the coin are the imponderables. As the late Malcolm Peebles memorably commented at one Gastech conference, the LNG industry has seen numerous demand forecasts, and the only consistent factor is that they are always wrong! No doubt my comments above have just added to the tally.

LNG Shipping at 50: Do you expect any breakthroughs in terms of new containment systems over the next 15 years?

Andrew Clifton: The main containment systems in use today are unlikely to be easily displaced. They are proven, well-established and have stood the test of time. The drive towards increased efficiency will continue, with a particular focus on better insulation to ensure lower natural boil-off gas (BOG) rates, in tandem with improvements in engine efficiency and the resultant lower requirement for BOG as fuel. For floating terminal projects there may be a trend towards greater use of Moss spheres or self-supporting, prismatic IMO Type B (SPB) tanks. The new, enlarged Panama Canal locks will determine the maximum size for future LNG vessels – about 175 000 m3 for membrane tank ships and 160 000 m3 for Moss ships for a maximum beam of 49 m.

Bill Wayne: No, I think there will be continual evolutionary development of established systems, mainly for lower BOG rates. There are high entry barriers to completely new containment systems, and backing a novel design is regarded as being a significant technological risk. To gain acceptance, a new design must be either significantly cheaper, quicker to build or, preferably, both.

Ed Carr: I believe that SPB will make a comeback, now that the JMU yard in Japan has received several orders for SPB tank vessels and has been able to reduce costs by using more automated welding. The displacement tonnage disadvantage of SPB ships has more or less been negated by the fact that many terminals have upgraded to accept Q-flex and Q-max size vessels. At 177 000 m3, conventional LNG carriers with Moss tanks have probably reached their maximum size, although spherical tank vessels of greater capacity could be used in offshore applications. I can’t imagine shipowners or charterers taking a chance on a new membrane or hybrid containment system just to save the GTT license fee. For that to happen there would need to be risk sharing, and we don’t see much of that in today’s business. Also, a deep-pocketed project participant willing to take that risk would be required. Having said that, it is interesting to note that ExxonMobil used a new tank design for its Adriatic LNG offshore terminal.

Chris Clucas: Possible increases in ship capacity could lead to an evolution of the current integral membrane, independent prismatic and independent spherical tank containment systems. Nirvana is still the internal insulation system but failures of the concept early in the industry’s history seem to have discouraged any serious work on this idea. However, new materials yet to be discovered may make such an internal insulation system feasible.

LNG Shipping at 50: What do you think will be the LNGC propulsion system of choice in 2029?

Andrew Clifton: I think technology will bring further changes. When dual-fuel diesel-electric (DFDE) engines were first ordered in the early part of the new millennium, no-one was talking about two-stroke gas injection (ME-GI) engines. Recently such vessels have been ordered. There will still be steam ships trading in 2029. Pressures to lower fuel consumption, increase engine efficiencies and control system emissions will push technology in different directions. The industry will learn from the performance of the early ME-GI engines and the use of LNG as a marine fuel on conventional ships and develop accordingly.

Jean-Yves Robin: Given the LNG industry’s traditional reluctance to take risks or innovate at too fast a pace, I do not expect a great change from the modern engines now being chosen for newbuildings. The current large orderbook for LNG ships and the propulsion systems that have been specified for these vessels provide a good indication of the direction the industry is taking.

Bill Wayne: Low-speed, two-stroke, duel-fuel diesel engines with low-pressure gas injection. The principal driver for this particular choice of propulsion system is IMO’s Energy Efficiency Design Index (EEDI) initiative, and hence fuel economy. Technically a neat design of combined cycle gas turbine could be interesting, but there is no advanced aero-derivative base engine to build the system around. Modern engines, such as the Rolls-Royce MT 90, are all too powerful for the needs.

Ed Carr: I think there will continue to be a market for all three propulsion systems. Steam, and now ultra steam, turbines have their advocates due to the system’s reliability and the ease of handing BOG at low speeds. DFDE, and TFDE, lends itself to flexible machinery space layouts and specific applications like the use of azipod propulsors. The downside is the high maintenance costs. ME-GI engines, once proven in service, will be attractive to projects where the cost of fuel is a significant issue in the scheme’s overall economics. However, many trading models only use their ships at full speed for a portion of time and low speed means a requirement to handle BOG. That means either adding an expensive reliquefaction plant or disposing of BOG via a gas combustion unit (GCU).

Chris Clucas: The same system as used for normal merchant ships, because such ships are also likely to be running on LNG! Although it is difficult to envisage what may happen in the next 15 years, fuel cell technology looks promising. Also, conventional two-stroke diesels have proved reliable under the very demanding conditions at sea, which is one factor that will not change. A simple and reliable propulsion system will be the key requirement, plus the ability to burn clean fuel efficiently so as to be in compliance with EEDI requirements and not cause environmental pollution.

LNG Shipping at 50: To what extent do you think the LNG industry will rely on floating LNG production in 2029?

Andrew Clifton: Five years ago there was no FLNG vessel on order and now we have four such units under construction and several more FLNG projects under serious discussion. It is inevitable that a reasonable percentage of the world’s production in 2029 will be FLNG-derived. The challenges associated with building an LNG export terminal at a greenfield onshore site, especially in a remote area with labour and local content issues, are huge. Project economics will determine the final choice. Operating an FLNG unit comes with its own challenges, including the provision of onshore support, onsite train maintenance and handling various weather scenarios.

Read also: Development of the FLNG and FONG for Gas Extraction

Jean-Yves Robin: Of the 230 mta of additional liquefaction capacity likely to come onstream between now and 2029, not more than 15–20 percent, or 35–45 mta, will be FLNG-derived. Most extensions of existing plant, brownfield projects, schemes with adequate onshore infrastructure and projects in areas where a high local content is required will rely on traditional shore-based export terminals.

Bill Wayne: Not much. I think FLNG will remain a niche product so long as there are sufficient reserves which can be developed with reasonable ease using traditional onshore plants. The main driver for FLNG is the elimination of the costly subsea line back to shore. Additionally, projects such as Prelude make sense due to the very high engineering, procurement and construction costs associated with developing onshore facilities in Australia.

Ed Carr: It really depends on the price of LNG. On a per tonne basis, offshore projects are almost always significantly more expensive then onshore projects, but any decision will be site-dependent. While there will be some floating LNG production going forward, I think it will be the exception rather than the rule.

Chris Clucas: To a significant extent. There will be an increasing need to use our offshore energy resources, and FLNG offers the opportunity to exploit small, stranded gas resources.

LNG Shipping at 50: To what extent do you think small-scale LNG, including the use of LNG as marine fuel, will be established by 2029?

Andrew Clifton: The delivery of smaller parcels of LNG to receivers who are not currently able to handle LNG will become much more common and small coastal LNG vessels will be required in greater numbers. The extent to which LNG is used as a marine fuel and the speed of its take-up will depend on when IMO’s global sulphur cap restrictions enter into force. By 2029 I would expect that a substantial worldwide LNG bunkering infrastructure will be largely in place, enabling many deepsea vessels to bunker with LNG. Small-scale LNG will be an integral part of this supply chain.

Jean-Yves Robin: Small-scale LNG, primarily for the supply of LNG as transportation fuel, could grow rapidly from 2020 onwards, to reach around 40 mta by 2029. That would be equivalent to around 10 percent of the total LNG market at that time. Both environmental (air pollution) and economic drivers (fuel price differentials and the cost of complying with IMO restrictions) are the underlying reasons.

Bill Wayne: I think there is quite a lot of potential here, particularly for vessels trading extensively in emission control areas (ECAs). I am less sure of the case for ships serving on long-haul, deepsea trade routes.

Ed Carr: The extent to which LNG as marine fuel is taken up will depend on price, supply and the continued spread of stricter emission control requirements. Look for ships operating in current ECAss, namely the Baltic and North Seas and North American coastal waters, to lead the way. They will be followed by vessels on long-haul, fixed routes, like large container ships sailing between Asia and Europe.

Chris Clucas: Having recently been appointed the founder president of the Society for Gas as Marine Fuel (SGMF), I would say completely! The business is already starting to happen and I am sure you will be hearing about orders for new LNG bunker delivery tankers very shortly.

LNG Shipping at 50: What do you think is the greatest challenge that the LNG industry will face over the next 15 years? What is the best way to meet this challenge?

Andrew Clifton: I believe it is two related issues which SIGTTO has been dealing with since the Society was formed – manning and safety. The remarkable safety record that LNG shipping has achieved needs to be protected and maintained; it is, in effect, our license to operate. Increases in activity bring increased risks and these need to be mitigated through appropriate control measures, including continuing to operate to best practice and not just the minimum requirements. Existing industry members need to ensure that new entrants embrace the high standards and practices the The Evolution of LNG Importer Cooperation – Partnerships, Safety, and Future DirectionsLNG shipping community has operated to these past 50 years. The industry also needs to continue to invest in training; there is no other solution to the skills shortage. Also, the focus must not be just on ship staff. Having sufficient numbers of shore support staff and trainers of the appropriate quality is vital too.

Jean-Yves Robin: There are many challenges. These include the uncertainty of demand in the Atlantic Basin, a potential breakthrough of unconventional gas in China and India, and competition from large pipelines into Asia. However, the major challenge within the LNG industry itself is the increasing cost of new investment stemming from factors such as environmental requirements, shortages of qualified personnel, and labour and material costs.

General market and political pressures to keep the level of energy prices low on the one hand and cost escalations on the other could squeeze margins over extended periods of time.

Bill Wayne: In an age where society is increasingly suspicious of large companies, and recognising that LNG projects will, for cost reasons, remain the preserve of such companies, the challenge of getting society, government and regulatory support for new projects remains significant. To have a chance of success it is vital that the industry’s reputation for reliability and safety are strongly maintained.

Ed Carr: Finding, training and developing adequate human resources to handle the growth. But also continuing a safety culture where no accident is acceptable.

Chris Clucas: Skills – in all areas, ashore and at sea. The best way to meet this challenge is through training and much better harnessing of educated engineering talent from our colleges and universities. Historically the LNG industry has been a rather «start-stop» sector, with many senior people leaving and not being replaced during the quieter parts of the business cycle. This is then followed by a mad panic and wage spiral a couple of years later when activity picks up. I was extremely fortunate to join the International Chamber of Shipping (ICS) just after graduating and chance brought me the opportunity to move into liquefied gas. It seems to me this sort of opportunity needs to be offered by some of our industry bodies. It is certainly on my agenda for SGMF and I have suggested this in the past to SIGTTO. The need exists in the companies that design and operate LNG plants, that manufacture LNG equipment and especially in those that man and operate LNG ships, where the entire sector faces a recruitment gap. Logic would suggest that general remuneration packages for LNG should be kept somewhat higher than comparable work in, say, oil or coal but this would probably be impossible in companies that work in all sectors.

LNG Shipping at 50: Do you foresee any other major changes taking place in the LNG industry over the next 15 years?

Andrew Clifton: More players in the industry mean more options and increased competition and expectations. The small, closed «LNG club» is now part of history. The percentage of the world’s fleet tied to specific projects is likely to be lower than it is today as the portfolio players use chartered/operated fleets to move their supply around. The way LNG is traded may also move away from the more traditional methods of the past. In addition we may see completely new uses for floating LNG such as integral power plants where storage, regasification and power generation is all on one huge unit supplied by ship-to-ship (STS) transfers. Such a solution would be ideal for major engineering projects in isolated locations or for dealing with areas recovering from natural disasters.

Jean-Yves Robin: The LNG business model in the Pacific Basin is likely to continue evolving towards the structure seen in the Atlantic Basin. In other words Asia’s traditional tramline model of long-term contracts and dedicated trade could gradually give way to a traded market and portfolio play, including by Asian companies. As a result by 2029 the current distinction between the business models of Atlantic-based and Pacific-based players would have all but disappeared.

Bill Wayne: There are a number of unknowns looking forward. How will the Chinese demand develop and will that bring Chinese capital into new projects? Will the premium, oil-linked price structure based on Japanese contracts continue, or will LNG develop its own, worldwide commodity pricing system. Despite this, I think we will still see projects underwritten by long-term contracts. While there may be some trend towards more short-term trade and, if you like, more commoditisation of LNG, I don’t think it will be substantial. Basically, LNG projects are highly capital-intensive and banks want the security of long-term contracts for their financial support. Additionally most buyers are supplying markets where their host governments put stringent requirements on them concerning continuity of supply. One easy way to meet these is through long-term contracting for the major proportion of their foreseeable demand. Recent political uncertainties around security of supply, such as could arise due to the current Russia/Ukraine situation, may well bring more countries into the LNG users’ club.

Ed Carr: I expect that more and more LNG will be sold on a trading basis with long-term contracts becoming less common. Shipowners will be challenged by shorter time charter periods.

Chris Clucas: More new companies entering the business, especially traders. The larger the market, the more opportunity for arbitrage trading. This is certainly not unique to LNG.

LNG Shipping at 50: Do you think the roles of SIGTTO and GIIGNL will change in any way over the next 15 years?

Andrew Clifton: I think both organisations will grow from strength to strength as the world’s focus on LNG increases. Both organisations are likely to be bigger, with more resources dealing with more activities. The importance of highly specialised, experienced and respected industry bodies with years of experience serving their members cannot be underestimated. On the basis that SIGTTO had 130 members 10 years ago and has 190 today, I will hazard a guess and say we will have 300 members by 2029!

Jean-Yves Robin: With expansion of the numbers of players active on the LNG scene, and in particular because of the development of small-scale LNG, safety will become an even more important focus for associations like SIGTTO and GIIGNL. With the objectives of safety, operational excellence and product-lobbying in mind, we might consider assembling an industry group that incorporates all the players in the LNG supply chain, from liquefaction down to suppliers of LNG in the small-scale market. If GIIGNL develops in such a direction, the membership could grow significantly.

Bill Wayne: I think we will see more of the same roles. There will undoubtedly be new challenges but the key role of the associations as the voice of the industry and, indeed, as the champions of the industry, will continue. On membership, I think SIGTTO’s will grow by about 10 percent. While new projects bring in new players, we often see consolidation taking place after a period, with some of the new players being absorbed by existing large players. For GIIGNL, I would put it a bit higher because I think more countries will be joining the LNG users’ club, and this means more importers.

Ed Carr: As the LNG business expands going forward, I think there will be more and more demand for the services of the two organisations, especially in the form of technical information. Membership will continue to expand with the business but it is hard to put a number on it.

Chris Clucas: There will be more members in locations remote from the organisations’ head offices. So there will have to be more local meetings, and travel requirements will be greater than at present despite the growing use of video-link technology. In short, both SIGTTO and GIIGNL will become more global.

Andrew Clifton is general manager of SIGTTO. Jean-Yves Robin is general delegate of GIIGNL. Bill Wayne is a former general manager of SIGTTO and now director of Sewallis Consulting. Ed Carr is a director of BGT and has worked in the LNG industry, afloat and ashore, for 35 years. Chris Clucas is group fleet director with the Bernhard Schulte Shipmanagement Group. The interviewees would like to point out that the views expressed above are their personal opinions and not necessarily those of their organisations.