When the situation of natural gas is compared to oil, the contrast could not be more striking. Unlike oil, where supply is often artificially manipulated, natural gas reserves are abundant, with the key challenge centering on distribution. This stark contrast immediately brings the territory of the former Soviet Union into focus. The enduring and dominant role of post-Soviet Russia in this sphere necessitates a deep dive into the underlying strategic factors.

This article explores the unique Russian Gas Geopolitics, examining how Russia has solidified its position as Eurasia’s indispensable energy linchpin and how this dominance challenges traditional energy market models. Furthermore, we move beyond mere market analysis to consider a fundamental question: does the current system, fraught with costly and environmentally damaging “fixes” like chemical hydrate management, demand a radical redirection toward a more sustainable, pro-nature approach to energy production and delivery?

Natural Gas in Eurasia: the Special Position of Post-Soviet Russia

When the situation of natural gas is compared to oil, the contrast could not be more striking. Even for what are commercially defined as natural gas sources, there is no shortage of supply, just some distribution constraints available for some degree of artificial and largely temporary manipulation. Most remarkably, one of the zones of greatest commercial supplies is the territory of the former Soviet Union, in which there never developed the upstream – downstream separation that facilitated US domination, the manipulation of excess demand for oil (EDO), and the ever-expanding gap between the stagnation in real constant-dollar costs of production in oil-exporting countries and the price extracted for products in the consuming countries.

Another factor further transforming the picture stems from the absence of the corporate as well as government-owned sectors of the oil and gas industries of post-Soviet Russia from any of the existing US or US-European production or marketing cartels. The territories of the former Soviet Union (including the separate republics of central Asia which emerged since 1991) possess the largest conventional oil reserves outside OPEC and the second-largest proven reserves of natural gas anywhere on earth. Its emergence as a major world-market “player” in its own right in the production and sale of crude and refined petroleum for markets in Europe, especially for the fastest-growing markets in China and the Asian subcontinent, challenges both the demand-management model used by OPEC and backed by the US oil majors to set and maintain a world oil price. As for natural gas, Russia provides the geographic linchpin for delivering to markets anywhere in the Eurasian land mass. For the more than four billion people living on that land mass, this fact must, over time, erode any notion of any purely local market for natural gas. The global distribution of commercial natural gas and its production are described.

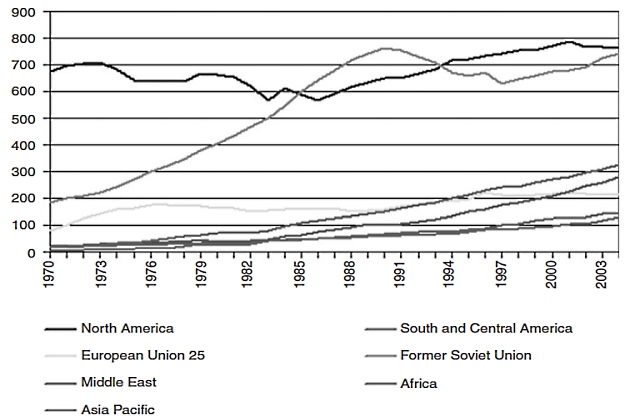

Proven natural gas reserves – those that could be produced economically with the current technology – are illustrated in Figure 1 as follows. The former Soviet Union holds the world’s largest natural gas reserves, 38 % of the world’s total. Together with the Middle East, which holds 35 % of total reserves, they account for 73 % of world natural gas reserves. In 2000 total world reserves were 150,19 trillion cubic meters.

Source: UNCTAD based on data from BP Amoco, Statistical Review of World Energy, June 2004

Global reserves more than doubled since the mid-1980s. The world’s ratio of proven natural gas reserves to production at current levels is about 60 years. This represents the time that remaining reserves would last if the present levels of production were maintained.

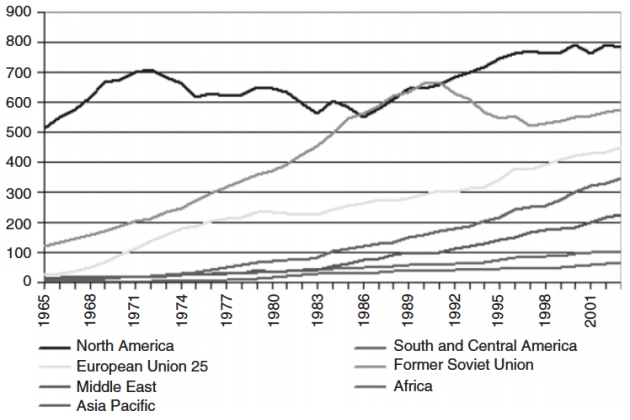

As Figure 2 illustrates, the world’s main natural gas-producing countries in 2000 were the United States (22,9 % of world production) and the Russian Federation (22,5 % of total production). Other major producing countries are Canada, United Kingdom, Algeria, Indonesia, Iran, Netherlands, Norway and Uzbekistan. These 10 countries alone accounted for more than 86 % of total Usage of Natural Gas Compressors in the Gas Production Operationsnatural gas production in 2000. North America and the former Soviet Union together accounted for 59 % of global production. Total world production in 2000 was 2 422,3 billion cubic meters.

Source: UNCTAD based on data from BP Amoco, Statistical Review of World Energy, June 2004

Production growth in 2000 was 4,3 %, a significantly higher growth rate than the 1990-2000 annual average. Although production increased in all regions, the faster growth was recorded in the Middle East and Africa. During the 1990s, production rose in all regions but the former Soviet Union.

Read also: Managing Liquefied Natural Gas Risks in the Marine Industry

Natural gas accounts for almost a quarter of the world’s energy consumption. As shown clearly in the Figure 2, LNG Market Dynamics – An In-Depth Exploration of Pricing, Contracts, and Current Trendsconsumption of natural gas has increased considerably since the mid-1970s.

As Figure 3 illustrates, the world’s main consuming countries in 2000 were the United States, accounting for 27,2 % of total consumption, and the Russian Federation, with 15,7 % of total consumption. North America and the former Soviet Union together consumed 55 % of total natural gas. The share of Europe in total natural gas consumption was 19,1 %.

Fig. 3 Natural gas consumption (billion cubic meters)

Source: UNCTAD based on data from BP Amoco, Statistical Review of World Energy, June 2004

These three areas account for three-quarters of global consumption. Consumption growth was 4,8 % in 2000, with the highest rates of growth registered in Africa (12,8 %) and Asia (7,8 %). Total world consumption was 2 404,6 billion cubic meters.

Post-Soviet Russia’s situation represents one of the foremost features of the world picture of commercial production of natural gas. Russia’s natural gas industry, a monopoly run by Gazprom, which controls about 86 % of the country’s marketed production, is the second major source of the world’s commercial production of natural gas and the world’s leading exporter of natural gas. Furthermore, within Russia, natural gas is the predominant industrial fuel, accounting for nearly half of the country’s domestic energy consumption.

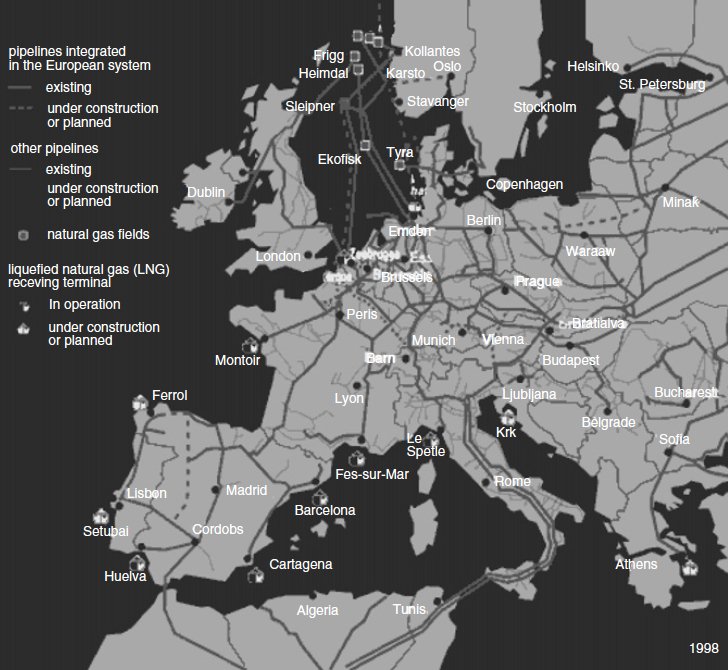

Another remarkable piece of the natural gas marketing picture related to this is the situation presented by western Europe, which possesses only about 5 % of commercial natural gas resources but has an insatiable appetite for this form of energy. The main producing countries are Netherlands, Norway, and United Kingdom.

The gas industry in Europe consists mainly of downstream activities undertaken by transmission and distribution companies. More than 30 % of gas consumption is met by pipeline imports from the former Soviet Union and Algeria, as well as liquefied natural gas imports from North Africa. The nearest and best source of supply is, logically, Russia, as Figure 4 shows.

Source: Eurogas Consortium

The general picture in international trading of natural gas further illustrates how the dominant positions of the leading producers are mediated by the forces that determine the basic cost structures of international trade, such as shipping cartels. According to Cedigaz, 26,3 % of total world marketed natural gas production was traded internationally. LNG tankers trade accounted for 21 % of total international trade. The low share of The International Trade LNG and LPGinternational trade is due to the complexity to transport gas and requiring large investments, while many gas resources are far from consuming centers. The construction and management of pipelines also pose legal and logistical problems. Main exporting countries by pipeline in 2000 were the Russian Federation, Canada, Norway, Netherlands, Algeria, and United Kingdom. The main importing area by pipeline, apart from United States, which took hold of all Canadian exports, was Europe.

LNG trade itself presents an even more checkered picture. This takes place predominantly in Asia – Pacific, with Indonesia, Malaysia, and Australia as exporting countries and Japan as the main importing country.

- Thirteen countries have liquefaction facilities: Abu Dhabi, Algeria, Australia, Brunei, Egypt, Indonesia, Libya, Malaysia, Nigeria, Oman, Qatar, Trinidad and Tobago, and the United States.

- Forty-seven receiving terminals are operating in 14 countries: 24 in Japan, 4 in Spain, 5 in the United States, 2 in Korea, 2 in France, 2 in India, and 1 each in Belgium, Dominican Republic, Greece, Italy, Puerto Rico, Taiwan Province of China, United Kingdom, and Turkey.

Looking ot Nature for a New Model

Normally we would end the chapter on gas pricing right here. However, as much as we may document how it works, the fact remains that the pricing of natural gas up until now has reflected neither the true energy content of the gas nor the true costs of its production and delivery to consumers. Many costs have come to be added that also added further layers of opacity to the problem. For example, there is a problem with hydrate formation in gas pipelines that can severely restrict flow. Tens of billions of dollars annually are expended on toxic chemicals that are injected into pipelines to arrest, break up, or slow down hydrate formation. This cost is passed on to consumers, and then sometimes the pipeline company – but more often society, usually in the form of government – is then also confronted with paying the costs of Prevention of Environmental Pollution by Tankers in the Event of Chemical Spillsenvironmental damage and cleanup from the toxic chemicals. This adds to the gross domestic product by simply increasing spending, but is it improving the standard of living of society as a whole?

It will be interesting: Individual Responsibilities on Liquefied Natural Gas Vessel

The adding of costs in this manner – and with them, further layers of opacity – is reflecting no significant improvement in either of the two most intangible aspects of the energy commodity, namely, its efficiency or quality. Indeed, this process so effectively marginalizes all discussion or consideration of these aspects that the deeper question starts to pose itself: is any of this entire proceeding on the right path? Resolving this issue, however, is by no means as straightforward as it might at first appear. The commonest approach is the familiar one of “cost-benefit” analysis: the costs and benefits of various paths are totted up, compared, and finally one presumably optimal path is selected. Such quantitative comparison has the advantage of being highly tangible, but what if the problem resides precisely in the tangibility of all the paths thus examined, i. e., the fact that they all quantify on the basis of putting dollar values on external manifestations?

There are alternatives to a number of the sources of added cost that follow a path quite different from that which can be directly engineered through adding chemicals. For example, bacteria can also break up hydrates and return to the environment without doing pollution damage. So far no one has found a way to turn such a thing into a multibillion dollar industry that would deliver a useful result. Some conclude from this state of affairs that such a course is uneconomic, but the fact of the matter is that doing this well would in the end be low cost, its essential mechanism (like many natural solutions) quite self-contained and thus unlikely to be spinnable into a grand new profit center. Of course this would also mean that a major increased charge on the final price of gas to the customer would be that much harder to justify in the name of defeating the hydrates menace and saving the environment.

The choices of path cannot be limited to rearranging and manipulating external features, elements that are extraneous to providing an energy source on a continuous and reliable basis. Natural paths are to be preferred over engineered paths, but the driver of the selection process remains “return on investment“. Not all engineered paths will deliver an optimum return on investment, but when natural paths are examined, the problem becomes far more complicated. When “return on investment” is the driver, every possible natural path looks hopelessly utopian and impossible to justify.

What is the essence of the problem posed by continuing with energy commodity production on the basis that has developed up to the present? Many question whether any actual social need of society or its individual members is being addressed within the confines of any presently available social or economic model. At the same time, who or where anywhere in this modern world can survive without a system of providing and meeting energy needs? Could it be the very fact that return on investment is the driver is ensuring that, in the end, no actual need or needs of society or its individual members is or are being, or can be, addressed?

Hydrates, like many of the other hazards attending the exploration, production, distribution, and Energy consumption Optimization and Improvements in the Natural Gas Liquefaction Processconsumption of natural gas, petroleum, and its by-products, become irremovable singularities that can only be dealt with either at the cost of private corporate profit or at public government expense. They are labeled “downsides” and entire forests have been felled to produce the thousands upon thousands of pages of statutes and regulations that are supposed to “manage” the problems created by these “downsides“, but nothing fundamental is transformed in the result. Why? Could the answer be because these approaches all follow one and the same antinature model?

Read also: Global gas market and history of LNG/LPG consumption

The antinature model takes on too many specific forms to be easily pigeon holed with a concise definition. However, in the case of energy commodity production, the production of energy mainly as a feedstock to produce energy in another form – oil or natural gas to make electricity or renewable solar energy for the same purpose – rather than for their highest and best uses directly as energy sources in their own right is one of the most commonly seen indicators of an antinature path and agenda.

The real issue is firmly and finally to step off this antinature path and renew the knowledge-based, researched approach to extracting solutions that are innovative, economically attractive, environmentally appealing, and socially responsible.

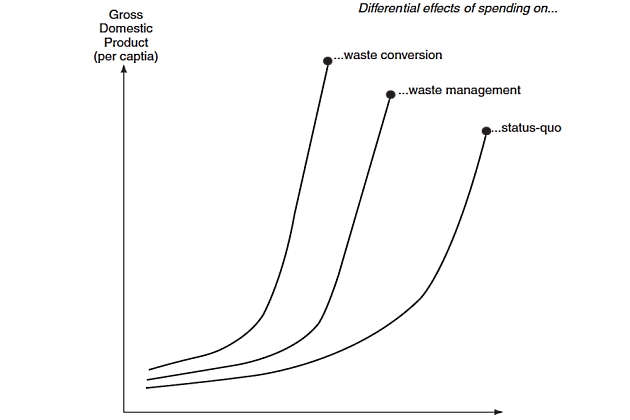

The production, distribution, and supply of energy are keys to modern social and economic existence everywhere on this planet. There is no corner left on this earth where the solution to these problems can be purely local or not connected with the wider world. How problems arising in the production, distribution, and supply of energy are addressed should to be the heart and soul of solving the problem of raising the true standard of living everywhere, the notion crudely and incompletely estimated by the well-known index forming the ordinate axis in Figure 5, namely, the “per capita gross domestic product“.

Of course, spending of all kinds is incorporated in the per capita Gross Domestic Product (GDP), from prostitution, gambling, and tobacco consumption, to armaments production and export, to outer space research and medical research, etc. The idea underlying per capita GDP is that even if individuals, institutions, and corporations each have their own priorities, personal, private, or social, a meaningful statistic about the general state of social development as a whole can nevertheless be generated by averaging spending on all these wildly divergent agendas over the entire population.

The legitimate question raised by this approach is what social progress other than mere arithmetic increases in spending can be registered by such a statistic? Mixing together privately directed and socially directed forms of spending on the assumption that their very direction, i. e., the agendas informing the actual spending decisions, is a matter of indifference to economic science ensures that spending that is indeed harmful and informed by some private agenda is placed on par with spending that is socially beneficial and informed by an agenda that is not purely self-serving. Yet it is widely understood as a fact of life anywhere in this world that “good for some and bad for others is bad for everyone”. Allegedly “scientific“-minded indifference to this crucial distinction acts as a serious blind to understanding the fundamental issue of path. What the graph brings out is how crucial it is for collective well-being that social concerns are assigned their proper priority: any change in this direction, even just a focus on waste management, would being about an improvement compared to the status quo.

The pro-nature path is attained quite readily by taking a knowledge-based and researched approach. This means starting from the position that nothing that presently exists is the “last word” in technology. One must be ready fearlessly to work out arrangements based on what is actually found to work in nature, not on the basis that nature is broken and needs to be “fixed“. Nothing that originates from nature can pollute the natural environment if it is used and returned to nature without in the meantime being artificially reconstituted, deconstituted, or otherwise engineered outside the range within which it serves its customary natural purpose(s). Nothing that originates in nature is linear in its native state; if it is linearized and then returned to nature it will either pollute or cease to be useful. Natural constituents utilized according to their customary functions within nature are in fact time tested. This often ensures over-coming, by entirely avoiding, the costly burden of having to reengineer short-term solutions developed away from a nature-based path as they inevitably break down and start to fail.

What is not being suggested here is either any romanticized notion about nature as a mysterious force or mysterious treasure house, nor a theological or teleological assumption about the purposes of nature. It is an unavoidable starting point of all scientific investigation, into either social or natural-physical phenomena, that the universe at any moment is a function of space and time:

The actual space relevant to any proper specific investigation is not to be confused with, or held to be coequal with universal space, the “x, y, z” of U as just defined. A proper investigation depends on finding ways of investigating – perceiving and measuring – the portion of space that is relevant. The temporal component, however, is a different matter.

The temporal component of some finite process or system being observed or investigated, which can be defined as commencing at tinitial and ending at tfinal, is one thing. However, the temporal component of processes in nature proper, so to speak, is very different, precisely because – frequently if not indeed customarily – tfinal is simply unknown. All engineered processes can be handled very nicely according to the paradigm of the [tinitial, tfinal] interval, whereas most natural processes can be investigated at best only according to an interval that looks something like [tinitial, t(finalbest – guess)], where the right-hand side of the interval cannot be closed. It could very well be that it closes at t = ∞.

The one thing that is certain is that right-hand “)” can only be replaced with a “]” after a true tfinal value is established, not before. From the standpoint of establishing scientific knowledge, it will not advance matters simply to assert and assume a tfinal value and a right-hand “]” without some testing procedure and associated criteria that either establish a tfinal value or demonstrate that tfinal only appears or converges at t = ∞. The temporal component of a natural process is thus inherently intangible. Usually at this point, accusations are heard about “introducing matters of metaphysics and religion into science”, etc. However, should acknowledging such intangibility have to be the end of further scientific discussion and investigation or could it not represent a new starting point?

Here it becomes important to clarify that what is being set forth is very far removed from the notions of intangibility presently attending the entire matter of natural gas pricing. These are quite concentrated, for example, in the specific area of Risk Management Techniques used in the Oil and Gas Industriesrisk management, specifically using derivatives (see Section “Understanding the Fundamentals of US Natural Gas Pricing and Market VolatilityEnergy Price Volatility and Derivatives“):

The asset that underlies a derivative can be a physical commodity (e. g., crude oil or wheat), foreign or domestic currencies, treasury bonds, company stock, indices representing the value of groups of securities or commodities, a service, or even an intangible commodity such as a weather-related index (e. g., rainfall, heating degree days, or cooling degree days). What is critical is that the value of the underlying commodity or asset be unambiguous; otherwise, the value of the derivative becomes ill-defined”.

The problem here lies with how intangible elements have been selected in the first place for inclusion among the components of the derivatives. The effective value of the derivative as a tradable instrument is entirely a function of time rendered in tangible form, namely the date(s) on which the underlying contract(s) must be completed. The intangibility of the “weather-related index” mentioned in the example earlier, however, is intended to provide the seller of the instrument with an “out“, an escape from liability, in the event of a failure to perform the contract. Time as the essential intangible of processing of anything within nature, however, either adds or subtracts effective value. Issues of liability, much less distancing contracting parties from its reach, do not arise.

It will be interesting: Merchant Shipping Safety – Access Regulations, Liability Act, and ILO Convention Ratifications

Viewed in the light that has been cast here, the time testedness of natural constituents and sources, before and without further chemically or industrially engineered processing, poses an interesting conundrum: are the best sources of energy locked in nature’s newest products, or its oldest? The conventionally trained scientist’s response would be that all of this is resolved by establishing the chemical structure: CH4 from the living cow at around 1 KPa pressure or CH4 from material that decayed eons ago, lying thousands of meters beneath the Earth’s surface under confining pressures of thousands of KPa is also CH4: end of story.

Consider, however, the implications of this claim:

- It is accepted that the entire planetary system and galaxies far beyond this planet and solar system are continuously undergoing change, and;

- it is accepted that animal species have undergone and continue to undergo evolutionary change, speciation etc., but;

- it is not acceptable to assume anything consequential might have happened at the molecular level over the billions of years that passed while some electron continued revolving about some nucleus.

The weight of this logic alone suggests that an important piece of the picture remains to be investigated further. Despite what has become commonly accepted, and which forms the basis of the entire energy extraction and processing sector, the energetic content of various well-defined molecular arrangements of carbon and hydrogen atoms may in the final analysis indeed not have been due after all, either mainly or entirely, to how these compounds as raw material were engineered (i. e., processed or refined).

Rather, these molecular remains of “dead” matter may have further transformed internally as raw material in the natural environment according to processes still not understood. Just because such material is no longer living organic material may not mean that it could not undergo further internal transformation on top of the transformations being imposed externally by continental drift and plate movement, climate change, etc. Within the field of petroleum engineering research, to dismiss any consideration of the possibility of subatomic intramolecular change in posthumous organic matter left undisturbed over geological periods of time cannot be considered a sign of wisdom. In the present context, it would even seem to serve as evidence for the conclusion that ongoing fanatical adherence to views that subsequent progress in actual research and discovery rendered unsustainable is a syndrome that cannot be attributed to any particular belief system, national or ethnic origin. All that is required to catch this disease is a strong will to remain ignorant.

Source: Pixabay.com

As energy is in continual demand, solutions are needed on a continuous basis and that which can be shown to work in the long term can therefore take care of the short term as well. That is why a pro-nature-oriented scientific research effort could reasonably be expected to produce innovative breakthroughs not confined to managing pollution and waste but to conversion of so-called waste into useful new social products. The energy potential locked within many so-called “waste materials“, researched and developed on a nature-friendly basis, could produce a tremendous improvement in the overall standard of living by rendering energy supplies affordable and available to broad sections of the population that are currently underserved and overcharged.

When it comes to problems of international economic development, the development of energy sources cannot be discussed seriously or honestly without addressing the critical issues of groundwater supply. This is the most fundamental metric of true living standards in the still overwhelmingly rural societies of Asia, Africa, and Latin America. The entire bias in favor of engineered solutions as “modern” and “sophisticated” has served to accelerate the departure from the pro-nature path. Before the arrival, starting in the 17th century (1600s), of colonizing powers from Europe and the United States in these regions, this path was the norm of many so-called “traditional” societies; it was the same story among the native peoples of North and Central America, who suffered an outright genocide that began a century earlier.

A powerful movement has spread far and wide in recent years in many of these countries to restore traditional technologies, renewed appropriately and sufficiently to deal adequately with the speed of information and development in the modern world but otherwise traditional in their fundamental approach, which was and had to be pro-nature by definition. This accounts for the success of such initiatives as the “Water University“, which has developed in several drought-stricken regions of the Asian subcontinent to recapture and reapply ancient traditional knowledge – dismissed for the last century and more as “old wives’ tales“, “folklore“, “anecdotes but not science” etc. – of how to use the ambient natural conditions to conserve precious supplies of groundwater. The rapidity and scale of this success represent a most telling indictment as well of the signal failure of allegedly “advanced technological solutions” to lift more than a tiny elite from these societies into the ranks of “civilized” colonizers.

Read also: New and Emerging LNG/CNG Markets

However, there is something yet more fundamental here than the confrontation between traditional societies and European colonization: the dependence of modern societal infrastructures on energy supplies is matched only by, and ultimately even underpinned by, the broader overall dependence of human social existence on the supply of water. The intimate connections between groundwater supplies and oil reservoirs were well understood in ancient times throughout Mesopotamia. One of the gravest indictments of the arrival of “advanced modern technology” to exploit the oil wealth of the region was the serious messing up of groundwater supplies that followed. The significance was multiplied greatly by the circumstance that these regions were literally at the edge of the westward-moving front of the central Asia desert. In the American southwest in particular, as activity in the civil courts serves to indicate, Comprehensive Guide to Local Content Policies and Infrastructure Developmentcommercial natural gas development has enormously disrupted groundwater supplies and aquifers on the traditional lands of many native American tribes.

The corporate mantra of the true believers in “return on investment” as the final arbiter of the possible seems to be “if oil and water don’t mix, forget the water!” Today, this stands increasingly exposed as a path imperiling the very future of humanity. The fact that one cannot sacrifice either the one or the other in the short term or the long term is increasingly well understood among all peoples everywhere. At the same time, Nature ultimately cannot accept the confines of any system of so-called private property. It has its own logic, which proceeds utterly oblivious to such inventions and conventions. That is why those following the corporate road must inevitably at some point take the antinature path – the path of “fixing” nature rather than learning its secrets and working with it, a path with a doubtful future even in the short term and no future whatsoever in the long term.

Source: Pixabay.com

Earlier in this chapter, the question was posed: considered from an engineering standpoint, are the patterns, changes, and trends in the supply of and demand for so-called “nonrenewable” energy commodities consistent with their actual potential? Our best answer at the moment is that the role of “return on investment” – as the driver matching the supply of energy commodities to an asserted demand that, more often than not, has been manipulated by hidden hands – seems to have blocked humanity’s access to the pro-nature path. This is the only path on which the actual potential for these commodities can be researched properly and the problems involved in releasing their potential solved in ways that will be innovative, economically attractive, environmentally appealing, and socially responsible.

In conclusion, natural gas has a key role to play as an energy source in the 21st century, and the demand, which will be driven by the development of new markets for natural gas, is growing steadily. The share of natural gas reserves located onshore, easy to produce and close to consumers, is decreasing while the share of natural gas reserves located offshore in challenging and hostile environments is growing. Technology is the driver, and current “stranded” gas resources may be developed using floating LNG plants, which could not be technically feasible just a few years ago. The major challenge of the Philosophy and general requirements in the gas industrygas industry is to be able to bring gas to the consumers economically. Substantial cost reductions achieved through technical progress have resulted in longer distance transports. LNG developments have also contributed to this evolution. In this case, gas transportation involves heavy and expensive infrastructures, which result in rather rigid ties between the producer and the consumer. Furthermore, a major part of transnational trade will be only feasible by long-distance gas pipelines. https://sea-man.org/lng-transportation-risks.htmlNatural gas transportation by pipelines is discussed in article “Raw Gas Transmission: Multiphase Flow, Hydrates, and Corrosion ChallengesRaw Gas Transmission“.