Explore the key commercial aspects of LNG with our comprehensive guide. Learn about essential terms and conditions, LNG measurement principles, equipment and procedures, sampling, custody transfer checklists, time charters, economic implications of boil-off management, relevant industry organizations, and vetting and inspection processes.

- Terms and Conditions in Use

- Have an awareness of the following terms and their relevance

- Schedule “A”

- Have an awareness of the principles of LNG measurement

- Equipment and procedures on board

- Equipment in the terminal

- Sampling, quantity and other

- LNG sales contract custody transfer checklist

- Have an awareness of the basic types of time charters

- Have an awareness of basic LNG time charter performance clauses

- Have an awareness of the economic implications of boil-off/heel management

- Have an awareness of the relevant industry international organisations and bodies

- Vetting and Inspection Processes

- Vetting

- Inspections

- Ship/Shore Compatibility Assessment

- Physical data

- Ship/shore interface

- Mooring analysis

- Reference Documents

Gain insights into ship/shore compatibility, including physical data, interface, and mooring analysis, along with crucial reference documents for effective LNG operations.

Terms and Conditions in Use

Reference: SIGTTO “LNG Shipping Suggested Competency Standards”, Sections:

1 Have an awareness of the following terms and their relevance:

- long term SPA (Sales and Purchase Agreements);

- short term SPA;

- NYMEX, Henry Hub, etc.;

- destination flexibility;

- buyers and sellers facilities;

- force majeure;

- gas quality;

- confirmation notice;

- annual program;

- free on board (FOB);

- delivery at pace (DAP);

- COA – contract of affreightment;

- LNG Terminal COU – Conditions of Use;

- Panama/Suez Canal transits.

2 Have an awareness of principles of LNG measurement:

- ISO Standards;

- GIIGNL – LNG Custody Transfer Handbook (Reference 12);

- equipment and procedures onboard;

- equipment in the terminal;

- sampling;

- delivered quantity;

- return vapour;

- line cool-down.

3 Have an awareness of the basic types of time charters:

- long term;

- medium term;

- short term;

- cost pass through;

- daily rate.

4 Have a basic awareness of LNG time charter performance clauses:

- speed;

- fuel;

- boil off;

- loading/discharging;

- off-hire;

- duty to perform;

- owner to provide;

- charterer to provide;

- shell LNG Time 1 and 2;

- performance review periods.

5 Have an awareness of the economic implications of boil off/heel management:

- value of boil off as fuel;

- “boil off equivalent” BOE;

- cooldown costs & measurement;

- reliquefaction.

6 Have an awareness of relevant industry international organisations and bodies:

- the Society of International Gas Tanker and Terminal Operators (SIGTTO);

- International Group of Liquefied Natural Gas Importers (GIIGNL);

- Oil Companies International Marine Forum (OCIMF);

- American Petroleum Institute (API);

- International Chamber of Shipping (ICS);

- Chemical Distribution Institute (CDI);

- Gas Transmission Europe (GTE);

- The Society for Gas as a Marine Fuel (SGMF);

- International Maritime Organisation (IMO).

Have an awareness of the following terms and their relevance

Ling term SPA (Sales and purchase agreements)

At the beginning of the transportation of LNG on a mass scale by sea, the infrastructure had to be built from scratch, attracting massive investment. LNG is unlike any other trade, requiring methane gas to be liquefied by cooling to minus 161,5 °C (-161,5 °C) for economically feasible carriage at sea. In the original pattern of LNG project development, nearly all buyers were either government monopoly or franchised utility companies. Sellers were typically either major oil companies or the national oil companies of gas producing countries.

To ensure return on investment, LNG contracts were typically for 25 years duration, although longer contracts were also common. The contracts were the “sales and purchase agreements” and time duration earned them the name “long term”. The point of delivery of LNG might be either FOB or DES (described later in this article), depending on which party assumed the LNG transportation responsibility. It was possible for the LNGC to be owned by the buyer, seller or independent ship-owners, but traditionally it was dedicated to the specific trade and usually for the life of the contract.

The phrase “the buyer takes the volume risk and the seller takes the price risk” explained the risk sharing logic of the contract. Most contracts featured “take or pay” provisions to assure buyer offtake at some minimum level. The volume obligation in the long-term SPA was embodied in the take or pay clause and usually obliged the buyer to take a minimum of 90 % of the annual contract quantity. LNG pricing is related to markets for hydrocarbons.

The “ship or pay” agreement differs from the longterm SPA in that it is for transportation only and can be freely traded among potential shippers. Contracts also include a price escalation clause to transfer responsibility for energy price fluctuations to the seller.

In the early days of LNG trade by sea, design flexibility for the LNGCs to serve other ports was unnecessary and LNG ships were built to operate between known Offshore terminal for transshipment of liquefied gasloading and discharge terminals. However, it has become increasingly common for LNGCs to be traded on the spot market. Ships are now also designed and built with this flexibility in mind.

A longterm SPA also covers gas quality and some terminals still cannot accept cargoes from some liquefaction plants because they fail to meet the quality and environmental specifications of the new terminal.

Short term SPA

LNG supply and demand is generally seasonal, although projections and pricing are subject to variation. There may be surplus quantity available so, buyers and sellers have utilised short-term markets to adjust over and under commitments among themselves. Contracts may be for as short as one voyage or for a longer term project.

Short and medium term agreements would look similar to a long term SPA except that they do not normally have “source of supply” or “take or pay” provisions. Many of the other provisions, such as price and scheduling, are much simpler. The specific details, such as price and quantity for each cargo, are confirmed by an accepted order, that contains a reference to the master agreement at the time of a particular sale.

NYMEX. NYMEX is the New York Mercantile Exchange, which is the place where prices and price ranges are provided for a large number of commodities, including LNG. Information provided by NYMEX also includes requests for quotations, actual sale prices and information on volumes traded.

Henry Hub (and other price referencing points)

Henry Hub is a point on the natural gas pipe system in Erath, Louisiana, that is used as the pricing point for the majority of natural gas futures contracts traded on the NYMEX. Spot and future prices set at Henry Hub are denominated in US$ per millions of British Thermal Units (MMBTU).

Price referencing points are used to establish starting points for pricing actual deliveries. For example, a delivery contract into a particular LNG terminal located on the east coast of the USA might be priced at the Henry Hub price plus $nn. In the Middle East, Qatar is the primary price referencing point. In Europe, National Balancing Point (NBP) is the primary price referencing point and in Asia, Japanese Crude Cocktail (JCC)is the primary price referencing point.

Destination flexibility

LNG SPAs traditionally required cargoes to be delivered at either a single destination or to a limited number of destinations in the same market. The “destination restriction” clause limits the ability of the buyer to resell any surpluses, preserving any margin on the resale for the account of the seller.

Destination flexibility allows freedom (usually for the FOB buyer) to take LNG cargo to any destination it wishes. It is beneficial to buyers:

- who want to access highest value markets;

- to mitigate possible “take or pay” problems;

- who may have greater demand for gas in different seasons. If a big seasonal swing is demanded by a buyer, a seller may request some form of a seasonal “take or pay”.

Loading and discharge facilities. These must be compatible with the LNGC and must ensure that the required rates/pressures/temperatures/safety restrictions can be maintained.

Force majeure

Force majeure is a contractual clause that allows either the buyer or the seller to default on delivery because of forces or events deemed to be beyond the control of either party. Force majeure is usually defined on a contract by contract basis.

A typical force majeure clause, where employed, means any cause not within the control of either party to the contract claiming suspension. These may include threats such as natural disasters, civil unrest, unplanned outages of a terminal or other uncontrollable events, etc. Either party claiming force majeure must notify the other party, providing full particulars of such force majeure as soon as is reasonably possible after the occurrence.

Gas quality

The export terminal will be fitted with equipment to remove impurities in the natural gas stream, including but not limited to:

- mercury,

- hydrates,

- propane,

- butane,

- sulphur,

- acid gas.

Detailed laboratory analysis of the stored LNG is provided to the buyer. It should be noted that the methane content of the LNG varies according to the field of supply. Natural gas is primarily methane but, depending on the regions of production, it may contain heavier liquid hydrocarbons, e. g. pentanes, hexanes, etc.

Schedule “A”

Pricing schedule for the LNG.

Annual delivery schedule

An annual delivery program (contract year) is usually the period of 12 consecutive months commencing on the 1st October and terminating on the 30th September. The contract year allows buyers to avoid the risk of supply disruption that would follow from a supply contract expiring in the middle of winter in the northern hemisphere, although for some new LNG contracts it has been specified as the calendar year, i. e. 1st January to 31st December.

Annual contract quantity (ACQ) is the amount of LNG a buyer agrees to purchase from the seller over the length of a contract year, expressed in MMBTU and measured in gross heating value (GHV). Actual ACQ is the amount of LNG a buyer physically takes delivery of during a contract year under a long term supply contract. It may be measured in the same units as ACQ or stated as a percentage of ACQ.

FOB (free on board)

FOB is a contract term according to which the goods are delivered on board the ship at the named port of origin (loading), at the seller’s expense. The buyer is responsible for the main carriage/freight, cargo insurance and other costs and risks. Delivery, inspection and loading costs involved in delivering LNG on an LNGC at sellers facilities are included in the agreed price. The buyer pays all additional costs to transport and unload the cargo. The export quotation may indicate the port of origin (loading), e. g. FOB Qatar.

For an FOB sale, the amount of energy transferred and subsequently invoiced for will be determined at the loading port. In the case of a CIF (Cost, Insurance and Freight) or a DES (Delivery Ex Ship) sale, the amount of energy transferred and subsequently invoiced for will be determined at the discharge port.

CTMS. There will be an opening and closing CTMS to determine the quantity of cargo loaded or discharged.

DES (delivery ex ship). DES is a contractual term under which the goods are delivered on board the ship to the named port of destination (discharge) at the seller’s expense. The buyer assumes the unloading fee, import customs clearance, payment of customs duties and taxes, cargo insurance, and other costs and risks. The agreed price includes cost of freight and insurance for transporting the LNG by LNGC to the buyers facilities.

COA (contract of affreightment)

This is a contract that satisfies the long term need for transport, particularly dealing with cargo quantities in bulk. Typically, it is an agreement between a charterer and a ship owner, disponent owner or carrier for the carriage of a specified quantity of specified cargo between specified places, over a specified period of time, by ships of a type and size stipulated by the charterer. The contract clearly specifies the cargo and the total period, but the dates of shipment are approximate only.

The contract may be based on a standard charter party as the main contract of affreightment document but with the inclusion of a number of rider clauses. There may be separate voyage charter parties relating to each voyage under a COA. COA may be used by an operator that does not have a fleet of their own. Some texts refer to “contract of carriage by sea” as the COA.

Suez Canal and Panama Canal

LNGCs must comply with certain requirements when planning to transit the Suez Canal. However, LNGCs in ballast and loaded condition or with certain destinations are granted a discount on Suez Canal dues advertised.

LNGCs should be equipped with their own gas-tight projectors (light) that conform to the Suez Canal Authority’s rule of Navigation. LNGCs with a bulbous bow must have their own projector. Speed and waiting time requirements of the charter, do not apply in the case of canal transit.

LNGCs must also comply with certain requirements when planning to transit the Panama Canal. Note that for some other transits and passages there may be additional requirements e. g. Magellan Straits.

Have an awareness of the principles of LNG measurement

ISO standards

ISO Standards provide general requirements for the specification and installation of the level gauges that are used in the measurement of liquid levels on board ships carrying refrigerated light hydrocarbon fluids at close to atmospheric pressure. The standard also covers testing of the equipment.

Sampling of LNG should be performed in accordance with the sampling standards of ISO 8943: 2007 (note that this standard was last reviewed and confirmed in 2016 and was at time of publication, the current standard). A number of key design issues and steps that must be considered to ensure a system fully complies with the requirements of the standards are included.

GIIGNL – LNG custody transfer handbook. The International Group of Liquefied Natural Gas Importers (GIIGNL) handbook covers the equipment, procedures and reports to be used with and generated by the CTMS. It includes the details for periodic checks and tests to confirm accuracy and calibration of the system sensors as well as guidelines on accurate volume calibration of the ship’s cargo tanks.

Equipment and procedures on board

There are three types of measurement taken:

- level,

- pressure,

- temperature.

Liquid level measurement:

- closed devices that do not penetrate the LNGC tank. These are of a radar type;

- closed devices that penetrate the LNGC tank. These include float gauges. Note that, increasingly, newer LNGCs are utilising dual radar systems instead of float gauges. See Level Gauging Systems in Liquefied Gas Tanks“Tank Level Gauge Systems for Gas Storage on LNGC“ for further details.

Temperature measurement. There are 5 temperature sensors in each tank, with 5 spare sensors fitted. One of these must be fitted in the vapour space, one fitted as close to the tank bottom as practicable and the other 3 must be spaced throughout the liquid height of the tank. See Figure Cargo System – Tank Construction“Illustration showing the locations of temperature probes in a membrane LNG tank” for further details.

Pressure measurement. There are two independent sensors required to measure the pressure in each tank. Pressure monitoring is required throughout the cargo system. The common positions include cargo tanks, liquid crossovers, vapour crossovers, pump discharge lines and compressor discharge lines. Pressure switches are also fitted to various systems for personnel protection and shut down.

Custody transfer

A CTMS requires a calibrated package of cargo measuring equipment. The calibrations have to be certified and the cargo tanks have to be calibrated by an independent body. Calibration records must be maintained for a specified period. See Custody Transfer Measurement System (CTMS) on Liquefied Gas Carriers“CTMS Solutions for LNG Carrier Unveiled Operations” for further details.

Accurate measurement determines the financial value of LNG for fiscal and customs purposes as it is transferred between the ship and shore.

Volume measurement procedure

The shipper/charterer must provide a certified copy of the gauging standards for each tank of the LNGC, as well as the calibration and correction tables/charts. For documentary purposes, the level of liquid in an LNGCs tanks is determined in the presence of a surveyor. At the same time, arithmetic average temperature is determined and logged/printed.

Gauging is carried out prior to loading and on completion of loading or, alternately, prior to discharging and on completion of discharge. The representatives of the shipper and terminal have a right to be present at gauging. The draught is checked at the time of each set of observations.

Density and Gross Heating Value (GHV) also need to be determined (see Sampling). These are usually provided by the loading terminal. The unloaded quantity does not include the vapour returned to the LNGCs tanks. Note that if gas burning, consumption records must be available.

Equipment in the terminal

The terminal will also be equipped with volume, level, temperature and pressure measuring devices.

Sampling, quantity and other

Sampling

Samples should be taken at a frequency that assures a representative analysis of the LNG being loaded or discharged. This is only done in loading or receiving terminals and on FSRUs/FLNGs. Samples of LNG are tested to determine the density using the chromatography/revised Klosek and McKinley method. The GHV of the LNG must be calculated on the basis of its molecular composition and of the molecular weights of each of its components. An analysis, or the average of such analyses, determines the molecular composition of the LNG. Gas is analysed for composition, purity, sulphur and BTU value by using gas chromatography, often fitted with multi-columns to separate the components.

The sampling device must permit the total and continuous vaporisation of a quantity of LNG, sufficient to take a gaseous sample that is representative of the LNG being loaded or discharged. No air must enter into the LNG sample bottle. A calibration of the chromatograph utilised is performed before the analysis of the samples taken, carried out with a gaseous mixture of a composition similar to the vaporised LNG being measured.

The LNGC may receive a container sample of the cargo for delivery to the receiving terminal.

Delivered quantity

Delivered quantity may be based upon the CTMS printout or the actual quantity as determined by the surveyor, subject to the contract. It is free of the boil-off vapour returned to the LNGC. Delivered quantity is the difference between the opening and closing CTMS measurements.

Read also: Liquefied Natural Gas Plant and Regasification Terminal Operations

The terminal can determine the quantity of LNG stored by a liquid level and temperature measurement of the terminal’s tanks. This method cannot be used to determine the delivered quantity but can be used for approximate comparisons.

Return vapour. Vapours generated during unloading are returned to the LNGCs cargo tanks via the vapour return line to keep a positive pressure in the ship’s tanks as LNG is pumped out. Return vapour does not form part of the delivered quantity. Some terminals or operators determine the temperature, volume and absolute pressure of the gas returned.

Cooldown. When an LNGC arrives at a loading terminal (say a new build or post dry docking) without any cargo, a certain amount of LNG is supplied for cooling down fits tanks or lines. When an LNGC arrives at a discharge terminal, the LNGC cools down Ship to Ship (STS) Preparation and Manifold Connection for Transfer Operationthe manifold and the MLAs. The quantity of this liquefied gas is determined using flow instruments at the terminal. This approximate volume, in addition to any heel for ballast passage, normally remains on board the LNGC for trading purposes up to the next servicing stage. The amount is normally allowed for in long term charters. For short term charters, exact loaded and discharged quantities are determined by the heel remaining on board the LNGC.

LNG sales contract custody transfer checklist

Items affecting quantity determination:

- calculation method;

- boil-off, vapour displacement, gas burning;

- impact of delay of transfer;

- ship measurement devices, including calibration;

- shore measurement devices, including calibration;

- independent surveyor(s);

- standards and guides (GIIGNL custody transfer handbook, ISO, etc.);

- condition of ship at gauging prior to and at completion of LNG transfer (e. g. ship’s trim and list).

For each ship tank:

- witnesses to measurement (opening and closing custody transfer surveys);

- method of recording number of gauge readings, time interval manual/electronic;

- where applicable, LNG sampling location, timing, method of sample vaporisation, method of analysis (gas chromatograph), location of analyser (i. e. laboratory), reserve samples, quantity and retention period.

Potential deviation:

- failure of instruments;

- inaccuracy in reading, calculations;

- off-specification.

Have an awareness of the basic types of time charters

The basic types of time charter are:

- long term;

- medium term;

- short term;

- cost pass through;

- daily rate.

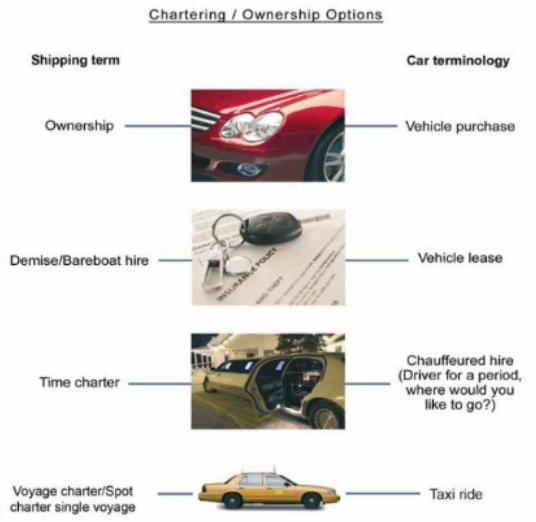

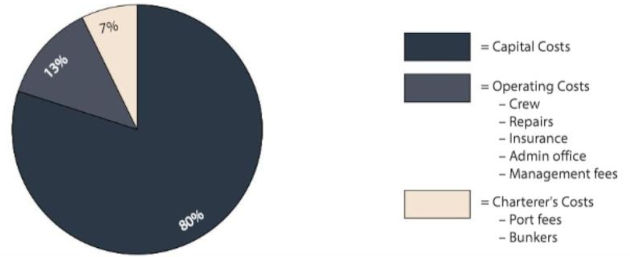

Time charter is the hire of a named ship for a specified period of time. The hire is based on a daily or monthly rate and is usually payable in advance for a certain time period. The technical characteristics of the ship are declared and agreed. The shipowner is responsible for the running expenses and operates the ship technically, but not commercially. The charterer is responsible for the employment of the ship and the associated expenditure.

The period is from delivery to re-delivery of the ship, with any delay dealt with through off-hire.

Long term

Long term time charter (period charter) contracts stretch over a number of years. Because of market fluctuations and inflation, the costs involved cannot be guaranteed so far in advance at the time of entering into contracts. The charter therefore allows the price/costs to be reviewed, and amended as necessary, at specified periods.

LNGCs were traditionally chartered to carry LNG under time-charter contracts. This means that a ship was hired for a fixed period of time, usually between 20 and 25 years or even longer. The charter rate is payable to the owner on a monthly basis.

Medium term. This charter is usually more than 12 months but is seldom over 5 years and the ship remains under the disponent owner. The payment is agreed on a daily rate paid monthly. Market fluctuations may be allowed for, in certain contracts although this is a rare type of charter for LNG.

Short term

Time charters under this heading mean either a voyage fixed on time-charter terms on the spot-market, sometimes referred to as voyage charter, or a charter for a short period of time, seldom exceeding 12 months. The payment may be agreed per day of ship use and could be payable every month or at agreed intervals. There is normally no allowance for any price or market fluctuation.

Short-term time charters of fewer than 12 months have increased in the LNG trade. Primarily, the growth of such charter has been for:

- increase in new LNG production capacity that is not fully committed to a particular importer;

- increase in seasonal demand for LNG;

- unforeseen disruptions to production in exporting countries;

- increased delivery flexibility by importers and related increased charter contract flexibility;

- the increasing availability of LNGCs not committed to a particular project, either as a result of the termination of existing time-charters without a replacement charter or because of the building of new LNGCs on a speculative basis.

Cost pass-through

A significant purpose of the cost pass-through is to maintain a measure of control of the fleet operations. A balance between controlling costs and recognising the need to maintain the ships to high standards is required.

In the case of long term LNG charters, the operational expenses are passed through to the charterers in return for maintaining the ship to standards above the ordinary practice.

Have an awareness of basic LNG time charter performance clauses

The basic clauses are:

| Basic clauses | |

|---|---|

| Speed | Fuel |

| Boil-off | Loading/Discharging |

| Diminished capability | Off-hire |

| Duty to Perform | Owner to provide |

| Charterer to provide | Shell Time 4 |

| Performance review periods | |

Speed

The speed of an LNGC is the average speed specified in knots, as the:

- laden service speed;

- ballast service speed;

- economical speed.

This is subject to agreed maximum fuel consumption. As a minimum, the LNGC must be able to maintain the agreed charter speed. Average speed is a calculation based on observed distance steamed and the duration of the voyage, excluding off-hire periods or any other deviations not covered by off-hire.

The following exclusions apply to LNGCs and are not considered as off-hire:

- bad weather;

- poor visibility;

- congested waters;

- period spent at waiting area following arrival;

- alterations of course or speed to avoid areas of bad weather;

- saving life;

- saving property with charterer’s consent.

Fuel

LNGC fuel may refer to two components, fuel oil and boil-off, which are both measured in metric tonnes. Fuel oil alone means only the oil component. At the time of delivery, all bunkers and heel on board an LNGC will be paid for by the charterers, with the same to be done by owners on re-delivery.

There will generally be agreed quantities of fuel oil, diesel oil and heel on board at the time of delivery or re-delivery. There should be a specified quantity of bunkers or fuel oil equivalent on board at all times for operating the LNGC and this should be in addition to the safety reserve fuel, enabling the LNGC to sail for a minimum number of days at her maximum speed. The grade of fuel oil and diesel oil supplied should be as per ISO standards. Where owners opt for more expensive fuel, they would be liable for extra costs.

Boil-off

BOG is the vapour that “results from vaporisation” of the “LNG in the cargo tanks”. During the period of the charter only one of these terms applies. It is calculated by subtracting the closing CTMS measurement at the load port from the opening CTMS measurement at the discharge port.

The charter specifies the guaranteed maximum boil-off rate:

- during laden passage, it should not exceed the maximum laden boil-off percentage per day;

- during ballast passage, it should not exceed the maximum ballast boil-off percentage per day.

The boil-off excess or saving is calculated by comparing the actual boil-off with the guaranteed maximum boil-off.

The warranted boil-off rate is not applicable if:

- charterers order the temperature or vapour pressure of a cargo to fall during a voyage and the order is complied with;

- charterers order to force vaporise LNG to eliminate or minimise use of bunkers and the order is complied with.

Owners have free use of boil-off, subject to provisions of the charter. Due diligence must be exercised to minimise any steam dumping of boil-off during periods of low fuel demand.

Loading/discharging. Loading and discharging time is agreed as the rate of the terminal based on the size of the shore lines, size of the ship’s lines, the ship’s loading capacity and the vapour return capacity. Unloading depends upon the terminal requirements (including pressure restrictions), ship’s pumping capacity, size restrictions of the manifold and shore lines and the head of liquid in the shore tanks.

Diminished capability. Diminished capability refers to the ship and reflects charter expectations not being met due to either extra fuel consumption or the loss of time/number of voyages by the action of the ship not proceeding at the agreed speed. The clause, or similar clauses, allow the charterer to make a reasonable deduction from the hire payment.

Off hire

Off hire conditions are specified in the charter. An LNGC would usually be considered off hire in the following cases:

- where there are any deficiencies preventing the efficient working of the ship for a specified period as noted in the charter party. Possible deficiencies may include waiting for repairs, breakdown, loss of power, etc.;

- pre-docking and repair procedure including warming, gas freeing or inerting;

- scheduled dry-docking or maintenance, waiting for same, survey, proceeding to or from a port or waiting for such purposes;

- post dry-dock repair procedure including inerting, gassing up and cooling down;

- refusal to sail, breach of orders, industrial action or neglect of duty on part of Master and crew;

- where making a deviation for obtaining medical advice, treatment of, or landing any sick or injured person or dead body;

- any detention by customs caused by smuggling or other illicit activity.

Owner to provide

Owners have the responsibility to provide:

- Maritime Labour Convention (MLC) requirements including crew wages, provisions, etc.;

- all deck, engine and cabin stores;

- maintenance, repair, overhaul and dry-docking expenditure;

- fumigation expenses and de-rat process and certificates;

- liabilities for customs, other than cargo;

- insurance of the LNGC;

- owners contribution towards general average arising from wages and provisions.

In a cost pass through contract, all of the above are provided by the owner but paid for by the charterer.

Charterer to provide

Charterers provide for:

- all fuel supplied to the LNGC to be used for propulsion, cargo operations, production of nitrogen and production of FBOG to be used as fuel, where applicable;

- agency fees, port charges, commissions;

- loading and discharging costs;

- canal charges;

- towage and pilotage;

- additional premiums relating to oil pollution cover required when visiting the USA and/or its protectorates.

Shell Time 4. This is a standard time charter form.

Performance review periods

There are generally agreed performance review periods throughout the duration of the charter:

- monthly reporting of safety and environmental issues;

- record of voyage instructions and logs maintained by the Master, including voyage details, loading/discharging port sheets and other returns as required by charterers;

- voyage reports from load to discharge port, including speed, boil-off and fuel consumption and any time off-hire;

- report of cargo loaded and discharged and heel;

- annual reports;

- other reports, as required, over a longer period.

Have an awareness of the economic implications of boil-off/heel management

Value of boil-off as fuel

LNG is carried at atmospheric pressure at a temperature of minus 161,5 °C (-161,5 °C). A small amount of LNG evaporates from the tank during storage, cooling the tank and keeping the pressure inside the tank constant while the LNG is at its boiling point. A rise in temperature is countered by LNG being vented from the cargo tank.

LNGCs are designed to collect the BOG from the cargo tanks, using a Low Duty Compressor(s) on the Liquefied Natural Gas Carrierslow duty compressor and pass it through a steam heater and onto the engine room, where applicable. As LNG vapour is lighter than air, under the IGC Code it can be consumed in the ship’s E/R. As per the IGC Code, LNG vapour can be consumed in the ship’s engine room.

Using statistical data, it can be calculated how much boil-off vapour is going to be generated during the voyage under different operational conditions. Since LNG has a high calorific value, instead of venting it to the atmosphere and losing it, the LNG industry makes use of the BOG as fuel. Another option is to fit a Liquefied Natural Gas Reliquefaction Plantreliquefaction plant and return LNG to the cargo tanks.

The use of BOG as fuel has cost savings for the ship operator as the fuel consumption of the ship is minimised. Additionally, there may be cost benefits to not installing, maintaining and operating a reliquefaction plant on board.

Historically, LNGCs were fitted with steam turbine propulsion where LNG vapour could be used to generate steam in the boiler instead of consuming the fuel oil. Due to the advancement of technology, LNGCs can now be fitted with DFDE/TFDE/ME-GI/X-DF engines (see Exploring Propulsion Systems and Turbo Alternators on Liquefied Gas Carriers“Propulsion Types”).

“Fuel oil equivalent” (FOE). In most charter parties a factor is stated as “xx” metric tonnes of fuel oil equals 1 m3 of LNG. Some charter parties state this factor as “boil-off equivalent”.

Cooldown costs and measurement

At the discharge port, the LNGC may not discharge all cargo as it may retain part as heel, as per charterers requirements. The main purpose of heel is to maintain the cargo tanks to the required low temperature to be “ready to load” LNG. A secondary purpose of heel may be to allow the generation of BOG for propulsion.

LNG tanks take time to cool down. To prevent the thermal stresses associated with cooling, all LNGCs have a stated cooldown rate (see Cooldown of Cargo System on the Liquefied Gas Carriers“Cargo Cooling System for Membrane and Moss Type Tanks”). As an example of how long cooldown takes:

| Size of LNG carrier and boil-off gas rates | |

|---|---|

| Ship particulars | |

| Cargo capacity | 150 000 m3 |

| Boil off rate in loaded conditions | 0,12 % per day |

| Volume of methane | 180,0 m3/day |

| Mass of methane (Density = 470 kg/m3) | 84 600 kg/day |

| Energy in methane (LCV: 50 000 kj/kg) | 4 230 GJ/day |

| Boil off rate in ballast conditions | 0,06 % per day |

| Volume of methane | 90,0 m3/day |

| Mass of methane (Density = 470 kg/m3) | 42 300 kg/day |

| Energy in methane (LCV: 50 000 kj/kg) | 2 115 GJ/day |

Cooldown procedures and time spent on cooldown have commercial implications:

- possibly of off-hire;

- quantity of LNG used for cooldown and time taken for cooldown;

- loss of productivity as the LNGC would be unable to make the expected number of voyages;

- consumption of bunkers during cool down operations;

- crew wages and maintenance costs for such periods.

| Tank type | Volume | Description |

| Membrane | 170 000 m3 | approx. 10 hours (up to 15 hours) from +40 °C to minus 130 °C (-130 °C) |

| Moss | 135 000 m3 | approx. 24 hours from +40 °C to minus 115 °C (-115 °C) |

In addition, there may be penalties for not maintaining a certain amount of heel on board during the course of trading, other than when proceeding for dry docking or repairs.

Have an awareness of the relevant industry international organisations and bodies

SIGTTO (Society of International Gas Tanker and Terminal Operators). The purpose of SIGTTO is to promote high operating standards and best practices in gas tankers and terminals worldwide. This is achieved by providing technical advice and support to its members and by representing their collective interests in technical and operational matters at the desired forums. Some individual companies and training providers have their training programmes accredited for compliance with SIGTTO’S “LNG Shipping Suggested Competency Standards”.

GIIGNL (“Groupe International des Importateurs de Gaz Naturel Liquefie” or “The International Group of Liquefied Natural Gas Importers”)

GIIGNL’s was set up to promote the development of activities related to LNG. These include, but are not limited to, purchasing, importing, processing, transportation, handling, regasification and various uses of LNG. In addition, the Group aims to provide an overview of state-of-the art technology in the LNG industry and its general economic state, to enhance facility operations and to diversify contractual techniques. It also looks at developing positions to be taken in international agencies.

It was founded on Gaz de France’s initiative in Paris in December 1971. It is represented by a large number of companies and has branches in different locations in the world where LNG is imported.

OCIMF (The Oil Companies International Marine Forum)

OCIMF is a voluntary association of oil companies that have an interest in the shipment of crude oil and oil products, including the terminal handling of such cargoes.

OCIMF is perceived as the foremost authority on the safe and environmentally responsible operation of oil tankers and terminals. It promotes continuous improvement in standards of design and operation of tankers and terminals worldwide. A significant element of OCIMF’s work is the SIRE (Ship Inspection Report Exchange Program) reporting system, where vetting inspections are carried out and a database is maintained for the use of those interested in chartering the tankers.

API (American Petroleum Institute)

The API was initially set up to represent all aspects of America’s oil and natural gas industry, but it soon expanded to a growing international dimension. On the domestic front it serves the producers, refiners, suppliers, pipeline operators and marine transporters, as well as service and supply companies that support all segments of the industry.

- in the USA, API acts as the spokesperson for the petroleum industry to the public, Congress and the Executive Branch, state governments, regulatory agencies, participates in legal proceedings and briefing of the media;

- API conducts or sponsors research including economic analysis, toxicological testing, etc. It collects, maintains and publishes statistics and data on all aspects of US industry operations;

- API is considered the industry leader in development of petroleum and petrochemical equipment and operating standards. API maintains more than 500 standards and recommended practices. The most significant of all is the Petroleum Measurement Tables, which are in international use. API also provides licences to various products and designs that meet it standards.

- API offers a witnessing program that provides knowledgeable and experienced witnesses to observe critical industry tests and verifications;

- API organises seminars, workshops, conferences and symposia on public policy issues.

ICS (International Commission on Shipping)

This is the international trade association for merchant ship operators and represents the collective views of the international industry from different nations, sectors and trades. It draws members from national ship-owners associations, representing over half of the world’s merchant fleet.

The aim of ICS is to promote the interests of ship-owners and operators in all matters of shipping policy and ship operations. ICS endeavours to:

- encourage high standards of operation and the provision of high quality and efficient shipping services;

- strive for a regulatory environment which supports safe shipping operations, protection of the environment and adherence to internationally adopted standards and procedures;

- promote properly considered international regulation of shipping and oppose unilateral and regional action by governments;

- press for recognition of the commercial realities of shipping and the need for quality to be rewarded by a proper commercial return;

- remain committed to the promotion of industry guidance on best operating practices;

- co-operate with other organisations, both intergovernmental and non-governmental, in the pursuit of these objectives;

- anticipate whenever possible, and respond whenever appropriate, to policies and actions which conflict with the above.

ICS represents the global interests of all the different trades in the industry, such as bulk carrier operators, tanker operators, passenger ship operators and container liner trades, including ship-owners and third party ship managers. ICS is heavily involved in a wide variety of areas including any technical, legal and operational matters affecting merchant ships.

ICS has consultative status with number of organisations, including the IMO, World Customs Organization, etc.

CDI (Chemical Distribution Institute)

CDI is an independent, non-profit organisation funded by the chemical industry to provide inspection and audit data for the risk assessment process. Its objectives include, but are not limited, to:

- constantly improve the safety, security and quality performance of marine transportation and storage for the chemical industry;

- drive the development of industry best practice in marine transportation and storage of chemical products through cooperation with industry and centres of education;

- provide information and advice on industry best practice and international legislation for marine transportation and storage of chemical products to customers and stakeholders;

- monitor current and future international legislation and provide experience, knowledge and advice from the chemical industry to the legislators;

- provide chemical companies with cost effective systems for risk assessment;

- provide a single set of reliable and consistent inspection data which chemical companies can use with confidence;

- provide the chemical industry with an independent organization for training, qualification and accreditation of inspectors, and development and maintenance of databases on which inspection and risk assessment information can be distributed.

GTE (Gas Transmission Europe). GTE aims to promote safe and efficient utilisation of the networks, based on non-discriminatory and transparent access, promoting a fully operational integrated European gas market. Gas Directive 98/30/EC, has drastically changed the gas market in Europe. LNG terminals built in the past had to satisfy the specific needs of the main national gas companies. These are now part of a dynamic market, where new players may be emerging, and the EC directives need to be satisfied.

IMO – IGC Code

The International Maritime Organization (IMO) is the United Nations agency with responsibility for the safety of life at sea and protection of the marine environment. To provide an international standard for the safe carriage of liquefied gases (and certain other substances) in bulk by ships, the IMO has developed the Gas Carrier Codes as amended.

The IMO Codes are intended to produce a common set of regulations, allowing a ship to be issued with a certificate of fitness indicating compliance with the Code. This certificate should be accepted by the nations to which the ship may trade as an assurance of the ship’s constructional safety. The Code requires periodic inspection of the ship during its lifetime to maintain validity.

The relevant Code or Codes applying to a particular ship must be carried on board. The current code is the IMO’s International Code for the Construction and Equipment of Ships Carrying Liquefied Gases in Bulk (IGC Code). The IGC Code also contains the present requirements for safe handling of cargoes and should be available for reference regardless of the age of the ship.

The Codes recommend suitable design criteria, construction standards and other safety measures for ships transporting liquefied gases and certain other substances in bulk. These “certain other substances” are liquid cargoes not defined as liquefied gases but which are transported as bulk cargo on gas tankers. These cargoes are listed in Chapter 19 of the IGC Code.

Liquefied gas tankers may have to comply with the Gas Carrier Code, either through their national laws or through laws of the port states. Port states may verify compliance with the IMO conventions and codes. For further information on regulations and the IGC Code, see Regulations and Guidance for Liquefied Natural Gas Shipping“Special Regulations and Guidance for LNG shipping” of this publication.

Vetting and Inspection Processes

Reference: SIGTTO “LNG Shipping Suggested Competency Standards”, Sections:

1 Have an awareness of vetting and inspection processes:

- the elements of vetting;

- the advantages and benefits of vetting.

2 Know and understand the vetting and inspection processes:

- application of vetting in an LNG context;

- guidance regarding the preparation and conduct of inspections;

- the SIRE system, HVPQ and VIQ, GTE.

Vetting

The elements of vetting

The purpose of vetting or inspection is to gain an understanding of an LNGCs operational and safety capability, to improve the safety on board and to mitigate the risks inherent in the maritime transportation of LNG. Also to be checked is the LNGCs compliance with all international, national and regional legislation affecting operations.

An inspection may be requested by the ship owner, buyers or the charterer. The decision for inspection should be communicated well in advance. The vetting inspector should have the ship owner’s permission before the inspection. The Master should be advised prior to the vetting inspector boarding the ship.

The inspector should be experienced enough to identify deficiencies not otherwise detected by the ship’s crew. The inspector should have received appropriate training and, if they have not had sufficient experience, should make at least two accompanied visits. The form is usually one required by an industry body such as OCIMF,such as the latest version of the vessel inspection questionnaire (VIQ).

The inspector should provide clear terms of reference that identify the scope of the inspection and on whose behalf the inspection is being made. They should clearly describe what the inspector is empowered to say and do regarding the deficiencies identified and their overall opinion of the state of the ship, its procedures and its crew. The inspector should ensure that they provide themself with all necessary PPE.

An inspection plan should be discussed with the Master. Equipment tested should be operated by the ship’s personnel. The inspector must not interfere with the ship’s operations. Observations or deficiencies should be documented and discussed with the Master or the owners representative during a post inspection debriefing. Ship’s personnel should be given the opportunity to comment on each deficiency.

Before leaving the ship, and on conclusion of the debriefing session, the inspector should make the Master aware of, or supply the Master with the final list of observations and deficiencies noted during the inspection. This should be followed up with the full report.

The advantages and benefits of vetting

Ship vetting provides a screening service and allows confidence about ships owned or operated by third parties, prior to their use by a company. The objectives of the vetting of an LNGC are:

- to provide a snapshot view of the condition of a ship and her immediate fitness for a specific purpose;

- to measure the extent of any improvement that has occurred since the last inspection;

- to provide an incentive for continued further improvement.

Vetting also serves a quality management purpose. With age, the physical capabilities of LNG ships may become increasingly at risk. It may be necessary to modify performance warranties by an agreed procedure where the age of the ship is reasonably expected to adversely affect its performance.

Application of vetting in an LNG context

The vetting of LNGCs is a ship approval procedure, checking the suitability of the ship that is requesting access to an Terminal Operations for LNG or LPG Carrier after Arriving in PortLNG terminal. This suitability is in terms of mechanical design, communication and safety. Additionally, for new LNGCs, a ship may be required to complete a pre-vetting or “dry SIRE“ before a maiden voyage or prior to loading a first cargo after dry-docking.

Generally, a terminal operator only allows ships that have successfully been through a vetting procedure to unload their LNG cargo at the terminal. This implies that any shipper requesting access must either make use of LNG ships already vetted and authorised or submit the new ship(s) to the approval procedure.

Approval procedures for LNGCs are generally based upon the existing international rules and regulations, implemented either by the flag State of the ship or by the port State/local authorities of the terminal, and on the recommendations of professional bodies such as OCIMF, SIGTTO, or GIIGNL. These procedures address some specific aspects of safety and security at the berth, along with crew qualifications for LNG and an understanding of the terminal procedures.

Inspections

SIRE (Ship Inspection Report Programme)

SIRE was devised by OCIMF to promote tanker safety and to enhance pollution prevention. It makes available a readily accessible pool of technical information concerning the condition and operational procedures of all tankers.

OCIMF members that participate in the SIRE program have direct access to this information. Governmental authorities and charterers who are not OCIMF members that have a direct and common interest, along with OCIMF members in tanker safety, may also access the information. OCIMF has an expectation that tanker owners will be encouraged to correct any observed deficiencies promptly and to devote greater efforts to tanker safety by making inspection reports more widely available to charterers, port authorities and others.

A single SIRE is valid for 12 months but normally 2 SIRE inspections are carried out within the period (at 6 monthly intervals). Normally one inspection will be at charterers request and one done by an energy (oil) major. The reports do not contain an overall tanker rating nor any overall indication of tanker acceptability in the view of the inspection company. OCIMF does not judge the rating of the tanker but is the recipient of the report that determines if the tanker is acceptable for its intended service.

The company that inspects the tanker will submit its report to OCIMF without any scores and, at this time, will pass the report to the tanker operator for comment. The tanker operator has only 14 days to reply to OCIMF. After the 14 day period, the report, with the attached owner’s responses, goes live and is available to users of the SIRE system.

VPQ (Vessel Particulars Questionnaire (OCIMF)). The ship’s VPQ is used to provide a number of organisations with accurate and up-to-date information regarding the ship and her certification. It is held on the SIRE system, for reference by participating companies.

VIQ (Vessel Inspection Questionnaire)

Vessel Inspection Questionnaires (VIQ) are utilised by inspectors to compile and submit SIRE inspection information for all tankers.

A VIQ addresses questions of certification, crew management, navigation, cargo handling, mooring, E/R and steering gear and other aspects associated with safety and pollution. It is completed in electronic format by an attending inspector, using the VIQ software, and then submitted electronically to the OCIMF member commissioning the inspection.

Ship/Shore Compatibility Assessment

Reference: SIGTTO “LNG Shipping Suggested Competency Standards”, Sections:

1 Know and understand the information required to determine a vessel’s compatibility with a terminal:

- physical data;

- ship/shore interface;

- mooring analysis.

Physical data

The safety of berthing/un-berthing operations and the safety of the LNGC at berth, including cargo transfer, depend on a good understanding of ship/shore compatibility issues and a good knowledge of loading and unloading procedures. The ship operator and the terminal operator must exchange information prior to the LNGCs first call at a liquefied gas terminal. Much of the information exchanged is related to physical characteristics of the ship and the berth, including but not limited to:

- main characteristics of the port and ship, covering their general description;

- dimensions of the entry channel, jetty, turning circle, etc.;

- mooring arrangements, mooring lines, quick release hooks, number of winches and strength, rope tails, lay-out, design weather criteria for mooring forces calculation;

- fender arrangement and strength/parallel or flat body lengths at different draughts;

- loading/unloading arm and manifold arrangements;

- cargo pumps, compressors and, if fitted, the following: fuel oil, diesel oil, fresh water, liquefied nitrogen connections, etc.;

- position of gangway, gangway support, gangway working area, weight of gangway on support;

- communications equipment, ESD configuration and procedures.

Procedures should also be agreed for loading/unloading operations (including custody transfer procedures), any terminal requirements while the ship is at the berth, emergency situations contingency planning, etc.

Ship/shore interface

A ship/shore interface meeting should be attended by representatives of the ship owner, ship operator/ charterer and terminal operator. Its purpose is to examine the berth, ship/shore interfaces, safety and communications items. Document analysis also forms part of the meeting.

The interface includes the shore safety plan, covering the documents dealing with fire fighting, cargo transfer and mooring. This includes:

| From the terminal | From the LNGC |

| Port Authority contact person, e. g. harbour master | Details of the shipping agent to be used. The agent should be experienced in dealing with special procedures for LNGCs |

| Port control radio channels | Ship/Shore Safety Checklist, checking and confirming safety interfaces, procedures, equipment and safety tests |

| LNG terminal/berth information covering maximum dimensions of LNGCs that can be accommodated | The LNGCs particulars, including general arrangement of the ship’s deck, clearly indicating mooring winches and bollards, etc., permanent communication channels and the communication stations |

| The mooring arrangement agreed between the ship operator and the LNG terminal, in accordance with port requirements | CTMS protocols |

| Pilots, tug boats, mooring line boats, quick release hooks, bollards, dolphins, tension monitoring equipment, etc. | Cargo transfer arrangements |

| Pilotage/berth approach including a description of the area, berthing procedure, jetty approach meter availability and locations, communication procedures, safety margins or distances, minimum requirements for mooring arrangement, minimum number of tugs required for port entry in loaded condition and for leaving port when unloaded | Emergency procedures and contingency planning in the form of a document prepared by the LNG terminal for each specific LNGC. This should be discussed with a representative of the ship operator and should be accepted and endorsed by both parties prior to the first port call. A copy should be available on board for crew reference |

| The terminal’s emergency response plan | Location of instrumentation interfaces and the configuration for communication equipment |

| Details of mechanical interfaces covering all longitudinal locations versus centre-line of vapour return arm | |

| Location(s) and size(s) of gangway landing platform(s) on the ship’s deck | |

| Flange or coupling details for ship’s connecting flanges for MLAs, vapour return, liquid nitrogen, heavy fuel oil, gasoil, fresh water (as appropriate), deck area suitable for loading/unloading of ship’s stores, garbage handling capability and any other services (where appropriate) |

Mooring analysis

A mooring analysis is conducted for LNGCs each time they visit a terminal. Its purpose is to review proposed mooring layouts, determine potential mooring line loads and assess the ship’s manifold positioning. It forms the basis for the definition of realistic limiting criteria for operational conditions to ensure safety of the ship and terminal as well as operability and down time. It is also a useful exercise when planning a new terminal or modifying the layout of an existing one.

Mooring analysis is generally based on simulation or data analysis for the LNGC in different states of loading and in different environmental (metocean) conditions. For terminal design and planning, a range of ship sizes and designs may be considered. The simulation or calculations take into account the following:

- dimensions of jetties and the proposed or designed mooring arrangements;

- manifold positioning requirements for lateral and longitudinal motions;

- wave motions and force predictions in the waters around the jetty;

- highest wind speed and maximum current/tidal stream force predictions for different design and loaded conditions of the ship;

- ship motions, also covering the effect of passing ships;

- fender numbers and loads;

- mooring lines and optimum arrangements;

- static balance assessment and dynamic mooring line analysis as per OCIMF guidelines.

There are several commercially available software programs that can be used to conduct these analyses, which are computationally intensive, particularly when considering the dynamic forces involved.

After inputting the mooring line arrangement that the LNGC proposes to use, programs will typically return a number of comprehensive reports detailing the forces on the different mooring elements (mooring lines, winches, etc.) in various situations, highlighting any mooring element submitted to forces exceeding the limits defined in “Mooring Equipment Guidelines” (OCIMF).This allows the ship and terminal to make any adjustments necessary to the planned mooring arrangement and re-run the simulation to ensure that the new arrangements will result in safe working loads for all expected metocean conditions.

Reference Documents

The documents below are references for the Underpinning Knowledge contained within this publication.

| Documents | ||

|---|---|---|

| Publisher | Title | Date |

| CDI/ICS/OCIMF/SIGTTO | Ship to Ship Transfer Guide for Petroleum, Chemicals and Liquefied Gases | 2013 |

| GIIGNL | LNG Custody Transfer Handbook (5th Edition) | 2017 |

| IMO | International Code of the Construction and Equipment of Ships Carrying Liquefied Gases in Bulk (IGC Code) | 2016 |

| MCA | Code of Safe Working Practices for Merchant Seafarers (Chapter One) | 2019 |

| OCIMF/ICS | International Safety Guide for Oil Tankers and Terminals (ISGOTT) (6th Edition) | 2020 |

| OCIMF/SIGTTO | Recommendations for Liquefied Gas Carrier Manifolds (2nd Edition) | 2018 |

| SIGTTO | Crew Safety Standards and Training for Large LNG Carriers | 2003 |

| Guidelines for the Alleviation of Excessive Surge Pressures on ESD for Liquefied Gas Transfer Systems (2nd Edition) | 2018 | |

| Liquefied Gas Carriers: Your Personal Guide to Safety (2nd Edition) | 2012 | |

| Liquefied Gas Fire Hazard Management | 2004 | |

| Liquefied Gas Handling Procedures on Ships and in Terminals (4th Edition) | 2016 | |

| LNG Operations in Port Areas: Essential Best Practices for the Industry | 2003 | |

| Recommendations for Relief Valves on Gas Carriers (3rd Edition) | 2020 | |

| Site Selection and Design for LNG Ports and Jetties (Information Paper No. 14) | 1997 | |

| Witherbys | LNG Port Info | 2020 |

| Witherbys | Ship Vetting and its Application to LNG (2nd Edition) | 2020 |